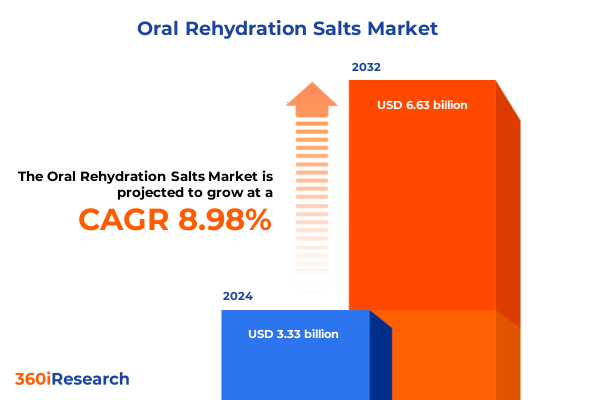

The Oral Rehydration Salts Market size was estimated at USD 3.61 billion in 2025 and expected to reach USD 3.93 billion in 2026, at a CAGR of 9.04% to reach USD 6.63 billion by 2032.

Setting the Stage for Transformative Global and Regional Shifts in Oral Rehydration Salts Demand within a Post-Pandemic Public Health Landscape

In a world where dehydration remains a persistent public health challenge due to diarrheal diseases and heat exposure, oral rehydration salts have emerged as a life-saving intervention endorsed by global health authorities. The latest World Health Organization guidelines highlight that diarrhea continues to be the third leading cause of death among children under five, claiming over 525,000 young lives each year, and that proper administration of low-osmolarity oral rehydration salts can prevent up to 93% of these fatalities. Beyond pediatric care, shifts in consumer behavior toward performance and wellness have propelled oral rehydration salts into the sports nutrition and everyday hydration markets, with formula enhancements and convenient delivery formats catering to active adults seeking rapid fluid and electrolyte replenishment.

Moreover, the COVID-19 pandemic exposed vulnerabilities in global medical supply chains, underscoring the need for resilient procurement and distribution systems to ensure uninterrupted access to essential rehydration therapies during health emergencies. As such, manufacturers and policymakers alike are prioritizing end-to-end traceability and diversified sourcing to mitigate risks of disruption, while integrating digital tools for real-time inventory management and demand planning.

This executive summary synthesizes these critical developments and offers strategic insights to help stakeholders navigate evolving market dynamics, regulatory landscapes, and consumer trends in the oral rehydration salts domain.

Uncovering the Transformative Shifts Redefining the Oral Rehydration Salts Landscape Amid Technological, Consumer, and Epidemiological Forces

Technological innovation is reshaping how oral rehydration salts interact with end users. Manufacturers are integrating mobile-responsive QR codes on sachets that link caregivers and athletes to digital reconstitution guides and dosage reminders, reducing administration errors and improving compliance in non-literate communities. Concurrently, the advent of effervescent sticks and single-use liquid sticks offers on-the-go hydration, aligning with consumer demand for portability without sacrificing clinical effectiveness.

Flavor diversification and sustainable packaging have emerged as powerful differentiators. Global product launches in 2024 saw a surge of mango, watermelon, and coconut variants that enhance palatability and adherence, particularly among pediatric and elderly populations. Biodegradable sachets and twist-cap bottles have also gained traction, reflecting industry efforts to address environmental concerns and reduce plastic waste in retail and public health distribution channels.

On the public health front, updated WHO recommendations for low-osmolarity formulations and co-packaged zinc therapies are driving adoption in emergency and pediatric healthcare settings. UNICEF procurement data indicates that over 29 million sachets of WHO-endorsed oral rehydration salts were distributed globally in 2022, with low-resource and conflict-affected regions receiving priority allocations. Looking ahead, the convergence of clinical best practices, consumer wellness trends, and digital engagement tools is set to redefine the oral rehydration salts landscape.

Assessing the Cumulative Consequences of 2025 United States Tariff Changes on Oral Rehydration Salts Supply Chains and Cost Structures

The United States’ 2025 tariff adjustments have introduced a 10% ad valorem duty on imported products from China, as stipulated in Executive Order 14266, effective for entries on or after May 14, 2025. For oral rehydration salts-particularly powdered formulations and ready-to-use liquids sourced from Chinese manufacturers-this measure raises import costs and compresses distributor margins, with potential downstream effects on end-user pricing and institutional procurement budgets.

In response, importers are reevaluating their supply bases, exploring ingredient sourcing from alternative nations and accelerating qualification of domestic excipient suppliers. Parallel discussions within trade associations underscore the urgency of securing tariff exemptions for critical health commodities to avoid exacerbating access gaps in hospital and humanitarian channels. This evolving policy landscape underscores the need for agile supply chain strategies and proactive engagement with trade regulators.

