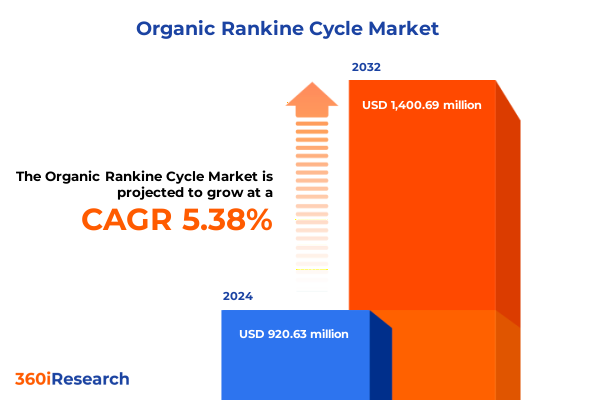

The Organic Rankine Cycle Market size was estimated at USD 968.04 million in 2025 and expected to reach USD 1,020.69 million in 2026, at a CAGR of 5.41% to reach USD 1,400.69 million by 2032.

Comprehensive Exploration of the Organic Rankine Cycle Market Landscape Highlighting Strategic Opportunities for Sustainable Energy Conversion Technologies Worldwide

The Organic Rankine Cycle (ORC) represents a pivotal technology in the transition toward cleaner energy production by enabling the conversion of low to medium-temperature heat into electricity. Leveraging organic fluids with favorable thermodynamic properties, ORC systems capture waste heat from industrial processes, geothermal sources, and solar thermal installations, transforming what was once considered lost thermal energy into valuable power. This design flexibility has positioned ORC as an attractive solution for industries seeking to enhance energy efficiency, reduce greenhouse gas emissions, and achieve sustainability targets. Moreover, ongoing advancements in heat exchanger design, control systems, and fluid chemistry have steadily broadened the applicability of ORC technology across increasingly diverse temperature ranges and operating conditions.

As regulatory frameworks worldwide tighten emissions standards and incentivize renewable energy deployment, interest in ORC solutions has surged among project developers, equipment manufacturers, and end-users. Public policy mechanisms, including tax credits, feed-in tariffs, and carbon pricing, are reinforcing the economic case for waste heat recovery and geothermal electricity generation. Concurrently, cost reductions stemming from modular system architectures and digitalized performance monitoring have lowered entry barriers for small and medium-scale installations. Consequently, organizations across the energy, manufacturing, and heavy-industry sectors are evaluating ORC as a strategic avenue for operational optimization and environmental stewardship.

In this executive summary, we will outline the key transformative shifts reshaping the ORC landscape, analyze the cumulative impact of recent United States tariffs, highlight critical segmentation and regional insights, and profile the leading companies advancing innovation. Synthesizing these elements will provide industry leaders with actionable recommendations to harness ORC technology for competitive advantage in an evolving energy ecosystem.

Key Technological and Market Shifts Reshaping the Organic Rankine Cycle Industry Towards Enhanced Performance and Scalability

The ORC industry is undergoing transformative shifts driven by technological innovation, evolving regulatory pressures, and strategic alliances that are redefining market boundaries. On the technology front, the integration of advanced working fluids-such as high-molecular-weight hydrocarbons and silicone-based compounds-has improved thermal stability and cycle efficiency at variable heat source temperatures. Simultaneously, breakthroughs in additive manufacturing for heat exchangers and next-generation coatings have enhanced system reliability and reduced material costs. These innovations are enabling modular, plug-and-play ORC units that can be rapidly deployed in remote or resource-constrained environments.

In parallel, digitalization is reshaping operational paradigms through the deployment of machine-learning algorithms for predictive maintenance and performance optimization. Real-time monitoring platforms now aggregate sensor data across turbines, pumps, and condensers to anticipate potential degradation, extending equipment life and minimizing downtime. This convergence of digital and physical technologies is fostering new business models, including performance-based service contracts and outcome-oriented energy-as-a-service offerings that align vendor incentives with asset performance.

Beyond technology, strategic partnerships and consolidation are accelerating scale economies and global market access. Joint ventures between equipment providers and EPC contractors are streamlining project delivery, while collaborations with research institutions are fast-tracking the commercialization of high-temperature cycles. Furthermore, the push toward decarbonization and circular economy principles is creating fresh opportunities for ORC integration with biomass energy, solar thermal installations, and waste heat recovery in manufacturing. These synergies underscore a dynamic ecosystem in which cross-sector collaboration and interdependent supply chains are vital for sustaining competitive advantage.

