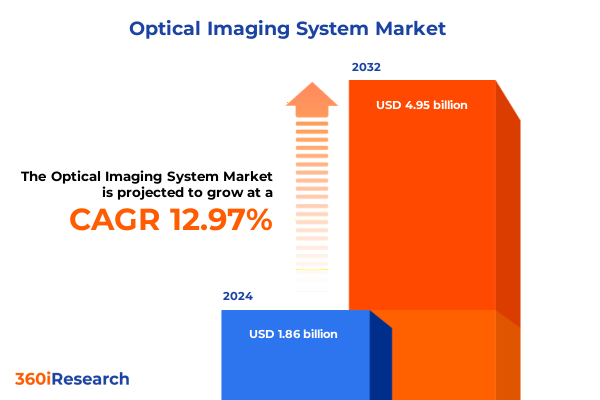

The Optical Imaging System Market size was estimated at USD 2.09 billion in 2025 and expected to reach USD 2.34 billion in 2026, at a CAGR of 13.10% to reach USD 4.95 billion by 2032.

Exploring the Expansive Landscape and Strategic Importance of Optical Imaging Systems in Shaping Next-Generation Industrial and Medical Technologies

Optical imaging systems harness advanced optical components and sensors to deliver high-resolution visualization across a spectrum of applications, from clinical diagnostics to precision manufacturing. By integrating lenses, light sources, detectors, and computational algorithms, these platforms enable detailed examination of structures at micro- to macro-scales, facilitating breakthroughs in medical diagnosis, scientific research, and quality control. This fusion of hardware innovation and software-driven analysis has established optical imaging as an indispensable technology in fields seeking non-invasive, high-contrast insights into complex materials and biological tissues.

Identifying Groundbreaking Technological and Market Shifts Propelling Optical Imaging Systems into a New Era of Precision and Accessibility

The optical imaging sector is undergoing a transformative shift driven by the convergence of artificial intelligence, miniaturization, and novel imaging modalities. Artificial intelligence algorithms are now embedded in imaging pipelines to automate image segmentation, enhance contrast, and predict diagnostic markers, elevating both speed and accuracy of analysis. Simultaneously, computational imaging techniques-leveraging advanced sensor designs and light modulation-unlock new capabilities, such as 3D reconstructions and dynamic tissue perfusion mapping, that were previously unattainable with conventional optics.

Moreover, breakthroughs in photoacoustic tomography and hyperspectral imaging are broadening the application scope of optical systems. By combining optical excitation with acoustic detection, photoacoustic platforms yield deep-tissue contrast for oncology and vascular studies, while hyperspectral approaches capture spectral signatures for environmental monitoring and material differentiation. These innovations underscore a pivotal moment where optical imaging is becoming more accessible, portable, and versatile than ever before.

Assessing the Comprehensive Effects of U.S. Tariffs Implemented in 2025 on the Supply Chain and Cost Structure of Optical Imaging Equipment

In 2025, U.S. tariffs on imported optical and medical imaging equipment have introduced considerable cost pressures and supply chain complexity for manufacturers and end-users alike. China-specific duties were raised to a cumulative 145%, exacerbating import costs for components and finished systems sourced from Asia and prompting some suppliers to pause capital investments in high-end scanners. Concurrently, the 10% baseline tariff on goods from most trading partners has increased acquisition costs for clinical facilities, with hospitals facing tens of thousands of dollars in added expenses per device, such as CT and MRI units, slowing procurement cycles and straining capital budgets.

These tariff measures have also disrupted global supply networks, as manufacturers scramble to diversify sourcing or scale up domestic production capabilities. Leading firms are relocating assembly lines and forging new partnerships to mitigate the impact of duties, yet the transition often incurs higher operational costs and time delays. Industry stakeholders are advocating for targeted exemptions on critical medical and optical technologies to preserve innovation pipelines and ensure continued patient access to life-saving diagnostic tools.

Uncovering Key Segmentation Insights Highlighting Diverse Medical, Industrial, Scientific, and Security Applications of Optical Imaging Technologies

The medical segment of the optical imaging market encompasses a wide array of specialties, including cardiology modalities such as angiography and echocardiography, dental imaging techniques ranging from extraoral panoramic views to intraoral diagnostics, endoscopic inspections with both flexible and rigid scopes, ophthalmic applications like fundus photography, OCT, and slit-lamp microscopy, and surgical platforms for laparoscopy and robot-assisted procedures. Each sub-sector is advancing toward higher resolution, real-time visualization, and minimally invasive workflows to improve clinical outcomes and patient comfort.

