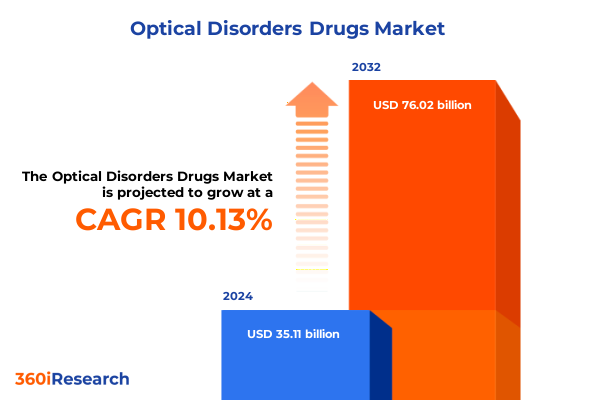

The Optical Disorders Drugs Market size was estimated at USD 38.59 billion in 2025 and expected to reach USD 42.46 billion in 2026, at a CAGR of 10.16% to reach USD 76.02 billion by 2032.

Setting the Stage for Tomorrow’s Breakthroughs in Vision Loss Treatment Through Cutting-Edge Therapeutics, Patient-Centric Care Trends, and Market Forces

Optical disorders encompass a wide array of conditions that can significantly impair quality of life, from progressive diseases like glaucoma and age-related macular degeneration to acute inflammatory challenges such as uveitis and conjunctivitis. At the outset, it is critical to recognize how patient needs are rapidly evolving, fueled by demographic shifts toward aging populations and increasing prevalence of chronic systemic diseases like diabetes. These changes heighten demand for therapeutic solutions that are not only effective but also optimized for longer durability and safety, underscoring the imperative for continuous innovation and adaptive commercialization strategies.

Moreover, recent years have revealed that advances in molecular biology and imaging technologies have converged to create novel opportunities for early detection and intervention. This convergence has paved the way for a new generation of precision therapeutics that target underlying disease mechanisms rather than simply alleviating symptoms. As a result, stakeholders across the value chain-from biopharmaceutical developers to healthcare providers-are compelled to redefine traditional treatment paradigms and adopt more integrated approaches that combine pharmacological, surgical, and diagnostic capabilities.

Looking ahead, this introduction frames a landscape in which the interplay of scientific breakthroughs, shifting patient demographics, and evolving health systems will dictate the pace of growth. By examining emerging trends in therapeutic modalities, market access pathways, and patient engagement models, a comprehensive understanding of the optical disorders domain emerges. This foundation sets the stage for subsequent sections to explore transformative shifts, policy implications, segmentation nuances, and strategic recommendations.

Examining the Rapid Evolution of Treatment Paradigms as Gene Therapies, Digital Diagnostics, and Collaborative Care Reshape Optic Disorder Management

The optical disorders landscape is undergoing a profound transformation driven by unprecedented innovation in therapeutic modalities and care delivery. Gene therapy pioneers have moved inherited retinal dystrophies into the realm of curative potential, with several candidates in late-stage trials exploring adeno-associated virus vectors to restore photoreceptor function. At the same time, large biopharmaceutical companies are collaborating with academic centers to accelerate the translation of CRISPR-based approaches for conditions like Leber congenital amaurosis, signaling a paradigm shift from chronic management to one-time interventions.

In parallel, the anti-VEGF space has seen the advent of next-generation bispecific antibodies that promise to enhance efficacy while reducing injection frequency. One notable example is faricimab-svoa, which received U.S. regulatory approval for multiple retinal conditions following Phase III studies demonstrating robust vision gains and improved retinal fluid dynamics. This breakthrough exemplifies how molecular engineering can address unmet needs in managing neovascular age-related macular degeneration and diabetic macular edema, offering patients greater convenience and clinicians more durable options.

