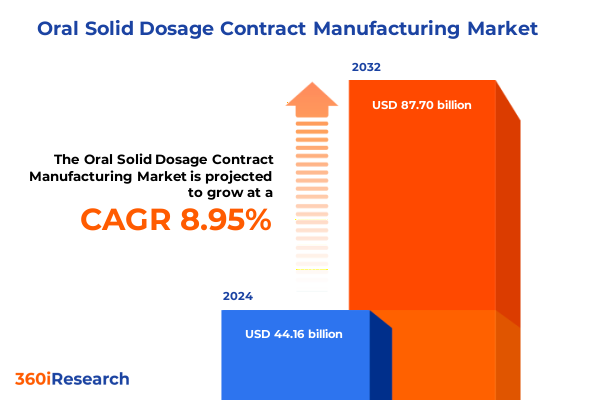

The Oral Solid Dosage Contract Manufacturing Market size was estimated at USD 48.10 billion in 2025 and expected to reach USD 52.39 billion in 2026, at a CAGR of 9.13% to reach USD 88.70 billion by 2032.

Exploring how strategic partnerships and advanced technologies are reshaping oral solid dosage contract manufacturing to meet evolving industry demands

The field of oral solid dosage contract manufacturing is at the crossroads of scientific innovation, cost optimization, and stringent regulatory oversight. Manufacturing partners are no longer mere service providers; they have become strategic collaborators integral to accelerating product development, ensuring supply chain resilience, and meeting complex compliance standards. As pharmaceutical and biotech companies streamline their operational focus toward discovery, formulation, and commercialization, they increasingly lean on contract development and manufacturing organizations (CDMOs) to shoulder critical activities ranging from preformulation studies through clinical and commercial-scale production.

An expanding therapeutic pipeline and an aging global population place a premium on oral dosage forms due to their convenience, stability, and patient adherence advantages. Tablets, capsules, granules, and multiparticulates dominate prescribing patterns worldwide, commanding over half of all pharmaceutical consumption in most developed markets. In response, CDMOs have invested heavily in advanced technologies-such as continuous manufacturing platforms, physiologically based pharmacokinetic modeling, and novel coating processes-to meet demand for both immediate-release and complex modified-release formulations under cGMP conditions.

Understanding how digital process integration and sustainable practices are catalyzing a paradigm shift in oral solid dosage contract manufacturing

In recent years, contract manufacturing has undergone transformative shifts driven by digitalization, sustainability imperatives, and the growing complexity of oral dosage forms. Digital process integration, incorporating sensors, real-time analytics, and data-driven decision frameworks, has enhanced process control and accelerated scale-up timelines. Manufacturers that deploy process analytical technology (PAT) and advanced modeling can ensure consistent quality attributes, reduce batch failure rates, and improve overall equipment effectiveness by up to 20%.

Simultaneously, a concerted industry shift toward green chemistry and sustainable manufacturing practices has led CDMOs to adopt solvent-minimizing granulation methods, recyclable continuous production lines, and energy-efficient drying technologies. These initiatives not only respond to regulatory expectations around environmental impact but also generate cost savings by reducing waste and resource consumption. As a result, leading providers are now evaluated not solely on technical expertise and capacity but also on their environmental and social governance credentials.

Analyzing the cumulative impact of enacted tariffs and potential duties up to 200% on U.S. oral solid dosage contract manufacturing landscapes

In 2025, the United States government implemented a 10% global tariff on imports across most categories, encompassing active pharmaceutical ingredients (APIs) and finished drug products under a Section 301 action that took effect on April 5. Later that summer, policymakers threatened to escalate duties on pharmaceutical imports up to 200%, giving manufacturers a grace period of up to 18 months to adjust supply chains or increase domestic production capacity.

These tariff measures have compelled contract manufacturers and their pharmaceutical sponsors to reconsider sourcing strategies, hybridize supply networks, and invest in localized API synthesis and fill-finish operations. While shorter-term hedging approaches-such as tariff engineering and dual sourcing-offer interim mitigation, long-term resilience will likely require significant expansion of U.S.-based manufacturing footprints and accelerated regulatory approvals for new facilities.

