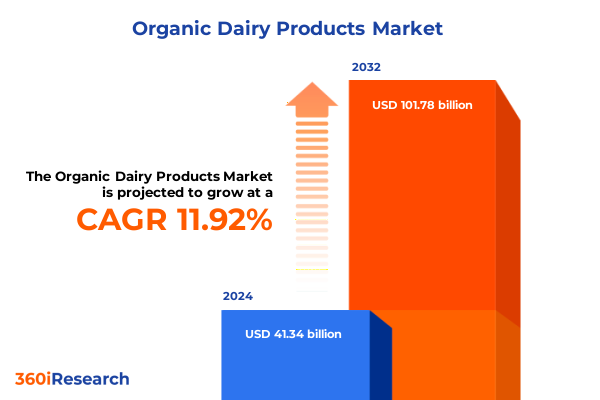

The Organic Dairy Products Market size was estimated at USD 46.18 billion in 2025 and expected to reach USD 51.41 billion in 2026, at a CAGR of 11.95% to reach USD 101.78 billion by 2032.

Setting the Stage for Organic Dairy Products: Uncovering the Evolving Consumer Preferences and Industry Dynamics Driving Market Transformation

The organic dairy market has evolved from a niche segment to a mainstream contender within global dairy consumption patterns. Increasing consumer awareness about the health benefits of pesticide-free and hormone-free products has spurred demand across multiple regions. In parallel, environmental concerns over livestock greenhouse gas emissions and land management practices have fueled calls for more sustainable farming approaches. Consequently, producers and retailers are investing heavily in certification, traceability systems, and regenerative agriculture methods to differentiate their offerings and meet evolving consumer expectations.

Against this backdrop, the organic dairy sector is witnessing unprecedented collaboration between farmers, processors, and technology providers. Digital platforms now enable end-to-end visibility from pasture to package, while advanced analytics optimize herd health, feed composition, and supply chain logistics. Meanwhile, policy support in key markets, including tax incentives, grant programs, and streamlined approval processes, has provided additional momentum. This introduction sets the stage for a deeper exploration of the transformative shifts reshaping production models, trade dynamics, consumer segmentation, and regional growth trajectories in the rapidly maturing organic dairy landscape.

Unraveling the Groundbreaking Shifts Redefining Production, Distribution, and Consumption in the Organic Dairy Landscape Worldwide

Emerging farm-level innovations are redefining the very foundation of organic dairy production. Regenerative grazing techniques that enhance soil carbon sequestration are rapidly being adopted, enabling producers to address environmental credentials while improving pasture productivity. Complementary to this, precision livestock farming tools such as wearable health monitors and automated milking systems are optimizing animal welfare and yield consistency. These advancements are converging to create a new paradigm in which sustainability and efficiency co-exist, delivering tangible value across the supply chain.

Simultaneously, distribution channels have experienced a seismic shift. Traditional brick-and-mortar retailers are integrating organic dairy assortments into premium shelf segments, while digital commerce platforms offer subscription-based home delivery services tailored to personalized consumption patterns. Retailers and direct-to-consumer brands are leveraging social media and influencer partnerships to tell authentic farm-to-table stories, further amplifying consumer engagement. Ultimately, these interconnected shifts are driving an era of transparency and accountability, transforming how organic dairy products are produced, marketed, and consumed.

Analyzing the Comprehensive Effects of 2025 United States Tariff Adjustments on Organic Dairy Trade Flows and Industry Resilience

In 2025, the United States implemented a new structure of tariffs on selected organic dairy imports to safeguard domestic production amid global supply volatility. The revised tariff schedules resulted in higher entry costs for international suppliers, prompting many to renegotiate trade terms or seek tariff-relief mechanisms. Domestic processors experienced a short-term supply contraction, which in turn encouraged investment in local organic dairy farms and processing infrastructure. Consequently, the domestic industry accelerated efforts to expand herd capacities and diversify organic feed sources to enhance resilience.

In parallel, importers adapted by strategically sourcing from tariff-exempt or low-rate trade agreements, while some shifted procurement to regions with favorable bilateral terms. These adjustments have underscored the importance of agile supply chain strategies capable of absorbing geopolitical and regulatory shocks. Moreover, the tariff environment has stimulated deeper collaboration between exporters and importers on compliance, labeling, and quality assurance to maximize cost efficiencies. Looking ahead, stakeholders are increasingly focused on lobbying for tariff quotas and exploring alternative export markets to mitigate potential disruptions linked to future policy adjustments.