Moving forward, stakeholders must weigh the short-term cost pressures against long-term opportunities for nearshoring and capacity expansion. By fostering local partnerships and strengthening manufacturing footprint domestically, the industry can build resilience against future tariff volatility while maintaining the affordability and availability of life-saving rehydration therapies.

Illuminating Deep Segmentation Insights to Navigate Form, Distribution, End User, Application, and Age Group Dynamics in ORS Markets

Formulation innovation remains a cornerstone of market differentiation. Powdered oral rehydration salts continue to dominate due to their long shelf life and cost efficiency, and these powders are offered in bulk, prefilled pouches, and consumer-friendly sachets subdivided into one-, two-, or four-gram doses tailored for varied clinical and at-home use. Ready-to-use liquids serve hospital and urgent care settings where rapid administration is paramount.

Distribution channels span hospital pharmacies that ensure clinical oversight, online platforms meeting consumer convenience demands, retail pharmacies offering point-of-purchase counseling, and supermarket and hypermarket outlets providing broad accessibility. Each channel presents unique regulatory requirements, margin structures, and promotional opportunities that shape go-to-market approaches.

End users traverse acute care clinics managing dehydration crises, home care settings where caregivers administer prescribed dosages, and hospitals requiring bulk stock for pediatric wards and emergency departments. Application contexts range from cholera treatment in outbreak zones to everyday diarrhea management in community health programs, and sports and exercise hydration for active individuals seeking performance support.

Age segmentation further differentiates the market into pediatric formulations designed for taste and compliance in children and adult-oriented variants optimized for electrolyte balance in physically demanding scenarios. Recognizing these distinct segments enables targeted product development, marketing, and distribution strategies tailored to stakeholder needs.

This comprehensive research report categorizes the Oral Rehydration Salts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Age Group

- Application

- End User

- Distribution Channel

Exploring Key Regional Insights Highlighting Growth Drivers and Challenges Across the Americas, EMEA, and Asia-Pacific ORS Ecosystems

The Americas exhibit robust demand driven by heightened sports participation, fitness culture, and integrated emergency preparedness protocols. United States hydration innovations focus on clean-label ingredients and convenience formats, with single-serve powders and on-the-go liquid sticks gaining shelf space in pharmacies and sporting goods retailers alike. Latin American public health initiatives also leverage oral rehydration salts in diarrhea control campaigns, underscoring region-wide commitment to child health outcomes.

Europe, the Middle East & Africa (EMEA) presents a dual narrative. In parts of sub-Saharan Africa, national cholera campaigns deploy ORS sachets through community health workers and mobile clinics to remote communities. Meanwhile, Western European markets emphasize preventive care and wellness, integrating electrolyte solutions into elderly care facilities and sports clubs. Regulatory harmonization under the European Medicines Organization streamlines cross-border approvals, facilitating wider adoption in the region.

Asia-Pacific leads global consumption with large-scale public health distribution in India, China, and Southeast Asia. India’s government schemes and school-based programs distribute sachets widely, while China’s urban clinics and digital pharmacies drive retail uptake. Tropical climates and recurring dengue outbreaks further amplify demand for reliable rehydration therapies. Across these diverse markets, partnerships between government agencies and private sector players continue to expand institutional coverage and consumer availability.

This comprehensive research report examines key regions that drive the evolution of the Oral Rehydration Salts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling the Competitive Landscape Through Key Company Innovations, Collaborations, and Strategic Advancements in ORS Development

A diverse competitive landscape spans multinational conglomerates and specialized innovators. Industry leaders such as PepsiCo and The Coca-Cola Company leverage their distribution networks to introduce electrolyte beverages, while Abbott Laboratories continually broadens its Pedialyte® portfolio with immune-support, organic, and electrolyte water formulations tailored for adults and children. Kraft Heinz and Liquid I.V. focus on e-commerce and direct-to-consumer channels, capitalizing on digital engagement and subscription models.

Otsuka Pharmaceutical’s Pocari Sweat remains a top electrolyte brand in Asia, supported by localized production and targeted marketing campaigns. Suntory’s Lucozade athlete-oriented offerings and DripDrop’s medically formulated packets address niche performance and clinical hydration requirements. Emerging players like SOS Hydration and Nuun Hydration differentiate through clean-label ingredients, adaptogens, and format innovation, fostering healthy competition and driving continuous product upgrades.

Strategic collaborations and joint ventures are on the rise, with companies forging alliances to expand geographic reach and accelerate formulation development. Co-packaging agreements with zinc and vitamin supplements, as well as partnerships with athletic organizations and humanitarian NGOs, underscore the sector’s commitment to innovation, accessibility, and public health impact.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oral Rehydration Salts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Bayer AG

- Beximco Pharmaceuticals Limited

- Cipla Limited

- Daksh Pharmaceuticals Pvt. Ltd.

- Danone S.A.

- GlaxoSmithKline plc

- Johnson & Johnson Services, Inc.

