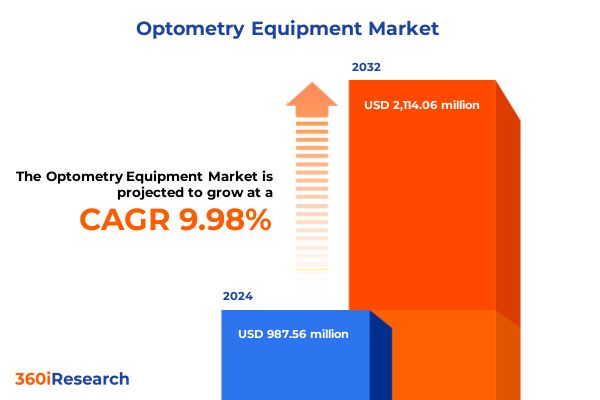

The Optometry Equipment Market size was estimated at USD 1.07 billion in 2025 and expected to reach USD 1.16 billion in 2026, at a CAGR of 10.19% to reach USD 2.11 billion by 2032.

An orientation to the evolving optometry equipment landscape where clinical needs, digital integration, and supply dynamics redefine procurement and service priorities

The optometry equipment landscape stands at a pivotal crossroads where clinical demand, technological innovation, and global trade dynamics converge to reshape purchasing, servicing, and manufacturing priorities. This introduction frames the market through an operational lens: buyers and providers now evaluate equipment purchases not only for clinical performance but for lifecycle cost, interoperability with electronic health records, and the agility of supplier networks. As patients demand faster diagnostics and providers seek efficiency gains, equipment portfolios that combine robust optics with data-driven imaging and simplified user workflows move to the forefront.

Consequently, executives must interpret product roadmaps and procurement strategies with an expanded set of criteria that includes digital enablement, parts availability, and regional regulatory pathways. The remainder of this executive summary synthesizes those forces and translates them into practical implications for product teams, supply chain leaders, and commercial strategists who must act decisively to preserve access and margin while navigating an increasingly complex external environment.

How digital transformation, supplier diversification, and service-centric commercialization are jointly redefining device value propositions and procurement behavior

The landscape is undergoing transformative shifts driven by three convergent vectors: rapid digitalization of diagnostic instruments, reconfiguration of global supply chains, and an intensifying focus on total cost of ownership rather than initial capex alone. Digital imaging and software-enabled diagnostics are expanding the clinical utility of devices that were once purely mechanical, enabling remote review, AI-assisted interpretation, and longitudinal patient tracking. These capabilities reposition devices such as slit lamps, fundus cameras, and optical coherence tomography systems from single-purpose tools to nodes in an integrated clinical data ecosystem.

At the same time, supply chain reconfiguration is accelerating as manufacturers pursue dual strategies: nearshoring to reduce tariff and logistics exposure, and strategic supplier diversification to protect continuity of service. This shift prompts design-for-manufacturability decisions and supplier consolidation in categories where specialist components are scarce. Moreover, buyer preferences are shifting toward vendor partnerships that bundle device sales with training, preventative maintenance, and subscription-based software to spread cost and ensure uptime. Taken together, these shifts demand that commercial teams align product differentiation with dependable service models and that R&D prioritize modularity and software-first design to capture clinical workflows and recurring revenue streams.

An objective assessment of how United States tariff adjustments in 2025 alter procurement costs, supplier strategies, and clinical equipment availability across ophthalmic care

Recent tariff developments in the United States have created a material layer of complexity for equipment procurement, component sourcing, and long-term supplier strategy. Policy actions that target imports of specific medical devices and components, combined with tariff adjustments on inputs such as steel, aluminum, and electronics, raise landed costs for equipment that relies on international supply chains and dense component integration. These measures have prompted many manufacturers to reassess where they produce sensitive subassemblies and to accelerate cost-avoidance strategies, including qualification of alternative suppliers outside tariff-affected jurisdictions.

Healthcare providers and procurement organizations confront two immediate operational consequences. First, short- to medium-term purchase decisions must account for higher import duties and potential delays tied to customs reviews and classification disputes, which disproportionately affect complex instruments and precision optical subcomponents. Second, payers and provider finance teams will pressure device vendors for clearer warranty, service, and refurbishment options to offset higher acquisition costs. Sector stakeholders including hospital associations have highlighted the disproportionate impact of tariff policy on consumables and high-volume supplies, raising concerns about inflationary pressures on care delivery and constrained access in low-margin service lines.

In response, business leaders are pursuing three practical mitigations. They are accelerating geographically diversified sourcing, redesigning products to limit tariff-exposed inputs, and negotiating more explicit pass-through and rebate terms in distribution agreements. Notably, firms in the medtech space are also pursuing strategic dialogues with trade counsel and government agencies to seek exclusions or temporary relief for critical medical technologies, recognizing that regulatory and policy relief can materially alter near-term commercial outcomes. These dynamics create both risk and opportunity: suppliers who can demonstrate reduced tariff exposure and predictable lead times will gain competitive advantage, while those dependent on single-region production may face sustained margin pressure.