Assessing How 2025 United States Tariffs Have Altered Supply Chains and Competitive Dynamics in the Organic Rankine Cycle Sector

In 2025, the United States implemented targeted tariff measures on steel, specialty alloys, and select imported components integral to ORC system manufacture, resulting in a notable shift in procurement strategies and cost structures. As a consequence, OEMs have faced increased lead times and elevated material expenses for heat exchangers, turbine blades, and high-pressure pumps. These pressures have prompted manufacturers to localize production, diversify supply chains, and in some cases, re-engineer system designs to accommodate domestically available materials. The cumulative effect has been a recalibration of the cost-benefit analysis for certain project types, particularly large-scale installations where raw material inputs constitute a significant portion of total capital expenditure.

Conversely, the tariff environment has catalyzed growth in regional fabrication capacity, with several U.S. based fabricators expanding their CNC machining and welding capabilities to meet rising demand. This shift has had the ancillary benefit of reducing transportation lead times and strengthening domestic supplier relationships, albeit at the expense of higher unit costs relative to pre-tariff imports. Some multinational developers have absorbed these additional expenses to protect project margins, while others have passed a portion of the cost onto end-users, leading to a discernible uptick in project-level levelized cost of energy for waste heat recovery applications.

Looking ahead, industry stakeholders are actively engaging with trade associations and government agencies to advocate for tariff exemptions on critical components and to explore alternative classifications that could mitigate duty burdens. At the same time, R&D teams are accelerating efforts to identify substitute materials and alloy compositions, thereby future-proofing ORC designs against ongoing geopolitical and trade uncertainty. This dynamic underscores the importance of agile supply chain management and strategic policy engagement in navigating the current U.S. tariff landscape.

Revealing Critical Segmentation Insights to Illuminate Component, Fluid, Cycle, Capacity, Application, and End-User Dynamics in ORC Markets

A nuanced understanding of market dynamics emerges when deconstructing the ORC industry through its primary segmentation dimensions. Examining components such as condensers, evaporator units, pumps, and turbines reveals a competitive landscape where reliability and thermal performance drive differentiation; condensers optimized for minimal fouling tend to command premium positioning, while high-efficiency turbines deliver enhanced power output at elevated steam pressures. Turning to working fluid types, the selection between hydrocarbons, refrigerants, and siloxanes is increasingly influenced by environmental regulations and heat source characteristics, with siloxanes gaining traction in high-temperature geothermal applications due to their thermal stability.

The delineation of cycle types-subcritical, supercritical, and transcritical-further underscores design trade-offs. Subcritical cycles remain prevalent in low-temperature waste heat recovery, offering cost advantages, while supercritical and transcritical cycles are being piloted for higher thermal gradients, unlocking efficiency gains at the expense of complex control requirements. When assessing system capacity, large-scale ORC installations continue to lead in centralized power generation use cases, whereas medium-scale systems strike a balance between capital intensity and output for industrial cogeneration. Meanwhile, small-scale ORC units are rapidly gaining adoption in distributed energy scenarios, particularly in remote operations where modular deployment is critical.

Application-based segmentation highlights distinct value propositions for biomass energy, geothermal power plants, solar thermal generation, and waste heat recovery. Biomass projects emphasize fuel flexibility and sustainable feedstocks, whereas geothermal initiatives leverage deep resource baseload generation. Solar thermal hybridization has emerged as a focal point for seasonal adaptation, and waste heat recovery remains the cornerstone for improving energy efficiency in manufacturing. Finally, end-user dynamics across energy & utilities, manufacturing, marine, and oil & gas sectors reflect tailored service offerings and maintenance packages that align with unique operational requirements, ensuring that ORC deployments deliver optimal returns on investment.

This comprehensive research report categorizes the Organic Rankine Cycle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Working Fluid Type

- Cycle Type

- Capacity

- Application

- End-User

Delineating Regional Dynamics and Key Growth Drivers Across Americas, Europe, Middle East & Africa, and Asia-Pacific in the ORC Landscape

Regional market dynamics for ORC technology exhibit divergent growth trajectories informed by regulatory frameworks, resource endowments, and industrial maturity. In the Americas, favorable incentive schemes for renewable power generation and waste heat utilization have bolstered project pipelines in both North and South America. Geothermal-rich areas such as the western United States and Central American volcanic belts are witnessing steady ORC plant commissioning, while industrial hubs in Brazil and Mexico are integrating ORC units to improve energy efficiency and reduce carbon intensity.

