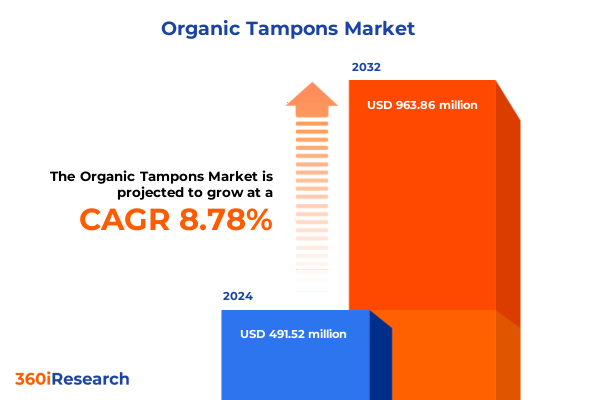

The Organic Tampons Market size was estimated at USD 534.80 million in 2025 and expected to reach USD 575.05 million in 2026, at a CAGR of 8.77% to reach USD 963.86 million by 2032.

Understanding the Dynamics of Organic Tampons Market Evolution and the Imperative for Sustainable Feminine Care Solutions

The organic tampons segment has emerged as a pivotal component of the feminine hygiene market, reflecting a broader shift toward sustainability and health-conscious consumer choices. In recent years, heightened awareness of environmental impact and chemical exposure has driven a growing number of women to seek alternatives that prioritize organic materials over synthetic counterparts. This movement is underpinned by a desire for products free from chlorine bleaching, pesticides, and GMOs, ensuring a gentler experience for both body and planet. As a result, the organic tampons category is witnessing sustained interest across diverse demographics, from environmentally minded millennials to value-driven Gen X consumers.

Simultaneously, brands within this space are harnessing innovations in sourcing and manufacturing to differentiate themselves. Companies are forging partnerships with certified organic cotton growers and incorporating renewable packaging solutions to reinforce their commitment to eco-responsibility. Regulatory bodies in key markets have also begun to emphasize product transparency, mandating clearer labeling and standardized certifications to bolster consumer trust. Consequently, market participants are investing in third-party verifications and robust supply chain traceability.

Looking ahead, the organic tampons sector is positioned at the intersection of escalating consumer demand and intensifying competitive dynamics. Stakeholders must navigate evolving regulatory landscapes, shifting tariff frameworks, and disruptive digital channels to maintain relevance. This report equips decision-makers with foundational insights into the forces shaping the category, offering a strategic lens through which to align product innovation, channel strategies, and sustainability commitments with consumer expectations.

Navigating the Emerging Consumer Preferences and Regulatory Shifts Redefining the Organic Tampons Competitive Landscape

Over the last few years, organic tampon manufacturers have confronted a series of transformative shifts that have redefined competitive boundaries and consumer engagement strategies. Initially, the rise of digital communities and social media influencers provided a powerful platform to amplify conversations around menstrual health and product safety, effectively lowering informational barriers for first-time buyers. Through educational campaigns and peer testimonials, brand narratives have become more authentic, fostering deeper trust and encouraging trial among cautious consumers.

Concurrently, regulatory initiatives have begun to mandate increased transparency around raw materials and production processes, prompting companies to adopt rigorous certification protocols. The Organic Content Standard and USDA Organic label have gained prominence, serving as critical differentiators in a market where authenticity can no longer be assumed. On top of this, NGOs and health advocacy groups are collaborating with manufacturers to develop improved product guidelines, catalyzing broader adoption of green manufacturing practices.

Moreover, the growing importance of circular economy principles has incentivized players to explore biodegradable and compostable packaging formats, as well as recyclable applicators. Such innovations are not only a response to consumer demands but also a proactive measure against impending environmental regulations targeting single-use plastics. As a result, sustainability credentials now play a central role in brand equity, shaping everything from product development roadmaps to marketing communications. Ultimately, these converging forces have created an ecosystem in which agility, transparency, and eco-innovation are vital for securing long-term market leadership.

Assessing the Wide-Ranging Effects of Recent United States Tariff Adjustments on the Organic Tampon Supply Chain in 2025

In 2025, a series of adjustments to United States import tariffs have exerted significant pressure on the organic tampon supply chain and cost structures. Adjusted duties on imported organic cotton and bamboo fiber have raised input costs for many manufacturers, compelling some to reevaluate their sourcing strategies. With higher landed prices on key raw materials, established brands have been forced to explore domestic cultivation partnerships and direct farmer collaborations to mitigate risk and preserve margin integrity.

The ripple effects of these tariff changes have been particularly acute for smaller niche players that lack the scale to absorb incremental expenses. These brands have responded by streamlining production runs, diversifying material blends, or negotiating long-term contracts to lock in more favorable rates. In contrast, vertically integrated companies with in-house processing capabilities have been able to maintain more stable pricing, reinforcing their competitive advantage.