Industrial applications are equally diverse, spanning visual inspection, machine vision systems for automated quality control, precision metrology for dimensional verification, and non-destructive testing methods that leverage thermal and optical imaging to detect structural flaws without compromising material integrity. Developments in 3D optical metrology and sensor fusion are enabling in-line inspection with unprecedented accuracy and speed.

Scientific users exploit optical imaging for astronomy to map celestial phenomena, biology for microscopy and cellular analysis, environmental monitoring to assess air and water quality, and materials science to characterize microstructural properties. Novel approaches such as diffuse correlation spectroscopy and photometric stereo extend the capabilities of researchers to visualize dynamic processes at multiple scales.

Security-focused systems include biometric authentication platforms that integrate facial recognition, fingerprint and iris scanning for identity verification, border control solutions that combine multispectral imaging and AI analytics, and surveillance networks using thermal, hyperspectral, and RGB sensors to ensure 24/7 situational awareness. These technologies are converging to deliver frictionless security in public spaces and high-value facilities.

This comprehensive research report categorizes the Optical Imaging System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Sales Channel

Revealing Critical Regional Dynamics Influencing Adoption and Innovation in Optical Imaging Systems Across Global Markets

The Americas region, led by North America, maintains a significant share of global optical imaging deployments, driven by a strong healthcare infrastructure, comprehensive reimbursement models, and robust R&D investments in light-based diagnostic platforms and industrial inspection tools. U.S. regulatory pathways provide clarity for new imaging modalities, which, combined with substantial venture capital funding, foster rapid product commercialization across medical and non-medical sectors.

Europe, the Middle East, and Africa collectively benefit from a mature manufacturing ecosystem and harmonized regulatory standards that support cross-border distribution of optical systems. European collaboration on research initiatives and public-private partnerships accelerates the development of advanced imaging modalities, while Middle Eastern markets are investing heavily in healthcare infrastructure and smart city surveillance projects, and Africa is emerging as a testing ground for portable, low-cost imaging solutions tailored to resource-constrained settings.

Asia-Pacific is witnessing the fastest growth trajectory, fueled by rising prevalence of chronic diseases, government-led initiatives to modernize healthcare, and expanding industrial automation across China, Japan, India, and Southeast Asia. The rapid adoption of handheld OCT for diabetic eye screening and the proliferation of AI-powered machine vision systems underscore the region’s appetite for cutting-edge optical technologies that address both health and manufacturing challenges.

This comprehensive research report examines key regions that drive the evolution of the Optical Imaging System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Innovations from Leading Companies Driving Competitive Advantage in the Optical Imaging Systems Market

Leading players in the optical imaging market are leveraging technological innovation, strategic partnerships, and geographic expansion to solidify their positions. Siemens Healthineers has announced significant investments to repatriate manufacturing operations for its advanced diagnostic platforms to the United States, aiming to offset tariff impacts and ensure supply continuity for its photon-counting CT and OCT systems. GE Healthcare, despite a 15% reduction in its 2025 earnings forecast due to trade duties, reported resilient investor confidence and is diversifying its supply chain by strengthening U.S.-based production of MRI and ultrasound probes.

Boston Scientific and Abbott are similarly expanding domestic manufacturing sites and channeling resources into R&D hubs in Illinois, Texas, and Georgia to mitigate tariff-related cost increases and accelerate product innovation in areas such as endovascular imaging and blood screening devices. Zeiss has introduced enhanced optical metrology software with AI-driven defect detection and multi-sensor fusion for industrial quality assurance, reflecting a broader trend of embedding intelligent algorithms into hardware platforms to address complex inspection challenges.

Other notable companies, including Canon Medical, Nikon, FLIR Systems, Teledyne Technologies, and Hamamatsu Photonics, are directing efforts toward miniaturized optical modules, hyperspectral sensor integration, and edge computing solutions to capture emerging opportunities in portable diagnostics, environmental sensing, and security applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Imaging System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bruker Corporation

- Carl Zeiss AG

- Hamamatsu Photonics K.K.