Exploring In-Depth Segmentation Dynamics Revealing How Consumer Preferences Shape Organic Dairy Categories and Packaging Choices Across Demographics

An examination based on product type reveals a nuanced landscape where every category exhibits distinct growth drivers. For instance, cheese continues to expand its foothold driven by hard varieties that deliver extended shelf life and versatile culinary applications, with processed and soft cheeses catering to convenience and gourmet segments respectively. Butter, cream, milk, and yogurt each respond to unique consumer motivators from indulgence and cooking performance to functional nutrition and probiotic benefits.

Shifting focus to packaging type, glass bottles remain prized for their premium positioning and recyclability, even as plastic bottles offer lightweight convenience for on-the-go consumption. Aseptic cartons have unlocked wider distribution geographies through ambient shelf stability, whereas refrigerated cartons preserve freshness for health-conscious audiences. Cups, pouches, and tubs further diversify the mix, enabling single-serve yogurt and cream formats that align with busy lifestyles.

Turning to source, cow-derived organic dairy continues to dominate, yet goat and sheep milk products are carving niche value propositions centered on digestibility and artisanal appeal. From a fat content standpoint, full-fat variants reinforce indulgence and mouthfeel, reduced-fat products balance health concerns, and skim options address calorie-conscious preferences.

Finally, distribution channel analysis highlights the pivotal role of offline retail, where convenience stores, specialty stores, and supermarket hypermarket corridors cater to bulk and impulse purchases. Concurrently, online retail platforms are capturing digitally native shoppers through curated assortments and home delivery experiences. Within end users, household consumption underpins volume demand, while the foodservice segment encompassing cafes, institutional providers, and restaurants leverages organic dairy as a quality differentiator.

This comprehensive research report categorizes the Organic Dairy Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Source

- Fat Content

- Distribution Channel

- End User

Decoding Regional Organic Dairy Market Insights Across Americas, Europe Middle East and Africa, and Asia Pacific to Guide Strategic Expansion

In the Americas, North America leads with a mature organic dairy infrastructure supported by stringent regulatory frameworks, expansive distribution networks, and elevated consumer spending on health-oriented foods. Latin American markets, although still emerging, are witnessing pilot organic dairy initiatives grounded in smallholder co-operatives and community-driven certification programs.

Meanwhile, Europe, the Middle East, and Africa present a tapestry of varied regulatory regimes and consumer awareness levels. Western Europe benefits from established organic standards and high per-capita consumption, whereas Eastern European markets are gradually integrating organic dairy into mainstream retail. In the Middle East, rising urbanization and health consciousness are illuminating growth paths, and Africa remains in an embryonic stage with focused interventions in select countries to bolster organic compliance and farm modernization.

Across the Asia-Pacific region, East Asian powerhouses are channeling investments into local organic dairy capacity expansions to counterbalance heavy reliance on imports. Southeast Asian economies are cultivating domestic organic dairy brands, while Oceania, particularly Australia and New Zealand, continues to serve as a major export hub due to its favorable agro-climatic conditions and strong international trade ties. This regional mosaic underscores the varied maturity levels and strategic priorities that industry players must navigate.

This comprehensive research report examines key regions that drive the evolution of the Organic Dairy Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Maneuvers Driving Innovation and Competitive Advantage in the Organic Dairy Sector

Leading organic dairy producers are forging partnerships with technology providers to elevate traceability and transparency from herd management to final delivery. Strategic acquisitions have enabled dairy processors to integrate vertically, ensuring tighter control over supply quality and regulatory compliance. Simultaneously, a wave of innovative start-ups is injecting agility and niche product offerings such as organic lactose-free milk and botanical-infused dairy alternatives, forcing established players to accelerate their own product development pipelines.

In addition, forward-thinking retailers have introduced private label organic dairy ranges, leveraging scale to offer competitive pricing while preserving margins. Collaborative research initiatives between academic institutions and industry participants are driving breakthroughs in pasture science, feed optimization, and animal health protocols. This multi-pronged competitive landscape is characterized by consolidation, innovation hubs, and community engagement, all of which are shaping the strategic maneuvers of top-tier companies and emerging challengers alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Organic Dairy Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agropur Dairy Cooperative

- Akshayakalpa Farms And Foods Pvt. Ltd.

- Andechser Molkerei Scheitz GmbH

- Arla Foods amba

- Aurora Organic Dairy

- Barambah Organics Pty Ltd.

- Dairy Farmers of America

- Danone SA

- Fonterra Co-operative Group Ltd.

- FrieslandCampina N.V.

