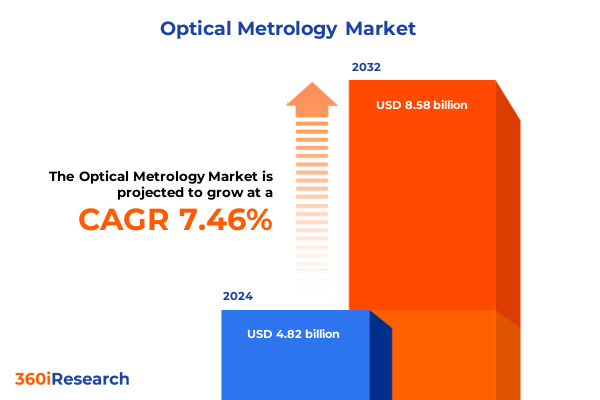

The Optical Metrology Market size was estimated at USD 5.18 billion in 2025 and expected to reach USD 5.57 billion in 2026, at a CAGR of 7.46% to reach USD 8.58 billion by 2032.

Unlocking the Strategic Foundations of the Optical Metrology Market for Advanced Industrial Measurement and Quality Assurance Applications Worldwide

Optical metrology has emerged as a pivotal enabler for precision measurement and quality assurance across an expanding range of industrial processes. As manufacturers and researchers push the boundaries of component miniaturization, surface finishing, and materials innovation, the demand for non-contact, high-resolution measurement solutions has intensified. Against this backdrop, understanding the foundational drivers of optical metrology becomes essential for organizations seeking to enhance manufacturing efficiency, minimize production defects, and foster next-generation product development.

In recent years, evolving challenges such as tighter tolerance requirements, accelerated production cycles, and integrated manufacturing environments have underscored the need for advanced optical metrology capabilities. The convergence of high-performance optics, sophisticated data analytics, and real-time process feedback has reshaped how companies approach inspection and measurement, facilitating rapid iteration and heightened consistency.

This executive summary distills the critical elements shaping the optical metrology market. It introduces key transformative shifts, examines the ripple effects of U.S. tariff policies, highlights segmentation and regional dynamics, profiles leading companies, and proposes targeted recommendations. By weaving together strategic insights and methodological rigor, this summary provides decision-makers with a coherent framework for navigating an increasingly complex and opportunity-rich metrology landscape.

Recognizing Transformative Technological and Market Shifts Redefining Future Directions in Optical Metrology and Precision Measurement

The optical metrology landscape is undergoing transformative shifts driven by the fusion of digital technologies and innovative measurement modalities. The integration of machine learning algorithms with high-resolution sensors has elevated the capacity for defect detection and predictive analysis, enabling manufacturers to preemptively address quality issues and optimize throughput. At the same time, cloud-based data management and edge computing architectures have facilitated more seamless connectivity between metrology instruments and broader Industry 4.0 ecosystems, ensuring that measurement insights translate directly into process adjustments and operational efficiencies.

Concurrently, the advent of additive manufacturing and the incorporation of complex geometries have challenged traditional measurement paradigms, prompting the development of hybrid inspection systems that blend optical and tactile modalities. This shift has driven instrument makers to adopt more modular designs, empowering end users to customize measurement chains according to specific application demands. Furthermore, sustainability imperatives have spurred investment in greener light sources and reduced-energy hardware configurations, reflecting a broader corporate commitment to environmental stewardship.

Moreover, the proliferation of remote monitoring solutions has expanded the reach of optical metrology into geographically dispersed production sites. By leveraging high-bandwidth connectivity and virtual instrumentation platforms, stakeholders can now oversee inspection routines from centralized quality centers, reducing the need for on-site specialists and accelerating decision cycles. Collectively, these transformative trends are reshaping competitive dynamics and redefining the strategic value of optical metrology within global manufacturing and research environments.

Assessing the Cumulative Implications of 2025 United States Tariff Policies on the Optical Metrology Industry Supply Chains and Cost Structures

In 2025, updated U.S. tariff policies have exerted a pronounced influence on the optical metrology supply chain, driving organizations to reevaluate sourcing strategies and cost structures. By extending import duties on key optical components and subsystems, these measures have elevated landed costs, particularly for high-precision lenses, laser modules, and advanced sensor arrays predominantly manufactured overseas. As a result, procurement teams face the dual challenge of maintaining quality standards while managing tighter budgetary constraints.

Trade uncertainties have also prompted a strategic reorientation toward supplier diversification. Many companies have accelerated partnerships with regional component manufacturers in North America, seeking to mitigate exposure to tariff volatility. Although reshoring initiatives entail upfront capital investment, they offer greater supply stability and reduced lead times. In parallel, the attractiveness of alternative trade routes and free trade agreements has risen, as firms explore reconfigured logistics networks to circumvent tariff zones and optimize duty benefits.

