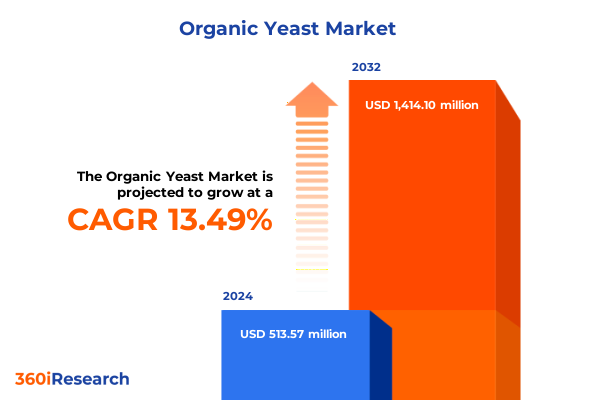

The Organic Yeast Market size was estimated at USD 572.59 million in 2025 and expected to reach USD 643.63 million in 2026, at a CAGR of 13.78% to reach USD 1,414.09 million by 2032.

Setting the Stage for the Organic Yeast Market's Evolution Amidst Rising Demand, Sustainable Innovation, and Transformative Supply Chain Dynamics

The organic yeast sector has emerged as a pivotal element of modern food, beverage, and biotechnological processes, responding to heightened consumer awareness around clean labels and sustainable sourcing. Over recent years, demand for alternatives to conventional yeast has intensified as manufacturers and end users seek ingredients that align with evolving dietary preferences and environmental goals. Against this backdrop, organic yeast has demonstrated its versatility by bridging artisanal baking traditions with large-scale industrial applications. Consequently, this market is now at a critical juncture where innovation, regulatory oversight, and consumer behavior converge to shape its trajectory.

As manufacturers invest in advanced fermentation and cultivation methodologies, they strive not only to optimize yield and consistency but also to uphold stringent organic certifications. Sustainability has become a guiding principle, driving facility upgrades that minimize resource consumption and waste. In parallel, stakeholders across the value chain prioritize transparency and traceability, leveraging digital technologies to trace raw material origins and authenticate organic claims. These initiatives not only address compliance requirements but also reinforce consumer trust, creating additional value throughout the supply continuum.

Moreover, integration of organic yeast into emerging applications-from nutraceuticals fortified with probiotics to plant‐based protein analogues-has unlocked new growth avenues. Strategic partnerships between ingredient suppliers, research institutions, and end‐product manufacturers facilitate co‐creation, accelerating time to market for differentiated formulations. In this context, the organic yeast market presents a compelling opportunity for industry participants to capitalize on dynamic consumer demands while advancing sustainability agendas.

Examining the Pivotal Transformations Reshaping the Organic Yeast Sector Driven by Technological Advancements and Consumer Value Expectations

Innovation and shifting consumer paradigms have catalyzed profound transformations within the organic yeast landscape. Advances in strain selection and genetic optimization now enable producers to tailor flavor profiles, enzymatic activities, and nutritional characteristics with unprecedented precision. Consequently, these technological breakthroughs have elevated product performance across a broad spectrum of applications, enhancing fermentation efficiency in beverages while boosting dough elasticity in bakery goods.

Furthermore, the industry has embraced sustainability as a core tenet, prompting widespread adoption of renewable feedstocks such as agricultural byproducts and plant‐based hydrolysates. These alternative substrates not only reduce reliance on traditional grain sources but also redirect waste streams into high‐value inputs. In parallel, manufacturers are piloting closed‐loop systems that recycle process water and capture biogas for on‐site energy generation, further shrinking the environmental footprint of organic yeast production.

Beyond production innovations, digital transformation has reshaped supply chain visibility and operational agility. Real‐time monitoring of temperature, humidity, and microbial viability enables predictive maintenance and quality assurance, reducing batch inconsistencies. Additionally, data‐driven demand forecasting and integrated logistics platforms facilitate smoother inventory management, mitigating risks of raw material shortages or spoilage. Collectively, these technological and operational shifts are redefining competitive dynamics, empowering agile market entrants while challenging incumbents to accelerate their own digital and sustainable initiatives.