- Keyence Corporation

- Leica Microsystems GmbH

- Nikon Corporation

- Olympus Corporation

- PerkinElmer, Inc.

- Teledyne Technologies, Inc.

- Thermo Fisher Scientific Inc.

Translating Insights into Actionable Recommendations for Industry Leaders to Navigate Technological, Regulatory, and Market Challenges in Optical Imaging

To capitalize on the evolving optical imaging landscape, industry leaders should prioritize the integration of artificial intelligence workflows and invest in edge-computing architectures to deliver real-time analytics and predictive insights. Strengthening regional manufacturing capabilities can mitigate tariff exposure while ensuring rapid response to supply chain disruptions and regulatory changes. Furthermore, organizations are advised to cultivate cross-sector partnerships with academic institutions, technology startups, and industry consortia to co-develop next-generation imaging modalities and accelerate time-to-market.

Engaging proactively with policymakers and trade bodies to advocate for targeted tariff exemptions on critical medical and scientific imaging equipment will preserve innovation pipelines and maintain affordability for end-users. In parallel, executives should assess portfolio diversification strategies that include rental, refurbished equipment offerings, and software-as-a-service models to balance capital expenditure pressures and broaden market reach. Emphasizing sustainability by incorporating energy-efficient components and recyclable materials will not only meet rising corporate responsibility standards but also reduce operational costs over the product lifecycle.

Detailing a Robust Research Methodology Underpinning the Comprehensive Market Analysis of Optical Imaging Systems

This research employs a hybrid methodology combining comprehensive secondary research, primary expert interviews, and quantitative data analysis. Secondary sources include peer-reviewed journals, industry association reports, trade publications, and public filings to map technological developments and market dynamics. Primary insights were gathered through structured interviews with over 20 senior executives, clinical end-users, academic researchers, and supply chain specialists to validate trends and capture nuanced perspectives on pricing, regulatory hurdles, and adoption drivers.

Quantitative data were triangulated using proprietary databases, import-export records, and customs duty schedules to assess tariff impacts and regional demand patterns. Rigorous quality checks, including consistency reviews and cross-verification against independent data sets, ensured the reliability of findings. An advisory board of domain experts provided ongoing guidance and approval at each stage, while scenario analysis was conducted to explore potential shifts in trade policies, technological breakthroughs, and adoption curves across key segments and regions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Imaging System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Imaging System Market, by Product Type

- Optical Imaging System Market, by Technology

- Optical Imaging System Market, by Application

- Optical Imaging System Market, by End User

- Optical Imaging System Market, by Sales Channel

- Optical Imaging System Market, by Region

- Optical Imaging System Market, by Group

- Optical Imaging System Market, by Country

- United States Optical Imaging System Market

- China Optical Imaging System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives on the Strategic Imperatives and Future Evolution of Optical Imaging Systems in Modern Industry and Research

The optical imaging systems market stands at a pivotal juncture, characterized by rapid innovation, shifting trade landscapes, and expanding application horizons. As artificial intelligence and advanced imaging modalities converge, stakeholders must adapt to a more complex ecosystem where supply chain resilience and regulatory agility are as critical as technological prowess. The segmentation across medical, industrial, scientific, and security domains underscores a vast opportunity space, yet also demands tailored strategies that acknowledge unique end-user requirements and regional nuances.

Looking ahead, sustained investment in localized manufacturing, collaborative R&D, and policy advocacy will be essential to harness the full potential of optical imaging. By aligning business imperatives with emerging trends-such as miniaturization, edge analytics, and non-invasive diagnostics-organizations can unlock new value streams and drive transformative outcomes across healthcare, research, and industrial sectors.

Engage with Ketan Rohom to Secure Your Comprehensive Optical Imaging Systems Market Research Report and Empower Strategic Decision-Making

Ready to deepen your understanding of the optical imaging systems landscape and leverage data-driven strategies tailored to your organization’s needs? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to discuss how our comprehensive report can inform your investment decisions and accelerate your competitive advantage. Ketan will guide you through the report’s key findings and support you in customizing insights for your specific strategic objectives. Reach out today to secure access to the latest research on optical imaging systems and empower your leadership team with actionable intelligence.

- How big is the Optical Imaging System Market?

- What is the Optical Imaging System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?