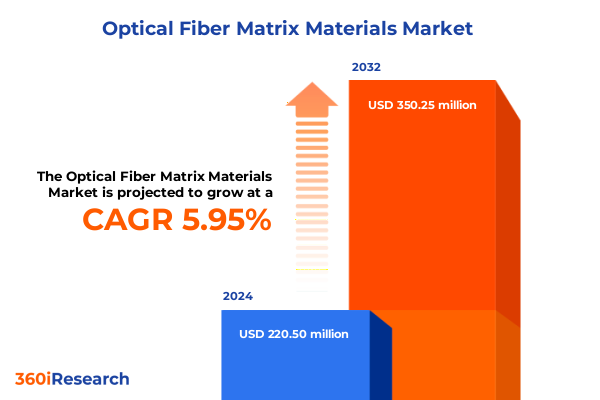

The Optical Fiber Matrix Materials Market size was estimated at USD 230.75 million in 2025 and expected to reach USD 245.16 million in 2026, at a CAGR of 6.14% to reach USD 350.25 million by 2032.

Pioneering Advances and Strategic Outlook in Optical Fiber Matrix Materials Shaping Resilient Connectivity and High-Performance Applications for Modern Networks

Optical fiber matrix materials represent the foundational architecture underpinning modern data transmission networks, industrial sensing systems, and defense-grade communication solutions. This section introduces the critical role played by composite matrices in enabling high-bandwidth, low-loss signal propagation over long distances, addressing the unrelenting demand for enhanced network reliability and performance. Recent advances in material science have catalyzed the evolution of matrices that not only minimize attenuation and dispersion but also deliver superior thermal stability and mechanical robustness under harsh environmental conditions. As optical networks expand to support next-generation applications, including 5G backhaul, edge computing, and intelligent infrastructure monitoring, the importance of meticulously engineered fiber matrices has never been more pronounced.

Setting the stage for a deep-dive exploration, this introduction outlines key themes that traverse material innovation, manufacturing sophistication, global trade dynamics, and end-user imperatives. It emphasizes the interconnectedness of material properties and system-level performance, underscoring how choices at the microscopic level ripple through to influence network uptime, maintenance costs, and lifecycle sustainability. By framing the discussion within a context of resilient connectivity and strategic foresight, this opening segment primes stakeholders to appreciate the far-reaching impact of optical fiber matrix materials on both current deployments and emerging technologies.

Emerging Innovations and Disruptive Technologies Driving Next-Generation Optical Fiber Matrix Material Performance Across Industries

The landscape of optical fiber matrix materials is undergoing profound transformation driven by cutting-edge innovations in polymer chemistry, additive manufacturing, and nanostructured reinforcements. Novel implementations of silica aerogel and silicone binder within silicon-based matrices are elevating thermal regulation and optical clarity while simultaneously reducing mass and footprint constraints. On the thermoplastic front, high-performance resins such as PEEK, polyamide, and PSU are being tailored to deliver unmatched dimensional precision and chemical resistance, enabling seamless integration into compact, high-density fiber assemblies. Additionally, next-generation thermosetting formulations encompassing epoxy, polyester, and vinyl ester systems are leveraging advanced crosslinking chemistries to impart exceptional mechanical strength and environmental resilience.

Parallel advancements in manufacturing techniques are fueling these material breakthroughs. Automated fiber placement driven by infrared and laser-assisted deposition is empowering manufacturers to achieve submicron alignment tolerances, enhancing signal fidelity and network uptime. Pultrusion processes-both continuous and discontinuous-are streamlining bulk matrix fabrication, while innovations in resin transfer molding, from high-pressure RTM to vacuum-assisted techniques, are unlocking opportunities for complex geometries and faster cycle times. As a result of these converging technological inflections, optical fiber matrix materials are transitioning from incremental enhancements to truly disruptive enablers of the next wave of high-speed, high-reliability communication and sensing infrastructures.

Assessing the Comprehensive Repercussions of U.S. Tariff Measures Implemented in 2025 on the Optical Fiber Matrix Materials Ecosystem

In early 2025, the United States enacted a series of tariff measures targeting imported precursors and composite materials integral to optical fiber matrix production. The levies have altered cost structures across the value chain, particularly impacting silicon-based inputs and advanced resin formulations sourced from key overseas suppliers. As manufacturers recalibrate procurement strategies, many have diversified sourcing to regions unaffected by the tariffs or accelerated qualification of domestic alternatives to preserve margin integrity and supply security. In parallel, end-users are negotiating revised contracts with integrators to offset incremental cost burdens, spurring collaborative value-sharing agreements that prioritize long-term stability over short-term price concessions.

The cumulative effect of the 2025 tariffs has extended beyond direct pricing implications, catalyzing a strategic push towards vertically integrated operations and nearshoring models. Firms are investing in local resin compounding capabilities and expanding in-house fiber drawing facilities to insulate against geopolitical volatility. Additionally, research partnerships between material developers and national labs have intensified, aiming to expedite the commercialization of tariff-exempt, locally produced composite formulations. Through a combination of supply chain reengineering, collaborative risk-sharing, and targeted R&D initiatives, stakeholders are successfully mitigating the adverse impacts of the tariff regime while positioning themselves for sustained growth in a more controlled regulatory environment.