Analyzing the Compound Effects of 2025 United States Tariff Policies on Organic Yeast Trade Dynamics and Industry Resilience

The introduction of new tariff measures by the United States in early 2025 has exerted a multi‐faceted influence on organic yeast trade flows and pricing structures. While the levies aimed to protect domestic agriculture and bioindustrial outputs, they inadvertently increased the cost of critical inputs sourced internationally, such as specialized nutrient blends and fermentation enhancers. Consequently, ingredient suppliers and producers have been compelled to reassess global sourcing strategies and negotiate alternative supplier agreements to mitigate margin pressures.

In addition, export opportunities for domestic manufacturers have faced new headwinds, as retaliatory duties and logistical complexities deter overseas buyers. Consequently, segment leaders have shifted emphasis toward reinforcing relationships with key regional partners, focusing on joint development agreements and co‐op branding to preserve market access. These collaborative endeavors help offset reduced competitiveness abroad by offering value‐added services, technical support, and supply chain assurances that transcend mere price considerations.

Moreover, the tariff environment has galvanized a renewed focus on enhancing local production capabilities. Investments in process intensification, automation, and modular manufacturing units have gained momentum, enabling rapid scaling of output closer to end‐market consumption. This strategic pivot not only buffers against global trade volatility but also aligns with sustainability objectives by reducing transportation distances and associated emissions. Ultimately, the cumulative effects of the 2025 tariff adjustments underscore the resilience of the organic yeast industry while prompting stakeholders to adopt more agile, vertically integrated supply chain models.

Unlocking Subtle Market Nuances Through Application, Formulation, Distribution, End User, and Packaging Perspectives to Drive Strategic Insights

An in‐depth examination of market segments reveals nuanced demand drivers and strategic touchpoints across multiple dimensions. When viewed through the lens of application, demand channels diverge among animal feed, baking, beverage, and nutraceutical domains. Within baking, bakers differentiate product offerings through specialized bread, cake, and pastry formulations that capitalize on the leavening and flavor‐enhancing properties unique to organic yeast. Meanwhile, beverage producers-spanning beer, spirits, and wine-leverage strain diversity to manipulate aroma profiles, alcohol yield, and fermentation kinetics. Nutraceutical developers, in turn, integrate organic yeast for its probiotic and micronutrient enrichment potential.

Turning to form, the dichotomy between dry and liquid presentations shapes logistics and product development strategies. Active dry and instant dry variants cater to manufacturers seeking shelf‐stable, easy‐to‐meter ingredients, whereas liquid cream and slurry options suit continuous processing lines and formulations with stringent moisture requirements. Each form factor necessitates distinct storage conditions, handling protocols, and packaging solutions to maintain viability and performance.

Distribution channels further shape market accessibility. Within offline channels, specialty stores, supermarkets, and wholesalers each target different customer profiles, from artisanal bakers seeking premium offerings to foodservice operators requiring bulk volumes. Online distribution via company websites and e-commerce platforms offers direct‐to‐customer models that facilitate rapid product launches, subscription services, and targeted promotional campaigns.

End users span cosmetics, food and beverage, and pharmaceutical industries. The food and beverage sub‐category encompassing breweries and commercial bakeries represents a core consumption base, while cosmetics brands incorporate yeast derivatives for skin conditioning and antioxidant properties. Pharmaceutical applications, including active pharmaceutical ingredient precursors, underscore the microbial biotechnology relevance of organic yeast.

Finally, packaging preferences range from bulk solutions such as bags and drums to retail formats like pouches and sachets. Bulk packaging serves large‐scale operations focused on cost efficiency, whereas smaller retail formats support sampling, private label branding, and convenience‐oriented end users. Collectively, these segmentation insights illuminate where value creation and growth opportunities converge within the organic yeast ecosystem.

This comprehensive research report categorizes the Organic Yeast market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Packaging Type

- Application

- Distribution Channel

- End User

Delineating Regional Performance Drivers Across the Americas, Europe Middle East & Africa, and Asia Pacific to Shape Expansion Strategies

Regional landscapes exhibit distinct characteristics that influence organic yeast adoption and commercialization strategies. In the Americas, market momentum stems from robust craft brewing and artisanal baking movements that prioritize locally sourced, high‐quality ingredients. Regulatory frameworks emphasize organic certification integrity, prompting producers to engage in transparent supply chain mapping and ingredient traceability to meet demanding certification audits and consumer expectations. Furthermore, the integration of nutrition‐focused applications in animal feed has opened avenues for functional yeast products that support gut health in livestock.

