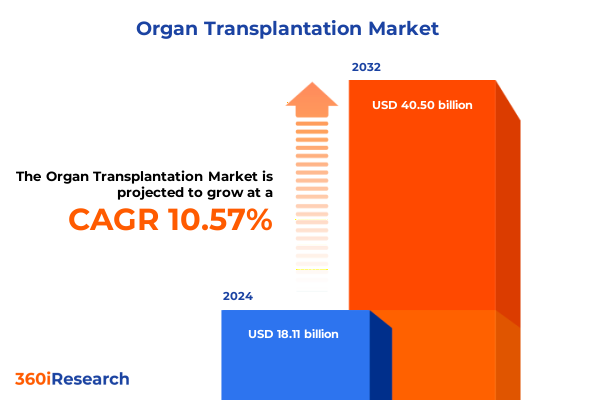

The Organ Transplantation Market size was estimated at USD 19.91 billion in 2025 and expected to reach USD 21.91 billion in 2026, at a CAGR of 10.67% to reach USD 40.50 billion by 2032.

Unveiling the critical gap and groundbreaking innovations driving the modern organ transplantation field to meet rising global demand

Transplantation stands at a pivotal juncture where lifesaving procedures meet a stark global supply challenge. Despite remarkable progress-in 2022, over 150,000 solid organ transplants were performed worldwide-this achievement still fulfills less than 10 percent of total patient need, underscoring the urgency of closing the gap between supply and demand. The disparity drives innovation, policy reform, and ethical debates across every tier of the ecosystem.

Demographic and epidemiological trends further intensify demand. An aging global population faces rising rates of chronic conditions such as cardiovascular disease, renal failure, and liver cirrhosis. In 2022, more than 108,818 organs were transplanted globally, with the United States and Europe accounting for roughly 62,153 and 40,337 procedures respectively, while many regions continue to see minimal transplant activity. This distribution reflects deep disparities in healthcare infrastructure, access to donation frameworks, and sociocultural factors influencing consent and donation rates.

Simultaneously, policy and regulatory landscapes are undergoing transformation. The U.S. Department of Health and Human Services has launched comprehensive reforms to its organ procurement system following high-profile investigations that revealed premature organ retrievals and protocol failures, mandating enhanced transparency, decertification measures, and robust safety protocols. Globally, the World Health Organization has advanced initiatives to standardize consent models and improve equitable access through resolutions slated for adoption by 2026.

Against this backdrop, technological breakthroughs are reshaping every phase of the transplant journey. Artificial intelligence-driven matching algorithms now analyze complex immunogenetic profiles to predict compatibility and rejection risk, while advanced perfusion platforms sustain organs in near-physiologic states during transport. Normothermic and hypothermic machine perfusion methods are extending preservation windows, and innovative immunomodulatory therapies, including CAR-T cell applications, are entering early clinical trials to reduce rejection rates and improve long-term outcomes. Together, these developments signal a transformative era for transplantation medicine.

Navigating seismic policy reforms and technology breakthroughs reshaping the organ transplantation paradigm across ethical and clinical dimensions

The organ transplantation ecosystem is experiencing a series of seismic shifts, driven by intertwined developments in policy, technology, and ethical governance. On the regulatory front, a landmark resolution approved at the World Health Assembly in May 2024 will task WHO with developing a global strategy on donation and transplantation by 2026, emphasizing ethical access and oversight to prevent exploitative practices and bolster system integrity. In the United States, the Health Resources and Services Administration’s probe into premature organ retrievals has already prompted mandatory reporting requirements for donation stoppages and the potential decertification of noncompliant procurement organizations, reflecting a new era of accountability and safety prioritization.

Technological progression is equally profound. AI-based platforms are now capable of parsing large-scale donor-recipient datasets, forecasting immune responses, and tailoring immunosuppression regimens with unprecedented precision. Early successes in AI-enabled matching have reduced graft rejection rates and streamlined allocation timelines, marking a departure from conventional HLA-centric protocols. Concurrently, machine perfusion technologies-particularly normothermic machine perfusion-are extending organ viability beyond traditional cold storage durations, allowing for real-time functional assessment and minimizing ischemia-reperfusion injury, a critical advance for marginal organs.

Innovations in cell and gene therapies promise to further redefine transplant medicine. CAR-T cell therapies, long a mainstay in oncology, are now under investigation for controlling alloimmune responses and reducing the need for lifelong immunosuppression. Mayo Clinic teams anticipate first-in-human trials by early 2025, targeting antibody-mediated rejection and enhancing immune tolerance in high-risk recipients. Moreover, efforts in xenotransplantation and bioengineering, exemplified by the FDA-cleared IND for gene-edited porcine livers paired with extracorporeal cross-circulation systems, signal a bold leap toward alternative organ sources for patients with no viable allograft options.

