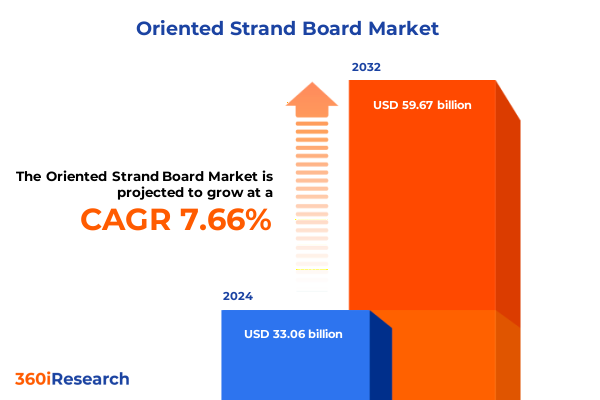

The Oriented Strand Board Market size was estimated at USD 35.57 billion in 2025 and expected to reach USD 37.90 billion in 2026, at a CAGR of 7.67% to reach USD 59.67 billion by 2032.

Establishing a Robust Foundation for Understanding the Shifts, Drivers, and Strategic Imperatives in the Global Oriented Strand Board Landscape

The global oriented strand board arena has undergone significant transformation as engineered wood solutions continue to gain prominence across construction, furniture production, and packaging industries. This executive summary distills the key insights from the in-depth study of production practices, consumption drivers, and emerging market forces that define today’s OSB landscape. By weaving together qualitative and quantitative perspectives, the analysis offers stakeholders a clear vantage point to assess both established trends and nascent opportunities.

With demand for versatile panel products accelerating in residential and non residential contexts, understanding the interplay of material innovation, regulatory influences, and supply chain dynamics has never been more critical. This introduction sets the stage by outlining the thematic focus areas of the report, including shifts in raw material sourcing, tariff impacts, segmentation analysis, regional developments, and leading corporate strategies. The ensuing sections will build upon this foundation to uncover actionable imperatives for industry participants.

Uncovering the Pivotal Disruptions and Emerging Technologies Reshaping Production, Supply Chains, and Demand Patterns in the OSB Sector

Over the past decade, the oriented strand board sector has witnessed pivotal disruptions driven by advancements in manufacturing automation, adhesive chemistry, and digital supply chain integration. The adoption of robotics and real-time monitoring systems has elevated production throughput while reducing variability in panel density and moisture content. Concurrently, breakthroughs in resin formulations have yielded eco-friendlier binders that meet stringent emission regulations without sacrificing structural performance. Together, these technological strides are redefining cost structures and product quality benchmarks across the industry.

Meanwhile, sustainability imperatives have spurred circular economy initiatives, prompting manufacturers to integrate post-consumer wood recovery and biomass co-generation into their operative frameworks. This shift not only mitigates material waste but also strengthens energy self-sufficiency within production complexes. In parallel, the rise of digital procurement platforms and predictive logistics tools has enhanced visibility across supplier networks, enabling just-in-time inventory strategies that cushion against raw material price oscillations. Such transformative shifts are reshaping the competitive contours of the OSB landscape and framing the strategic choices for market leaders.

Analyzing the Comprehensive Effects of Evolving United States Tariffs on Import Flows, Pricing Structures, and Competitive Dynamics throughout 2025

In 2025, the United States reinforced its tariff regime on imported wood panels, including oriented strand board, as part of broader trade balancing measures. Section 232 reviews and anti-dumping investigations led to higher duty rates on key suppliers, notably from Canada, which historically accounted for a significant share of U.S. OSB imports. These escalating duties have had a cascading influence on pricing structures, driving domestic mill operators to capture incremental value while spurring raw material cost pressures across downstream sectors.

