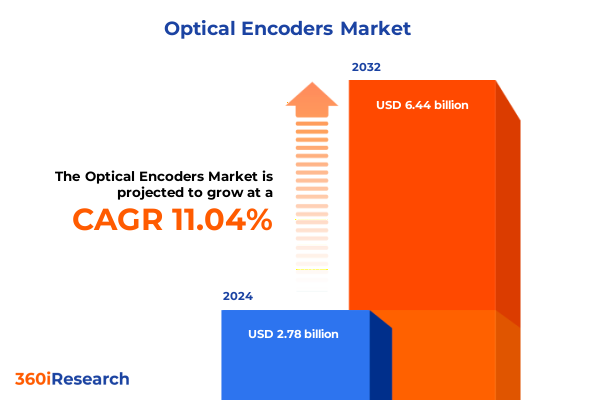

The Optical Encoders Market size was estimated at USD 3.07 billion in 2025 and expected to reach USD 3.39 billion in 2026, at a CAGR of 11.13% to reach USD 6.44 billion by 2032.

Introduction to the Critical Role of Optical Encoders in Modern Automation and Precision Control Across Emerging Technological Frontiers

Optical encoders have emerged as foundational components for precision measurement and control across a diverse array of industries, ranging from robotics and industrial automation to aerospace systems and consumer electronics. As devices that translate angular or linear position into digital or analog signals, these components enable feedback loops that underpin motion control, positioning accuracy, and system diagnostics. Their inherent accuracy, high resolution, and immunity to electromagnetic interference position them as critical enablers of next-generation machinery and devices. In recent years, the optical encoder market has experienced accelerated innovation, driven by advancements in miniaturization, sensor integration, and digital signal processing.

Against this backdrop, understanding the evolving landscape of optical encoders requires a nuanced perspective that spans technology variations such as capacitive, magnetic, and optical sensing methods as well as product differentiators like absolute versus incremental feedback. Moreover, the integration of high-definition digital output alongside legacy analog interfaces has widened the scope of applications, prompting end users in sectors such as industrial automation, renewable energy, and telecommunications to reassess their control architectures. This introduction sets the stage for a deep dive into the transformative shifts, regulatory pressures, segmentation insights, and strategic imperatives that define the current and future trajectory of optical encoders.

How Rapid Digitalization and Industry 4.0 Integration Are Driving Fundamental Shifts in Optical Encoder Applications and Innovations

The optical encoder industry stands at the nexus of rapid digital transformation and the proliferation of connected devices, catalyzed by Industry 4.0 paradigms and the Internet of Things. As manufacturers adopt smart factory frameworks, the demand for feedback devices that offer real-time data, predictive diagnostics, and seamless integration with cloud-based analytics has surged. Optical encoders, with their capacity for high-resolution measurement and robust digital output, are increasingly embedded within servo motors, collaborative robots, and autonomous guided vehicles, enabling sophisticated motion control algorithms and self-optimizing workflows.

Concurrently, innovations in miniaturization have yielded compact hollow shaft encoders and linear encoder modules that can be integrated into confined spaces without sacrificing performance. Advances in photonic sensor design and on-chip signal processing have improved noise immunity and temperature stability, broadening the operational envelope of these devices across harsh environments. Furthermore, the convergence of edge computing and encoder intelligence allows for decentralized data processing, reducing latency and bandwidth requirements. These transformative shifts underscore a broader industry movement toward distributed intelligence, end-to-end connectivity, and adaptive control systems powered by optical sensing technologies.

Assessing the Ripple Effects of 2025 United States Trade Tariffs on the Supply Chain Dynamics and Cost Structures of Optical Encoders

The imposition of new United States trade tariffs in 2025 on imported components and assemblies has generated a ripple effect across the global supply chain for optical encoders. Under these measures, key inputs such as precision optical scales, photodetector arrays, and custom glass substrates are subject to escalated duties, prompting manufacturers to reassess sourcing strategies. In many cases, tariff-related cost increases have been absorbed internally, leading to margin compression, while others have passed additional expenses on to end users, elevating capital expenditure for system integrators.

In response, leading encoder producers have diversified their supply networks to include domestic fabrication facilities and nearshore partners, mitigating exposure to punitive tariff schedules. This has accelerated investments in regional manufacturing capabilities and local content development, particularly for high-stakes applications in defense and aerospace where procurement requirements emphasize domestic production. At the same time, design teams are exploring modular architectures that permit the substitution of imported subassemblies with tariff-exempt alternatives, further insulating product roadmaps from geopolitical fluctuations. These cumulative impacts highlight the critical need for agile supply chain management and strategic supplier collaboration in the face of tariff-driven market disruptions.

Unveiling Deep Insights into Market Segments That Define the Demand Spectrum for Optical Encoders Across Applications and Technologies

In dissecting market dynamics, the interplay between product types such as absolute encoders and incremental encoders reveals distinct value propositions. While absolute encoders prevent positional ambiguity after power loss, incremental models offer cost efficiencies and simplicity that align with cost-conscious applications. Similarly, the adoption of capacitive technology, magnetic technology, and optical technology underscores varying trade-offs in signal integrity, environmental resilience, and production complexity. Analog output systems continue to serve legacy installations, even as digital output configurations unlock advanced diagnostics and seamless integration with PLCs and networked controllers.