Europe, the Middle East, and Africa present a heterogeneous environment where sustainability credentials and regulatory alignment drive purchasing decisions. In Western Europe, strict organic standards compel producers to harmonize production protocols across multiple jurisdictions, while in emerging markets, demand growth is fueled by rising disposable incomes and expanding retail infrastructures. The Middle East exhibits a growing interest in specialty bakery and premium wine segments, often imported from established European producers. Across Africa, nascent local production hubs seek partnerships with multinational technology providers to accelerate capability building.

Meanwhile, Asia Pacific represents a rapidly evolving frontier characterized by surging urbanization, expanding bakery chains, and escalating nutraceutical awareness. In markets such as Japan and South Korea, consumer sophistication around fermentation technologies has spurred premium product launches, whereas in Southeast Asia, cost competitiveness and supply reliability remain pivotal. Strategic alliances with local co‐packers, combined with investments in regional manufacturing facilities, have become essential for navigating tariff variations and attaining timely market entry. By tailoring product portfolios and go‐to‐market approaches to these diverse regional dynamics, stakeholders can unlock differentiated value propositions and optimize growth trajectories across geographies.

This comprehensive research report examines key regions that drive the evolution of the Organic Yeast market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leading Organic Yeast Companies Highlighting Strategic Initiatives That Propel Competitive Differentiation and Growth

A review of prominent industry participants illustrates a landscape defined by strategic collaborations, capacity expansions, and innovation pipelines. Leading fermentative ingredient suppliers have prioritized acquisitions of niche biotech firms to enhance their strain libraries and accelerate R&D cycles. Such alliances furnish access to proprietary microorganisms while integrating advanced analytics capabilities for strain performance optimization.

Simultaneously, established producers have modernized production sites by implementing modular bioreactor systems and automated quality control platforms, enabling rapid responsiveness to fluctuating demand and minimizing downtime. These capital investments underscore an industrywide emphasis on lean manufacturing principles that drive cost efficiencies and reduce environmental impact.

Innovation extends beyond production to encompass novel product formulations and value‐added services. Some companies have introduced co‐development programs with end users, offering pilot‐scale testing, application trials, and customized technical support. This consultative approach reinforces customer loyalty and fosters deeper integration of organic yeast solutions within complex product formulations.

On the sustainability front, market leaders are unveiling carbon neutrality roadmaps, incorporating renewable energy sources, and participating in industry coalitions focused on regenerative agriculture. Meanwhile, digital initiatives such as traceability platforms and consumer engagement portals are emerging as differentiators. By balancing operational excellence with forward‐looking research collaborations and corporate responsibility commitments, top players are setting benchmarks for competitive advantage and future growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Organic Yeast market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Angel Yeast Co., Ltd.

- Archer Daniels Midland Company

- Associated British Foods plc

- Chr. Hansen A/S

- International Flavors & Fragrances Inc.

- Koninklijke DSM N.V.

- Lallemand Inc.

- Lesaffre S.A.

- Novozymes A/S

- Puratos N.V.

Strategic Imperatives for Organic Yeast Industry Leadership Emphasizing Innovation, Collaboration, and Commitment to Sustainable Excellence

To navigate the rapidly evolving organic yeast landscape, industry leaders should pursue targeted innovation strategies by investing in strain development programs that offer differentiated sensory and functional attributes. In parallel, diversifying feedstock portfolios to include agricultural residues and byproducts can hedge against raw material price volatility while advancing circular economy principles. These dual imperatives will position producers at the forefront of sustainable ingredient solutions.

Furthermore, strategic collaborations with academic institutions and end‐use manufacturers can fast‐track application development and validate performance claims under real‐world conditions. Such partnerships boost time to market for novel offerings and reinforce credibility among discerning customers. Additionally, adopting digital supply chain tools for end‐to‐end traceability and real‐time quality monitoring will enhance risk management and drive operational agility.

From a market development perspective, executives are advised to explore underpenetrated regions by forging joint ventures with local distributors and co‐packers. Tailoring product portfolios to regional sensory preferences and regulatory requirements will increase acceptance and adoption rates. Moreover, embedding sustainability narratives within branding initiatives can resonate with eco‐conscious consumers, adding premium value to organic yeast products. By balancing technical innovation with market intelligence and stakeholder engagement, industry participants can secure durable competitive advantages and capitalize on emerging growth opportunities.

