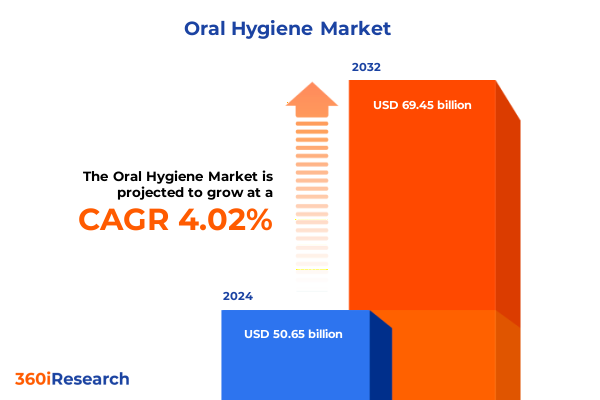

The Oral Hygiene Market size was estimated at USD 52.70 billion in 2025 and expected to reach USD 54.58 billion in 2026, at a CAGR of 4.02% to reach USD 69.45 billion by 2032.

Overview of Key Drivers and Emerging Opportunities Shaping the Future of the Global Oral Hygiene Market for Strategic Business Growth

Oral health remains a critical component of overall well-being, with a staggering 3.7 billion individuals worldwide affected by dental diseases, underscoring the urgent need for effective preventive and therapeutic oral care solutions. Untreated dental caries stands out as the most prevalent condition, contributing to significant pain, discomfort, and economic burden. As global healthcare systems strive to integrate oral health into universal coverage, the imperative for innovative products and services that address both basic hygiene and specialized care continues to intensify.

Revolutionary Trends and Disruptive Innovations Redefining Consumer Engagement and Product Evolution in the Oral Hygiene Sector by 2025

Technological innovation is revolutionizing oral hygiene, as smart toothbrushes equipped with AI-powered sensors, Bluetooth connectivity, and mobile app integration offer personalized feedback and enhanced cleaning efficacy. These advanced devices guide user behavior in real time, encouraging two-minute brushing routines and targeted plaque removal, while generating valuable usage data to inform future product improvements. Meanwhile, cutting-edge mouthwash formulations featuring natural extracts, probiotics, and microbiome-friendly ingredients are gaining traction by promising both fresh breath and gum health.

Comprehensive Analysis of How 2025 United States Tariff Policies Are Reshaping Cost Structures and Supply Chains in Oral Care Products

The introduction of new U.S. tariffs in 2025 has significantly reshaped cost structures and supply chain strategies for leading oral care manufacturers. Colgate-Palmolive anticipates approximately $200 million in incremental costs split evenly across the second through fourth quarters, driven largely by duties on raw materials and finished goods imported from China. Procter & Gamble, facing similar headwinds, has responded by accelerating price adjustments on premium offerings-most notably its high-end electric Oral-B iO series-to maintain margins amid rising import levies.

Strategic Examination of Product, Distribution, and Application Segmentation Delivering Deep Insights into Consumer Behavior and Market Dynamics

A strategic examination of market segmentation reveals critical dynamics across product categories, distribution channels, and applications. Toothbrushes have bifurcated into manual and electric subsegments, with electric models commanding premium pricing due to advanced features such as pressure sensors and sonic cleaning technology, while manual brushes retain broad accessibility. Within toothpaste, consumer demand splits between gels, pastes, polishes, and powders, each catering to specific needs from whitening and sensitivity relief to enamel remineralization. Distribution channels likewise reflect evolving consumer behavior, as offline outlets including supermarkets, pharmacies, and convenience stores remain vital for impulse and routine purchases, while online retail-comprising direct-to-consumer brand platforms and large e-commerce marketplaces-drives subscription-based replenishment models. Application-focused products address a spectrum of oral health concerns: anticavity formulations uphold core preventative care, desensitization lines alleviate tooth sensitivity, freshening variants appeal to image-conscious demographics, orthodontic care solutions serve braces and aligner users, and whitening systems continue to outpace other categories in innovation and consumer uptake.

This comprehensive research report categorizes the Oral Hygiene market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Application

Illuminating the Distinct Market Characteristics and Growth Drivers Across Americas, EMEA, and Asia-Pacific Oral Hygiene Sectors

Across the Americas, the United States dominates through robust consumer spending on premium products and a well-developed retail infrastructure, with electric toothbrush sales alone driving billions in annual revenue. Latin America displays more price-sensitive purchasing patterns, yet growing awareness of oral health and expanding access to care present significant growth potential. In Europe, Middle East, and Africa, regulatory harmonization in the European Union fosters innovation but also introduces stringent safety and labeling requirements, while markets in the Middle East and Africa benefit from rising disposable incomes and public health initiatives to broaden preventive care access. Asia-Pacific emerges as the fastest-growing region, propelled by urbanization, rising middle-class populations, and surging online sales-China alone recorded online oral care retail revenues exceeding ¥13.37 billion in the first half of 2024, a 9.8% year-on-year increase.