Digital diagnostics and telehealth platforms are concurrently reshaping patient monitoring by leveraging artificial intelligence to detect subtle morphological changes in retinal imagery. Remote visual acuity testing and home-based optical coherence tomography devices are gaining traction, enabling proactive adjustments to treatment schedules and reducing the burden on clinical facilities. Such integrated care models foster closer patient engagement and support real-world evidence generation, further informing therapeutic optimization.

Taken together, these developments illustrate a dynamic environment in which collaborative research, precision biologics, and digital health converge to redefine the management of optical disorders. This evolutionary shift demands that industry participants recalibrate their strategies to remain at the forefront of emerging opportunities.

Unpacking the Cumulative Effects of Proposed US Pharmaceutical Tariffs on Ophthalmic Drug Supply Chains, Pricing Dynamics, and Industry Resilience

The United States has historically maintained minimal tariff barriers on pharmaceutical imports to ensure patient access to essential medicines. However, recent policy proposals have introduced the prospect of substantial reciprocal tariffs on medications, including those targeting ophthalmic conditions. While existing World Trade Organization commitments have thus far exempted most drug imports from additional duties, the administration’s ongoing Section 232 investigation indicates that tariffs may soon extend to active pharmaceutical ingredients and finished dosage forms in the optical disorders segment.

Industry experts warn that applying tariffs of up to 200 percent on imported pharmaceuticals could significantly increase manufacturing costs for key therapies, including anti-VEGF agents and corticosteroids commonly used in retinal diseases and uveitis. Elevated input costs would likely be passed downstream, placing upward pressure on treatment regimens and potentially limiting formulary inclusion in hospital and ambulatory settings. Moreover, disruption of established supply chains-where a majority of small-molecule APIs and biologic fill-finish processes originate offshore-may exacerbate vulnerabilities to shortages, particularly for complex injectable formulations.

Despite assurances of delayed implementation to allow industry adaptation, the uncertainty surrounding timing and scope of tariffs has already prompted strategic realignment of sourcing practices. Some manufacturers are exploring onshore or near-shore production for essential components, yet repatriating specialized manufacturing facilities requires substantial investment and regulatory approvals. In the interim, parallel efforts to secure tariff exceptions for critical medications have emerged, with healthcare associations emphasizing that tax incentives and capacity-building grants would offer a more stable path to domestic resilience than punitive duties.

In sum, while the policy objectives aim to bolster U.S. manufacturing and national security, the cumulative impact of proposed tariffs threatens to disrupt access to advanced ophthalmic therapies, increase treatment costs, and introduce supply chain fragility. Stakeholders across the value chain must navigate this evolving regulatory environment with agility to safeguard continuity of care for patients with optical disorders.

Illuminating Market Diversity Through Drug Classifications, Administration Routes, Dosage Forms, and Patient-Centric Segmentation Strategies

A nuanced understanding of market segmentation reveals how diverse product categories and patient use cases converge to shape competitive dynamics. Drug class analysis spans alpha agonists that manage ocular hypertension through vascular modulation to prostaglandin analogs renowned for potent intraocular pressure reduction in glaucoma. Within this framework, anti-VEGF agents occupy a central role and warrant deeper granularity: aflibercept, bevacizumab, brolucizumab, faricimab, and ranibizumab each occupy unique niches based on dosing intervals, molecular specificity, and cost considerations.

The route of administration significantly influences treatment experience and adherence. Intravitreal injection remains the gold standard for delivering biologics to the posterior segment, yet periocular and subconjunctival injections offer alternative delivery pathways with potential benefits in localized drug distribution. By contrast, topical formulations and systemic tablets provide noninvasive options, predominantly employed for anterior segment disorders like conjunctivitis and uveitis, where patient convenience and safety profiles drive prescribing patterns.

Dosage form distinctions further delineate market opportunities. Solutions and suspensions vary in pharmacokinetic behavior, impacting ocular bioavailability and shelf stability, while oral tablets present valuable adjunctive options for conditions requiring systemic immunosuppression or long-duration therapies. Concurrently, the evolving balance between branded and generic products shapes cost-access dynamics, with generic corticosteroids and carbonic anhydrase inhibitors delivering affordability, even as branded anti-VEGF agents command premium positioning.