In-Depth Segmentation Insights Revealing Material, Fiber, Application, Industry, and Manufacturing Technology Dynamics in Optical Fiber Matrices

A granular examination of material-based segmentation reveals distinct performance and cost characteristics across silicon-based, thermoplastic, and thermosetting resin families. Silicon-based matrices, particularly those incorporating silica aerogel and silicone binder, deliver unparalleled thermal management and low optical attenuation, making them indispensable in high-throughput, temperature-sensitive applications. Thermoplastic resins-spanning PEEK, polyamide, and PSU grades-offer a compelling blend of mechanical resilience and process adaptability, enabling manufacturers to optimize throughput in automated fiber placement and pultrusion operations. Meanwhile, thermosetting chemistries encompassing epoxy, polyester, and vinyl ester systems are prized for their crosslink density and environmental durability, often serving as the backbone of long-life defense and energy sector deployments.

From the perspective of fiber type, single-mode materials remain the gold standard for long-haul, high-capacity transmission, whereas multimode variants excel in short-reach, cost-sensitive networks. Application-driven segmentation illustrates a surge in data communication deployments-spanning fiber to the home and premises-as well as robust growth in industrial contexts. Structural health monitoring and temperature sensing use cases are supported by specialized sensing fibers integrated within resilient matrix composites. End-user industry insights underscore the criticality of data centers optimizing latency, defense programs prioritizing survivability under extreme conditions, energy networks requiring corrosion-resistant composites, and telecom operators balancing rapid rollout with lifecycle economics. Overlaying these usage profiles, manufacturing technology segmentation highlights the ascendancy of infrared and laser-assisted automated fiber placement, evolving pultrusion techniques, and both high-pressure and vacuum-assisted resin transfer molding. Collectively, these segmentation dynamics offer a comprehensive lens for stakeholders to tailor product portfolios, invest in targeted R&D, and align production capacity with emergent market demands.

This comprehensive research report categorizes the Optical Fiber Matrix Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Fiber Type

- Manufacturing Technology

- Application

- End User Industry

Regional Landscape Analysis Highlighting Americas, Europe Middle East Africa, and Asia-Pacific Drivers in Optical Fiber Matrix Developments

Regional analysis uncovers differentiated demand patterns and strategic imperatives across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust investment in data center expansion and next-generation defense sensor networks is driving uptake of high-durability matrices, complemented by energy sector modernization projects requiring advanced fiber-based grid monitoring. Collaborative initiatives between equipment suppliers and network operators are streamlining adoption curves, reinforcing North America’s role as a technology vanguard.

Across Europe Middle East & Africa, regulatory alignment on infrastructure resilience and sustainability is accelerating the integration of eco-friendly resin systems and lifecycle assessment frameworks. Industrial automation programs in Germany, smart grid deployments in the Middle East, and telecommunications densification in South Africa collectively fuel regional growth in optical fiber matrix solutions. Asia-Pacific stands out for its unparalleled scale of telecom infrastructure rollouts, buoyed by government-led broadband initiatives in China, Japan’s 6G precursor programs, and Southeast Asia’s burgeoning data traffic. Manufacturing hubs across the region are increasingly serving as contract production centers for global market leaders, leveraging cost efficiencies and technical expertise to meet escalating demand.

This comprehensive research report examines key regions that drive the evolution of the Optical Fiber Matrix Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape and Strategic Positioning of Leading Players Steering Innovation in Optical Fiber Matrix Material Solutions

Market leadership in optical fiber matrix materials is characterized by a blend of deep material science expertise, robust manufacturing capabilities, and strategic partnerships across the value chain. Innovators specializing in silicon-based aerogel matrices have carved out a niche addressing extreme thermal management needs, while resin formulators focusing on high-performance thermoplastics have differentiated through proprietary grade development that enhances processing speed and mechanical properties. Major fiber producers are collaborating with composite integrators to co-develop pre-aligned fiber assemblies, optimizing end-to-end signal fidelity.

Concurrently, leaders in automated fiber placement technology are forging alliances with resin transfer molding specialists to deliver turnkey solutions that accelerate time to market. Strategic M&A has enabled some firms to vertically integrate downstream capabilities, securing fiber drawing, matrix compounding, and final assembly under one roof. This consolidation trend enhances supply chain transparency and fosters accelerated R&D synergies. Additionally, several companies are investing heavily in pilot lines for infrared and laser-assisted deposition, positioning them to capitalize on growing demand for sub-micron precision and high-throughput manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Fiber Matrix Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Fujikura Ltd.

- Belden Inc.

- Coherent Corporation

- CommScope Holding Company, Inc.

- Corning Incorporated

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Hengtong Optic-Electric Co., Ltd.

- Jiangsu Zhongtian Technology Co., Ltd.

- LS Cable & System Ltd.

