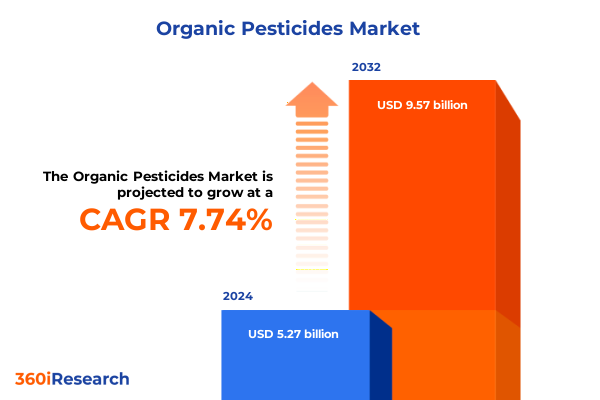

The Organic Pesticides Market size was estimated at USD 5.66 billion in 2025 and expected to reach USD 6.09 billion in 2026, at a CAGR of 7.78% to reach USD 9.57 billion by 2032.

Understanding the Rise of Eco-Friendly Pest Management Solutions and the Imperative Shift Toward Organic Pesticides in Modern Agriculture

The global agricultural sector is undergoing a pivotal shift as farmers, regulators, and consumers increasingly demand pest control solutions that minimize environmental impact while maintaining crop productivity. Conventional synthetic pesticides, once hailed for their efficacy and scalability, now face scrutiny over their ecological footprints, residue concerns, and potential impacts on human health. This growing awareness has catalyzed the rise of organic pesticides as a critical component of integrated pest management strategies.

Organic pesticides encompass a diverse range of naturally derived substances, including biochemical, microbial, and plant-extract-based modes of action. Their adoption is bolstered by supportive policy frameworks, particularly in regions with stringent environmental regulations, and by premium market opportunities in organic and sustainable agriculture segments. As a result, industry stakeholders are investing in research and development to enhance efficacy, broaden spectrum activity, and develop user-friendly formulations.

Transitioning from legacy chemical approaches to organic alternatives requires a comprehensive understanding of product performance, application methodologies, and end-user requirements. Moreover, supply chain implications-from raw material sourcing to distribution channels-play a pivotal role in determining overall market viability. This report embarks on an in-depth exploration of current trends, market dynamics, and strategic imperatives shaping the future of organic pesticides, setting the stage for actionable insights and informed decision-making.

Examining Transformational Forces Shaping the Organic Pesticide Landscape in Response to Sustainability Demands and Technological Advancements

The organic pesticide landscape is being reshaped by several transformative forces. Foremost among these is the acceleration of sustainability mandates issued by governmental bodies and global initiatives aimed at reducing agricultural environmental footprints. Farmers and agribusinesses are under increasing pressure to adopt practices that align with United Nations Sustainable Development Goals, driving substantial investments in alternative pest control solutions.

In parallel, rapid advancements in biotechnology and formulary science have yielded more potent and targeted organic pesticide products. Innovations in microbial strain engineering, precision application techniques, and synergistic biopesticide blends are enhancing efficacy while mitigating non-target effects. Digital agriculture platforms and data analytics further optimize application timing and dosage, improving operational efficiencies and reducing input costs.

Concurrently, shifting consumer preferences toward organic and clean-label produce exert downstream pressure on the value chain. Retailers and food processors are demanding provenance assurances and residue-free guarantees, elevating the strategic importance of organic pesticide adoption. These converging forces herald a new era in pest management-one where ecological responsibility, technological ingenuity, and market-driven imperatives coalesce to redefine competitive advantage.

As these trends continue to evolve, stakeholders must remain agile, leveraging cross-sector partnerships and embracing iterative innovation to capture emerging opportunities in the organic pesticide space.

Assessing the Cumulative Effects of Recent U.S. Trade Tariffs on the Supply Chain Dynamics and Cost Structures of Organic Pesticide Producers

Over the past several years, U.S. trade policies have significantly influenced input costs and the availability of organic pesticide active ingredients. Section 301 tariffs, initially imposed on certain chemicals and agricultural commodities sourced from key export markets, have gradually impacted the cost structure for manufacturers reliant on imported raw materials. This has spurred a reassessment of global sourcing strategies and prompted investments in domestic production capabilities.

