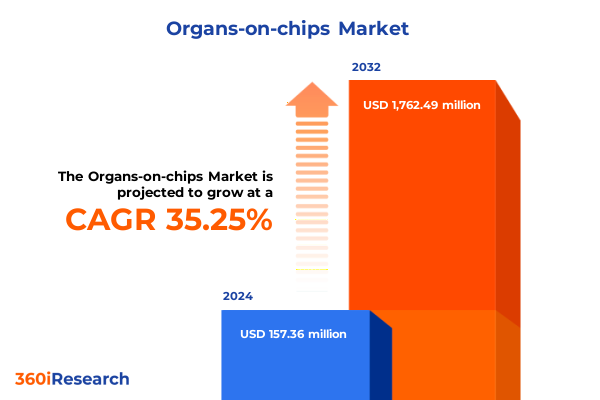

The Organs-on-chips Market size was estimated at USD 212.96 million in 2025 and expected to reach USD 278.79 million in 2026, at a CAGR of 35.24% to reach USD 1,762.49 million by 2032.

Discover how organs-on-chips platforms are revolutionizing biomedical science by integrating microengineering principles to model human physiology

In recent years, traditional drug discovery and disease modeling approaches have faced mounting scrutiny due to persistent challenges in translating preclinical results into clinical success. Animal models, while historically foundational, often fail to replicate the complexities of human physiology and pathology, leading to high attrition rates and substantial development costs. Against this backdrop, organs-on-chips technology has emerged as a disruptive platform that merges microengineering, cell biology, and biomaterials science to recreate tissue interfaces and microenvironments at physiologically relevant scales. As these microfluidic devices evolve, they offer unprecedented opportunities to mimic organ-level functions, enabling more predictive human-relevant data and fostering accelerated innovation in pharmaceutical research and personalized medicine.

By harnessing advances in microfabrication techniques and stem cell differentiation protocols, researchers can now construct dynamic, perfusable tissue models that capture critical aspects of vascularization, mechanical forces, and cellular cross-talk. This integration of engineering precision and biological complexity marks a paradigm shift in in vitro modeling. Furthermore, regulatory agencies have begun to recognize the potential of organs-on-chips for safety assessment and drug efficacy evaluation, as evidenced by collaborative initiatives between technology developers and public health bodies. Consequently, this introduction sets the stage for understanding how organs-on-chips are poised to redefine preclinical testing, catalyze innovation, and ultimately transform the way we approach human health and disease.

Exploring the paradigm shift in preclinical testing as organs-on-chips drive transformative changes in drug development and disease modeling landscapes

The organs-on-chips field is experiencing a series of transformative shifts that extend beyond technological refinement to include evolving partnerships, regulatory engagement, and strategic investment patterns. Initially driven by academic proof-of-concept studies, the landscape now features an array of technology providers forming collaborations with pharmaceutical companies and contract research organizations to co-develop application-specific solutions. These alliances are propelling the technology from research benches to commercial pipelines, illustrating a fundamental shift in stakeholder roles and value creation models.

Simultaneously, the regulatory environment is adapting to incorporate novel in vitro platforms into safety and efficacy frameworks. Progressive guidance documents and pilot qualification programs are fostering early adoption by industry leaders. In parallel, venture funding and corporate venture initiatives have increasingly targeted organs-on-chips startups, reflecting growing confidence in the platform’s capacity to deliver human-relevant insights and reduce reliance on animal testing. Combined with advances in high-resolution imaging, sensor integration, and automation, these market forces are accelerating the field toward mainstream adoption and establishing a new paradigm in biomedical research.

Analyzing the cumulative effects of newly implemented US tariffs in 2025 on the supply chain dynamics and cost structures within the organs-on-chips industry

The introduction of new United States tariffs in 2025 has generated significant reverberations throughout the supply chain of organs-on-chips manufacturing. Raw materials such as specialized polymers and glass components, many of which are sourced from global suppliers, have become subject to increased import duties. Consequently, producers of microfluidic devices have had to reevaluate sourcing strategies, negotiate revised contracts, and, in some cases, adjust product pricing to accommodate higher input costs. These cost pressures have prompted an uptick in material innovation aimed at reducing reliance on tariff-impacted imports by exploring domestically sourced thermoplastics and advanced composites.

At the same time, end users including academic institutes and biotechnology companies are closely monitoring total cost of ownership to justify investment in next-generation in vitro models. Some instrument providers have responded by optimizing manufacturing workflows and consolidating component suppliers to mitigate the impact of tariff-induced expenses. Although these adjustments have introduced short-term challenges in procurement and budgeting, they have also stimulated deeper collaboration across the value chain to enhance supply resilience and support long-term industry sustainability. Looking ahead, the market’s adaptive measures to navigate the 2025 tariff environment underscore its capacity for innovation under economic constraints and its commitment to maintaining progress in biomedical research.

