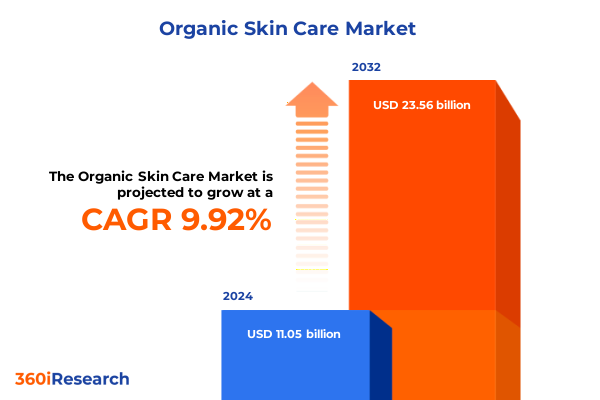

The Organic Skin Care Market size was estimated at USD 12.17 billion in 2025 and expected to reach USD 13.19 billion in 2026, at a CAGR of 9.89% to reach USD 23.56 billion by 2032.

Embracing the Rise of Conscious Consumerism as a Catalyst for Unprecedented Growth in Organic Skin Care Markets and Driving Innovation Across the Value Chain

Organic skin care has emerged as one of the most dynamic and fast-evolving segments within the broader personal care industry, driven by an unwavering consumer appetite for clean, sustainable, and ethically produced products. Over the past decade, a growing awareness of ingredient transparency, environmental stewardship, and holistic well-being has propelled organic formulations from niche boutiques into mainstream retail channels. This momentum has been buoyed by consumers across age groups who are increasingly scrutinizing product labels, demanding third-party certifications, and valuing brand authenticity as much as efficacy.

Amidst this backdrop, industry participants are redefining the concept of luxury, shifting away from purely premium brand perception toward experiences that blend wellness, sustainability, and performance. As a result, established beauty conglomerates and agile start-ups alike are investing heavily in botanical research, novel extraction techniques, and eco-friendly packaging solutions. This convergence of consumer consciousness and technological innovation is setting the stage for unprecedented growth opportunities in organic skin care markets around the globe, compelling stakeholders to reassess their value propositions and supply chain strategies to stay ahead in an increasingly competitive landscape.

Navigating the Shifting Dynamics of Consumer Expectations Sustainability Standards and Technological Advancements Shaping Organic Skin Care Evolution

The organic skin care sector is undergoing a paradigm shift, as evolving consumer expectations blur traditional lines between beauty, health, and environmental responsibility. Shoppers now demand not only clinically proven efficacy but also assurance that every ingredient is ethically sourced, cruelty-free, and aligned with broader sustainability commitments. Brands that once competed on scent and texture are now differentiating through regenerative farming partnerships, carbon-neutral operations, and full-circle recycling programs.

Concurrently, technological advancements-such as AI-driven personalized formulation platforms and micro-encapsulation delivery systems-are elevating performance benchmarks for clean products. These innovations allow brands to target specific skin concerns with precision, while maintaining integrity around organic certification standards. The integration of digital tools into product development and consumer engagement is further accelerating market transformation, enabling companies to scale customization at unprecedented speeds and forge deeper emotional connections with their audiences.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Revisions on Global Supply Chains and Organic Skin Care Market Dynamics

In 2025, a series of United States tariff revisions on select cosmetic inputs and essential oils have introduced new cost pressures across the organic skin care supply chain. Manufacturers that rely on imported botanicals such as shea butter, argan oil, and elderflower extract have experienced margin compression, prompting an industry-wide reassessment of sourcing strategies. As a result, many brands are exploring domestic cultivation partnerships and vertically integrated production models to mitigate exposure to import duties and currency fluctuations.

These structural changes have also catalyzed a broader reallocation of R&D budgets. Companies are channeling investments toward developing novel analogs of traditionally imported ingredients, improving extraction yields, and enhancing on-shore processing capabilities. While short-term price adjustments were absorbed by a mix of incremental retail price increases and cost optimization measures, the longer-term impact of the tariffs is likely to accelerate regional supply diversification, strengthening domestic agricultural sectors while reshaping global trade flows in organic raw materials.