The cumulative effect of these trade measures has manifested in higher procurement expenses, leading some producers to absorb increased costs, while others have transferred them through marginal price adjustments. Small and mid-sized enterprises, in particular, have felt the strain, as they often lack the scale necessary to negotiate favorable supply contracts or vertically integrate production. At the same time, larger players have capitalized on strategic partnerships and backward integration to buffer against volatility.

In response, many organizations have diversified supplier portfolios, sourcing critical substrates such as microbial cultures and botanical extracts from alternative regions in Southeast Asia and Latin America. This reconfiguration of supply chains has strengthened resilience but also introduced complexities related to quality assurance, regulatory compliance, and logistical coordination. Looking ahead, the evolving trade landscape will remain a pivotal factor in cost optimization and competitive differentiation for organic pesticide providers operating in the U.S. market.

Unveiling Key Segmentation Insights Revealing How Diverse Product Types Crop Applications Formulations Methods and Channels Drive Market Nuances

A nuanced examination of product type segmentation reveals how distinct categories cater to varying agronomic and operational requirements. Fungicides, encompassing biochemical, microbial, and plant-extract variants, are pivotal for managing fungal threats while complying with strict residue regulations. Herbicides, primarily derived from plant-based formulations, address weed control with minimal ecological disruption. Insecticides cover a diverse spectrum, with botanical solutions such as neem- and pyrethrin-based extracts joining microbial agents like Bacillus thuringiensis, Beauveria bassiana, and Metarhizium anisopliae; pheromone-based techniques further enhance integrated pest management through mating disruption and monitoring applications. Additionally, rodenticides formulated with capsaicin and castor oil derivatives offer non-toxic alternatives for vertebrate pest suppression.

When analyzing crop type segmentation, clear patterns emerge. Baseline staples such as cereals and grains-including maize, rice, and wheat-drive foundational demand for broad-spectrum organic solutions. Meanwhile, high-value horticultural produce like berries, citrus fruits, leafy greens, and solanaceous vegetables necessitate precision-targeted products to meet premium safety standards. Oilseeds and pulses from canola, lentil, and soybean cultivation favor microbial and plant-extract options that enhance seed vigor and yield quality. Turf and ornamental applications on golf courses and landscaped environments prioritize aesthetic integrity, making gentle yet effective foliar sprays and root-zone treatments indispensable.

Formulation preferences reflect end-user convenience and environmental considerations. Emulsifiable concentrates, particularly emulsion-in-water preparations, offer ease of mixing; granule presentations, including dry flowables, facilitate soil applications; liquid concentrates such as soluble and suspension types are adaptable for both conventional equipment and bespoke dosing systems; powders subdivided into dustable and wettable categories provide targeted coverage and long-term efficacy. Application method further diversifies user approaches, with aerial and ground foliar sprays, seed treatment via coating and pelleting, and soil treatments delivered through drip irrigation and drench protocols.

Distribution channels shape accessibility and service models. Direct sales foster close technical collaboration between manufacturers and end users, while partnerships with agro dealers and retailers enable wide regional penetration. The digital age has accelerated e-commerce adoption, with B2B marketplaces and company websites offering streamlined procurement pathways. Each of these segmentation factors intertwines to create a complex ecosystem that influences product development priorities and go-to-market strategies within the organic pesticide arena.

This comprehensive research report categorizes the Organic Pesticides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Crop Type

- Formulation

- Application

- Distribution Channel

Highlighting Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific That Shape the Adoption and Distribution of Organic Pesticides

Regional dynamics profoundly shape the adoption and diffusion of organic pesticides. In the Americas, supportive regulatory frameworks in North America and growing demand for residue-free commodities empower market expansion. Canada’s sustainable agriculture programs and the U.S. National Organic Program’s accreditation standards create fertile ground for innovative biopesticide entrants. Meanwhile, Latin American producers, driven by export requirements and ecological conservation commitments, increasingly integrate organic solutions to access premium markets in Europe.

Across Europe, the Middle East & Africa, stringent pesticide authorization processes under EU regulations and voluntary reduction targets encourage the development of novel organic actives and formulations. European agrarian landscapes, from large-scale cereal operations to boutique vineyards, necessitate a spectrum of product efficacies. In the Middle East, water-scarce conditions drive precision application methods, while North African nations seek cost-effective, climate-adapted biopesticides to bolster food security.

