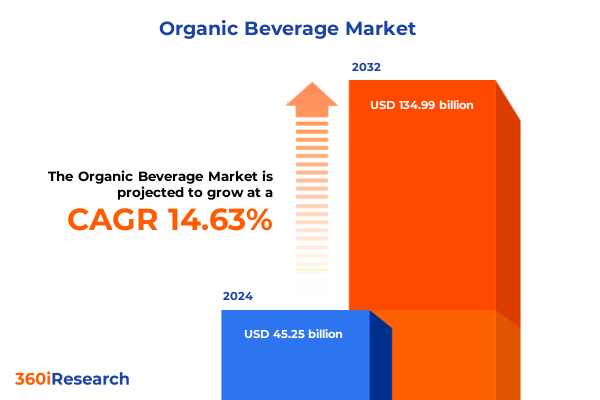

The Organic Beverage Market size was estimated at USD 51.83 billion in 2025 and expected to reach USD 58.67 billion in 2026, at a CAGR of 14.65% to reach USD 134.99 billion by 2032.

Exploring the Emerging Dynamics of the Global Organic Beverage Sector Amidst Shifting Consumer Preferences and Sustainability Imperatives

The organic beverage sector is experiencing a profound transformation as consumer preferences evolve toward health, sustainability, and transparency. Once confined to niche health stores, organic options are now finding shelf space in mainstream supermarkets and online channels, reflecting a broader acceptance among diverse demographic groups. This shift is underscored by a growing emphasis on clean-label credentials, where the sourcing of non-GMO, pesticide-free ingredients commands premium pricing and fosters brand loyalty.

In addition to ingredient purity, the sector’s momentum is driven by an increased focus on functional benefits. Consumers are seeking beverages fortified with probiotics for gut health, adaptogens for stress relief, and antioxidants for immune support. As a result, product innovation has accelerated, with brands leveraging plant-based extracts and ancient grains to deliver both flavor and health outcomes. This innovation extends beyond formulation to encompass sustainable sourcing practices encompassing regenerative agriculture and fair-trade partnerships, further elevating the organic beverage proposition.

Moreover, technology plays a critical role in this landscape. From blockchain-enabled supply chain transparency to e-commerce platforms offering direct-to-consumer subscription models, digital solutions are enhancing consumer engagement and operational efficiency. As organic beverage brands harness data analytics to predict trends and personalize offerings, the sector stands at the forefront of a new era where authenticity, efficacy, and digital integration converge to meet the demands of modern consumers. These foundational elements set the stage for understanding the profound shifts reshaping the organic beverage market today.

Unveiling Transformative Shifts in Consumer Behavior Supply Chain Sustainability and Innovation Driving Organic Beverage Evolution

An array of transformative forces is converging to redefine the organic beverage industry, challenging legacy paradigms and propelling innovation. Consumer behavior has gravitated toward experiences that align with personal values, prompting brands to transcend traditional product development and embrace holistic narratives around wellness, social impact, and environmental stewardship. This evolution is evident in the surge of premium functional waters infused with adaptogens and nootropics, as well as the emergence of non-alcoholic sodas designed to offer indulgence without compromise.

Simultaneously, supply chain resilience has ascended as a strategic priority. Disruptions from climatic variability and global logistics constraints have underscored the value of localized sourcing and transparent cold-chain logistics for preserving product integrity. As a result, some forward-looking organic beverage firms have invested in regional processing hubs to mitigate transit delays and support local farming communities, thereby fortifying both supply continuity and brand authenticity.

Innovation in packaging is another hallmark of this period of change. Consumers demand sustainable solutions, driving the adoption of compostable pouches, recycled glass bottles, and lightweight aluminum cans. Brands are harnessing material science advances to minimize carbon footprints and enhance recyclability, ensuring that package design aligns with the organic ethos. As the industry navigates these sweeping shifts, strategic agility and a commitment to continuous reinvention will distinguish the market leaders from the followers.