Unveiling Comprehensive Segmentation Insights to Illuminate Consumer Preferences Product Innovations and Distribution Strategies in Organic Skin Care

Deep analysis of consumer behavior and purchase patterns reveals pronounced preferences by product type, distribution channel, price tier, skin concern, end user, age group, certification, and packaging format. In the realm of product categories, foaming cleansers continue to appeal broadly, while micellar water has secured a loyal following among eco-conscious millennials. Oil cleansers and nutrient-rich serums have seen a surge in adoption, reflecting a growing demand for multi-functional skincare that addresses hydration and barrier repair. In parallel, body lotions and face creams maintain consistent turnover, but premium potencies and targeted actives in the anti-aging segment command higher price points.

On the distribution side, online retail channels have solidified their dominance, driven by seamless e-commerce experiences, personalized subscription models, and influencer-led education. Pharmacies and drugstores retain importance for acne control and sensitive skin solutions, while specialty stores and supermarkets play pivotal roles in discovery and convenience. Within pricing strategies, luxury and premium tiers are capturing disproportionate attention from affluent demographics seeking exclusivity, whereas mass-market offerings appeal to budget-minded yet ingredient-savvy consumers.

Targeting specific skin concerns, anti-aging and hydration remain top priorities, yet brightening formulations have garnered increased interest as consumers seek even tone and radiance. Acne control and sensitive skin treatments sustain stable demand, underscoring the importance of dermatologist-approved organic options. Demographically, women represent the primary cohort, with unisex lines gaining traction among male consumers and teen-focused botanicals driving early adoption behaviors. Older adults value premium certifications such as USDA Organic and Ecocert as trust signals, while younger segments are open to non-certified clean-label innovations that prioritize natural efficacy and sustainable packaging in bottles, jars, pumps, or tubes.

This comprehensive research report categorizes the Organic Skin Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Skin Concern

- Age Group

- Packaging Type

- Distribution Channel

- End User

Decoding Regional Variations in Organic Skin Care Consumption Regulatory Frameworks and Growth Drivers Across Major Global Markets

Regional dynamics illustrate that the Americas lead in both consumer awareness and retail channel maturity, with North America exhibiting strong affinity for personalized online services and loyalty-driving subscription plans. Latin American markets, meanwhile, are rapidly embracing local organic ingredients and artisanal brands that celebrate regional biodiversity and heritage. In Europe, Middle East & Africa, stringent regulatory frameworks around organic claims and certification have elevated product standards, prompting brands to secure COSMOS and Ecocert endorsements to access discerning European consumers. Meanwhile, the Middle East and select African countries exhibit an appetite for ultra-premium formulations, often blended with indigenous botanicals that reflect local beauty rituals.

In the Asia-Pacific region, growth is fueled by a combination of rising disposable incomes, digital native demographics, and cultural traditions that favor botanical remedies. Chinese and Korean markets are leading the charge, with cross-border e-commerce channels facilitating access to international organic brands, even as domestic players ramp up investment in clean-label R&D. Southeast Asian consumers show strong interest in hydrating and brightening products formulated for tropical climates, creating opportunities for region-specific innovations that marry global organic standards with local climate sensibilities.

This comprehensive research report examines key regions that drive the evolution of the Organic Skin Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Market-Leading Players Strategies Their Innovation Pipelines and Collaborative Ventures Reshaping the Organic Skin Care Competitive Landscape

Market leaders are distinguishing themselves through a combination of brand heritage, scientific research, and strategic collaborations. Established players like Dr. Hauschka and Weleda leverage decades of botanical expertise and deep ties to certified organic farming cooperatives, positioning themselves as trusted innovators in holistic skin wellness. Emerging challengers, including boutique digital-first brands, are partnering with biotech firms to develop lab-grown actives that meet clean label criteria while delivering potent performance.

Collaborative ventures between beauty conglomerates and ingredient houses have accelerated the launch of next-generation formulations, blending traditional plant extracts with cutting-edge peptide complexes. Some companies have also embarked on M&A strategies to acquire niche organic label startups, integrating their artisanal credentials and loyal followings into broader retail networks. Meanwhile, alliances with sustainability-focused organizations are helping brands achieve carbon-neutral shipping goals and explore refillable packaging pilots, reinforcing their commitment to environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Organic Skin Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aveda Corporation

- Burt's Bees, Inc.

- Dr. Bronner's Magic Soaps

- Earth Mama Organics

- EO Products

- Juice Beauty, Inc.

- Jāsön Natural Products

- Kora Organics

- L'Occitane International S.A.

- Natura & Co.

- Neal's Yard Remedies

- The Body Shop International Limited

- The Estée Lauder Companies Inc.