Ethical frameworks and supply chain transparency mechanisms are also evolving. Blockchain-based platforms have been proposed for secure tracking of organ provenance and handling, reducing the risk of illicit trafficking and ensuring traceability from retrieval to transplant. As these transformative shifts converge, they lay the foundation for a more resilient, data-driven, and ethically sound transplantation ecosystem.

Assessing the far-reaching consequences of 2025 U.S. tariffs on critical imports shaping organ transplantation supply chains and cost structures

The U.S. tariff landscape in 2025 has introduced substantial headwinds for the organ transplantation supply chain, heightening cost pressures and operational complexities. Beginning April 5, a sweeping 10 percent global tariff applies to nearly all imports, including active pharmaceutical ingredients (APIs) and medical device components critical to transplantation procedures. This blanket tariff forces healthcare providers and manufacturers to reevaluate sourcing strategies and absorb or transfer elevated costs amid fixed reimbursement schedules.

Tensions with key trading partners further exacerbate challenges. Tariffs of up to 245 percent on Chinese-sourced APIs, including immunosuppressive compounds, threaten to disrupt the availability of generic formulations that form the therapeutic backbone for transplant recipients. Meanwhile, Canada and Mexico face 25 percent duties on medical devices unless they meet USMCA compliance, risking delays in procurement for essential surgical instruments, perfusion systems, and preservation platforms. As generics and devices become costlier, healthcare systems may confront inventory shortages or extended lead times.

The tariff regime’s ripple effects extend to global supply chains. Organizations reliant on multi-tiered international logistics are compelled to diversify procurement, shifting toward lower-tariff regions such as India and Germany-a transition that involves requalification of suppliers, new quality audits, and longer cargo routes. Recent reports highlight backlogs in critical components for surgical kits and imaging devices, with healthcare facilities activating contingency plans such as stockpiling and supplier triage to mitigate supply disruptions.

Ultimately, these trade policies pose a strategic inflection point. While tariffs aim to incentivize domestic manufacturing, the healthcare sector’s limited ability to rapidly reshore specialized production underscores the immediate need for industry stakeholders to advocate for exemptions on life-saving medical goods, implement flexible sourcing frameworks, and collaborate with policymakers to ensure patient access remains uninterrupted in an increasingly protectionist environment.

Illuminating crucial market dynamics through organ type, technology, donor source, and care delivery insights that drive strategic focus

Organ transplantation markets are dissected through multiple lenses, each revealing distinct growth dynamics and investment priorities. When examining the landscape by organ type, kidney transplants dominate procedural volumes due to the high prevalence of chronic kidney disease and the feasibility of living donation pathways; in contrast, heart and liver procedures, though fewer in number, command significant resource intensity and specialized technology utilization for perfusion and viability assessment. Lung and pancreas transplants represent niche segments with unique clinical protocols and emerging innovations in donor expansion and ex vivo preservation.

The product type perspective highlights the foundational role of immunosuppressive therapies, where established calcineurin inhibitors and next-generation drug delivery approaches ensure graft tolerance, alongside burgeoning markets for perfusion systems that sustain organ function in transit. Preservation solutions, encompassing cold storage and normothermic machine perfusion platforms, are essential for mitigating ischemic injury and enabling longer-distance logistics, while surgical instruments and accessories continue to evolve toward minimally invasive designs that streamline implantation procedures. Transplant diagnostics and monitoring solutions, leveraging genomics and cell-free DNA assays, now provide real-time insights into graft health and immunological risk, reshaping post-operative care protocols.

By source of organs, deceased donation remains the cornerstone of supply, with policy reforms and public awareness campaigns driving incremental increases in donation rates; living donation, however, offers a vital counterbalance, particularly for kidneys and liver segments, and benefits from enhanced ethical frameworks and donor support initiatives. End-user segmentation underscores transplantation centers as the primary delivery venues for complex procedures, while hospitals and ambulatory surgical centers play critical roles in patient stabilization, pre-transplant evaluations, and follow-up care, necessitating integrated infrastructure and workflow solutions across clinical settings.

This comprehensive research report categorizes the Organ Transplantation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type of Organ

- Product Type

- Source of Organs

- End-User

Deciphering regional transplantation landscapes to align strategies with diverse infrastructure, policy, and cultural contexts

Regional dynamics wield profound influence over transplantation practices and investment priorities. In the Americas, advanced healthcare systems and integrated organ procurement networks underpin leading global transplant volumes, yet disparities across states and socioeconomic groups persist, driving state-level reforms and targeted outreach to expand donor registries. North American programs also pioneer digital registries and AI-based allocation tools, reinforcing the region’s innovation leadership and shaping policy dialogues on equity and access.

