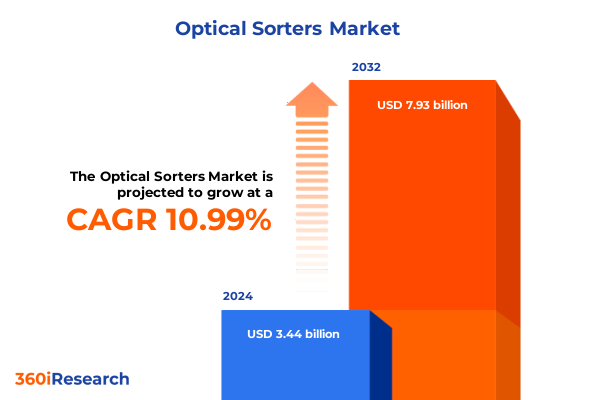

The Optical Sorters Market size was estimated at USD 3.81 billion in 2025 and expected to reach USD 4.21 billion in 2026, at a CAGR of 11.02% to reach USD 7.93 billion by 2032.

Unveiling the Optics Revolution Transforming Sorting Technologies Through Precision and Efficiency Gains Across Diverse Industries

The introduction sets the stage by underscoring how optical sorters have emerged as pivotal enablers of precision and productivity across diverse industries. Driven by relentless advances in imaging technologies, machine learning algorithms, and materials science, these systems now deliver unprecedented accuracy in identifying and separating particles and objects based on color, shape, size, and chemical composition. This transformation is not merely incremental; it represents a fundamental paradigm shift in how manufacturers, processors, and recyclers approach quality assurance, throughput optimization, and waste reduction in their operations.

As organizations grapple with rising labor costs, stringent quality regulations, and evolving consumer expectations, optical sorters have transitioned from optional efficiency boosters to strategic imperatives. Early adopters in the food industry leveraged basic color-sorting cameras to eliminate foreign objects and enhance product consistency, but today’s solutions integrate hyperspectral imaging and near-infrared spectroscopy to detect subtle defects, contaminants, and compositional variations that were previously undetectable. Moreover, the convergence of robotics and AI-powered vision systems has streamlined integration with conveyors, freefall chutes, and hybrid platforms, enabling seamless throughput at speeds that outpace manual or legacy mechanical processes.

This report’s introduction frames optical sorting not just as a tool for incremental improvement, but as a cornerstone technology reshaping competitive dynamics. The ensuing analysis unpacks transformative shifts, evaluates policy impacts, and distills actionable recommendations for stakeholders aiming to harness the full potential of optical sorters in an increasingly complex global supply chain.

Navigating Disruptive Forces Redefining the Optical Sorter Landscape From Automation Integration to Environmental Compliance Challenges

Recent years have witnessed a confluence of disruptive forces propelling the optical sorter market into a new era of sophistication and strategic relevance. At the technological core, the transition from standard RGB cameras to advanced hyperspectral imaging and combined sorter architectures has unlocked novel detection capabilities. Hyperspectral cameras now scan objects across hundreds of contiguous spectral bands, enabling identification of chemical signatures and material properties rather than surface-level attributes alone. Combined sorters integrate laser, near-infrared, and color-based sensing in unified platforms, delivering unmatched versatility and accuracy in applications ranging from food processing to mineral beneficiation.

Simultaneously, automation integration has accelerated, with manufacturers embedding optical sorters within fully automated lines that employ robotic pick-and-place systems and real-time analytics dashboards. This seamless convergence between hardware and software ecosystems offers predictive maintenance alerts, throughput optimization suggestions, and dynamic reconfiguration capabilities that adapt to shifting production demands. Environmental compliance pressures have further spurred innovation, as sorters are engineered for energy efficiency, reduced air and noise emissions, and minimal water consumption-attributes that resonate with sustainability goals in the Americas and Europe.

In tandem, rising digitalization across mining operations has spurred demand for freefall and belt-mounted configurations capable of sorting raw ores by compositional quality before grinding, thereby reducing downstream energy use. The recycling sector has also embraced lane-style sorters fitted with laser-based optical modules to distinguish polymer types, metals, and organic contaminants at unprecedented throughput rates. These transformative shifts underscore an industry at the crossroads of technological ingenuity and strategic necessity.