Therapeutic indications span a spectrum from chronic degenerative diseases-age-related macular degeneration and diabetic macular edema-to acute inflammatory conditions like uveitis and allergic conjunctivitis. Distribution channels, comprising hospital pharmacies, retail outlets, and the growing online pharmacy segment, accommodate varying prescribing environments and patient access needs. Finally, end users range from specialized ophthalmology clinics and ambulatory surgery centers, where procedural administration predominates, to hospital settings handling complex cases requiring multidisciplinary care coordination.

Together, these segmentation dimensions illuminate the multifaceted nature of the optical disorders market and underscore the importance of tailoring development, pricing, and commercialization strategies to the specificities of each segment.

This comprehensive research report categorizes the Optical Disorders Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Dosage Form

- Drug Type

- Indication

- Distribution Channel

- End User

Exploring Regional Variations Across the Americas, Europe Middle East Africa, and Asia-Pacific Markets in Ophthalmic Drug Adoption and Access Trends

Regional dynamics profoundly shape the competitive landscape and dictate localized approaches to market entry and growth. In the Americas, mature healthcare infrastructure and established reimbursement frameworks facilitate rapid uptake of innovative therapies, particularly in the United States where Medicare and private payors support advanced biologics. Nonetheless, cost-containment pressures have intensified, prompting payors to demand real-world outcomes data and value-based contracting models that link reimbursement to clinical performance measures.

Within Europe, the Middle East, and Africa, heterogeneous regulatory pathways and divergent health-economic environments create both challenges and opportunities. Western European nations often employ health technology assessments to evaluate therapeutic value, influencing pricing negotiations and access timelines. In contrast, emerging markets in Eastern Europe and the Middle East prioritize affordability and volume-based procurement, making generics and biosimilars critical components of supply strategies. Meanwhile, in certain African regions, infrastructure limitations still hinder widespread deployment of complex injectable treatments, placing a premium on cold chain logistics and local capacity building.

The Asia-Pacific region exemplifies a dual-speed dynamic, where developed markets such as Japan and Australia rapidly embrace next-generation anti-VEGF therapies, driven by aging demographics and supportive regulatory frameworks. Conversely, high-growth markets in Southeast Asia and South Asia often contend with constrained healthcare budgets and uneven provider availability, steering demand toward cost-effective generics and multi-indication platforms. Strategic collaborations with local manufacturers and technology transfer agreements have emerged as effective means to balance affordability with access to advanced care.

Collectively, these regional insights highlight the necessity for tailored market entry strategies that align product portfolios with local regulatory expectations, reimbursement systems, and patient access challenges. By adapting supply chain models, pricing structures, and stakeholder engagement plans to regional nuances, companies can maximize reach and ensure sustained adoption across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Optical Disorders Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators in Ophthalmic Therapeutics and Their Strategic Initiatives Driving Advancement of Optical Disorder Treatments

The competitive arena for ophthalmic therapies is anchored by a cohort of global pharmaceutical and biotechnology leaders whose innovation pipelines and strategic collaborations define the field. A prominent example is Roche, which has leveraged its bispecific antibody platform to introduce next-generation agents targeting dual pathways in retinal vascular diseases. Similarly, Regeneron has pursued extended-interval anti-VEGF constructs alongside antibody–drug conjugates designed for posterior segment delivery, reflecting a commitment to improving patient convenience.

Novartis maintains a diversified presence through its Alcon division, combining surgical device expertise with sustained-release pharmacotherapies aimed at intraocular pressure control and neovascular conditions. This integrated approach enables cross-functional solutions spanning diagnostics, drug delivery, and surgical intervention. Bayer’s portfolio emphasizes both branded vascular endothelial growth factor inhibitors and carbonic anhydrase inhibitors, underscoring a balanced strategy between high-margin specialty products and broader-volume generics.

