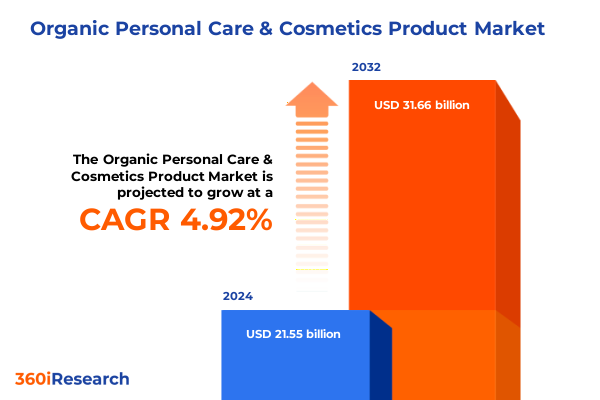

The Organic Personal Care & Cosmetics Product Market size was estimated at USD 22.56 billion in 2025 and expected to reach USD 23.62 billion in 2026, at a CAGR of 4.95% to reach USD 31.66 billion by 2032.

Discover the Evolving Organic Personal Care and Cosmetics Market Dynamics Shaping Consumer Demand and Industry Growth Trajectories

The organic personal care and cosmetics sector has evolved into a dynamic arena defined by the intersection of consumer consciousness and scientific innovation. In recent years, shoppers have shifted their purchasing philosophies toward ingredients that promise purity, sustainability, and authenticity. This evolution has prompted brands to rethink formulations, supply chains, and brand narratives to resonate with audiences that seek transparency and efficacy. By focusing on ethical sourcing and hallmark certifications, companies have begun to differentiate themselves, building trust among increasingly educated consumers.

As the landscape transforms, industry participants confront a delicate balance between preserving brand heritage and pursuing disruptive innovation. Established heritage brands and emerging indie labels alike face pressure to demonstrate social responsibility while delivering products that meet elevated performance standards. The surge in digital platforms has further amplified consumer voices, making brand stories more visible and subject to real-time feedback loops. Consequently, companies that integrate consumer insights into product development cycles gain a tangible edge.

In this context, understanding the underpinnings of consumer behavior and the strategic levers at play is essential. This report delves into the structural and attitudinal shifts driving market momentum, setting the stage for industry leaders to align resources, anticipate regulatory trends, and foster long-term growth in the organic personal care and cosmetics arena.

Uncover the Transformative Forces and Innovation Drivers Disrupting Organic Personal Care and Cosmetics Industry Standards and Consumer Expectations

Over the last several years, transformative currents have reshaped the organic personal care and cosmetics arena, driven by a convergence of technological advances and cultural imperatives. Biotechnology breakthroughs, such as plant-derived actives and biodegradable packaging, have redefined standards for product efficacy and environmental impact. At the same time, the rise of social media communities and influencer collaborations has accelerated trend cycles, compressing the timeline between concept validation and market launch.

Simultaneously, tightening regulatory frameworks across key markets have heightened scrutiny over ingredient sourcing and product labeling. Enforcement bodies are expanding transparency requirements, prompting brands to invest in traceability solutions and comprehensive third-party audits. This regulatory complexity has fostered a more sophisticated consumer base that interprets label claims with greater discernment, challenging companies to substantiate every marketing assertion with credible science.

Moreover, sustainability has transcended its status as a differentiator to become a table stakes expectation. As consumers demand circular economies and reduced carbon footprints, brands are embracing life-cycle analyses and strategic partnerships that extend beyond traditional production models. Collaboration between ingredient suppliers, packaging innovators, and logistics specialists is forging new pathways to decarbonize operations and enhance product authenticity. These intersecting forces have catalyzed a paradigm shift, redefining competitive advantage and elevating industry benchmarks.