Mounting options like panel mount and through hole mount influence installation workflows, with panel mount variants favored in centralized control panels and through hole mount units integrated directly into motor housings. Resolution tiers spanning high resolution, medium resolution, and low resolution address performance requirements ranging from sub-micrometer measurement in semiconductor equipment to cost-sensitive position sensing in consumer electronics. Form factors such as hollow shaft encoders, linear encoders, and shaft encoders each serve differentiated mechanical architectures, enabling design engineers to prioritize space constraints and torque requirements. Finally, distribution channels, whether offline or online, shape procurement experiences as global OEMs and system integrators leverage e-commerce platforms alongside traditional regional distributors. Application contexts in aerospace & defense, automotive, consumer electronics, healthcare, industrial automation, renewable energy, and telecommunications further define tailored feature sets, regulatory compliance standards, and lifecycle support models.

This comprehensive research report categorizes the Optical Encoders market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Output Signal

- Mounting Type

- Resolution

- Form Factor

- Distribution Channel

- Application

Mapping Regional Growth Drivers and Challenges Shaping the Adoption and Evolution of Optical Encoders Across Global Markets

Geographically, the Americas continue to exhibit strong demand for optical encoders driven by robust industrial automation investments in North America and renewable energy projects in South America. The United States, in particular, remains a focal point for onshore manufacturing initiatives and advanced robotics deployments, stimulating growth in high-performance, absolute encoder solutions that support precision machining and autonomous material handling.

Meanwhile, Europe, Middle East & Africa present a multifaceted landscape where stringent safety standards, energy efficiency mandates, and the resurgence of onshore manufacturing hubs influence regional product requirements. Germany’s emphasis on Industrie 4.0 and the United Kingdom’s focus on aerospace innovation create pockets of demand for ruggedized encoder designs with embedded safety features. In the Middle East, large-scale infrastructure and defense programs foster opportunities for reliable, long-life encoders, while North African manufacturing expansions drive demand for cost-optimized incremental systems.

In Asia-Pacific, rapid industrialization and burgeoning consumer electronics production fuel widespread adoption of both analog and digital optical encoders. Countries like China, South Korea, and Japan lead investments in semiconductor equipment and automotive production lines, demanding ultra-high-resolution, compact encoders. At the same time, Southeast Asian manufacturing hubs are embracing automation in packaging and logistics, increasing the uptake of modular, linear encoders and motion control packages.

This comprehensive research report examines key regions that drive the evolution of the Optical Encoders market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Driving Technological Advancements and Competitive Dynamics in the Optical Encoder Sector

A cohort of specialized sensor manufacturers and diversified automation suppliers drive competitive dynamics in the optical encoder sector. Established precision motion control firms leverage decades of photonic sensor expertise to deliver high-end absolute and incremental encoders with sub-micrometer accuracy. These companies invest heavily in proprietary glass scale fabrication, advanced signal conditioning electronics, and integrated firmware that enables in-situ diagnostics and remote calibration.

At the same time, emerging technology players differentiate through cost-effective production techniques and flexible, modular product lines. By offering scalable platforms that accommodate multiple output signals and mounting configurations, they address the needs of system integrators seeking reduced time-to-market. Partnerships between sensor innovators and industrial automation conglomerates further accelerate integrated mechatronic solutions, combining servo motors, drives, and encoders into optimized packages for automotive assembly, semiconductor fabrication, and robotics applications.

Consolidation trends have surfaced as companies pursue strategic acquisitions to bolster capabilities in optical sensor design, digital signal processing, and embedded firmware development. These acquisitions strengthen regional footprints, catalyze new product introductions, and create more comprehensive solution portfolios that encompass hardware, software, and lifecycle support services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Encoders market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Motion, Inc.

- AMETEK, Inc.

- Balluff GmbH

- Bourns, Inc.

- Broadcom Inc.

- Celera Motion by Novanta Inc.

- Changzhou Fulling Motor Co., Ltd.

- CTS Corporation

- Dr. Fritz Faulhaber GmbH & Co. KG

- Dynapar Corporation

- Elinco International JPC, Inc.

- Gage-Line Technology, Inc.

- GrayHill Inc.

- Gurley Precision Instruments, Inc.

- Honeywell International Inc.

- Johannes Hübner Fabrik elektrischer Maschinen GmbH

- Nexen Group, Inc.

- Nidec Corporation

- Pepperl+Fuchs SE

- PixArt Imaging Inc.

- Renishaw PLC

- Rockwell Automation Inc.

- Sensata Technologies, Inc.

- Sensor Systems, LLC

- Siemens AG

- Sinotech, Inc.

- Velmex, Inc.