- Gläsernen Bio Molkerei

- Groupe Lactalis

- Gujarat Cooperative Milk Marketing Federation Ltd

- Maple Hill Creamery LLC

- Mother Dairy Fruits & Vegetables Pvt Limited

- Nestlé S.A.

- Organic Valley

- Parag Milk Foods Limited

- Privatmolkerei Naarmann GmbH

- Saputo Inc.

- Savencia Fromage & Dairy

- Shengmu Organic Milk Ltd.

- Stonyfield Farm

- Straus Family Creamery Inc.

- The Organic Milk Company

Crafting Actionable Strategies for Industry Leaders to Enhance Market Position and Capitalize on Emerging Organic Dairy Opportunities

Industry leaders should prioritize forging regenerative agriculture partnerships that bolster soil health and biodiversity, thereby aligning product narratives with consumer sustainability expectations. Simultaneously, investing in digital traceability platforms will enhance brand credibility by delivering transparent data on animal welfare, pasture provenance, and processing milestones. To capture the premium end of the market, companies ought to diversify their portfolios with specialty offerings like lactose-free, high-protein, and botanical-enriched dairy products.

Moreover, refining supply chain resilience through multi-sourcing strategies and tariff-hedging mechanisms will mitigate future policy-induced disruptions. Embracing omnichannel distribution by synergizing offline retail partnerships with direct-to-consumer subscriptions can deepen market penetration and foster loyalty. Finally, leaders must cultivate consumer engagement via storytelling and experiential marketing, leveraging farm visits, virtual reality tours, and influencer collaborations to forge authentic brand connections.

Illuminating Rigorous Research Methodology Underpinning the Comprehensive Analysis of Organic Dairy Market Trends and Competitive Dynamics

This analysis integrates a robust research framework comprising both secondary and primary research methods. Secondary data was collected from industry publications, regulatory filings, and peer-reviewed journals to establish a foundational understanding of production technologies, trade policies, and consumption patterns. Primary research encompassed structured interviews and surveys conducted with a cross-section of stakeholders including dairy farmers, processors, distributors, retailers, and end-consumers to validate secondary findings and capture emerging trends.

Data triangulation techniques were employed to reconcile insights across multiple sources and ensure consistency. Segmentation analyses were performed using category-specific performance metrics, while regional breakdowns leveraged demographic, economic, and policy indicators. Desktop research was supplemented by virtual farm tours and site visits to gauge operational practices. Analytical frameworks such as SWOT and PESTEL provided additional context, informing strategic implications and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Organic Dairy Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Organic Dairy Products Market, by Product Type

- Organic Dairy Products Market, by Packaging Type

- Organic Dairy Products Market, by Source

- Organic Dairy Products Market, by Fat Content

- Organic Dairy Products Market, by Distribution Channel

- Organic Dairy Products Market, by End User

- Organic Dairy Products Market, by Region

- Organic Dairy Products Market, by Group

- Organic Dairy Products Market, by Country

- United States Organic Dairy Products Market

- China Organic Dairy Products Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding Perspectives on the Future of Organic Dairy Market Growth Amid Sustainability Imperatives and Shifting Consumer Demands

The journey through the organic dairy market reveals an industry at the crossroads of tradition and innovation. Transformative agricultural practices, digital traceability, and evolving consumer aspirations are converging to create a dynamic landscape rich with opportunity. Despite headwinds from trade policy changes and market fragmentation, resilience is being built through diversified sourcing, strategic partnerships, and continuous product innovation.

As the global organic dairy ecosystem matures, stakeholders who proactively adapt to regulatory shifts, invest in sustainable practices, and engage with consumers on a narrative of authenticity and transparency will be best positioned to lead. The collective insights presented here underscore the imperative for an integrated approach that balances environmental stewardship, economic viability, and consumer satisfaction, charting a path toward long-term growth and value creation.

Engage with Our Associate Director to Access the Full Organic Dairy Market Research Report and Drive Strategic Business Decisions

To explore the complete spectrum of market insights, strategic recommendations, and detailed segmentation analysis, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By engaging with Ketan, you will gain bespoke guidance on how this research can inform your organization’s strategic planning, operational decision-making, and investment priorities. His expertise will help you identify the most relevant deliverables, choose the right level of analysis, and tailor the report to your specific business objectives. Reach out today to secure your copy of the comprehensive organic dairy market report and empower your team with the actionable intelligence needed to stay ahead in a rapidly evolving marketplace

- How big is the Organic Dairy Products Market?

- What is the Organic Dairy Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?