Assessing the Cumulative Impact of United States Steel and Aluminum Tariffs on Packaging Costs Supply Chains and Beverage Producers in 2025

The introduction and escalation of United States tariffs on steel and aluminum in 2025 have materially influenced the cost structures and supply chain strategies of organic beverage producers. On March 12, an executive proclamation extended a 25 percent ad valorem tariff on all aluminum and steel imports, eliminating prior exemptions and applying the levy to derivative articles including beverage cans and packaging components. Subsequently, on June 4, the tariff rate was further raised to 50 percent, with limited reprieves under the U.S.-UK Economic Prosperity Deal, intensifying cost pressures for packaging reliant on imported metals.

Despite these challenges, industry data indicates that beverage can manufacturers have largely absorbed much of these additional costs by leveraging domestically recycled aluminum, which constitutes over 70 percent of the raw material supply for rigid metal cans. This closed-loop system has insulated indigenous producers from the full brunt of tariff hikes, preserving supply continuity for high-growth segments such as energy drinks and ready-to-drink cocktails. Nevertheless, smaller companies and those less vertically integrated face heightened exposure, prompting a strategic pivot toward alternative packaging formats and intensified negotiations with suppliers to secure cost-effective commitments.

In response, organic beverage firms have embarked on multi-pronged strategies: some have expanded partnerships with domestic can producers to capitalize on recycled content, while others are accelerating the adoption of glass bottles and plant-based cartons that fall outside the scope of metal tariffs. These adaptive measures are not only safeguarding profit margins but also aligning with sustainability goals, enabling brands to navigate the tariff landscape without compromising their organic credentials or consumer promise.

Revealing Critical Segmentation Insights Spanning Product Types Distribution Channels Packaging Formats and Flavor Preferences in Organic Beverages

The organic beverage market can be understood through several critical lenses, each revealing unique opportunities and challenges. Viewed through product type, coffee drinks have matured as consumers seek organic cold brews and nitro-infused formats, while flavored water is diversifying with botanical infusions that offer low-calorie hydration combined with subtle wellness benefits. Juice drinks continue to innovate with cold-pressed, high-nutrient blends, and the sports drink category is infusing natural electrolytes and adaptogens to meet demand for performance-oriented beverages. Tea drinks, meanwhile, are evolving from simple iced tea to functional elixirs enriched with prebiotics and herbal extracts tailored for recovery and relaxation.

Examining distribution channels, offline retail remains foundational, with convenience stores offering trial packaging and supermarkets and hypermarkets stocking a wide array of organic selections across shelf-tier designations. Specialty stores curate artisanal and premium variants, reinforcing brand storytelling through tailored merchandising. Online retail is experiencing rapid expansion, leveraging subscription models and direct-to-consumer platforms that facilitate personalized nutrition plans and auto-replenishment services, delivering both convenience and elevated margins for producers.

From a packaging perspective, bottles dominate as a canvas for graphic storytelling, whether in glass to convey premium positioning or in plastic for on-the-go convenience. Cans offer portability and superior recyclability, while cartons provide a lightweight, fully recyclable alternative favored by brands targeting eco-conscious consumers. Pouches, both spouted and stand-up, deliver functional flexibility for single-serve and multi-serve formats, driving innovation in dosage-specific delivery for health-centric shots and blends. Finally, flavor segmentation underscores the market’s diversity, as fruit-forward profiles deliver familiar taste experiences, mixed flavors combine complementary botanical notes, and vegetable-based blends appeal to consumers prioritizing low-sugar, nutrient-dense options. This nuanced segmentation framework enables brands to fine-tune their portfolios and engage distinct consumer segments with precision messaging.

This comprehensive research report categorizes the Organic Beverage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Flavor

- Distribution Channel

Analyzing Regional Dynamics in the Organic Beverage Market Across the Americas Europe Middle East Africa and Asia Pacific

Regional markets exhibit distinct dynamics that shape the performance of organic beverage brands. In the Americas, North America leads with robust retail infrastructure and consumer willingness to pay premiums for certified organic products, driving a proliferation of private-label organic lines in mass merchandisers. Latin America is emerging as both a production hub and a growth market, with local cold-pressed juice brands harnessing native fruits and indigenous botanical knowledge to appeal to health-conscious consumers.