Granular segmentation insights that map product architectures, distribution channels, end-user profiles, and digital technology variants to practical commercialization choices

Segmentation analysis reveals distinct demand patterns across product families and buying channels that should inform portfolio management and go-to-market tactics. Product-level differentiation is pronounced: Autorefractors continue to prioritize throughput and ease of use for optical centres, whereas fundus cameras now split demand between handheld, smartphone-based, and tabletop formats reflecting field screening, tele-ophthalmology, and clinic-based imaging needs respectively. Optical coherence tomography systems differentiate by imaging architecture-spectral domain devices balance resolution and cost for general clinics, swept source platforms deliver deeper tissue penetration for specialty clinics, and time domain systems retain niche use where cost and simplicity matter. Phoropters and tonometers remain stalwarts for routine refraction and intraocular pressure measurement, while slit lamps bifurcate into analog devices favored for cost-sensitive settings and digital slit lamps that integrate imaging and patient records for advanced practices.

Distribution channels shape purchasing velocity and service expectations. Direct sales arrangements enable tighter clinical customization and bundled service contracts for hospitals and large optical chains, whereas distributors provide breadth and local stocking for regional optical centres, and online retail channels increasingly serve standalone practices that prioritize price transparency and fast delivery. End-user profiles drive features and procurement cycles: hospitals demand integration, traceability, and large-scale service agreements; optical centres prioritize throughput, ease of training, and predictable consumable costs; and specialty clinics focus on premium imaging capabilities, upgrade paths, and referral-driven return on investment. Technology orientation further segments adoption patterns: digital platforms-available as handheld or standalone form factors-accelerate early uptake in telehealth and screening programs, while non-digital instruments retain strong adoption where cost and simplicity are decisive. Together, these segmentation lenses provide a framework for aligning product development, channel incentives, and service models to match the nuanced needs of each buyer cohort.

This comprehensive research report categorizes the Optometry Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Distribution Channel

- End User

Regional dynamics and procurement behaviors across the Americas, Europe Middle East & Africa, and Asia-Pacific that determine adoption curves and service expectations

Regional dynamics underscore that geographic context materially shapes procurement strategy, regulatory pathway, and competitive positioning. In the Americas, market behavior emphasizes consolidation among established hospital systems, investment in outpatient optical centres, and strong demand for devices that deliver rapid throughput and enterprise-level integration. Currency and logistics volatility in parts of the region prompt purchasing organizations to prioritize service agreements and local spare parts inventories to assure uptime.

In Europe, Middle East & Africa, regulatory heterogeneity and a wide spectrum of payer models create differentiated uptake patterns: Western European providers often lead in early adoption of software-enabled imaging and integrated service contracts, while parts of the Middle East invest selectively in high-end imaging for specialty clinics. African markets show increasing interest in portable, low-cost fundus cameras and handheld diagnostics that support screening and outreach programs, with NGOs and public health initiatives driving procurement in many jurisdictions.

Across Asia-Pacific, demand reflects a broad continuum from high-volume, price-sensitive optical centres to advanced tertiary hospitals investing in swept source OCT and integrated imaging suites. Supplier strategies in this region often balance competitive local manufacturing with export-oriented production, creating a dense ecosystem for component suppliers and contract manufacturers. In each region, localized service networks, regulatory approval timelines, and tariff or trade policy considerations determine the optimal mix of local inventory, on-site maintenance capability, and remote diagnostics support.

This comprehensive research report examines key regions that drive the evolution of the Optometry Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How leading manufacturers differentiate through modular product design, service-led commercial models, and resilient manufacturing footprints to outcompete peers

Company-level dynamics revolve around product differentiation through software, manufacturing footprint optimization, and expanded service offerings that embed maintenance and analytics into commercial propositions. Competitive leaders invest in modularity-allowing upgrades from analog to digital slit lamps or from tabletop fundus cameras to networked imaging platforms-thus creating upgrade paths that preserve installed base value and foster recurring revenue. Strategic partnerships with software vendors, cloud providers, and distribution networks enable faster commercialization of AI-assisted diagnostics and remote monitoring features that practitioners increasingly expect.

Operationally, firms that prioritize dual sourcing for critical optics and electronic subcomponents mitigate tariff and logistics exposure while maintaining product quality. Companies are also expanding service organizations to offer predictive maintenance and rapid parts replacement, thereby shifting procurement conversations from discrete purchases to outcomes-based contracts. For new entrants, differentiation often rests on niche strengths: lower-cost handheld imaging for outreach programs, highly compact OCT for small specialty clinics, or tightly integrated practice management features for optical chains. The competitive landscape rewards clarity: companies that can demonstrate product reliability, software security, and transparent supply continuity will capture the highest-value customer segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optometry Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Vision LLC

- Bausch + Lomb Corporation

- Canon Medical Systems Corporation

- Carl Zeiss AG

- Clearlab SG Pte, Ltd.

- CooperVision, Inc.

- Escalon Medical Corp.

- Essilor International

- Haag-Streit Group

- Heidelberg Engineering Inc.