- Mitsubishi Chemical Group

- Nexans S.A.

- OFS Fitel, LLC

- Optical Cable Corporation

- Panduit Corp.

- Prysmian SpA

- Sterlite Technologies Limited

- Sumitomo Electric Industries, Ltd.

- Superior Essex Communications

- Yangtze Optical Fibre and Cable Joint Stock Limited Company

Strategic Action Plan and Best Practices for Industry Leaders to Thrive in the Evolving Optical Fiber Matrix Materials Market

Industry leaders should prioritize a multifaceted strategy that balances material diversification with manufacturing agility to maintain competitive advantage. Embracing alternative resin chemistries and qualifying domestic sources can mitigate tariff-induced cost volatility, while investing in advanced process automation such as laser-assisted fiber placement will enhance throughput and alignment accuracy. Strengthening collaborative frameworks with fiber producers and end-user integrators can drive co-innovation, ensuring that matrix compositions are optimized for specific deployment environments.

Further, organizations are encouraged to develop digital twins of composite fabrication lines, enabling real-time quality monitoring and predictive maintenance to reduce downtime. Expanding in-house pilot facilities for continuous and discontinuous pultrusion and resin transfer molding will allow rapid prototyping of next-generation geometries. Finally, forging partnerships with government research entities and leveraging public funding opportunities can accelerate the development of sustainable, eco-friendly matrix systems, addressing both regulatory pressures and end-customer expectations. By executing these recommendations, industry stakeholders will be well-equipped to navigate evolving market dynamics and capture value in high-growth segments.

Robust Research Framework and Methodological Approach Ensuring Data Integrity and Comprehensive Analysis in Matrix Material Studies

This report’s methodology integrates both primary and secondary research to ensure the highest standards of data integrity and analytical rigor. Primary inputs were gathered through in-depth interviews with key executives at fiber manufacturers, resin developers, OEMs, and end-user organizations, supplemented by insights from academic and government research laboratories. Secondary research incorporated peer-reviewed journals, patent databases, conference proceedings, company technical white papers, and global trade statistics to construct a holistic market perspective.

Analytical techniques employed include supply chain mapping to trace precursor materials from raw input through to final assembly, scenario analysis to evaluate the impact of tariffs and geopolitical shifts, and expert panel workshops to validate emerging trends. Quantitative findings were triangulated against multiple independent sources, with iterative feedback loops ensuring consistent alignment between market intelligence and stakeholder realities. Where possible, digital visualization tools were used to model manufacturing efficiencies and technology adoption curves, providing a dynamic foundation for the strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Fiber Matrix Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Fiber Matrix Materials Market, by Material Type

- Optical Fiber Matrix Materials Market, by Fiber Type

- Optical Fiber Matrix Materials Market, by Manufacturing Technology

- Optical Fiber Matrix Materials Market, by Application

- Optical Fiber Matrix Materials Market, by End User Industry

- Optical Fiber Matrix Materials Market, by Region

- Optical Fiber Matrix Materials Market, by Group

- Optical Fiber Matrix Materials Market, by Country

- United States Optical Fiber Matrix Materials Market

- China Optical Fiber Matrix Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesis of Critical Findings and Visionary Outlook Guiding Stakeholders in the Optical Fiber Matrix Materials Domain

Through a synthesis of material breakthroughs, manufacturing enhancements, and regulatory developments, this report offers a panoramic view of the optical fiber matrix materials market’s present state and future trajectory. The analysis uncovered clear differentiation among material types, fiber modalities, application vectors, and end-user imperatives, underscoring the importance of tailored strategies for distinct segmentation categories. Regional insights highlighted the divergent growth levers across the Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting unique adoption catalysts and competitive dynamics.

The cumulative impact of U.S. tariffs has prompted a strategic reappraisal of sourcing, production localization, and vertical integration, signaling a shift towards more resilient, domestically enabled value chains. Competitive mapping illuminated how leading firms are leveraging technology alliances and M&A to fortify their market positions, while actionable recommendations provide a pragmatic blueprint for navigating complexity and capturing emergent opportunities. As stakeholders look ahead, agility, collaborative innovation, and investment in advanced manufacturing will be paramount in sustaining growth and driving the next chapter of optical fiber matrix material excellence.

Engage with Ketan Rohom to Secure Comprehensive Optical Fiber Matrix Material Market Insights and Drive Your Strategic Objectives

To delve deeper into the comprehensive analysis, bespoke market insights, and tailored recommendations presented in this report, stakeholders are invited to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging in a personalized briefing, organizations can secure privileged access to detailed segmentation breakdowns, competitive benchmarking, and strategic roadmaps crafted to optimize decision-making and accelerate innovation. Whether you seek in-depth technology assessments, scenario planning support, or targeted go-to-market strategies, Ketan Rohom stands ready to facilitate seamless acquisition of the full optical fiber matrix materials market research report. Elevate your strategic initiatives and harness actionable intelligence by partnering with Ketan Rohom today.

- How big is the Optical Fiber Matrix Materials Market?

- What is the Optical Fiber Matrix Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?