In the Asia-Pacific region, robust agricultural production systems combined with progressive sustainability agendas catalyze demand for organic pest control. Key players in China, India, and Southeast Asia are scaling up microbial biopesticide manufacturing to address local plant health challenges. Australia and New Zealand’s organic certification regimes have fostered niche markets for plant-extract formulations, while Japan’s integrated pest management ethos advances pheromone-and-microbial hybrid strategies. Diverse climatic zones and cropping patterns across the region inform tailored application protocols and product development roadmaps.

These regional insights underscore the heterogeneous nature of organic pesticide adoption, highlighting the need for adaptive strategies that respond to local agronomic conditions, regulatory landscapes, and end-user expectations.

This comprehensive research report examines key regions that drive the evolution of the Organic Pesticides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Driving Competitive Differentiation in the Global Organic Pesticides Industry Landscape

The organic pesticide landscape features an array of industry players combining legacy chemical expertise with cutting-edge biotechnological innovation. Established agrochemical firms have expanded into organic solutions through strategic acquisitions of microbial biopesticide startups, leveraging their distribution networks to accelerate market penetration. Mid-tier specialists concentrate their R&D investments on next-generation actives, such as RNA interference agents and enhanced pheromone dispensers, to differentiate offerings and capture emerging niche applications.

Collaborative ventures between agricultural universities, contract research organizations, and private companies are accelerating the commercial readiness of novel organic compounds. These partnerships facilitate rigorous field trials across diverse geographies, validating efficacy under variable climatic and crop conditions. At the same time, vertically integrated enterprises-spanning raw material cultivation to final formulation-are optimizing cost structures and ensuring supply continuity in the face of global trade uncertainties.

Smaller innovators are carving out specialized segments, such as residue-free post-harvest treatments and organic rodent deterrents, capitalizing on direct-to-farm channels and digital marketplaces to reach end users. Their agile business models prioritize customized solutions, technical service, and localized manufacturing, enabling rapid iteration based on customer feedback. This dynamic competitive environment is stimulating continuous product refinement and service enhancements, heightening value propositions across the spectrum of organic pesticide providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Organic Pesticides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Bayer AG

- BioSafe Systems, LLC

- Certis USA L.L.C.

- Dow AgroSciences LLC

- Gowan Company, LLC

- Marrone Bio Innovations, Inc.

- Monsanto Company

- Natural Industries, Inc.

- Nufarm Limited

- Sipcam Agro USA, Inc.

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- The Scotts Miracle-Gro Company

- Valent BioSciences LLC

- Valent U.S.A. LLC

Delivering Tailored Actionable Recommendations to Empower Industry Leaders to Capitalize on Sustainability Trends and Strengthen Organic Pesticide Portfolios

To harness the full potential of organic pesticides, industry leaders should adopt a multi-faceted strategy that balances innovation with operational resilience. First, investing in collaborative R&D initiatives can accelerate the development of broad-spectrum and species-specific formulations, enhancing utility across diverse cropping systems. Co-development partnerships with academic institutions and biotech firms can expedite the translation of laboratory breakthroughs into commercially viable products.

Second, companies must re-evaluate supply chain architectures to mitigate the impacts of trade tariffs and geopolitical uncertainties. Establishing regional production hubs for critical active ingredients and leveraging contract manufacturing relationships will ensure consistent availability while optimizing logistics costs. Integrating traceability platforms can further bolster quality assurance and compliance with evolving regulatory frameworks.

Third, expanding digital outreach through targeted e-commerce platforms and precision agriculture partnerships will drive customer engagement and streamline procurement processes. Data analytics tools can provide granular insights into usage patterns, enabling tailored recommendations that improve application efficiency and customer satisfaction. Equally important is investing in technical training programs and digital agronomy services that empower end users to derive maximum value from organic pesticide solutions.

Finally, aligning product portfolios with emerging consumer preferences for clean-label and residue-free produce will enhance market positioning. By synergizing organic actives with supplemental agronomic services-such as soil health assessments and pest monitoring-organizations can create integrated solutions that meet the evolving demands of value chain stakeholders.