Moving to Europe, Middle East & Africa, the emphasis on decarbonization has propelled ORC adoption across a mosaic of national markets. In Europe, stringent emissions targets and circular economy directives have accelerated waste heat recovery in heavy manufacturing and chemical processing. The Middle East is exploring ORC for unconventional energy sources, including high-temperature solar thermal and oilfield waste heat, whereas North African countries are evaluating ORC as a complement to emerging geothermal ventures. Sub-Saharan Africa presents nascent opportunities for off-grid ORC microgrids in mining and remote industrial sites.

Asia-Pacific stands out for its rapid industrialization and growing demand for reliable power solutions. In China, government subsidies for biomass and waste heat projects have stimulated large-scale ORC deployments, while Japan and South Korea are advancing supercritical cycle pilots to enhance thermal efficiency. Australia’s mining sector has embraced small-scale modular ORC units to offset diesel consumption, and Southeast Asian economies are piloting geothermal-based ORC plants to diversify their energy mix. Collectively, these regional dynamics underscore a global expansion of ORC technology driven by localized incentives and resource potential.

This comprehensive research report examines key regions that drive the evolution of the Organic Rankine Cycle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation, Strategic Partnerships, and Competitive Excellence in the Organic Rankine Cycle Industry

Leading enterprises in the ORC arena are differentiating through technology leadership, strategic alliances, and global footprint expansion. Ormat Technologies continues to set the benchmark for geothermal-focused ORC solutions, leveraging decades of operational experience to refine turbine designs and enhance cycle efficiencies. Its investment in proprietary direct-drive generators and modular plant architectures has reinforced its dominant position in utility-scale geothermal power generation. Turboden, now part of a major heavy industries conglomerate, has bolstered its research capabilities to advance supercritical cycle performance and broaden application scopes, from biomass plants to waste heat recovery in marine vessels.

Multinational conglomerates like General Electric and Mitsubishi Heavy Industries are integrating ORC modules within broader energy system portfolios, offering turnkey solutions that combine gas turbines, heat recovery steam generators, and ORC units for combined cycle plants. Their global service networks and project finance teams are instrumental in securing large platform orders and delivering life-cycle support. Emerging innovators, such as Electratherm and Exergy, are carving niches in specialized markets by pioneering low-temperature ORC systems optimized for industrial process waste heat and biomass combustion byproducts.

Collaborative ventures between equipment vendors and EPC contractors have gained momentum, with consortia focusing on bespoke solutions tailored to complex project requirements. These partnerships facilitate accelerated project delivery timelines and mitigate integration risks. Additionally, strategic acquisitions are enabling key players to expand their product portfolios and geographic reach, ensuring they remain agile in responding to shifting regulatory imperatives and customer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Organic Rankine Cycle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Againity AB

- Air Squared, Inc.

- ALFA LAVAL AB

- Atlas Copco AB

- Calnetix Technologies LLC

- CLEAN ENERGY TECHNOLOGIES, INC.

- DeVeTec GmbH

- Dürr Aktiengesellschaft

- ElectraTherm, Inc.

- Enogia SA

- Exergy International S.r.l.

- General Electric Company

- Heatlift SAS

- Kaishan USA

- Mitsubishi Heavy Industries, Ltd.

- ORCAN ENERGY AG

- Ormat Technologies, Inc.

- Siemens AG

- Terrapin Geothermics

- Triogen B.V.

Actionable Recommendations to Accelerate Market Adoption, Optimize Operational Efficiency, and Strengthen Competitive Positioning in the ORC Sector

For ORC industry leaders aiming to capitalize on emerging opportunities, a set of actionable measures can fortify market positioning and drive growth. First, prioritizing R&D investment in proprietary working fluids and advanced heat exchanger materials will yield performance improvements and differentiate offerings. Concurrently, forging alliances with academic institutions and national laboratories can accelerate technology transfer and reduce time to market for next-generation cycle designs.

Second, strengthening end-to-end supply chains through near-shoring of critical component fabrication and diversifying supplier portfolios will shield operations from geopolitical and tariff-related disruptions. This approach should be supplemented by digital procurement platforms that enhance transparency and enable dynamic supplier selection based on real-time risk assessments. Third, embracing digital twin capabilities and predictive analytics will optimize asset operations and unlock new service revenue streams tied to uptime guarantees and efficiency thresholds. Establishing performance-based contracts aligned with customer objectives can foster long-term partnerships and recurring revenue.