Looking ahead, the cumulative impact of these tariff adjustments is likely to catalyze greater vertical integration within the optical metrology sector. Equipment vendors may increasingly internalize critical component fabrication or secure long-term agreements with tariff-exempt jurisdictions. In turn, end users can anticipate a transitional period characterized by price restructuring, strategic procurement alliances, and a recalibrated balance between cost efficiency and measurement precision.

Revealing Key Insights Across Technology, End-User Verticals, Product Offerings, and Application Domains in Optical Metrology Market Segmentation

A holistic understanding of optical metrology demands scrutiny across multiple segmentation dimensions, each revealing distinct value drivers and growth levers. From a technological perspective, the market is dissected through confocal microscopy, subdivided into confocal laser scanning and Nipkow disk variants for high-resolution surface profiling, alongside ellipsometry techniques that afford unparalleled thin-film characterization. Interferometry also commands attention, blending laser interferometry for nanometer-scale displacement analysis with white light interferometry optimized for 3D surface mapping. Complementing these are optical profilometry methods, spanning focus variation to vertical scanning interferometry for rugged industrial applications, and spectroscopy platforms that encompass both FTIR and Raman modalities to elucidate material composition and molecular structure.

Turning to end-use sectors, demand converges on industries where precision and reliability are paramount. Aerospace and defense delineate stringent quality requirements for critical components, while automotive manufacturers integrate inline metrology to support mass production of safety systems. Electronics producers rely on surface measurement techniques to guarantee circuit integrity, and energy firms harness metrology inspection for turbine blade validation. Healthcare and life sciences researchers leverage microscopy and spectroscopy for biomaterial analysis, whereas research and academia drive foundational innovation. Meanwhile, semiconductor fabs continue to push resolution limits, reinforcing metrology’s role in driving Moore’s Law progression.

With respect to product differentiation, modules offer targeted measurement capabilities that users can integrate into custom configurations, while services encompass field calibration, maintenance, and technical support essential for minimizing downtime. Software platforms deliver advanced analytics, reporting, and automation workflows, and turnkey systems bring together hardware and software into fully configured solutions. Across applications, optical metrology is deployed for defect detection at submicron scales, layer thickness measurement in multilayer stacks, metrology inspection for geometric validation, roughness quantification on critical surfaces, stress analysis in precision components, overall surface measurement for flatness and form, and thin-film analysis critical to coating and semiconductor processes.

This comprehensive research report categorizes the Optical Metrology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- End-User

- Application

Unveiling Regional Dynamics Driving Optical Metrology Adoption and Innovation Trends Across the Americas, Europe Middle East Africa, and Asia-Pacific

Regional dynamics play a pivotal role in shaping optical metrology adoption, with each geography exhibiting unique innovation drivers and operational priorities. In the Americas, a robust manufacturing base in sectors such as aerospace, automotive, and semiconductors underpins demand for high-precision measurement solutions. Domestic policy initiatives and government-sponsored technology programs further encourage investment in metrology infrastructure, while end users benefit from proximity to leading instrument vendors and research institutions.

In Europe, the Middle East, and Africa, engineering excellence found in Germany, the United Kingdom, and France continues to fuel advanced metrology applications, particularly within automotive and renewable energy supply chains. Regulatory mandates on product safety and environmental compliance drive the uptake of non-contact inspection techniques. Meanwhile, the Middle East’s push toward economic diversification and Africa’s emerging manufacturing hubs create new frontiers for metrology deployment, often supported by public–private partnerships and infrastructure development schemes.

Across the Asia-Pacific region, rapid industrialization in China, Japan, South Korea, and India sustains a burgeoning appetite for optical metrology technologies. These markets leverage scale in electronics and semiconductor fabrication to accelerate adoption of inline inspection systems, while advanced manufacturing initiatives in Japan and South Korea emphasize collaborative robotics and digital twin integration. Furthermore, local government incentives and strategic alliances between technology providers and academic research centers facilitate the diffusion of cutting-edge metrology solutions throughout the region’s diverse industrial ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Optical Metrology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Optical Metrology Market Players with Strategic Innovations, Competitive Positioning, and Growth Initiatives Shaping Industry Progression

Leading companies in the optical metrology sphere distinguish themselves through strategic investments in research and development, digital transformation, and global service networks. These organizations are reinforcing their competitive positioning by expanding modular hardware portfolios, embedding advanced software analytics, and cultivating ecosystem partnerships that span hardware, software, and services.

Key players are pioneering cloud-based instrumentation platforms that enable centralized data aggregation, remote diagnostics, and subscription-based business models. Simultaneously, they are pursuing acquisitions of specialized sensor startups to integrate novel measurement modalities. Collaborative initiatives with original equipment manufacturers facilitate co-development of industry-specific metrology workflows, ensuring seamless integration with production lines and automated quality control.