The Europe, Middle East, and Africa corridor presents a tapestry of regulatory frameworks and consumer attitudes. Western Europe maintains stringent organic certification standards, reinforcing consumer trust, while Eastern European markets are witnessing nascent growth as disposable incomes rise. In the Middle East, a young, digitally engaged demographic is fueling demand for functional beverages, particularly those offering immune support and gut-health benefits. African markets, while still in early stages of development, hold promise due to abundant raw-material availability and a growing middle class in urban centers.

Asia-Pacific remains the most dynamic region, underpinned by shifting dietary preferences and rapid urbanization. Japan and South Korea are at the forefront of premium tea-based functional drinks, while Southeast Asian markets such as Thailand and Malaysia are seeing a surge in organic fruit juice innovations. China’s expanding middle class is driving volume growth, although regulatory complexities around organic certification and import standards require localized strategies. Across Asia-Pacific, digital commerce and mobile payments are accelerating adoption and expanding access to remote consumers, setting the stage for sustained growth in the organic beverage sector.

This comprehensive research report examines key regions that drive the evolution of the Organic Beverage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Organic Beverage Industry Players Their Strategic Innovations and Competitive Initiatives Shaping Market Leadership

Organic beverage pioneers and mainstream giants alike are deploying diverse strategies to capture market share. Suja Life has recently executed a comprehensive rebrand, spotlighting ingredient transparency and functional benefits. The company replaced juice concentrates with whole foods and doubled probiotics in gut-health lines to meet heightened wellness expectations. Suja’s strategic acquisitions of the Slice soda brand and Vive Organic have expanded its reach across multiple consumer occasions, positioning it as a ‘house of brands’ that addresses daypart-specific needs with precision.

GT’s Living Foods continues to lead the kombucha segment through active engagement and co-creation with its community. By harnessing social media-driven flavor contests, the brand launched its Pomelo Pink Lemonade Raw Kombucha in response to over 25,000 consumer votes. This fan-centric approach not only fosters loyalty but also informs product development with direct consumer input. Additionally, GT’s emphasizes live-culture stability and eco-friendly packaging to appeal to both health-minded and sustainability-oriented buyers.

Traditional beverage conglomerates are also increasing their organic footprints. Major CPG firms are integrating organic lines within their portfolios, leveraging established distribution networks to achieve scale. However, their challenge lies in balancing authenticity with growth, as discerning consumers scrutinize brand heritage and sourcing transparency. Consequently, partnerships with regenerative farmers and investments in traceability technologies are becoming critical differentiators among leading players in this competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Organic Beverage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Belvoir Fruit Farms Ltd.

- Blue Sky Natural Beverage Co.

- Califia Farms, LLC

- Coca-Cola Company

- Danone S.A.

- Eden Foods, Inc.

- Fever-Tree Drinks PLC

- Hain Celestial Group, Inc.

- Naked Juice Company

- Nature's Best

- Odwalla Inc.

- Organic Valley

- PepsiCo, Inc.

- Pinnacle Foods

- R.W. Knudsen Family

- Reed's, Inc.

- Suja Life, LLC

- Unilever PLC

Proven Actionable Recommendations for Organic Beverage Industry Leaders to Navigate Emerging Trends Operational Challenges and Regulatory Shifts

Industry leaders seeking to thrive in the organic beverage arena must adopt a proactive and integrated approach that aligns brand purpose with operational excellence. First, investing in scalable sustainable packaging innovations will mitigate the impact of evolving regulations and cost pressures while reinforcing consumer trust in brand ethics. Brands should evaluate life-cycle analyses of carton, glass, and recycled aluminum solutions to identify optimal pathways for reducing environmental footprints.

Second, forging strategic alliances with domestic recyclers and packaging suppliers will enhance supply chain resilience. By diversifying material sources and leveraging recycled-content programs, producers can insulate themselves from tariff-induced fluctuations and global logistics disruptions. Collaborative forecasting and long-term procurement agreements will further stabilize input pricing and decrease volatility.