Evaluating the Compounding Effects of 2025 United States Tariff Policies on Optical Sorting Equipment Supply Chains and Customer Pricing Dynamics

The introduction of new tariff measures by the United States government in early 2025 has reverberated through global supply chains, profoundly affecting the optical sorter market. With import duties imposed on key components such as hyperspectral cameras, semiconductor lasers, and near-infrared detectors, equipment manufacturers have faced higher input costs, prompting many to reevaluate sourcing strategies and production footprints. Some global vendors have responded by shifting assembly operations closer to end markets, while others have pursued localization of critical subsystems to mitigate exposure to tariff volatility.

These added costs have been partly absorbed through lean manufacturing initiatives and strategic supplier partnerships, yet downstream customers have still encountered elevated prices for turnkey sorter systems. In certain cases, legacy contracts negotiated before tariff enactment have shielded buyers temporarily, but long-term procurement agreements are now renegotiated to reflect the new duties. The economic impact is particularly pronounced for smaller operators in the recycling sector, where margins are thin and capital budgets constrained, making price sensitivity acute.

Despite these headwinds, the imposed tariffs have inadvertently stimulated innovation, as manufacturers accelerate research into alternative sensing technologies that fall outside duty classifications. Laser diode advancements and miniaturized hyperspectral modules developed domestically have gained accelerated funding, laying the groundwork for next-generation sorters that balance performance with cost resilience. This section unpacks the cumulative effects of the 2025 tariff environment and elucidates how industry players are adapting to sustain growth amid shifting trade dynamics.

Revealing Critical Market Segmentation Patterns Illuminating Demand Drivers Across Technologies Platforms and Industry Applications in Optical Sorting

Understanding the multifaceted segmentation of the optical sorter market is essential for industry stakeholders seeking targeted growth opportunities. From a technological standpoint, camera-based solutions continue to dominate entry-level applications, particularly in basic color and shape recognition tasks. However, the rapid uptake of hyperspectral cameras and combined sorters highlights a broadening requirement for chemical and compositional analysis in sectors such as mining, where precise ore grading translates directly to operational efficiency. Simultaneously, laser-based modules are carving out a niche in high-speed recycling lines for their ability to differentiate polymers and metals through reflective and absorptive spectral signatures, while near-infrared sorters maintain strong relevance in food safety and quality control due to their sensitivity to moisture content and organic compounds.

Platform variety further tailors solutions to specific throughput and spatial constraints. Belt systems are prized in continuous processing environments like grain handling and mining, where consistent feed rates align with conveyor-based sorters. Freefall configurations afford a cost-effective option for smaller operations or volume-variable streams, offering gravity-fed sorting without the footprint of extensive conveyor networks. Hybrid platforms blend the advantages of belts and freefall chutes, yielding flexible layouts adaptable to diverse line speeds. Lane-style sorters, equipped with modular sensor arrays, excel in high-resolution applications such as recycled plastics sorting, where precise segregation by polymer type demands individual lanes dedicated to specific material streams.

Application sectors include food processing, where removing foreign objects and grading produce quality remains foundational; mining, which leverages advanced spectroscopy to segregate ore by mineral composition and improve downstream recovery rates; and recycling, where sorting complex waste streams into pure material fractions underpins circular economy objectives. This granular segmentation analysis illuminates key demand vectors and underscores the critical interplay between technology, platform design, and end-use requirements.

This comprehensive research report categorizes the Optical Sorters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Modality

- End-Use Industry

- Sales Channel

Analyzing Regional Dynamics and Market Drivers Shaping Optical Sorter Adoption Trends Across the Americas, EMEA and the Asia-Pacific Ecosystems

Geographical markets exhibit distinct adoption trajectories for optical sorting systems, shaped by regional regulations, infrastructure maturity, and commodity profiles. In the Americas, the combination of stringent food safety mandates and a well-established recycling ecosystem has driven rapid replacement of legacy sorters with advanced laser and near-infrared units. Several North American beverage bottlers, for instance, have invested in lane-style configurations to ensure stringent glass and plastic purity thresholds, while South American grain exporters leverage hyperspectral sorters to comply with international phytosanitary standards.