Crafting Forward-Looking Strategies to Leverage Technological Breakthroughs and Optimize Supply Chain Resilience for Optical Encoder Manufacturers

To thrive amid evolving market pressures, industry leaders should prioritize supplier diversification strategies that align with geopolitical realities and tariff landscapes. Developing multiple sourcing channels across domestic, nearshore, and offshore partners can mitigate supply disruptions and provide negotiating leverage on key materials. Equally important is the adoption of modular design frameworks that allow rapid reconfiguration of subassemblies and streamlined qualification processes for alternate suppliers.

In parallel, investment in embedded intelligence within encoder modules can unlock new revenue streams through condition monitoring, predictive maintenance, and value-added software services. By integrating edge analytics and secure, cloud-native architectures, manufacturers can offer subscription-based performance monitoring platforms that increase customer stickiness and differentiate their offerings. Additionally, focusing R&D on optical and photonic innovations-such as integrated laser scale technologies and miniaturized detector arrays-can improve resolution and dynamic performance while reducing manufacturing costs through wafer-level processing techniques.

Finally, cultivating strategic alliances with automation solution providers, semiconductor equipment OEMs, and industrial software vendors will enable more cohesive mechatronic ecosystems. These partnerships can expedite the development of turnkey motion control packages that seamlessly integrate encoders, drives, and control logic, addressing end users’ demand for single-source accountability and rapid deployment.

Detailing Rigorous Research Methodologies and Data Triangulation Processes Underpinning the Insights Into Optical Encoder Market Dynamics

The insights presented in this report are underpinned by a rigorous research methodology combining primary and secondary data collection, qualitative expert interviews, and quantitative data analysis. Primary research consisted of in-depth discussions with senior engineers, product managers, and procurement leaders across leading encoder manufacturing companies, system integrators, and end-user verticals. These interviews provided firsthand perspectives on technology adoption cycles, supply chain challenges, and evolving customer requirements.

Secondary research was conducted through comprehensive reviews of industry publications, trade journals, technical whitepapers, and publicly available regulatory filings. Market intelligence databases and patent analytics platforms supplemented these efforts, enabling the mapping of competitive landscapes and innovation trajectories. Data triangulation ensured consistency across multiple sources, validating key trends and corroborating anecdotal insights with empirical evidence.

Quantitative analysis involved the integration of shipment data, import-export statistics, and macroeconomic indicators to contextualize regional demand drivers. This multidimensional approach facilitated the identification of demand pockets, growth catalysts, and potential supply-side constraints. Quality control measures, including cross-validation with third-party experts and iterative feedback loops, further strengthened the robustness and reliability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Encoders market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Encoders Market, by Type

- Optical Encoders Market, by Technology

- Optical Encoders Market, by Output Signal

- Optical Encoders Market, by Mounting Type

- Optical Encoders Market, by Resolution

- Optical Encoders Market, by Form Factor

- Optical Encoders Market, by Distribution Channel

- Optical Encoders Market, by Application

- Optical Encoders Market, by Region

- Optical Encoders Market, by Group

- Optical Encoders Market, by Country

- United States Optical Encoders Market

- China Optical Encoders Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1431 ]

Synthesizing Key Takeaways and Strategic Imperatives to Guide Stakeholders Through the Rapidly Evolving Optical Encoder Landscape

In summary, the optical encoder market is poised for sustained innovation and growth driven by digital transformation, advanced photonic technologies, and the imperative for precise motion control. While tariff-induced supply chain pressures and regional regulatory nuances introduce complexity, they also catalyze strategic realignments and localized manufacturing initiatives. The segmentation analysis highlights how product types, technologies, output signals, mounting options, resolution tiers, form factors, distribution channels, and application verticals collectively shape the competitive landscape.

Regional insights underscore the unique drivers in the Americas, Europe, Middle East & Africa, and Asia-Pacific, each presenting distinct opportunities and challenges. Companies that maintain agility through supplier diversification, modular platform development, and embedded intelligence stand to lead market share gains. Moreover, strategic collaborations across the value chain will be critical in delivering integrated solutions that meet the evolving needs of end users in aerospace, automotive, industrial automation, and beyond.

By synthesizing these findings, stakeholders can craft informed strategies that harness the latest technological breakthroughs, optimize supply networks, and capitalize on emerging market trends. The detailed research and analysis provided herein serve as a strategic roadmap for navigating the complexity of the optical encoder landscape and driving long-term value creation.

Drive Informed Decision Making and Unlock Growth Opportunities by Securing the Comprehensive Optical Encoder Market Research Report Today

For organizations seeking to drive innovation and capitalize on emerging opportunities within the optical encoder market, proactive engagement with specialized research insights is essential. To empower strategic decision making and secure a competitive edge, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By leveraging his expertise, you can gain instant access to the comprehensive market research report tailored to the complex dynamics of optical encoders. Reach out today to explore tailored licensing options, supplement internal analyses with granular data, and unlock the actionable intelligence necessary to navigate evolving market challenges and maximize return on research investments

- How big is the Optical Encoders Market?

- What is the Optical Encoders Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?