Unveiling critical segmentation perspectives across materials products technologies end users applications and organ types shaping the market structure insightfully

A granular examination of market segmentation reveals multifaceted drivers shaping the organs-on-chips ecosystem across materials, products, technologies, end users, applications, and organ types. Material preferences vary based on device performance criteria: while glass offers chemical inertness and optical clarity, polydimethylsiloxane remains popular for its biocompatibility and ease of prototyping, and thermoplastics are gaining traction for scalable manufacturing. Each material choice influences downstream product design, cost structures, and regulatory considerations.

On the product front, consumables such as microplates and reagents underpin assay development workflows, while instruments facilitate fluid handling and environmental control, and software platforms enable data acquisition and analysis. The consumables segment’s diversity highlights the importance of supply chain integration and quality control, whereas instrument innovation and software interoperability are central to streamlining end user experiences. From a technological standpoint, microfluidic chips encompass both multilayer and single layer formats, offering varying degrees of complexity, while single organ models provide focused insights into specific tissue functions, and multi organ chips pave the way for systemic studies of inter-organ communication.

Adoption across end users spans academic institutes, biotechnology firms, contract research organizations, and pharmaceutical players, with global and specialty pharmaceutical companies increasingly leveraging these platforms for disease modeling, high throughput screening, and lead optimization. Applications extend to personalized medicine and toxicity testing, underscoring the versatility of organs-on-chips for diverse research needs. Finally, organ type segmentation ranges from gut and heart models to lung and kidney systems, with liver chips differentiating between hepatocyte based platforms and spheroid based constructs, illustrating the field’s drive toward physiologically representative models tailored to specific research objectives.

This comprehensive research report categorizes the Organs-on-chips market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Product

- Technology

- Organ Type

- Application

- End User

Examining regional nuances across Americas Europe Middle East Africa and Asia Pacific revealing distinctive adoption drivers and growth enablers in organs-on-chips

Regional dynamics in the organs-on-chips realm reflect distinct adoption drivers and innovation ecosystems across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, strong research infrastructure combined with substantial public and private investment has established the region as a hub for early technology validation and commercialization. Academic pioneers and biotechnology clusters have fostered vibrant start up communities, accelerating the transition of lab scale prototypes into marketable products.

Meanwhile, Europe Middle East and Africa exhibits a collaborative landscape characterized by cross national consortia and regulatory harmonization efforts. Public funding programs support translational research projects, and a network of specialized contract research organizations enables broad access to advanced in vitro models. This region’s emphasis on ethical testing alternatives and sustainable sourcing has reinforced organs-on-chips as key contributors to the reduction of animal experimentation.

In the Asia Pacific, rapid industrialization and burgeoning life sciences markets are driving robust demand for high throughput and cost effective testing solutions. Local market players are investing in manufacturing scale up, and partnerships between regional instrument vendors and global software providers are enhancing platform accessibility. Regulatory agencies in several countries are also exploring pathways for data acceptance from microphysiological systems, promoting wider adoption across pharmaceuticals, cosmetics, and chemical safety testing applications.

This comprehensive research report examines key regions that drive the evolution of the Organs-on-chips market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling influential companies leading innovation partnerships and market expansion strategies within the organs-on-chips sector to illuminate competitive dynamics

The competitive landscape of organs-on-chips features a mix of pioneering startups, established instrument manufacturers, and software innovators collaborating to expand the technology frontier. Several early entrants have distinguished themselves through proprietary microfluidic architectures and biomimetic tissue models, garnering strategic partnerships with global pharmaceutical firms. Concurrently, traditional laboratory equipment providers are integrating microphysiological modules into their portfolios to deliver turnkey solutions bolstered by robust service networks.

Software companies are also playing an instrumental role by developing analytics platforms capable of managing large volumes of experimental data, enabling end users to derive actionable insights from complex physiological readouts. In addition, contract research organizations have begun establishing dedicated microfluidics divisions to offer hands on validation services, further reducing barriers to adoption. Collectively, these diverse players are driving continuous innovation, forging alliances, and shaping standards to ensure data reproducibility and facilitate regulatory acceptance. This dynamic ecosystem underscores the importance of cross sector collaboration in propelling organs-on-chips from niche research tools to mainstream applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Organs-on-chips market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIM Biotech Pte. Ltd.

- Altis Biosystems

- AlveoliX AG

- Bi/ond B.V.

- BiomimX S.r.l.

- Cherry Biotech

- CN Bio Innovations Ltd.

- Dynamic42 GmbH

- Elvesys Group

- Emulate Inc.