- Kenvue Inc.

- Macleods Pharmaceuticals Limited

- Merck & Co., Inc.

- Nestlé S.A.

- Novartis AG

- Otsuka Pharmaceutical Co., Ltd.

- PepsiCo, Inc.

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Limited

- Unilever PLC

- Viatris Inc.

Actionable Recommendations Empowering Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the ORS Market

Industry leaders should prioritize diversification of supply chains by qualifying multiple ingredient and finished-goods partners across geographies to mitigate risks associated with future tariff changes and geopolitical disruptions. By establishing strategic alliances with regional manufacturers, companies can reduce lead times, optimize logistics costs, and enhance responsiveness to local demand fluctuations.

Investing in digital traceability and inventory management platforms will ensure real-time visibility into stock levels and expiration dates, supporting proactive replenishment and minimizing waste. Implementation of cloud-based quality management systems can streamline compliance with evolving regulatory standards and bolster stakeholder confidence in product integrity.

To capture adjacent growth opportunities, firms can expand offerings into sports nutrition and everyday wellness segments by introducing customized flavor profiles, functional ingredients, and sustainable packaging solutions. Collaborations with fitness influencers, healthcare practitioners, and humanitarian organizations will amplify brand credibility and facilitate targeted outreach initiatives.

Lastly, maintaining active engagement with trade bodies and policymakers is essential to navigate the changing tariff environment and advocate for safe-harbor provisions for critical health commodities. Such advocacy ensures the continued affordability and accessibility of life-saving oral rehydration therapies across all regions.

Revealing Rigorous Research Methodology Underpinning Data Collection, Analysis, and Validation for Robust Insights in ORS Market Intelligence

This research integrates detailed secondary analysis of peer-reviewed literature, World Health Organization guidelines, and governmental trade documents, alongside primary interviews with clinicians, supply chain executives, and regulatory experts. Data triangulation ensures that insights are validated across multiple sources to identify consistent trends and emergent opportunities.

Field observations and stakeholder consultations were conducted across North America, EMEA, and Asia-Pacific regions to capture regional nuances in product adoption, distribution dynamics, and regulatory landscapes. Quantitative import and distribution data were corroborated with in-market audits to assess channel effectiveness.

Rigorous quality assurance protocols, including cross-referencing tariff schedules, public health procurement reports, and company disclosures, underpin the analysis. Findings were pressure-tested through scenario planning workshops with subject-matter experts to evaluate resilience strategies under varied market conditions.

This methodology combines methodological rigor with real-world stakeholder perspectives, providing a robust framework for actionable insights and strategic decision-making in the oral rehydration salts market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oral Rehydration Salts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oral Rehydration Salts Market, by Form

- Oral Rehydration Salts Market, by Age Group

- Oral Rehydration Salts Market, by Application

- Oral Rehydration Salts Market, by End User

- Oral Rehydration Salts Market, by Distribution Channel

- Oral Rehydration Salts Market, by Region

- Oral Rehydration Salts Market, by Group

- Oral Rehydration Salts Market, by Country

- United States Oral Rehydration Salts Market

- China Oral Rehydration Salts Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Delineating the Strategic Conclusions from Comprehensive ORS Market Analyses to Guide Stakeholder Decision-Making and Future Initiatives

Comprehensive analysis reveals that oral rehydration salts occupy a pivotal position at the intersection of public health imperatives and evolving consumer wellness trends. Technological advancements, from digital engagement tools to sustainable packaging, are redefining product value propositions and delivery models.

Despite new tariff-induced cost pressures, opportunities abound for resilient supply chain optimization and nearshoring to enhance market access and supply stability. Segmentation by form, channel, end-user, application, and age group offers a granular roadmap for targeted product development and marketing strategies.

Regional insights highlight the importance of aligning distribution approaches with local healthcare infrastructures and consumer behaviors, while competitive benchmarking underscores the critical role of strategic collaborations in driving innovation and expanding market reach.

Ultimately, stakeholders equipped with these strategic conclusions can navigate complexity, seize emerging growth avenues, and contribute to improved health outcomes globally through access to effective rehydration therapies.

Take the Next Step to Secure Exclusive Insights and Drive ORS Market Growth with Personalized Support from Ketan Rohom Associate Director

If you’re ready to harness the power of comprehensive, data-driven insights to strengthen your position in the dynamic oral rehydration salts market, connect with Ketan Rohom, Associate Director of Sales & Marketing.

Ketan offers tailored guidance to help you translate these findings into winning strategies, whether that means accelerating product innovation, optimizing your supply chain footprint, or deepening regional partnerships for expanded reach.

Don’t let uncertainty hold you back. Reach out today to secure your exclusive access to the full market research report and drive sustained growth in the evolving rehydration landscape.

- How big is the Oral Rehydration Salts Market?

- What is the Oral Rehydration Salts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?