Assess the Multifaceted Effects of 2025 United States Tariff Policies on Organic Personal Care and Cosmetic Supply Chains and Cost Structures

In 2025, the implementation of new United States tariff policies has introduced multifaceted challenges and opportunities for organic personal care and cosmetics stakeholders. Tariffs applied to select botanical extracts, cosmetic packaging components, and machinery have altered cost structures and prompted supply chain reevaluations. Brands reliant on international sourcing have responded by diversifying supplier networks and investing in domestic cultivation initiatives to mitigate exposure to tariff volatility.

These adjustments have reverberated throughout manufacturing and distribution channels, compelling companies to pursue leaner inventory strategies and localize key production stages. As logistics costs rise, companies are optimizing route planning and forging strategic alliances with regional distributors. In turn, retailers are recalibrating shelf-space agreements and promotional calendars to accommodate longer lead times and adjusted cost bases.

Despite the immediate impact on input expenses, some brands have leveraged the tariff environment to tell compelling product origin stories, amplifying consumer perceptions of local craftsmanship and quality. By transparently communicating the rationale behind price adjustments, forward-thinking companies have sustained brand affinity and even uncovered new premiumization pathways. Ultimately, the 2025 tariff environment has galvanized the industry to strengthen resilience through supply chain agility and narrative authenticity.

Gain Deep Segmentation Insights Revealing Consumer Preferences across Product Types, Distribution Channels, Price Tiers, Gender Profiles, and Packaging Formats

An in-depth examination of the organic personal care and cosmetics landscape reveals nuanced consumer preferences shaped by product offerings, distribution strategies, pricing philosophies, gender-oriented formulations, and packaging innovations. Across bath and shower segments, demand varies among effervescent bath bombs, aromatic shower gels, and hydrating bath oils, reflecting shifting ritualistic behaviors and self-care routines. Fragrance enthusiasts gravitate toward delicate body mists for everyday wear, while Eau De Toilette and perfume formulations command interest for special-occasion usage. Haircare subdivisions, including fortifying shampoos, color treatments, and styling aides, cater to a wide spectrum of hair health and aesthetic aspirations.

Distribution channels also profoundly influence purchase journeys. Traditional brick-and-mortar outlets, from pharmacies to specialty boutiques and hypermarkets, offer tactile experiences and immediate gratification for shoppers. Conversely, brand web portals, broad e-commerce platforms, and digital marketplaces provide personalized recommendations, tailored subscriptions, and curated discovery tools. Pricing tiers further delineate consumer segments, where luxury labels captivate aspirational buyers, premium selections appeal to value-driven professionals, and mass-market alternatives retain broad household penetration.

Gender classifications shape formulation priorities, as female and male consumers pursue distinct benefit claims, while unisex offerings continue to erode rigid demographic boundaries. Packaging types-from ergonomic bottles to sustainable jars and squeezable tubes-reinforce brand positioning and usage convenience. In aggregate, segmentation analysis empowers stakeholders to tailor innovation roadmaps, optimize omnichannel engagement, and enhance consumer resonance across diverse touchpoints.

This comprehensive research report categorizes the Organic Personal Care & Cosmetics Product market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Gender

- Packaging Type

- Distribution Channel

Explore the Key Regional Market Dynamics Shaping Organic Personal Care and Cosmetics Adoption across Americas, Europe Middle East & Africa, and Asia Pacific

Regional perspectives on organic personal care and cosmetics underscore the diversity of consumer mindsets, regulatory rigor, and innovation ecosystems. In the Americas, mature markets drive demand through well-established retail networks, but consumer focus has pivoted toward ingredient transparency and ethical sourcing. North American consumers, for instance, exert pressure for cruelty-free certifications and carbon-neutral supply chains, prompting brands to invest in blockchain-backed traceability and carbon offset partnerships. Meanwhile, Latin American markets demonstrate rapid adoption of locally relevant natural extracts and wellness-driven personal care rituals.

Europe, the Middle East, and Africa present a tapestry of regulatory leadership and growth corridors. The European Union’s stringent cosmetics regulation sets a global benchmark for safety testing and environmental stewardship. Brands operating in this region channel resources into green chemistry and eco-designed packaging. The Middle East’s luxury-oriented clientele seeks opulent, high-performance formulations, often with bespoke scent profiles. In Africa, homegrown brands are embracing indigenous botanicals, fueling a renaissance in product authenticity and local economic empowerment.