Outlining the Rigorous Research Framework Integrating Primary Engagements and Secondary Analyses to Ensure Reliability and Depth of Insights

This research incorporates a robust, multi‐phased methodology to ensure the integrity and reliability of insights. The process commenced with secondary research, encompassing a comprehensive review of scientific journals, industry whitepapers, regulatory filings, and public trade data to map the organic yeast ecosystem. This foundational analysis identified key market drivers, regulatory frameworks, and technological trends, establishing a contextual baseline for deeper investigation.

Subsequently, primary research engagements were conducted through structured interviews and surveys with a diverse panel of stakeholders, including manufacturers, distributors, research scientists, and end‐use customers. These conversations provided rich qualitative insights into application challenges, adoption barriers, and strategic priorities. Quantitative data collection followed, leveraging standardized questionnaires and data‐validation protocols to ensure consistency and accuracy across respondent groups.

Data triangulation techniques were then applied to reconcile findings from multiple sources, mitigating bias and corroborating critical assumptions. Advanced analytical tools supported segmentation analyses and scenario mapping, while expert review panels validated the conclusions and recommendations. Throughout the research lifecycle, adherence to ethical guidelines and confidentiality standards was maintained, ensuring that proprietary information informed the report without compromising participant anonymity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Organic Yeast market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Organic Yeast Market, by Form

- Organic Yeast Market, by Packaging Type

- Organic Yeast Market, by Application

- Organic Yeast Market, by Distribution Channel

- Organic Yeast Market, by End User

- Organic Yeast Market, by Region

- Organic Yeast Market, by Group

- Organic Yeast Market, by Country

- United States Organic Yeast Market

- China Organic Yeast Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Key Market Insights and Strategic Perspectives to Confidently Navigate the Future Trajectory of the Organic Yeast Industry

In closing, the organic yeast market presents a confluence of innovation, sustainability imperatives, and shifting trade dynamics that collectively define its future trajectory. Advances in strain engineering and fermentation processes have unlocked new performance capabilities across baking, beverage, and nutraceutical domains, while stringent organic certification demands have heightened the importance of supply chain integrity.

Simultaneously, tariff adjustments have underscored the necessity for agile sourcing strategies and localized production models, prompting stakeholders to reevaluate global logistics networks and invest in regional manufacturing capacity. Segmentation insights have revealed distinct value drivers linked to application, form, distribution, end user, and packaging, offering a roadmap for customized product and channel strategies. Moreover, regional variances highlight the need for tailored approaches that reflect local regulatory landscapes, consumer preferences, and infrastructural realities.

Against this backdrop, company‐level innovations-spanning cross‐sector collaborations, digital traceability platforms, and sustainability roadmaps-serve as benchmarks for competitive differentiation. The recommendations outlined herein, from expanding feedstock diversification to deepening strategic partnerships, provide actionable pathways for industry participants to secure market leadership.

Ultimately, by synthesizing these multifaceted insights and embracing a cohesive strategic framework, stakeholders can confidently navigate the complexities of the organic yeast domain and harness emerging opportunities for long‐term growth and resilience.

Discover How to Secure Your Comprehensive Organic Yeast Market Report with Expert Guidance from Associate Director Ketan Rohom for Tailored Insights

I invite you to secure access to the full organic yeast market research report by connecting with Ketan Rohom, Associate Director, Sales & Marketing. He will provide personalized guidance to align the report’s strategic insights with your organization’s objectives and help you translate data into actionable business initiatives. Engaging with this comprehensive intelligence will equip you with a nuanced understanding of market dynamics, segmentation intricacies, and regional considerations that are crucial for making informed investment and partnership decisions. Reach out to Ketan Rohom to discuss customized research packages, receive sample excerpts, and explore how tailored advisory sessions can accelerate your market entry or expansion efforts. By collaborating with an industry expert, you ensure that your strategic roadmap is informed by the latest organic yeast trends, competitive benchmarks, and regulatory landscapes. Take the next step toward proactive decision‐making and secure your competitive advantage in the evolving organic yeast market today by partnering with Ketan Rohom to obtain the insights you need for sustained growth and innovation

- How big is the Organic Yeast Market?

- What is the Organic Yeast Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?