Europe, the Middle East, and Africa present a heterogeneous tapestry of transplantation capacity. Western European nations maintain some of the highest donation and transplant rates per capita, supported by robust funding and centralized coordination, while Eastern European and Middle Eastern jurisdictions are undertaking legislative overhauls and workforce development to close performance gaps. In Africa, nascent programs grapple with infrastructure constraints, prompting international collaborations and capacity-building initiatives to establish foundational governance and training frameworks.

The Asia-Pacific region is characterized by rapid expansion of living and deceased donor initiatives, notably in China and India, where government-led registries and reimbursement reforms are driving significant volume growth. China’s organ donation registrations have surpassed six million, and state councils continue to refine transparency and ethical oversight to bolster public trust. India’s pioneering state models, such as the Jeevandan program in Andhra Pradesh, rotate hospital coordinators to optimize cadaveric donation rates, reflecting a commitment to scalable best practices and community engagement.

This comprehensive research report examines key regions that drive the evolution of the Organ Transplantation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting leading innovators reshaping perfusion platforms, immunosuppression therapies, organ preservation, and diagnostics

Leading companies across the transplantation value chain are driving advancements through innovative offerings and strategic investments. TransMedics stands at the forefront of perfusion technology with its Organ Care System (OCS) platform, which enabled revenue growth from $30 million in 2021 to $425 million in 2024 by sustaining organs during transport and expanding U.S. transplant volumes; recent first-quarter 2025 results highlighted a 48 percent year-over-year revenue increase to $143.5 million, underscoring robust demand for its liver perfusion solutions. Despite regulatory scrutiny and short-seller allegations, the company maintains optimistic guidance and is expanding manufacturing footprints to mitigate tariff impacts.

In the immunosuppressive drug segment, Novartis, Astellas Pharma, AbbVie, Pfizer, and Bristol-Myers Squibb dominate with established tacrolimus and mTOR inhibitor portfolios. These players continue to launch extended-release formulations, explore pediatric indications, and deploy pharmacogenetic-guided dosing algorithms to enhance graft longevity and patient safety. Their collective focus on innovative delivery systems and drug monitoring solutions is reshaping standard-of-care protocols and driving incremental improvements in therapeutic adherence and outcomes.

Preservation technology leadership is exemplified by OrganOx, whose metra normothermic machine perfusion system has received U.S. FDA premarket approval and leveraged more than 5,000 liver transplants globally. A $142 million funding round led by HealthQuest Capital and FDA-cleared IND partnerships for xenogeneic perfusion applications reflect significant investor confidence and clinical promise for extending organ viability and exploring regenerative therapies.

In transplant diagnostics and monitoring, CareDx leads with its AlloSure and HeartCare platforms, presenting pivotal data at the 2025 ISHLT meeting demonstrating the prognostic value of donor-derived cell-free DNA for acute rejection detection and long-term graft dysfunction prediction. Its growth trajectory is supported by expanding Medicare coverage for surveillance tests, underscoring the shift toward precision medicine in post-transplant care.

Meanwhile, Medtronic’s strategic acquisition of Fortimedix Surgical to integrate articulating endoscopic instruments into its Hugo robotic system highlights the convergence of surgical robotics and minimally invasive techniques, promising enhanced procedural precision and reduced patient trauma in transplant surgeries.

This comprehensive research report delivers an in-depth overview of the principal market players in the Organ Transplantation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 21st Century Medicine

- Abbott Laboratories

- AbbVie Inc.

- Astellas Pharma Inc.

- Bio-Rad Laboratories, Inc.

- BiolifeSolutions, Inc.

- Bridge to Life Ltd.

- Bristol-Myers Squibb Company

- CHIESI Farmaceutici S.p.A.

- Dr. Franz Kohler Chemie GmbH

- eGenesis Inc.

- F. Hoffmann-La Roche Ltd

- Illumina, Inc.

- Medtronic PLC

- Novartis AG

- Organ Recovery Systems, Inc.

- Organovo, Inc.

- OrganOx Limited

- Pfizer Inc.

- Plexision, Inc.

- Preservation Solutions, Inc.

- Sanofi S.A.

- Stryker Corporation

- Terumo Corporation

- Teva Pharmaceuticals Industries Ltd.

- Thermo Fisher Scientific Inc.

- TransMedics Group, Inc.

- United Therapeutics Corporation

- Veloxis Pharmaceuticals, Inc. by Asahi Kasei Corp.