Additionally, the tariff landscape has spurred heightened interest in alternative fibers, including hemp and organic flax, as manufacturers seek to reduce dependency on traditional cotton supplies. Although these alternatives present their own logistical complexities and regulatory considerations, they represent a strategic hedge against future trade disruptions. As cross-border tensions persist, the ability to adapt sourcing matrices rapidly is emerging as a critical determinant of operational resilience and market agility.

Unveiling Critical Insights from Product Type to Pricing Tiers Revealing Core Segmentation Drivers in Organic Tampons

A nuanced understanding of the organic tampons market emerges when examining the breadth of product types, revealing divergent consumer preferences between applicator and non-applicator options. Applicator variants continue to gain traction among users valuing enhanced hygiene and ease of insertion, while non-applicator offerings resonate with individuals prioritizing minimalistic design and reduced packaging waste. As distribution channels evolve, products are strategically positioned across convenience stores, drugstores, online retail platforms, specialty stores, and supermarket and hypermarket environments. Each channel presents unique touchpoints: online platforms deliver subscription and customization possibilities, whereas brick-and-mortar outlets provide immediate availability and in-store promotions that can drive trial among spontaneous purchasers. Transitioning to absorbency levels, routine needs are served by regular variants, while super, super plus, and ultra formats cater to high-flow days and niche use cases, enabling brands to address the full spectrum of menstrual experiences. Packaging formats further influence consumer choice with box sizes of 12, 16, 18, or 20 units accommodating distinct shopping behaviors-from trial purchases to bulk stocking-impacting both shelf turnover and inventory planning. Price stratification manifests through low, medium, and premium price tiers, reflecting diverse sensitivity thresholds; value-oriented consumers seek affordability without sacrificing organic credentials, while the premium segment is willing to invest in superior materials or innovative delivery mechanisms. Underpinning all of these elements is the choice of raw material, where bamboo fiber and organic cotton represent competing eco-narratives: bamboo offers rapid renewability and moisture-wicking properties, whereas organic cotton appeals to traditional notions of comfort and softness, requiring manufacturers to balance ecological impact with user experience.

This comprehensive research report categorizes the Organic Tampons market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Absorbency Level

- Packaging Format

- Raw Material

- Distribution Channel

Exploring Regional Demand Variations Across the Americas Europe Middle East Africa and Asia Pacific Organic Tampon Markets

Regional variations in demand patterns underscore the importance of localized strategies across the Americas, Europe Middle East and Africa, and Asia Pacific markets for organic tampons. In the Americas, particularly the United States and Canada, consumer commitment to certified organic goods remains robust, with mainstream retailers expanding shelf space to accommodate new entrants. Awareness campaigns and influential health organizations have bolstered adoption rates by educating consumers on the health benefits of organic materials and the environmental costs of conventional alternatives.

Across Europe Middle East and Africa, regulatory frameworks and diverse cultural attitudes toward menstrual health have shaped varying degrees of market maturity. Western European nations exhibit high penetration of certified organic options, supported by strict labeling requirements and strong environmental advocacy. Meanwhile, in parts of the Middle East and Africa, nascent awareness coupled with rising disposable incomes is generating incremental demand, though price sensitivity and distribution limitations pose constraints to rapid uptake.

The Asia Pacific region demonstrates some of the fastest growth trajectories, driven by urbanization, rising health literacy, and the proliferation of e-commerce platforms. Markets such as China and India are witnessing increased dialogue around menstrual wellness, facilitated by digital influencers and grassroots NGOs. Simultaneously, Australia and Japan have long embraced sustainability in personal care, creating stable environments for premium organic introductions. As a result, companies must tailor their approaches to each region’s maturity level, balancing price, accessibility, and educational initiatives to capture emerging opportunities.

This comprehensive research report examines key regions that drive the evolution of the Organic Tampons market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Brands Driving Innovation and Market Leadership within the Global Organic Tampons Industry

A competitive landscape analysis reveals that several key companies are spearheading innovation and driving market expansion within the organic tampons category. Established consumer goods brands have leveraged their extensive distribution networks to introduce organic lines, often partnering with specialized manufacturers to ensure product authenticity. Emerging pure-play businesses have differentiated themselves through vertically integrated supply chains, controlling everything from fiber sourcing to final packaging. Strategic collaborations with health organizations and endorsements by medical associations have further amplified the credibility of leading brands, elevating consumer trust.

Innovation initiatives range from biodegradable applicator designs to subscription-based delivery models, with market leaders investing in R&D to refine product ergonomics and environmental performance. Some trailblazers have explored infused botanicals and natural odor-control technologies to add functional benefits beyond basic protection. In parallel, investments in sustainable packaging materials, such as compostable wrappers and recycled carton materials, have become table stakes for competing at scale. Ultimately, the ability to synchronize product innovation, go-to-market tactics, and sustainability commitments is differentiating the companies securing dominant positions and attracting new customer segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Organic Tampons market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cora

- L. Organic

- Maxim Hygiene Products Inc.

- Natracare LLC

- Organyc

- Rael, Inc.

- Seventh Generation, Inc.

- Tampax

- The Honest Company, Inc.