The Europe, Middle East & Africa region presents a diverse tapestry of market drivers and challenges. Western Europe’s focus on sustainability and circular economy targets has accelerated deployment of combined sorters in recycling facilities, enabling higher throughput and finer material segregation. In the Middle East, demand for mining-oriented hyperspectral solutions is rising in tandem with growing investment in mineral extraction projects, particularly in phosphate and rare earth mining. Meanwhile, Africa’s emerging agribusiness sector increasingly integrates cost-effective belt-mounted sorters to reduce post-harvest losses and enhance export quality.

In the Asia-Pacific region, manufacturing hub status and escalating labor costs have catalyzed automation across food, mining, and recycling segments. Chinese producers are at the forefront of hyperspectral sorter development, driving component price reductions and offering locally engineered systems tailored to regional crops and mineral compositions. Southeast Asian nations are rapidly adopting freefall sorters in rice mills to meet rising yield and safety standards, while Australia’s robust mining sector continues to refine ore-sorting workflows with combined laser and spectral imaging modules. These regional insights highlight evolving market priorities and underscore the necessity for customized deployment strategies.

This comprehensive research report examines key regions that drive the evolution of the Optical Sorters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Technological Advancements in the Optical Sorter Industry Across Global Markets

The optical sorter landscape is defined by a constellation of technology leaders, innovative startups, and collaborative partnerships that collectively accelerate industry progress. Major multinational corporations have leveraged their global R&D infrastructure to introduce next-generation hyperspectral and combined sensing platforms, embedding AI-driven defect detection algorithms and cloud-enabled analytics in their offerings. These incumbents maintain rigorous certification processes, extensive service networks, and comprehensive training programs, reinforcing their market leadership in food processing and recycling applications.

Concurrently, agile technology firms have emerged with niche expertise in laser optics and miniaturized NIR modules, securing venture funding and strategic alliances to scale production. Their breakthroughs in diode efficiency and sensor miniaturization have lowered barriers to entry for mid-sized recyclers and mining outfits seeking tailored sorter configurations. Strategic partnerships between camera manufacturers and AI software providers have further enriched the innovation ecosystem, delivering turnkey solutions that combine hardware precision with deep learning-based anomaly detection and predictive maintenance capabilities.

Beyond pure-play sorter vendors, OEMs in related equipment sectors have integrated optical sorting modules into broader processing lines, offering end-to-end solutions that streamline procurement and service. These collaborations extend across conveyor system providers, robotics integrators, and data management platforms, creating holistic value chains that support rapid deployment and scalable upgrades. This dynamic interplay among established market giants, disruptive innovators, and system integrators underscores the competitive intensity and collaborative spirit defining today’s optical sorter industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Sorters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allgaier Process Technology GmbH

- Anzai Sorting Technology Co., Ltd.

- Aweta B.V.

- Binder+Co AG

- BoMill AB

- Bühler Group

- Cabinplant A/S

- Cimbria A/S

- Daewon GSI Co., Ltd.

- Elisam International S.A.

- Hefei Meyer Optoelectronic Technology Inc.

- Key Technology, Inc.

- Meyer Optoelectronic Technology (Kunshan) Co., Ltd.

- NEWTEC GmbH

- Orange Sorting Machines (India) Pvt. Ltd.

- Pellenc S.A.

- Raytec Vision S.p.A.

- Satake Corporation

- TOMRA Systems ASA

- Unitec S.p.A.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Evolving Optical Sorter Market

To thrive amidst evolving market complexities, industry leaders should adopt a multipronged strategy that balances innovation, operational efficiency, and customer-centric service. Prioritizing R&D investments in emerging sensing modalities-such as machine-vision-enhanced hyperspectral cameras and compact laser diode arrays-will position companies to address growing demand for finer material discrimination and real-time quality analytics. Concurrently, developing modular, scalable platforms that can be rapidly customized for belt, freefall, hybrid, or lane configurations will capture diverse application requirements and streamline installation timelines.