This comprehensive research report examines key regions that drive the evolution of the Oral Hygiene market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-Depth Insights into Leading Oral Care Players and Their Strategic Initiatives Shaping Competitive Dynamics in the Global Hygiene Market

Major players are leveraging innovation, sustainability, and supply chain resilience to maintain competitive positioning. Colgate-Palmolive is prioritizing capacity expansion in North America, alternative sourcing of key ingredients, and formula streamlining to offset tariff pressures. Procter & Gamble continues to invest in its Oral-B electric toothbrush platform and premium toothpaste launches, capitalizing on consumers’ willingness to pay for differentiated performance. Kenvue’s Listerine brand sustains global leadership in mouthwash by advancing clinical formulations-such as its Clinical Solutions line-and committing to sustainable packaging innovations through up to 50% recycled plastic bottles and traceable flavor oils. Emerging challengers are carving niches with organic and herbal ingredient profiles, digitally enabled product experiences, and D2C subscription models that enhance consumer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oral Hygiene market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baidyanath

- Canbro Healthcare

- Colgate-Palmolive Company

- Dabur India Limited

- DentCare

- GlaxoSmithKline plc

- Global Health Care Products

- Goran Pharma Private Limited

- Himalaya Wellness Company

- Hindustan Unilever Limited

- Orchid Lifesciences Limited

- Patanjali Ayurved Limited

- Procter & Gamble Company

- Sensodyne

- Sunstar Suisse S.A.

- Trio Lifescience Private Limited

- Vicco Laboratories

Practical Strategies and Innovative Approaches for Industry Leaders to Drive Growth and Navigate Emerging Challenges in Oral Hygiene Markets

Industry leaders should prioritize strategic diversification of manufacturing footprints to mitigate tariff-related risks, balancing near-shoring with multi-regional sourcing partnerships. Investing in advanced oral care technologies-including AI-enabled toothbrushes and microbiome-friendly formulations-will capture premium segments and foster long-term brand loyalty. Brands must also harness direct-to-consumer channels and subscription frameworks to drive recurring revenue while leveraging data analytics for personalized marketing and product development. Furthermore, accelerating sustainability initiatives in packaging and ingredient sourcing can differentiate offerings and resonate with eco-conscious consumers. Finally, forging collaborative alliances with dental professionals, regulatory bodies, and public health organizations will strengthen market access, reinforce credibility, and expand outreach through preventive care education.

Rigorous Research Design and Methodological Framework Ensuring Data Integrity and Comprehensive Insights in Oral Hygiene Market Analysis

This analysis integrates comprehensive primary research-encompassing in-depth interviews with oral care innovators, dental professionals, and distribution experts-with extensive secondary sources, including regulatory filings, trade association publications, and reputable news outlets. Quantitative data are triangulated through a meticulous review of import/export records, company financial disclosures, and clinical study outcomes. Qualitative insights from expert interviews inform scenario modeling, ensuring robust validation of market trends. Our methodological framework adheres to rigorous quality control protocols, delivering data integrity, reproducibility, and transparency at every stage of the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oral Hygiene market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oral Hygiene Market, by Product Type

- Oral Hygiene Market, by Distribution Channel

- Oral Hygiene Market, by Application

- Oral Hygiene Market, by Region

- Oral Hygiene Market, by Group

- Oral Hygiene Market, by Country

- United States Oral Hygiene Market

- China Oral Hygiene Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Conclusive Perspectives Emphasizing Key Findings and Strategic Imperatives for Sustainable Success in the Evolving Oral Hygiene Industry

The evolving oral hygiene landscape presents both challenges and unprecedented opportunities. Technological advancements are reshaping product innovation, while shifting consumer behaviors demand greater personalization, convenience, and sustainability. Tariff-induced cost pressures underscore the imperative for resilient supply chains and differentiated value propositions. Regional dynamics reveal diverse pathways to growth, from established markets in North America to high-potential territories across Asia-Pacific and EMEA. By synthesizing segmentation nuances, competitive positioning, and actionable recommendations, industry stakeholders can make informed strategic decisions to navigate complexity and unlock sustainable expansion in this dynamic sector.

Contact Ketan Rohom to Unlock Comprehensive Oral Hygiene Market Intelligence and Propel Your Strategic Growth with the Full Research Report

For tailored insights, pricing details, and personalized consultation on harnessing these comprehensive findings to your advantage, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through the full scope of the report, answer specific business questions, and help craft a strategic action plan that leverages our in-depth market intelligence. Secure the full research report today to stay ahead of industry shifts and capitalize on emerging growth opportunities in the oral hygiene sector.

- How big is the Oral Hygiene Market?

- What is the Oral Hygiene Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?