Lastly, proactive engagement with policymakers and participation in industry associations will enable leaders to influence regulatory developments and secure incentive frameworks favorable to ORC deployment. By advocating for technology-neutral incentives and streamlined permitting processes, industry stakeholders can accelerate project approvals and expand market accessibility. Collectively, these strategies will empower organizations to navigate complex market dynamics and drive the next wave of ORC adoption.

Outlining Robust Research Methodology Employed to Ensure Accuracy, Credibility, and Comprehensive Coverage of the Organic Rankine Cycle Market Analysis

The research methodology underpinning this analysis integrates a rigorous blend of primary and secondary data collection, critical to ensuring the validity and comprehensiveness of market insights. Secondary research encompassed an exhaustive review of industry journals, government policy papers, technical patents, and regulatory filings, supplemented by examination of white papers published by leading technology providers. This foundational desk research established a contextual framework, informing subsequent data triangulation and hypothesis formation.

Primary research involved structured interviews and workshops with C-suite executives, project developers, equipment engineers, and end-user representatives across energy, manufacturing, and marine sectors. These engagements yielded qualitative perspectives on technology adoption drivers, supply chain constraints, and regional policy impacts. Quantitative validation was achieved through bespoke surveys circulated to a curated panel of ORC system integrators and OEM procurement teams, capturing metrics on project lead times, cost components, and performance benchmarks.

Triangulation methods were applied to reconcile insights from disparate sources, ensuring consistency and reliability. Data points were cross-verified against public company disclosures, patent filings, and international trade statistics. The analysis further employed sensitivity testing to examine the robustness of thematic conclusions under varying policy and market scenarios. Finally, an expert advisory council comprising seasoned ORC practitioners provided peer review, ensuring that the findings reflect current industry realities and incorporate forward-looking perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Organic Rankine Cycle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Organic Rankine Cycle Market, by Components

- Organic Rankine Cycle Market, by Working Fluid Type

- Organic Rankine Cycle Market, by Cycle Type

- Organic Rankine Cycle Market, by Capacity

- Organic Rankine Cycle Market, by Application

- Organic Rankine Cycle Market, by End-User

- Organic Rankine Cycle Market, by Region

- Organic Rankine Cycle Market, by Group

- Organic Rankine Cycle Market, by Country

- United States Organic Rankine Cycle Market

- China Organic Rankine Cycle Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Highlight Emerging Trends and Strategic Imperatives Shaping the Future of the Organic Rankine Cycle Market

This executive summary has illuminated the multifaceted landscape of the Organic Rankine Cycle market, capturing pivotal technology innovations, regulatory influences, and supply chain dynamics. Advanced working fluids and modular designs are driving operational efficiencies, while digital tools are enhancing performance monitoring and predictive maintenance. The 2025 United States tariffs have underscored the importance of supply chain resilience and strategic policy engagement, catalyzing near-shoring initiatives and material substitution efforts.

Segmentation analysis has revealed that component optimization, fluid selection, cycle type differentiation, and application-specific designs are central to competitive positioning across diverse capacity tiers and end-user scenarios. Regionally, incentives and resource availability are steering deployment strategies in the Americas, Europe, Middle East & Africa, and Asia-Pacific, each presenting unique growth vectors. Key industry players are reinforcing their market leadership through targeted R&D, strategic alliances, and integrated solution portfolios, reflecting an ecosystem increasingly defined by collaboration and specialization.

Collectively, these insights highlight a sector at the convergence of sustainability imperatives and technological possibility. As decarbonization agendas intensify and energy efficiency mandates proliferate, the Organic Rankine Cycle is set to play an integral role in global energy transition journeys. The recommendations outlined herein offer a roadmap for stakeholders to harness this momentum and to position themselves at the forefront of an expanding market landscape.

Contact Ketan Rohom to Unlock In-Depth Organic Rankine Cycle Market Intelligence and Guide Strategic Decision-Making with Expert Insights

To access unparalleled market depth and informed intelligence on the Organic Rankine Cycle sector, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Through a personalized consultation, you can explore bespoke insights tailored to your strategic objectives and operational challenges. Engaging with Ketan Rohom will grant you privileged access to a comprehensive research compendium that distills the latest technological advancements, policy implications, and competitive dynamics shaping the ORC landscape. Armed with this critical intelligence, you will be poised to anticipate market shifts, assess potential partnerships, and refine your go-to-market strategies with precision. Take the next step toward competitive advantage by reaching out to secure your copy of the full market research report and unlock actionable recommendations designed to accelerate growth and innovation in your organization.

- How big is the Organic Rankine Cycle Market?

- What is the Organic Rankine Cycle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?