The Asia-Pacific region remains a hotbed of innovation and consumer experimentation. East Asian markets, driven by K-beauty and J-beauty influences, emphasize multi-step skincare rituals and novel ingredient discoveries. Southeast Asia’s youthful demographics and burgeoning digital infrastructure favor DTC engagement and influencer-led brand advocacy. Across all subregions, a shared emphasis on holistic wellness and preventive care continues to redefine personal care routines and product development priorities.

This comprehensive research report examines key regions that drive the evolution of the Organic Personal Care & Cosmetics Product market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine the Strategic Movements and Innovations of Leading Companies Steering the Organic Personal Care and Cosmetics Landscape Forward

Leading companies in the organic personal care and cosmetics arena have deployed strategic initiatives ranging from ingredient innovation to omnichannel transformation. Global conglomerates harness proprietary research capabilities and extensive distribution networks to accelerate new product introductions. At the same time, independent brands leverage agility and niche storytelling to captivate discerning consumers seeking authenticity and ingredient provenance.

Collaborations between multinational brands and emerging technology firms have generated hybrid offerings that blend natural actives with cutting-edge delivery systems. These partnerships underscore the value of cross-sector expertise, uniting biotech innovators with personal care formulators. Meanwhile, smaller labels differentiate through community-driven models, engaging local artisans and cooperatives to co-create products that reflect regional heritage. Such alliances not only enrich product portfolios but also reinforce social impact narratives that resonate in a crowded marketplace.

Moreover, strategic acquisitions and minority investments have become pivotal in securing access to disruptive brands and next-generation technologies. By absorbing specialized players, larger organizations expand their organic reach and accelerate sustainability goals. In parallel, a concentration on digital transformation-spanning interactive retail experiences, AI-powered personalization, and data-driven R&D pipelines-demonstrates how established players and insurgents alike are adapting to evolving consumer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Organic Personal Care & Cosmetics Product market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amway Corporation

- Arbonne International, LLC

- Eminence Organic Skin Care

- Honasa Consumer Ltd.

- L'Oréal S.A.

- L’Occitane Groupe S.A.

- Natura &Co Holding S.A.

- Purity Cosmetics

- Shiseido Co., Ltd.

- Tata Harper Skincare

- The Clorox Company

- The Estée Lauder Companies Inc.

- The Hain Celestial Group, Inc.

- Weleda AG

- Yves Rocher International

Identify Actionable Strategies Industry Leaders Can Deploy to Capitalize on Emerging Opportunities and Overcome Challenges in Organic Personal Care

Industry leaders can fortify their market position by pursuing targeted strategies that bridge innovation with operational resilience. Firstly, deepening investments in vertically integrated supply chains mitigates exposure to external disruptions and enhances traceability from farm to finished goods. By cultivating direct relationships with botanical growers and sustainable packaging manufacturers, companies can safeguard ingredient quality and reinforce brand authenticity.

Concurrently, prioritizing digital ecosystem development enhances both consumer engagement and internal efficiency. An integrated approach to e-commerce platforms, mobile loyalty applications, and AI-driven consumer insights facilitates personalized product recommendations and rapid iteration. This digital pivot should be complemented by experiential retail concepts that blend tactile product trials with immersive brand storytelling, creating seamless omnichannel journeys.

Finally, nurturing a culture of continuous improvement through collaborative innovation networks and cross-functional teams ensures that emerging consumer trends are swiftly transformed into market-ready solutions. By aligning R&D, marketing, and supply chain functions around shared sustainability and performance goals, organizations can navigate regulatory complexities and consumer expectations with confidence. These strategies collectively empower stakeholders to capitalize on growth opportunities and navigate volatility in the organic personal care and cosmetics industry.