In the retina space, smaller biotech firms are advancing disruptive concepts in gene editing and neuroprotection. These specialized players frequently engage in co-development agreements with larger companies to harness global commercialization networks while retaining focus on pioneering science. MacuLogix and Apellis Pharmaceuticals, for instance, are exploring complement-targeting therapies that address underlying inflammatory mechanisms in age-related macular degeneration, positioning them as potential partners for licensing or acquisition.

Collectively, these key industry participants exemplify varied strategic postures-from scale-driven distribution networks of established multinationals to nimble, science-driven ventures-each contributing to a competitive environment that rewards both incremental improvements and platform-shifting innovations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Disorders Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Adverum Biotechnologies, Inc.

- Aerie Pharmaceuticals, Inc.

- Ajanta Pharma Ltd.

- Alcon Inc.

- Bausch + Lomb Corporation

- Bayer AG

- Beximco Pharmaceuticals Ltd.

- Carl Zeiss AG

- Chengdu Kanghong Pharmaceutical Group Co., Ltd.

- Cipla Limited

- Ellex Medical Lasers Ltd.

- Essilor International S.A.

- EyeGate Pharmaceuticals, Inc.

- EyePoint Pharmaceuticals, Inc.

- F. Hoffmann-La Roche Ltd

- Glaukos Corporation

- Hoya Corporation

- ICON plc

- Intas Pharmaceuticals Ltd.

- Iridex Corporation

- Johnson & Johnson Service, Inc.

- Kalvista Pharmaceuticals Inc.

- Lotus Pharmaceuticals

- Lupin Limited

- Merck & Co., Inc.

- Nicox S.A.

- Novartis AG

- Ocular Therapeutix, Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Outlook Therapeutics, Inc.

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Santen Pharmaceutical Co., Ltd.

- Senju Pharmaceutical Co.,Ltd.

- Somerset Pharma, LLC.

- Sun Pharmaceutical Industries Ltd.

Strategic Imperatives for Industry Stakeholders to Navigate Emerging Therapeutic Innovations, Regulatory Shifts, and Competitive Landscapes in Ophthalmology

To capitalize on emerging opportunities and mitigate regulatory uncertainties, industry stakeholders must adopt a multifaceted approach that aligns scientific innovation with pragmatic execution. First, prioritizing partnerships between global biopharma firms and localized contract manufacturers can expedite regional onshoring of critical APIs and finished dosage forms, reducing exposure to potential tariff shocks and enhancing supply chain resilience.

Simultaneously, developers should invest in real-world evidence platforms and digital biomarkers to substantiate value-based contracting propositions. Demonstrating sustained patient-relevant outcomes through longitudinal data registries not only supports reimbursement negotiations but also fosters clinician confidence in novel modalities. Coupled with predictive analytics, these insights can guide portfolio optimization and resource allocation across therapeutic segments.

Furthermore, a sharpened focus on patient engagement-leveraging teleophthalmology applications and home-monitoring tools-can improve adherence and capture early signals of suboptimal response. By integrating these technologies into clinical trial designs and post-marketing plans, organizations can accelerate regulatory approvals and drive market differentiation through superior patient experience.

Finally, navigating the evolving policy landscape requires proactive engagement with regulators and trade bodies. Articulating the patient impact of proposed tariffs and advocating for targeted incentives or exemptions will be essential to safeguard uninterrupted access to advanced therapies. By participating in collaborative dialogues, companies can influence policy outcomes that balance national manufacturing objectives with patient-centric imperatives.

Outlining a Rigorous Multi-Source Research Approach Combining Primary Interviews, Secondary Data, and Triangulation for Market Intelligence Integrity

This research leverages a robust methodology designed to ensure depth, accuracy, and actionable insights. The process commenced with an extensive secondary research phase, encompassing peer-reviewed journals, regulatory agency databases, and publicly available financial disclosures. Such sources provided foundational context on therapeutic mechanisms, approval timelines, and corporate strategic priorities.