Uncovering insightful dimensions of capsule, granule, pellet, and tablet manufacturing across therapeutic, application, stage, and customer serving requirements

A robust understanding of end-market dynamics necessitates drilling down into multiple segmentation dimensions. By formulation type, the market spans capsules-both hard and soft gelatin-granules in immediate and modified release, coated and multiparticulate pellets, and coated and uncoated tablets. Each format presents unique process requirements, excipient compatibilities, and regulatory quality attributes.

Therapeutic area segmentation captures distinct demand patterns across anti-infectives-antibiotics and antivirals-cardiovascular agents targeting hyperlipidemia and hypertension, central nervous system treatments for depression and epilepsy, gastrointestinal therapies such as acid reducers and prokinetics, and oncology drugs for hematological and solid tumors. Formulation complexity and potency drive specialized handling and containment measures as well as targeted CDMO expertise.

In addition, application segmentation bifurcates into over-the-counter solutions and prescription medicines, reflecting differing timelines, labeling controls, and supply chain rigor. Stage segmentation differentiates clinical trial manufacturing-requiring small-batch flexibility and rapid turnaround-from commercial scale, where consistency, capacity, and cost efficiency are critical. Finally, customer type segmentation spans biotechnology innovators, nutraceutical producers, and large-scale pharmaceutical companies, each with their distinctive project scopes, quality standards, and partnership models.

This comprehensive research report categorizes the Oral Solid Dosage Contract Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form Type

- Therapeutic Area

- Stage

- Application

- End User

Examining how manufacturing capacities and regulatory landscapes in Americas, Europe-Middle East-Africa and Asia-Pacific define the global oral solid dosage contract manufacturing market

Regional dynamics continue to shape capacity, cost, and compliance landscapes for contract manufacturing. In the Americas, end-user proximity to key U.S. and Latin American markets drives demand for supply chain agility and CMC expertise under FDA oversight. Investments in capacity expansions in the Midwest and East Coast of the U.S. have been catalyzed by reshoring incentives and tax credits that encourage domestic production of critical APIs and finished dosage forms.

In Europe, the Middle East, and Africa region, a blend of robust regulatory frameworks-in particular the EU’s Annex I GMP revisions-and cost arbitrage opportunities in Eastern Europe foster a tiered manufacturing ecosystem. Leading providers maintain interlinked sites across Germany, France, and the U.K., while mid-tier players leverage Poland and the Czech Republic for cost-effective clinical and early commercial needs.

In Asia-Pacific, a mature CDMO presence in India and China addresses global demand for high-volume generics and complex formulations, supported by ongoing regulatory convergence with ICH standards. China’s rising biopharma ecosystem and India’s entrenched API and tablet capacity reinforce this region’s significance, even as U.S. and European clients seek to diversify away from concentrated supplier bases.

This comprehensive research report examines key regions that drive the evolution of the Oral Solid Dosage Contract Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading global CDMOs and specialized providers driving innovation and capacity across oral solid dosage contract manufacturing

Key players in the oral solid dosage contract manufacturing arena differentiate themselves through scale, technology depth, and global footprint. Catalent, now under Novo Holdings’ ownership, boasts more than 20 global oral solid facilities featuring advanced granulation, coating, and encapsulation platforms alongside integrated packaging services.

Lonza, headquartered in Switzerland, operates a network of small molecule and health ingredients sites, emphasizing integrated formulation development through commercial manufacturing. Its Tampa and Bend facilities lead in powder micro-dosing technology and clinical bottling services, serving both immediate and modified release portfolios.

Thermo Fisher Scientific’s Patheon division and Recipharm deliver broad CDMO capabilities across the spectrum of oral dosage forms with a strong presence in both mature and emerging markets. Piramal Pharma Solutions and Corden Pharma complement these tier-one firms by offering specialized development services and customer-tailored process solutions, particularly in high-potency and controlled-release technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oral Solid Dosage Contract Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Bio-Pharma Services, LLC

- Almac Group Ltd.

- Aurobindo Pharma Limited

- Boehringer Ingelheim International GmbH

- Catalent, Inc.

- CordenPharma International GmbH

- Curia Global, Inc.