Understand the Comprehensive Research Methodology Employed to Analyze Market Trends, Consumer Behaviors, and Industry Supply Chain Dynamics

The research framework underpinning this analysis integrates both qualitative and quantitative methodologies to deliver robust and actionable insights. Primary research initiatives include in-depth interviews with industry executives, procurement specialists, and innovation leaders, as well as structured focus groups with end consumers to capture nuanced perceptions and usage behaviors. These first-hand accounts are complemented by ethnographic studies that observe real-world product interactions in both digital and physical retail environments.

Secondary research draws on a broad spectrum of credible sources, encompassing regulatory filings, patent databases, trade journals, and sustainability reports. A comprehensive review of global customs and tariff schedules provides clarity on international trade dynamics, while supply chain data is synthesized from logistics partners and procurement analytics platforms. To ensure data integrity, all information is triangulated through cross-validation with public disclosures and expert consults.

Analytical techniques employed in this study involve thematic coding for qualitative inputs, enabling the identification of prevailing narrative patterns and unmet consumer needs. Quantitative data undergoes statistical trend analysis to reveal cost drivers and distribution channel performance. The integration of these approaches fosters a holistic understanding of market forces, equipping decision-makers with the strategic context required to anticipate shifts and prioritize resource allocation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Organic Personal Care & Cosmetics Product market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Organic Personal Care & Cosmetics Product Market, by Product Type

- Organic Personal Care & Cosmetics Product Market, by Gender

- Organic Personal Care & Cosmetics Product Market, by Packaging Type

- Organic Personal Care & Cosmetics Product Market, by Distribution Channel

- Organic Personal Care & Cosmetics Product Market, by Region

- Organic Personal Care & Cosmetics Product Market, by Group

- Organic Personal Care & Cosmetics Product Market, by Country

- United States Organic Personal Care & Cosmetics Product Market

- China Organic Personal Care & Cosmetics Product Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Summarize the Crucial Insights and Future Outlook Informing Strategic Decision Making in Organic Personal Care and Cosmetics Sectors

The organic personal care and cosmetics landscape is characterized by rapid evolution, shaped by the interplay of consumer values, regulatory frameworks, and supply chain intricacies. Key insights reveal that ingredient transparency, environmental stewardship, and digital engagement stand as foundational pillars for sustained brand differentiation. Regional nuances underscore the importance of tailoring innovation roadmaps to local preferences, whether in botanical sourcing, formulation aesthetics, or retail channel orchestration.

Furthermore, the impact of trade policies and tariff adjustments in 2025 has highlighted the necessity for supply chain agility and narrative clarity. Companies that pivoted to localized procurement models and transparently communicated value rationales have reinforced consumer trust and unlocked latent premiumization segments. In tandem, segmentation analysis illustrates that success hinges on nuanced product formulations, targeted channel strategies, and adaptive price architectures aligned with consumer aspirations across all demographics.

Looking ahead, industry participants that embrace collaborative innovation, integrate sustainability at every touchpoint, and harness data-driven decision-making will be best positioned to lead in an increasingly competitive environment. By synthesizing these insights, stakeholders can chart a clear path forward, ensuring their brands remain relevant, resilient, and responsive to the evolving landscape of organic personal care and cosmetics.

Connect with Associate Director of Sales and Marketing to Secure Your Comprehensive Organic Personal Care Market Research Report Today

To gain a competitive advantage and secure the full spectrum of insights into the organic personal care and cosmetics domain, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Through this engagement, you will obtain unparalleled access to the comprehensive research report, complete with expert analysis and in-depth context tailored to your strategic needs.

By partnering with Ketan Rohom, your organization can accelerate decision cycles, refine product roadmaps informed by rigorous research, and identify priority areas for innovation. This personalized touchpoint ensures your team can navigate regulatory shifts, supply chain dynamics, and evolving consumer preferences with confidence.

Secure your copy of the definitive organic personal care and cosmetics market research report today and empower your business to lead in a rapidly changing landscape. Contact Ketan Rohom to transform data into decisive action.

- How big is the Organic Personal Care & Cosmetics Product Market?

- What is the Organic Personal Care & Cosmetics Product Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?