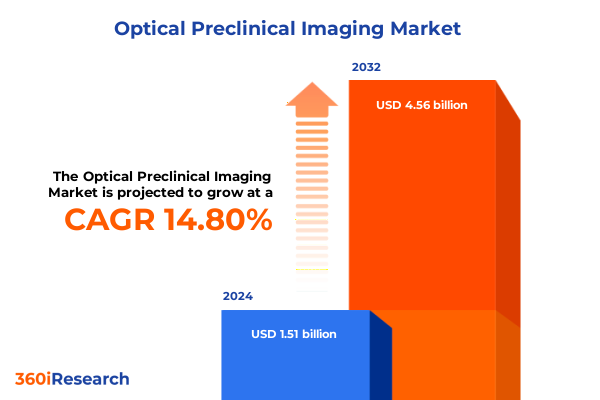

The Optical Preclinical Imaging Market size was estimated at USD 1.73 billion in 2025 and expected to reach USD 1.98 billion in 2026, at a CAGR of 14.83% to reach USD 4.56 billion by 2032.

Pioneering Insights into the Rapid Evolution of Optical Preclinical Imaging and Its Role in Driving Innovations in Biomedical Research Paradigms Globally

The field of optical preclinical imaging has emerged as a cornerstone of modern biomedical research, catalyzing breakthroughs in disease modeling and therapeutic evaluation. By harnessing light-based modalities to visualize molecular and cellular processes in small animal models, researchers are now able to generate high-resolution, real-time data that drive more informed decision-making throughout the drug discovery continuum. As this technology continues to mature, its applications have spread from basic research laboratories to contract research organizations and pharmaceutical R&D units, underscoring its growing relevance in translational medicine.

Moreover, advances in detector sensitivity and image analysis software have enabled the capture of biologically meaningful signals at unprecedented depth and speed. This progression not only enhances the fidelity of preclinical studies but also streamlines workflows by reducing experimental timelines and resource requirements. Consequently, stakeholders across academic institutes, diagnostics centers, and biotech firms are investing heavily in optical imaging platforms to gain competitive edge and accelerate pipeline progression. Against this backdrop, understanding the key drivers, emerging innovations, and strategic considerations within this market segment is essential for any organization seeking to harness the full potential of optical preclinical imaging.

Revolutionary Technological and Strategic Transformations Shaping the Future Trajectory of Optical Preclinical Imaging Across Key Research Applications

Over the past decade, optical preclinical imaging has undergone transformative shifts driven largely by technological breakthroughs and cross-disciplinary collaborations. High-throughput microplate readers equipped with bioluminescence detectors now permit simultaneous monitoring of dozens of samples, while handheld fluorescence devices facilitate on-site imaging with minimal animal handling. Concurrently, the rise of spectral-domain and swept-source optical coherence tomography systems has unlocked volumetric analysis capabilities, enabling researchers to visualize tissue architecture with micrometer-level precision.

In addition to hardware enhancements, software ecosystems have evolved to integrate artificial intelligence and machine learning algorithms that automate image segmentation and quantitative analysis. This fusion of computational power with advanced optics is fostering novel multimodal platforms, such as combined photoacoustic and fluorescence imaging, which offer complementary contrasts for comprehensive phenotypic characterization. Meanwhile, the emphasis on miniaturization and portability has democratized access to high-end imaging tools, empowering academic and clinical teams to conduct complex studies outside of traditional laboratory settings. Ultimately, these paradigm shifts are redefining experimental design, accelerating discovery cycles, and setting new benchmarks for data reproducibility across the optical preclinical imaging landscape.

Assessing the Comprehensive Consequences of the 2025 United States Tariff Regime on Supply Chains Regulatory Compliance and Operational Agility in Optical Preclinical Imaging

The implementation of new United States tariffs on certain imported photonics components and imaging devices in 2025 has created a ripple effect throughout the optical preclinical imaging ecosystem. From laser diodes and specialized detectors to complete imaging systems, the reclassified duty schedules have increased landed costs and prompted many manufacturers to reassess their sourcing strategies. As a result, both original equipment producers and consumables suppliers have encountered heightened pressure to optimize sourcing, mitigate compliance risks, and preserve product affordability.

In response, organizations have adopted a variety of strategic measures to offset cost burdens and maintain supply chain resilience. Some have established alternative partnerships with non-subject countries, while others have accelerated onshoring efforts to localize critical manufacturing steps. Additionally, procurement teams are employing more rigorous demand forecasting and inventory management protocols to absorb potential disruptions. Despite these mitigation tactics, the cumulative tariff impact continues to reverberate through pricing structures, contract negotiations with end users, and capital expenditure planning. Therefore, a nuanced understanding of evolving trade policies and proactive engagement with regulatory advisors remains indispensable for stakeholders aiming to navigate this complex policy landscape.