- Evonik Industries AG

- Fareva SA

- Hetero Drugs Limited

- Jubilant Pharmova Limited

- Lonza Group AG

- PCI Pharma Services, Inc.

- Piramal Pharma Limited

- Recipharm AB

- Siegfried Holding AG

- Thermo Fisher Scientific Inc.

Harnessing continuous manufacturing, supply chain resilience, and digital analytics as pillars for future-proof oral solid dosage contract manufacturing strategies

To maintain competitive advantage, industry leaders should prioritize investment in continuous manufacturing technologies that enhance process efficiency, reduce waste generation, and foster real-time quality assurance. Strategic alliances with equipment suppliers and digital solution vendors can expedite PAT implementation and bolster process robustness.

Further, establishing dual-source API supply chains and modular, multi-purpose manufacturing suites will provide resilience against geopolitical and tariff-driven disruptions. Collaborative R&D initiatives with pharmaceutical sponsors-focused on green excipient development and patient-centric formulations-can differentiate offerings and yield new value pools.

Finally, leveraging data-analytics platforms for end-to-end supply chain transparency will enable predictive capacity planning and dynamic risk assessment, ensuring uninterrupted production and meeting evolving customer and regulatory requirements.

Detailing the rigorous primary and secondary research approach that underpins the credibility of insights in this oral solid dosage contract manufacturing executive summary

This analysis is grounded in a multi-stage research methodology combining primary interviews with CDMO executives, pharmaceutical end-users, and regulatory experts alongside secondary data from regulatory filings, industry reports, and peer-reviewed literature. Facility footprints, service portfolios, and technology adoptions were validated through corporate disclosures and regulatory inspection databases.

For tariff and trade policy insights, official notices from the U.S. Federal Register, WTO filings, and reputable news outlets were synthesized to capture enacted measures and policy proposals. Regional capacity assessments draw on site registries maintained by the FDA, EMA, and local health authorities to ensure up-to-date facility evaluations.

Segmentation frameworks were constructed by integrating therapeutic pipelines, dosage form trends, and application requirements identified through clinical trial registries and product approval databases. Qualitative recommendations emerged from scenario planning workshops with industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oral Solid Dosage Contract Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oral Solid Dosage Contract Manufacturing Market, by Form Type

- Oral Solid Dosage Contract Manufacturing Market, by Therapeutic Area

- Oral Solid Dosage Contract Manufacturing Market, by Stage

- Oral Solid Dosage Contract Manufacturing Market, by Application

- Oral Solid Dosage Contract Manufacturing Market, by End User

- Oral Solid Dosage Contract Manufacturing Market, by Region

- Oral Solid Dosage Contract Manufacturing Market, by Group

- Oral Solid Dosage Contract Manufacturing Market, by Country

- United States Oral Solid Dosage Contract Manufacturing Market

- China Oral Solid Dosage Contract Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Summarizing the imperative for technology leadership and supply chain agility to define the next era of oral solid dosage contract manufacturing excellence

As the pharmaceutical landscape evolves, oral solid dosage contract manufacturing will remain a strategic linchpin for sponsors seeking speed, cost efficiency, and compliance. The convergence of digitalization, sustainability goals, and geopolitical dynamics creates both challenges and opportunities for CDMOs to differentiate through technology leadership and agile supply chains.

Contract manufacturers that harness continuous production, green processing, and robust data-driven quality systems will not only withstand tariff pressures but also attract long-term partnerships with innovators across biotech, nutraceuticals, and large pharma. By aligning service portfolios with customer needs-from early-stage formulation to commercial-scale supply-leading CDMOs can continue to drive value across the product lifecycle.

Ultimately, the capacity to blend technical expertise with resilient, compliant operations will define the next generation of oral solid dosage manufacturing partnerships, shaping outcomes for patients and stakeholders alike.

Act now to partner with Ketan Rohom for exclusive access to critical data insights that will transform your oral solid dosage contract manufacturing strategies

To secure a definitive competitive edge in the rapidly evolving oral solid dosage contract manufacturing space, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to the comprehensive market research report and unlock data-driven insights for strategic decision-making

- How big is the Oral Solid Dosage Contract Manufacturing Market?

- What is the Oral Solid Dosage Contract Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?