Furthermore, companies are strengthening regional footprints through localized research centers and technical support hubs, enhancing responsiveness to client needs and reducing time to service. Emphasis on sustainability has driven innovations in energy-efficient light sources and recyclable material usage within instrument components. Collectively, these strategies underscore a market characterized by rapid technological convergence and escalating demand for turnkey, data-driven metrology solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Metrology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Bruker Corporation

- Carl Zeiss AG

- FARO Technologies, Inc.

- Hexagon AB

- Jenoptik AG

- Keyence Corporation

- Mitutoyo Corporation

- Nikon Corporation

- Renishaw plc

Formulating Actionable Strategies Empowering Industry Leaders to Harness Emerging Technologies, Optimize Operations, and Strengthen Market Resilience in Optical Metrology

To navigate the evolving optical metrology landscape, industry leaders should prioritize targeted investments in intelligent automation and data analytics. Integrating artificial intelligence and machine learning into measurement workflows can amplify defect detection capabilities and enable predictive maintenance, thereby reducing inspection bottlenecks and enhancing overall equipment effectiveness.

Moreover, optimizing supply chain resilience through diversified sourcing strategies and strategic alliances with regional component suppliers will mitigate exposure to trade policy fluctuations. Organizations should also evaluate opportunities to co-locate manufacturing and metrology operations to streamline logistics and minimize lead times. In parallel, forging partnerships with software vendors and academic research centers can accelerate the adoption of digital twin frameworks, integrating real-time measurement data into virtual process simulations for rapid iteration.

Employee skill development remains equally critical. Investing in training programs that build proficiency in advanced optics, data interpretation, and system integration will empower teams to extract maximum value from next-generation metrology platforms. By establishing cross-functional centers of excellence, companies can foster knowledge sharing and ensure consistent quality standards across global operations. Ultimately, a holistic approach-encompassing technology, operations, and talent-will equip organizations to capitalize on emerging opportunities and sustain competitive advantage.

Detailing Robust Research Methodologies Integrating Primary Insights, Secondary Data Analysis, and Expert Validation to Ensure Analytical Rigor and Accuracy

This research leverages a mixed-methods approach to ensure comprehensive and accurate insights into the optical metrology domain. Initially, primary data was collected through structured interviews with industry experts, technical directors, and end-user practitioners to capture firsthand perspectives on emerging trends, technology adoption, and operational challenges. These insights were complemented by quantitative surveys administered across key verticals, enabling prioritized identification of segment-specific drivers and barriers.

Secondary research encompassed an exhaustive review of peer-reviewed journals, patent databases, conference proceedings, and corporate white papers to map technological advancements and strategic initiatives. Triangulation techniques cross-validated findings, comparing primary inputs with documented industry developments and public disclosures. Furthermore, scenario analysis was applied to assess the impact of trade policy changes and technology shifts under multiple business environments.

Finally, an expert validation panel convened subject-matter authorities to review draft findings, ensuring factual accuracy, methodological rigor, and actionable relevance. This iterative process of data collection, analysis, and expert review underpins the credibility of the report’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Metrology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Metrology Market, by Product

- Optical Metrology Market, by Technology

- Optical Metrology Market, by End-User

- Optical Metrology Market, by Application

- Optical Metrology Market, by Region

- Optical Metrology Market, by Group

- Optical Metrology Market, by Country

- United States Optical Metrology Market

- China Optical Metrology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding with Strategic Perspectives on Catalyzing Innovation, Operational Excellence, and Sustainable Growth in the Evolving Optical Metrology Landscape

The optical metrology market stands at the intersection of technological innovation and operational transformation. As digitalization, additive manufacturing, and sustainability imperatives accelerate, organizations that embrace modular, data-driven measurement strategies will secure leadership positions in their respective industries. Navigating the complexities of trade policies and supply chain reconfiguration remains a critical success factor, demanding proactive planning and collaborative partnerships.

Furthermore, the convergence of intelligent analytics, cloud connectivity, and edge computing promises to redefine how measurement insights inform decision-making. By harnessing these capabilities, companies can drive continuous improvement, reduce time to market, and deliver products that meet ever-stricter quality and regulatory standards. Looking forward, sustained investment in talent development and ecosystem collaboration will underpin the next wave of metrology innovation.

In conclusion, the evolving optical metrology landscape offers a wealth of opportunities for organizations that combine strategic foresight with operational discipline. By aligning technology roadmaps with emerging market demands, industry participants can transform measurement data into a powerful competitive asset.

Driving Decision-Making Momentum with a Compelling Invitation to Connect for Comprehensive Optical Metrology Market Insights and Strategic Growth Opportunities

To gain unparalleled insights into the optical metrology landscape and equip your organization for rapid growth and innovation, reach out today. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive market research report can inform your strategic decisions, optimize your technology investments, and unlock new opportunities across diverse industry applications. Ketan brings a deep understanding of the precision measurement ecosystem and a dedication to tailoring solutions that align with your unique challenges and growth ambitions. Contact him to secure your copy of the report and start transforming data-driven insights into competitive advantage.

- How big is the Optical Metrology Market?

- What is the Optical Metrology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?