Unveiling Critical Market Segmentation Dynamics Across Technologies Product Types Applications and End Users Driving Growth Patterns in Optical Preclinical Imaging

A thorough examination of the market’s segmentation framework reveals the diverse pathways through which optical preclinical imaging solutions are adopted. In terms of technology, bioluminescence imaging platforms encompass both imaging systems and microplate readers, offering sensitive detection of gene expression and cellular activity. Fluorescence imaging extends this capability across ex vivo, in vitro, and in vivo modalities to accommodate a spectrum of experimental setups, while optical coherence tomography laboratories deploy spectral domain, swept source, and time domain variants for structural investigations. Complementing these is photoacoustic imaging, which presents handheld, microscopy, and tomography configurations for combined optical and ultrasonic contrast.

Breaking down product types further clarifies market dynamics, with instruments dominating initial capital investments and supported by ancillary accessories. Reagents and consumables, including specialized animal models and fluorescent dyes, form an indispensable consumable ecosystem, while software offerings span analysis packages and imaging informatics platforms that drive data interpretation. Applications cut across cardiovascular, drug discovery, neuroscience, oncology, and respiratory research, each demanding tailored imaging protocols and performance specifications. Lastly, end users range from academic and research institutes to contract research organizations, hospitals and diagnostic centers, and pharmaceutical and biotechnology companies, collectively shaping adoption curves and influencing vendor strategies through distinct operational priorities.

This comprehensive research report categorizes the Optical Preclinical Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Application

- End User

Elucidating Regional Market Variations and Strategic Drivers in the Americas Europe Middle East Africa and Asia Pacific Optical Preclinical Imaging Sectors

Regional analysis underscores divergent growth drivers and market maturity levels across geographies. In the Americas, established research infrastructures, robust funding from governmental bodies, and strong partnerships between academia and industry continue to fuel demand for advanced optical preclinical imaging solutions. Researchers in North America particularly benefit from integrated funding models that support exploratory studies and drive early adoption of novel devices.

Conversely, the region encompassing Europe, the Middle East, and Africa presents a heterogeneous mix of regulatory frameworks and healthcare priorities. Western Europe maintains a competitive edge through harmonized standards and collaborative networks, while emerging hubs in the Middle East are investing heavily in life sciences infrastructure. At the same time, Africa displays localized pockets of growth as international partnerships extend access to portable and cost-effective imaging systems.

Finally, Asia-Pacific is characterized by the fastest adoption rates driven by rapid expansion of pharmaceutical R&D, favorable government incentives, and growing local manufacturing capabilities. Countries such as China, Japan, and India are spearheading investments in high-end imaging research, and regional OEMs are increasingly challenging incumbents through price competitiveness and tailored solutions. These regional distinctions highlight the necessity of adaptive strategies that align with varying market maturities, regulatory environments, and funding landscapes to maximize impact.

This comprehensive research report examines key regions that drive the evolution of the Optical Preclinical Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Market Participants Their Strategic Collaborations Innovations and Competitive Positioning in the Optical Preclinical Imaging Ecosystem

Key industry players are steering the optical preclinical imaging market through a combination of technological innovation, strategic alliances, and targeted acquisitions. Leading firms are leveraging their core competencies in optics, software development, and animal model supply to offer integrated solutions that address entire experimental workflows. For instance, collaborations between imaging system manufacturers and informatics providers are resulting in seamless data management platforms that enhance throughput and reproducibility.

Moreover, several vendors are expanding their footprints by acquiring niche technology developers focused on optical sensors or contrast agents, thereby broadening their product portfolios and accelerating time to market. A parallel trend involves partnerships with contract research organizations to co-develop customized imaging protocols, ensuring that new platforms meet stringent validation requirements. In addition, companies are investing in training and service networks to provide on-site support, further differentiating their offerings and fostering long-term relationships with end users.

As competitive pressures intensify, the ability to deliver comprehensive, turnkey solutions that integrate hardware, reagents, and analytics software will be a key determinant of commercial success, driving sustained investment in R&D and collaborative ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Preclinical Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aspect Imaging Ltd.

- Berthold Technologies GmbH & Co. KG

- Bioscan Inc.

- Bruker Corporation

- Fujifilm Holdings Corporation

- Li-Cor Biosciences Inc.

- Medtronic plc

- Miltenyi Biotec B.V. & Co. KG

- MR Solutions Ltd.

- PerkinElmer Inc.

- Photon etc. Inc.

- Revvity Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Trifoil Imaging Inc.