Complementing this desk-based work, primary research was conducted through in-depth interviews with a cross-section of stakeholders, including ophthalmologists, health-economic experts, payor representatives, and manufacturing specialists. These structured engagements aimed to validate secondary findings, uncover real-world practice patterns, and extract nuanced perspectives on future innovations and policy developments.

To guarantee analytical rigor, a data triangulation approach was employed, reconciling quantitative information from sales and pipeline databases with qualitative feedback from key opinion leaders. Discrepancies were systematically addressed through follow-up inquiries, ensuring consistency and reliability. Additionally, regional regulatory frameworks and reimbursement scenarios were mapped to align segmentation insights with local market realities.

Finally, the research synthesis integrated thematic analysis of emerging trends with strategic scenario planning. This combination enabled the identification of high-priority opportunities and potential risks, forming the basis for actionable recommendations. Throughout, quality control mechanisms, including peer reviews and methodological audits, reinforced the integrity of findings and the relevance of strategic guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Disorders Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Disorders Drugs Market, by Drug Class

- Optical Disorders Drugs Market, by Route Of Administration

- Optical Disorders Drugs Market, by Dosage Form

- Optical Disorders Drugs Market, by Drug Type

- Optical Disorders Drugs Market, by Indication

- Optical Disorders Drugs Market, by Distribution Channel

- Optical Disorders Drugs Market, by End User

- Optical Disorders Drugs Market, by Region

- Optical Disorders Drugs Market, by Group

- Optical Disorders Drugs Market, by Country

- United States Optical Disorders Drugs Market

- China Optical Disorders Drugs Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Synthesizing Insights on Transformative Therapies, Tariff Considerations, and Strategic Pathways for Future Growth in Optical Disorder Treatments

The optical disorders arena is poised at a critical inflection point where scientific innovation, shifting demographics, and policy considerations converge to redefine therapeutic possibilities. The maturation of targeted biologics and gene-based interventions promises durable benefits for patients who once faced progressive vision loss with limited recourse. Simultaneously, emerging digital health tools are augmenting clinical decision-making and fostering more personalized care pathways.

Nevertheless, external factors such as proposed tariff measures and divergent regional reimbursement dynamics underscore the need for agility and collaboration across the value chain. Companies that successfully integrate supply chain resilience, evidence generation, and stakeholder engagement will be best positioned to navigate uncertainties and capitalize on growth trajectories. Moreover, a patient-centric lens-emphasizing access, adherence, and real-world outcomes-remains paramount to translating scientific advances into meaningful improvements in quality of life.

Ultimately, the future of optical disorder treatment will be defined by convergent strategies that marry cutting-edge therapeutics with innovative care models. By staying attuned to policy shifts, regional market intricacies, and evolving patient expectations, industry leaders can orchestrate cohesive responses that deliver both clinical value and sustainable growth. This synthesis of insights underscores a clear mandate: drive forward with both bold innovation and strategic foresight to shape the next chapter in vision care.

Engage with Associate Director Ketan Rohom to Secure Exclusive Ophthalmic Drug Market Intelligence and Drive Strategic Decision-Making with Actionable Research

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, offers a direct pathway to unlock the full spectrum of actionable insights presented in this comprehensive report. His expertise in ophthalmic market dynamics and deep understanding of industry challenges equip him to guide you through tailored data interpretations and strategic recommendations. By initiating a discussion, you can explore customized research packages designed to align with your organization’s unique objectives and investment criteria. Reach out to secure exclusive access to in-depth analyses, proprietary segmentation breakdowns, and forward-looking strategic guidance that will empower your decision-making and drive competitive advantage in the optical disorders arena.

- How big is the Optical Disorders Drugs Market?

- What is the Optical Disorders Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?