- TOTM Consumer Health LLC

Strategic Imperatives and Actionable Roadmaps for Industry Executives to Enhance Market Position in Organic Tampons

Industry leaders seeking to capitalize on the organic tampons opportunity must prioritize a multi-pronged strategy that harmonizes sustainability, consumer engagement, and operational resilience. First, investing in research and development to explore alternative raw materials and novel delivery mechanisms will broaden product portfolios and reinforce brand credibility. Simultaneously, brands should intensify digital marketing initiatives, leveraging social media platforms and influencer partnerships to educate consumers and accelerate trial. By crafting authentic brand narratives that underscore certifications and transparent sourcing, companies can deepen emotional connections with their target audiences.

Moreover, supply chain diversification is essential to mitigate the impact of tariff volatility and material shortages. Establishing strategic alliances with regional fiber suppliers and exploring near-shoring opportunities can reduce lead times and buffer against geopolitical disruptions. On the distribution front, adopting an omnichannel approach that integrates e-commerce, brick-and-mortar, and direct-to-consumer models will maximize market coverage and provide seamless purchasing experiences.

Finally, fostering industry partnerships with health organizations, environmental NGOs, and regulatory bodies will not only inform product development but also amplify advocacy efforts. By taking a leadership role in sustainability initiatives and menstrual health education, companies can elevate category growth while reinforcing their reputations as responsible corporate citizens.

Detailing the Rigorous Approach and Analytical Framework Underpinning the Market Research into Organic Tampon Trends

This market research report is founded upon a rigorous methodology that integrates primary and secondary data sources to ensure both depth and accuracy. Initially, secondary research involved an exhaustive review of academic journals, regulatory filings, industry association publications, and patent databases to map the regulatory landscape and technological innovations influencing the organic tampons sector. Complementing this desk-based analysis, primary research was conducted through structured interviews with senior executives from leading manufacturers, suppliers, and distribution partners, providing first-hand perspectives on challenges and opportunities.

Quantitative surveys targeting a broad cross-section of retail buyers and end users were administered to capture purchase drivers, brand perceptions, and price sensitivities. These insights were triangulated against shipment and import data to validate market dynamics at both global and regional levels. A detailed supply chain analysis traced material flows from farm to factory, identifying critical nodes at risk of disruption and highlighting resilient sourcing strategies.

Throughout the research process, qualitative expert panels and peer reviews were leveraged to challenge assumptions and refine analytical models. Data validation protocols ensured consistency across all inputs, while statistical techniques were applied to reveal significant trends and correlations. The result is a comprehensive, actionable view of the organic tampons market that balances robust quantitative findings with rich qualitative insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Organic Tampons market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Organic Tampons Market, by Type

- Organic Tampons Market, by Absorbency Level

- Organic Tampons Market, by Packaging Format

- Organic Tampons Market, by Raw Material

- Organic Tampons Market, by Distribution Channel

- Organic Tampons Market, by Region

- Organic Tampons Market, by Group

- Organic Tampons Market, by Country

- United States Organic Tampons Market

- China Organic Tampons Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Key Takeaways and Future Imperatives Shaping the Organic Tampon Sector in a Rapidly Evolving Marketplace

In summary, the organic tampons market is experiencing a confluence of factors that are reshaping its competitive and operational landscape. Heightened consumer health consciousness and environmental stewardship are driving sustained demand for certified organic products, while regulatory initiatives and digital platforms are amplifying transparency and education. Concurrently, the recent tariff adjustments in the United States have underscored the importance of flexible sourcing strategies and supply chain resilience.

Segmentation analysis reveals that nuances such as product type, channel preferences, absorbency levels, packaging formats, price tiers, and raw material choices are all critical to capturing distinct consumer segments. Regionally, the Americas lead in market maturity, Europe Middle East and Africa exhibit mixed adoption levels, and Asia Pacific presents high-growth potential driven by urbanization and digital connectivity. Industry leaders continue to differentiate through product innovation, sustainable practices, and partnerships that enhance credibility.

Looking forward, companies that proactively integrate these insights into their strategic planning-by diversifying supply chains, investing in R&D, and engaging consumers through authentic narratives-will be best positioned to thrive in an increasingly competitive environment. This comprehensive analysis provides the foundation for informed decision-making, supporting market participants as they navigate the evolving landscape of organic feminine care.

Take the Next Step Toward Strategic Growth by Engaging with Ketan Rohom to Access the Comprehensive Organic Tampons Market Report

Ready to transform your strategic vision and capitalize on the evolving dynamics of the organic tampons market? Engage with Ketan Rohom, Associate Director of Sales & Marketing at our firm, to secure the most comprehensive and actionable market research report available. This meticulously crafted resource offers invaluable insights into consumer trends, tariff impacts, regional demand variations, and competitive positioning that will empower your organization to make data-driven decisions. By connecting with Ketan Rohom, you will gain access to personalized support and expert guidance to navigate market complexities and accelerate your growth strategy. Don’t miss this opportunity to stay ahead of emerging trends and protect your market share; reach out today to explore customized solutions tailored to your unique business objectives and unlock the full potential of the organic tampons market.

- How big is the Organic Tampons Market?

- What is the Organic Tampons Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?