- True Botanicals, Inc.

- Weleda AG

- Yogaheada

Implementing Targeted Growth Strategies Sustainable Practices and Digital Innovations for Industry Leaders to Capitalize on Organic Skin Care Opportunities

Industry leaders are advised to deepen their emphasis on consumer education, leveraging AI-powered diagnostic tools and interactive content to guide shoppers toward personalized organic regimens. Investing in vertically integrated supply chains-spanning seed-to-shelf traceability for key botanicals-will further differentiate brand credibility and mitigate future tariff-related disruptions. Additionally, piloting modular refill systems and post-consumer recycling programs can align circular economy principles with premium pricing architectures, enhancing both customer loyalty and environmental impact.

To capitalize on emerging segments, executives should explore entry strategies in high-growth regional pockets, such as hydrating and brightening formulations tailored for tropical climates in Asia-Pacific and localized anti-pollution solutions for urban European markets. Formulating hybrid models that combine mass accessibility with premium dripped-in actives will broaden appeal across diverse price tiers. Finally, forging cross-industry partnerships-for instance, with health and wellness platforms or hospitality brands-can amplify organic skin care adoption through experiential marketing and subscription bundle offerings.

Detailing a Rigorous Combination of Primary Interviews Secondary Sources and Data Analytics Underpinning Research on the Organic Skin Care Market

This research integrates both primary and secondary methodologies to ensure rigorous and validated insights. Primary data was collected through in-depth interviews with senior executives across leading brands, ingredient suppliers, and distribution partners, capturing nuanced perspectives on supply chain adjustments, innovation pipelines, and consumer targeting tactics. Additionally, surveys of verified end users across key geographies provided quantitative validation of shifting purchase drivers and price sensitivities.

Secondary sources comprised regulatory filings, certification body reports, and public financial disclosures, supplemented by a thorough review of scientific literature on botanical efficacy and emerging formulation technologies. Advanced data analytics were deployed to process social listening inputs, e-commerce transaction data, and retail scan statistics, enabling robust trend mapping and segmentation modeling. Together, this mixed-method approach establishes a comprehensive foundation for both strategic decision-making and operational planning in the evolving organic skin care arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Organic Skin Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Organic Skin Care Market, by Product Type

- Organic Skin Care Market, by Skin Concern

- Organic Skin Care Market, by Age Group

- Organic Skin Care Market, by Packaging Type

- Organic Skin Care Market, by Distribution Channel

- Organic Skin Care Market, by End User

- Organic Skin Care Market, by Region

- Organic Skin Care Market, by Group

- Organic Skin Care Market, by Country

- United States Organic Skin Care Market

- China Organic Skin Care Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings Emerging Trends and Strategic Imperatives to Conclude the Organic Skin Care Market Analysis with Clear Directions

The convergence of conscious consumerism, regulatory complexity, and scientific innovation has created a fertile environment for organic skin care brands to redefine beauty standards. Key takeaways underscore the critical importance of transparent supply chains, differentiated product portfolios that target specific skin concerns, and adaptive pricing strategies that balance mass-market reach with premium positioning. Tariff-driven shifts in raw material sourcing have catalyzed on-shore cultivation efforts, signaling a newfound resilience in domestic agricultural partnerships.

Looking ahead, the trajectory of the organic skin care market will be shaped by brands that champion circularity-both in packaging and ingredient lifecycles-while harnessing data-driven personalization to foster deeper consumer engagement. Regional nuances will demand localized formulations and go-to-market playbooks, even as global brands leverage digital platforms to blur geographical boundaries. Ultimately, organizations that embrace holistic innovation, from seed selection to consumer doorstep, will capture outsized gains and set new benchmarks for sustainable beauty.

Encouraging Stakeholders to Connect with Associate Director for Exclusive Access to the Comprehensive Organic Skin Care Market Research Report

To access the full depth of insights, data, and strategic frameworks that underpin this analysis, we encourage you to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By partnering with Ketan, you will secure a comprehensive package that includes proprietary research, detailed charts, and expert recommendations tailored to your organizational priorities. Whether you seek targeted advice on navigating tariff shifts or wish to explore advanced segmentation models, Ketan will guide you through the process of acquiring the complete market research report. Engage now to empower your business with actionable intelligence and unlock the full potential of the organic skin care market.

- How big is the Organic Skin Care Market?

- What is the Organic Skin Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?