- Vivalyx GmbH

- Xvivo Perfusion AB

Empowering industry stakeholders with decisive strategies to fortify resilience, innovation, and patient-centric growth

Industry leaders should prioritize several actionable strategies to navigate evolving market complexities and capture growth opportunities. Engaging with policymakers to advocate for tariff exemptions on critical medical supplies will safeguard affordability and continuity in transplant care while reinforcing the imperative of patient-centric trade policies. Concurrently, companies must diversify supply chains by building partnerships in lower-cost markets and establishing flexible manufacturing footprints to mitigate future trade disruptions.

Investments in digital and AI-driven transplantation solutions are essential to optimizing organ matching, predicting graft outcomes, and personalizing immunosuppression regimens. Organizations should allocate resources toward integrating predictive analytics into allocation systems and post-transplant monitoring workflows, thereby enhancing both efficiency and patient safety. Collaborations with academic centers and technology providers will accelerate validation and adoption of these next-generation tools.

Strengthening donor engagement initiatives through targeted education campaigns, living donor support programs, and transparent ethical frameworks can expand the donor pool. Deploying community-based donation coordinators and leveraging telehealth for donor follow-up will foster trust and streamline consent processes. Industry stakeholders should also invest in robust data platforms and blockchain-based tracking systems to ensure end-to-end traceability, combat illicit organ trade, and enhance public confidence.

Finally, fostering cross-sector alliances that bridge medtech, pharmaceutical, and digital health companies will drive integrated solutions spanning organ preservation, surgical implantation, and long-term care. By co-developing modular platforms and bundled service models, organizations can deliver seamless patient journeys and unlock new revenue streams.

Detailing a robust research framework blending global data sources, expert interviews, and segmentation analysis for actionable insights

This research leverages a comprehensive methodology combining rigorous secondary research and targeted primary engagements. Secondary sources include global policy resolutions, peer-reviewed literature, regulatory filings, and financial disclosures from leading providers, ensuring a robust synthesis of quantitative and qualitative insights. Over 50 publications and datasets from entities such as WHO, HRSA, FDA, NCBI, and major industry news outlets informed macro-level trend analysis and regional benchmarking.

Primary research comprised in-depth interviews with procurement organization executives, transplant surgeons, and biopharma innovators to validate emerging technologies and capture real-world implementation challenges. Segmentation frameworks were applied to dissect organ type, product categories, donor sources, and end-user landscapes, aligning findings with thematic market developments. Data triangulation and expert workshops refined strategic imperatives and recommendations, ensuring alignment with stakeholder priorities and ethical standards.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Organ Transplantation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Organ Transplantation Market, by Type of Organ

- Organ Transplantation Market, by Product Type

- Organ Transplantation Market, by Source of Organs

- Organ Transplantation Market, by End-User

- Organ Transplantation Market, by Region

- Organ Transplantation Market, by Group

- Organ Transplantation Market, by Country

- United States Organ Transplantation Market

- China Organ Transplantation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing key findings to guide strategic alignment in a complex, opportunity-rich organ transplantation environment

The organ transplantation sector stands at an inflection point where policy reform, technological innovation, and market dynamics intersect to redefine patient outcomes and industry trajectories. From unprecedented AI-driven matching algorithms to normothermic perfusion systems and gene-edited xenografts, the potential to enhance organ utilization and extend patient survival has never been greater. Yet, the sector’s growth is tempered by supply shortages, ethical imperatives, and geopolitical trade headwinds that demand proactive strategies.

Key segmentation and regional analyses illuminate differentiated needs across organ types, product categories, donor models, and geographic contexts, offering tailored pathways for investment and collaboration. Strategic alignment with policy advocacy, supply chain diversification, and integrated digital-health platforms will be critical for stakeholders aiming to drive sustainable expansion and improve equity in organ access. As leading companies continue to advance perfusion, immunosuppression, preservation, and diagnostics capabilities, coherent partnerships across medtech, pharma, and digital health will unlock transformative patient benefits.

By harnessing these insights, industry leaders can navigate complex market forces, influence conducive policy environments, and deliver innovative solutions that address both current challenges and future opportunities in the organ transplantation landscape.

Unlock unparalleled strategic intelligence to accelerate your organization’s success in the ever-evolving organ transplantation market

For further guidance on leveraging these insights to drive strategic growth and operational excellence in the organ transplantation sector, connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore our comprehensive market research report and tailored consulting services that can empower your organization to stay ahead of industry shifts and achieve transformative outcomes.

- How big is the Organ Transplantation Market?

- What is the Organ Transplantation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?