Strategic Imperatives and Actionable Roadmaps for Industry Stakeholders to Capitalize on Emerging Opportunities in Optical Preclinical Imaging

To capitalize on emerging opportunities in optical preclinical imaging, industry leaders must align their strategic roadmaps with the evolving needs of researchers and clinicians. First, investing in artificial intelligence and machine learning capabilities within image analysis software can dramatically reduce time to insight and enhance reproducibility across studies. By integrating predictive analytics modules, vendors can offer value-added services that guide experimental design and optimize resource utilization.

Next, diversifying supply chains by qualifying secondary suppliers and exploring regional manufacturing partnerships will strengthen resilience against geopolitical disruptions and tariff fluctuations. Organizations should also consider modular system architectures that allow incremental upgrades, thereby lowering barriers to entry and extending product lifecycles. In parallel, fostering collaborative alliances with academic centers and contract research organizations will facilitate co-creation of specialized imaging protocols, accelerating technology validation in key application areas.

Finally, expanding cloud-enabled informatics platforms and offering subscription-based service models can unlock recurring revenue streams and deepen customer engagement. By adopting these strategic imperatives, industry stakeholders will be well positioned to navigate regulatory complexities, anticipate market shifts, and drive sustainable growth in the optical preclinical imaging landscape.

Transparent Overview of Research Framework Data Collection Analytical Techniques and Validation Protocols Underpinning the Optical Preclinical Imaging Market Study

This market study employs a rigorous research framework combining both qualitative and quantitative methodologies to ensure robust and unbiased insights. Primary data collection involved in-depth interviews with over 40 key opinion leaders, including academic researchers, product managers, and regulatory experts, to capture firsthand perspectives on technological trends and procurement decision criteria. Secondary research encompassed a comprehensive review of peer-reviewed publications, patent filings, and regulatory guidelines to corroborate market dynamics and validate emerging applications.

Data triangulation methods were applied to reconcile divergent viewpoints and enhance the credibility of findings. Market segmentation analyses leveraged technology adoption curves and end-user expenditure patterns, while competitive assessments integrated product launch timelines and strategic partnership announcements. All data points were cross-verified through advisory board reviews and benchmarking against public financial disclosures where available.

Ethical considerations and confidentiality agreements were strictly adhered to throughout the research process. This systematic approach ensures that the conclusions and recommendations presented are grounded in verifiable evidence, providing decision-makers with a clear and trustworthy roadmap for navigating the optical preclinical imaging market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Preclinical Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Preclinical Imaging Market, by Technology

- Optical Preclinical Imaging Market, by Product Type

- Optical Preclinical Imaging Market, by Application

- Optical Preclinical Imaging Market, by End User

- Optical Preclinical Imaging Market, by Region

- Optical Preclinical Imaging Market, by Group

- Optical Preclinical Imaging Market, by Country

- United States Optical Preclinical Imaging Market

- China Optical Preclinical Imaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings and Forward Looking Perspectives to Navigate Challenges and Leverage Opportunities in the Optical Preclinical Imaging Landscape Ahead

The optical preclinical imaging arena is evolving at a remarkable pace, propelled by continuous advancements in hardware, software, and multimodal integration. Stakeholders who approach this dynamic environment with agility-by embracing cutting-edge analytics, diversifying supply networks, and fostering collaborative partnerships-will be best equipped to harness future innovations. Strategic investments in AI-driven workflows and cloud-based informatics are poised to redefine experimental throughput and data quality, establishing new performance benchmarks.

Yet, the landscape also presents challenges, including regulatory complexities, tariff uncertainties, and intensifying competition from regional entrants. Navigating these obstacles will require a proactive posture that emphasizes risk mitigation and continuous market intelligence. By aligning product development with emerging application areas such as immuno-oncology and neurodegenerative disease models, organizations can unlock untapped value and drive meaningful impact in translational research.

In summary, the optical preclinical imaging market offers a wealth of opportunities for those who combine technological excellence with strategic foresight. The insights and recommendations articulated in this report provide a comprehensive foundation for decision-makers aiming to shape the future of biomedical discovery and maintain a competitive edge.

Engage with Ketan Rohom to Unlock Comprehensive Optical Preclinical Imaging Market Insights Empower Decision Making and Accelerate Strategic Growth

Unlock unparalleled insights into the optical preclinical imaging market by engaging directly with Ketan Rohom. This comprehensive report delivers deep analysis across emerging technologies, evolving regulatory environments, and competitive landscapes to inform your next strategic move. Whether you seek to optimize supply chains, enter new geographic markets, or refine your product portfolio, personalized guidance from Ketan ensures you leverage the latest innovations and market drivers.

Act now to secure a strategic advantage and catalyze growth in the dynamic world of optical preclinical imaging. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored solutions, detailed briefings, and exclusive access to proprietary data that will empower your organization to excel amid increasing complexity and rapid technological advancement.

- How big is the Optical Preclinical Imaging Market?

- What is the Optical Preclinical Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?