Third, prioritizing robust digital engagement strategies-ranging from interactive e-commerce experiences to community-driven product co-creation-will deepen consumer connections. Leveraging data analytics for personalized marketing and predictive product innovation can unlock additional avenues for revenue growth and foster brand loyalty.

Finally, maintaining a vigilant stance toward regulatory developments, particularly in areas such as organic certification and trade policy, will ensure compliance and strategic agility. By proactively participating in industry coalitions and government consultations, firms can advocate for standards that support market expansion and shared growth. Implementing these recommendations will position organic beverage leaders to navigate complexity and sustain competitive advantage.

Detailing the Robust Research Methodology Combining Primary Interviews Secondary Data Analysis and Triangulation Techniques Ensuring Report Reliability

This report’s findings are grounded in a rigorous multi-method research design that combines qualitative and quantitative analyses. Primary data were collected through in-depth interviews with C-level executives, category managers, and procurement specialists across leading organic beverage brands, packaging suppliers, and distribution partners. These conversations provided firsthand perspectives on strategic priorities, operational bottlenecks, and innovation trajectories.

Secondary research encompassed a thorough review of industry publications, trade journals, regulatory filings, and white papers to contextualize market dynamics. Proprietary databases and syndication services were consulted to capture historical trends in consumer behavior, pricing, and supply chain metrics. This foundational research informed the development of hypotheses regarding segmentation, regional performance, and competitive benchmarking.

Triangulation techniques were employed to validate insights by cross-referencing primary input, secondary sources, and publicly available data. Discrepancies were identified and reconciled through follow-up queries and data triangulation, ensuring the robustness of conclusions. Finally, all findings were subjected to peer review within the research team to uphold methodological rigor and deliver actionable intelligence with the highest standards of reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Organic Beverage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Organic Beverage Market, by Product Type

- Organic Beverage Market, by Packaging Type

- Organic Beverage Market, by Flavor

- Organic Beverage Market, by Distribution Channel

- Organic Beverage Market, by Region

- Organic Beverage Market, by Group

- Organic Beverage Market, by Country

- United States Organic Beverage Market

- China Organic Beverage Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Insights on the Future Trajectory of the Organic Beverage Sector and the Strategic Imperatives for Stakeholder Success

The organic beverage market stands at a pivotal juncture, where shifting consumer values and external pressures converge to reshape growth trajectories. Brands that have embraced ingredient transparency, functional innovation, and sustainable practices are poised for differentiation in an increasingly crowded landscape. The ability to adapt to fluctuating trade policies, leverage domestic supply chains, and harness consumer co-creation will delineate the next wave of market leaders.

Regional variations underscore the importance of localized strategies that resonate with cultural preferences and regulatory environments. While North America and Asia-Pacific offer robust demand drivers, emerging markets in Latin America and EMEA provide opportunities for strategic expansion. Success will hinge on balancing global brand consistency with regional agility.

Looking forward, the imperative for continuous innovation and stakeholder collaboration cannot be overstated. Organic beverage companies must refine their approaches to packaging, supply chain management, digital engagement, and regulatory advocacy to sustain momentum. As the sector evolves, those who integrate these strategic imperatives into their core operations will shape the future contours of this dynamic and high-potential industry.

Engaging Call To Action to Connect With Associate Director Sales & Marketing Ketan Rohom for Acquisition of Comprehensive Organic Beverage Market Research

Elevate your strategic plans and gain a competitive edge in the rapidly evolving organic beverage landscape by securing access to our in-depth market research report. Contact Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored data and actionable insights that will empower your organization to capitalize on emerging opportunities. Engage with Ketan today to discuss customized solutions, discover detailed segment analyses, and ensure your business decisions are grounded in authoritative research. Reach out now and take the decisive step toward unlocking the full potential of the organic beverage market.

- How big is the Organic Beverage Market?

- What is the Organic Beverage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?