Outlining Rigorous Research Methodology Integrating Primary and Secondary Approaches to Ensure Accurate and Comprehensive Organic Pesticide Market Analysis

This report is underpinned by a rigorous methodology designed to deliver comprehensive and unbiased market insights. Primary research efforts included extensive interviews with key stakeholders across the value chain, spanning global agrochemical executives, independent distributors, regulatory specialists, and end-user representatives. These qualitative engagements yielded nuanced perspectives on product performance, regulatory compliance, and market access challenges.

Secondary research complemented primary findings through an exhaustive review of publicly available sources, including peer-reviewed scientific studies, industry whitepapers, regulatory databases, and sustainability reports. Patent analysis provided visibility into emerging technologies, while trade data and customs records informed supply chain trend assessments. Methodological triangulation ensured that insights derived from disparate inputs were corroborated and validated.

Quantitative market segmentation analyses were informed by a bottom-up approach, systematically categorizing product types, crop applications, formulations, application methods, and distribution channels. This segmentation framework was applied across major geographic regions-Americas, Europe Middle East & Africa, and Asia-Pacific-to uncover regional variations in adoption and competitive dynamics. Throughout the research process, adherence to stringent data quality protocols and cross-validation mechanisms ensured the reliability and relevance of conclusions.

By integrating primary and secondary inputs within a transparent and repeatable framework, this study provides a robust foundation for strategic decision-making in the dynamic organic pesticide market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Organic Pesticides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Organic Pesticides Market, by Product Type

- Organic Pesticides Market, by Crop Type

- Organic Pesticides Market, by Formulation

- Organic Pesticides Market, by Application

- Organic Pesticides Market, by Distribution Channel

- Organic Pesticides Market, by Region

- Organic Pesticides Market, by Group

- Organic Pesticides Market, by Country

- United States Organic Pesticides Market

- China Organic Pesticides Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Synthesizing Core Insights from Emerging Trends Segmentation Analyses and Trade Considerations to Frame the Future Trajectory of Organic Pesticides

Drawing together the pivotal findings of this study, it is clear that the organic pesticide sector stands at an inflection point driven by sustainability imperatives, technological advances, and evolving trade policies. The convergence of stricter environmental regulations and consumer demands for residue-free produce has elevated organic pest control from a niche offering to a mainstream imperative in modern agriculture.

Segmentation analyses reveal that no single product type or application method dominates; instead, diverse crop requirements and local agronomic conditions necessitate a tailored portfolio of solutions. The interplay between formulations-ranging from emulsifiable concentrates to dustable powders-and delivery methods underscores the importance of versatility and ease of use. Moreover, distribution channel strategies must balance close technical engagement with digital procurement efficiencies to meet the varied needs of global end users.

Trade dynamics, particularly the cumulative impact of U.S. tariffs, have underscored the value of supply chain resilience and regional manufacturing capabilities. Industry players that proactively diversified sourcing and strengthened backward integration have managed to navigate cost pressures and maintain market momentum. The competitive landscape is defined by agile innovators and established players alike, each leveraging collaborative research and strategic partnerships to develop differentiated offerings.

Looking ahead, success in the organic pesticide domain will hinge on continued R&D investment, adaptive supply chain strategies, and customer-centric service models. Organizations that align their strategic priorities with emerging sustainability and regulatory trends will be best positioned to drive growth and shape the future trajectory of organic pest management.

Engage with Ketan Rohom to Unlock In-Depth Organic Pesticide Market Intelligence and Propel Your Strategic Decisions with Tailored Research Insights Today

To take full advantage of the insights detailed throughout this report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan’s deep expertise in the organic pesticide sector will guide you through the nuances of sustainable pest management and strategic positioning. Engaging with him early ensures you align your research objectives with actionable market intelligence tailored to your organization’s goals.

By partnering with Ketan, you gain access to extensive data-driven analyses, expert consultations, and customizable insights designed to inform high-impact decisions. This collaboration empowers you to refine product portfolios, optimize distribution strategies, and anticipate regulatory changes. Act now to secure your competitive edge and accelerate innovation in the fast-evolving organic pesticide market.

- How big is the Organic Pesticides Market?

- What is the Organic Pesticides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?