- Hesperos Inc.

- InSphero AG

- Kirkstall Ltd.

- Lena Biosciences Inc.

- MEPSGEN Co., Ltd.

- MIMETAS B.V.

- NETRI SAS

- Nortis Inc.

- Obatala Sciences

- React4life

- SynVivo Inc.

- The Charles Stark Draper Laboratory Inc.

- TissUse GmbH

Offering actionable strategies for industry leaders to enhance innovation collaboration supply chain resilience and regulatory engagement in organs-on-chips domain

Industry leaders seeking to capitalize on the organs-on-chips revolution should prioritize establishing strategic collaborations across the value chain. By partnering with raw material suppliers and device integrators, companies can secure supply resilience and co innovate on next generation materials that mitigate tariff pressures. Moreover, engaging early with regulatory stakeholders through qualification programs and pilot initiatives can accelerate acceptance pathways and inform design standards for safety and efficacy applications.

To enhance technological differentiation, organizations should invest in modular platform architectures that enable rapid customization for diverse research needs, while also adopting open data frameworks to facilitate interoperability between software solutions. Building multidisciplinary teams that combine expertise in engineering biology regulatory science and data analytics will ensure robust product development and seamless integration into existing workflows. Additionally, aligning research priorities with emerging therapeutic areas such as immuno-onco logy and personalized medicine will unlock new opportunities for high impact applications. By implementing these targeted strategies, industry leaders can strengthen their competitive advantage and drive sustainable growth in the organs-on-chips market.

Detailing rigorous research methodology combining primary expert interviews secondary literature analysis and comprehensive data triangulation approaches

This report’s findings are grounded in a rigorous research methodology that integrates primary and secondary data sources to ensure comprehensive analysis and actionable insights. The primary research component includes in-depth interviews with key opinion leaders across academia industry and regulatory agencies, as well as structured surveys with end users spanning pharmaceutical companies contract research organizations and biotechnology firms to capture nuanced perspectives on adoption drivers and technological needs.

Complementing this qualitative work, the secondary research phase involved systematic review of peer reviewed literature patent filings clinical trial registries and relevant conference proceedings to trace technology evolution and identify emerging trends. Data triangulation was applied to validate insights, cross referencing stakeholder inputs with documented case studies and publicly available information on partnerships and regulatory initiatives. This multi-pronged approach ensures that the report provides an objective and holistic view of the organs-on-chips landscape, empowering decision makers with reliable evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Organs-on-chips market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Organs-on-chips Market, by Material

- Organs-on-chips Market, by Product

- Organs-on-chips Market, by Technology

- Organs-on-chips Market, by Organ Type

- Organs-on-chips Market, by Application

- Organs-on-chips Market, by End User

- Organs-on-chips Market, by Region

- Organs-on-chips Market, by Group

- Organs-on-chips Market, by Country

- United States Organs-on-chips Market

- China Organs-on-chips Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding with overarching reflections on the future trajectory challenges and strategic cross stakeholder collaboration opportunities for organs-on-chips

The organs-on-chips field is poised at an inflection point where technological sophistication, regulatory momentum, and strategic collaborations converge to redefine preclinical research paradigms. Throughout this executive summary, we have examined how microphysiological systems are overcoming traditional model limitations, how industry stakeholders are adapting to new economic realities, and how segmentation insights reveal diverse pathways for targeted innovation. Regional analyses underscore the importance of localized ecosystems in driving adoption, while competitive profiling highlights the collaborative spirit essential for sustained progress.

As the sector advances, stakeholders must balance the drive for rapid commercialization with commitments to data standardization, quality assurance and ethical considerations. Future success will depend on robust cross sector partnerships, continuous material and technological innovation, and proactive engagement with regulatory frameworks to ensure the acceptance of microphysiological data. By leveraging the actionable recommendations and methodological rigor outlined herein, decision makers are well positioned to navigate this dynamic landscape and harness the transformative potential of organs-on-chips to accelerate drug discovery and improve patient outcomes.

Encouraging decision makers to connect with an associate director to access the full market research report for strategic insights and partnership opportunities

To explore the full depth of market trends challenges and strategic pathways outlined in this executive summary and to gain access to comprehensive datasets case studies and expert interviews that will empower your organization to lead in the rapidly evolving organs-on-chips industry, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan is available to guide you through customized insights tailored to your specific needs and to facilitate timely delivery of the full market research report. Partnering with Ketan will ensure that your team stays ahead of the curve in innovation, regulatory foresight, and competitive positioning within this transformative biomedical technology landscape. Connect today to secure your advantage and transform scientific potential into strategic growth.

- How big is the Organs-on-chips Market?

- What is the Organs-on-chips Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?