- HEINE Optotechnik GmbH & Co. KG

- Hoya Corporation

- Huvitz Corp.

- Johnson & Johnson Services, Inc.

- Kowa Company, Ltd.

- Leica Microsystems by Danaher Corporation

- Lumenis Be Ltd.

- Nidek Co., Ltd.

- Ophtec BV

- STAAR Surgical Company

- Topcon Corporation

- Visionix Group

- Volk Optical Inc.

- Ziemer Ophthalmic Systems AG

Actionable strategies for device makers and buyers to de-risk trade exposure, monetize service offerings, and secure long-term clinical adoption

Industry leaders should pursue an integrated defensive and offensive strategy that reduces exposure to trade policy while unlocking new commercial value. First, accelerate product designs that minimize dependence on tariff-sensitive inputs by substituting materials where clinically feasible and by qualifying alternate component vendors across multiple regions. This design-for-resilience approach reduces single-source risk and shortens the timeline to re-route production when policy shocks occur.

Second, commercial teams must reframe pricing and contracting to reflect service and software value, offering bundled maintenance, training, and tele-support to spread cost and secure recurring revenue. Such packages make purchase decisions more predictable for hospitals and optical centres and reduce total cost of ownership anxiety. Third, build strategic inventory buffers for high-impact consumables and critical spares while expanding local service capabilities in core markets to ensure uptime under logistical stress. Finally, actively engage with trade counsel and industry associations to seek targeted tariff exclusions or temporary relief for clinically critical products; combine these advocacy efforts with public evidence demonstrating clinical dependence to improve the likelihood of favorable rulings. Together these actions fortify market position and create defensible advantages in an environment of persistent uncertainty.

A transparent, interview-driven research methodology combining primary stakeholder interviews and secondary policy analysis to validate market signatures and supplier risk

This research synthesizes primary and secondary evidence through a structured, reproducible methodology designed to validate market signals and capture practitioner priorities. Primary research incorporated in-depth interviews with procurement leaders, clinical directors, and field service managers across hospitals, optical centres, and specialty clinics to capture decision drivers, service expectations, and procurement timelines. Secondary research triangulated regulatory filings, tariff announcements, and supplier disclosures to map supply chain pathways and identify tariff-exposed product lines.

Analytical methods include cross-segmentation mapping of product types against distribution channels and end-user profiles, qualitative coding of interview transcripts to identify recurring adoption barriers, and scenario analysis to test tariff exposure under alternative policy pathways. Quality controls included supplier validation checks and a multi-review editorial process to ensure clarity, consistency, and defensibility of conclusions. This methodology produces insights that directly inform strategic planning, procurement prioritization, and product roadmap decisions while remaining transparent about assumptions and data limitations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optometry Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optometry Equipment Market, by Product Type

- Optometry Equipment Market, by Technology

- Optometry Equipment Market, by Distribution Channel

- Optometry Equipment Market, by End User

- Optometry Equipment Market, by Region

- Optometry Equipment Market, by Group

- Optometry Equipment Market, by Country

- United States Optometry Equipment Market

- China Optometry Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding synthesis emphasizing the strategic necessity of resilience, digital integration, and service monetization for sustained market leadership

In conclusion, the optometry equipment market is maturing into a data-centric, service-driven ecosystem where product success depends on more than optical performance alone. Digital enablement, modular upgradeability, and resilient supply chains are now integral to competitive positioning. Providers seek partners who can guarantee uptime, integrate imaging into clinical workflows, and offer predictable lifecycle economics in the face of tariff volatility and logistics uncertainty.

Moving forward, stakeholders who align R&D roadmaps with pragmatic sourcing strategies and who translate device functionality into measurable clinical and operational outcomes will capture disproportionate share of high-value procurement decisions. The combination of software-enabled differentiation, service monetization, and manufacturing flexibility defines the playbook for sustained growth and resilience through the next policy and technology cycles.

Secure a tailored executive briefing and purchase the comprehensive optometry equipment market report with a senior sales leader to unlock custom data and next steps

To obtain the full, authoritative market research report and a tailored briefing, contact Ketan Rohom, Associate Director, Sales & Marketing, who can facilitate access to the full dataset, custom regional breakdowns, and executive briefing packages. The briefing can be structured to highlight product-level performance across autorefractors, fundus cameras and optical coherence tomography systems, distribution channel dynamics spanning direct sales and online retail, and end-user adoption among hospitals, optical centres and specialty clinics. It can also include a detailed analysis of tariff exposure scenarios and supplier relocation pathways to support procurement and strategic sourcing decisions.

A commissioned briefing can be delivered virtually or on-site and will include clear next steps for procurement teams, product managers, and commercial leaders seeking to accelerate go-to-market plans or to optimize supply chain resilience. Requesting the report unlocks access to granular segmentation tables, supplier scorecards, and validated primary interview transcripts with major OEMs and systems integrators. Engage now to convert these insights into quantifiable actions that preserve margins, accelerate product innovation, and de-risk global sourcing pathways.

- How big is the Optometry Equipment Market?

- What is the Optometry Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?