Operational excellence should be reinforced through the establishment of regional assembly centers to mitigate tariff exposure and reduce lead times. These localized facilities can integrate domestic supply chains for critical components, complementing global manufacturing hubs and promoting cost resilience. At the same time, enhancing after-sales capabilities-through predictive maintenance services, remote diagnostics, and comprehensive training offerings-will bolster customer retention and facilitate recurring revenue streams.

Finally, forging strategic alliances with AI software developers, automation integrators, and materials science laboratories will accelerate solution development and broaden addressable markets. Collaborations that span the food processing, mining, and recycling sectors can uncover cross-industry synergies, enabling the cross-pollination of best practices and use cases. By aligning innovation pipelines with customer pain points and leveraging ecosystem partnerships, industry players can chart a sustainable growth trajectory in the optical sorter domain.

Transparent Research Methodology Ensuring Accuracy Through Rigorous Data Collection Expert Interviews and Robust Analytical Frameworks

This report’s findings are underpinned by a rigorous research methodology designed to ensure accuracy, relevance, and depth of insight. Primary research began with dozens of in-depth interviews conducted with senior executives, R&D heads, and operations managers across leading equipment manufacturers, end-user organizations, and component suppliers. These conversations provided qualitative insights into market drivers, technology adoption barriers, and regional deployment dynamics.

Secondary research encompassed a comprehensive review of industry journals, technical whitepapers, regulatory filings, and patent databases to track technological developments in hyperspectral imaging, laser diodes, and near-infrared spectroscopy. In parallel, analyst teams evaluated financial reports, press releases, and conference presentations to chart strategic partnerships, product launches, and M&A activity. Data triangulation methods were employed to cross-verify quantitative inputs and qualitative observations, ensuring consistency across disparate sources.

Analytical frameworks such as Porter’s Five Forces, SWOT analysis, and value chain mapping were applied to distill competitive intensity, innovation hotspots, and potential entry barriers. These models were tailored to account for segmentation by technology type, platform architecture, and application sector, as well as by regional market characteristics. The result is a robust, multi-layered approach that delivers actionable intelligence for stakeholders at every level of the optical sorter ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Sorters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Sorters Market, by Sensor Modality

- Optical Sorters Market, by End-Use Industry

- Optical Sorters Market, by Sales Channel

- Optical Sorters Market, by Region

- Optical Sorters Market, by Group

- Optical Sorters Market, by Country

- United States Optical Sorters Market

- China Optical Sorters Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 4611 ]

Drawing Conclusive Perspectives on the Future Trajectory of Optical Sorter Technology Adoption Amidst Regulatory Shifts and Market Transformation

As the optical sorter market continues its rapid evolution, several convergent trends will shape its future trajectory. The ongoing shift towards integrated sensing platforms-combining hyperspectral, laser, and near-infrared modalities-will set new benchmarks for accuracy and throughput, particularly in high-precision applications such as rare mineral sorting and microplastic detection in recycling streams. Concurrently, digital twins and cloud-based analytics are poised to transform maintenance paradigms, shifting operations from reactive troubleshooting to proactive system optimization.

Regulatory landscapes will also play a decisive role, with sustainability mandates and food safety directives driving adoption curves. Companies that anticipate these policy shifts by designing energy-efficient sorters and comprehensive traceability features will secure competitive advantage. Moreover, continued regional supply chain realignment in response to trade policy fluctuations underscores the importance of localized production hubs and diversified sourcing strategies.

Ultimately, the convergence of technological innovation, strategic partnerships, and adaptive business models will determine market leaders. Stakeholders who harness the insights within this report-leveraging segmentation analysis, regional intelligence, and actionable recommendations-will be best positioned to navigate uncertainties and capitalize on the full potential of optical sorting technologies.

Empowering Decision Makers to Secure Comprehensive Insights by Engaging with Ketan Rohom for Access to the Definitive Optical Sorter Market Report

To gain deeper intelligence and secure your copy of the full market research report on optical sorters, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan and his team will guide you through the detailed findings, tailored insights, and supplemental data sets that underpin this executive summary. By connecting with him, you will unlock exclusive access to the comprehensive analysis, proprietary scenario planning, and bespoke strategic recommendations designed to help you drive competitive advantage in the rapidly evolving optical sorter market.

- How big is the Optical Sorters Market?

- What is the Optical Sorters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?