Consequently, import volumes have declined, and inventory management has become more complex for distributors and fabricators. Elevated landed costs of Canadian panels have incentivized procurement teams to explore alternative supply corridors in Central Europe and Southeast Asia, albeit at the expense of longer lead times. To address potential shortages, some domestic producers have accelerated capital investments in capacity expansions, targeting incremental annual output that can absorb displaced imports. While this dynamic supports near-term competitiveness for sub-$200 per thousand board feet pricing tiers, it also introduces volatility risks as demand projections adjust to tariff-driven market distortions.

Revealing Critical Application, End Use Industry, Thickness, Resin Type and Channel Segmentation Trends Driving OSB Adoption and Value Perception

Understanding the market through multifaceted segmentation reveals nuanced drivers across applications, end use industries, thickness profiles, resin technologies, and distribution channels. Flooring applications have gained traction where OSB’s high shear strength and dimensional stability add value, while furniture manufacturing segments are leveraging decorative grade panels for integrated shelving and substrate components. In packaging contexts, lightweight OSB alternatives are emerging to address both protective performance and sustainability expectations. Roofing, sheathing, and wall paneling utilize distinct texture and moisture resistance attributes to meet regulatory requirements in various climates.

End use industry analysis further differentiates demand flows, with furniture manufacturing and non residential construction driving consistent volume based on commercial fit-out needs. Meanwhile, packaging industry adoption is propelled by environmentally conscious brands seeking fiber-based solutions. Residential construction bifurcates into multifamily housing projects-where OSB flooring underlayment and structural sheathing are preferred for cost efficiency-and single family housing initiatives that prioritize ease-of-install installation and thermal conditioning. Across thickness profiles, mid-range panels in the 15–18 millimeter band dominate structural sheathing applications, though slender grades between 6–12 millimeters find niche utility in temporary formwork, and heavier panels above 22 millimeters serve specialty infrastructure uses.

Resin type preferences showcase a gradual shift toward melamine urea formaldehyde formulations, which balance formaldehyde emissions compliance with performance reliability, while phenol formaldehyde remains the choice for high-moisture environments such as exterior sheathing. Distribution channels are evolving with direct sales models strengthening customer relationships, distributors offering logistics bundling, and a surge in e-commerce transactions enabling smaller order sizes. Home improvement stores retain a critical role, where big box retail formats capture mainstream DIY and professional renovator purchases, and specialty retailers cater to bespoke architectural and design applications.

This comprehensive research report categorizes the Oriented Strand Board market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Thickness

- Application

- End Use Industry

- Distribution Channel

Mapping Regional Growth Drivers, Consumption Patterns and Strategic Opportunities across the Americas, EMEA, and Asia-Pacific OSB Markets

Regional dynamics underscore the heterogeneity of OSB consumption and regulatory landscapes across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, the United States leads in renovation and modular construction projects, while Canada focuses on maximizing mill throughput for export markets. Latin American economies are gradually integrating OSB into commercial construction frameworks, supported by government incentives for affordable housing schemes.

Across Europe, Middle East & Africa, stringent building codes and sustainability mandates drive interest in low-emission panel products, particularly within urban regeneration initiatives in the European Union. In the Gulf Cooperation Council states, rapid infrastructure expansion underscores demand for high-performance sheathing solutions that can withstand extreme temperature fluctuations. Africa’s market remains nascent yet promising, with international developers piloting OSB in mixed-use developments.

The Asia-Pacific region exhibits the fastest growth rate, led by China’s vast residential construction push, Japan’s embrace of engineered wood in earthquake-resistant building codes, and Australia’s robust renovator market. Southeast Asian nations are ramping up capacity with new greenfield plants, leveraging locally sourced fast-growing plantations to feed both regional consumption and export requirements. This geographic mosaic of drivers illustrates that tailored strategies are essential for effectively aligning production, distribution, and product development pursuits within each region.

This comprehensive research report examines key regions that drive the evolution of the Oriented Strand Board market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Market Leadership, Competitive Strategies and Innovation Portfolios of Major Oriented Strand Board Manufacturers and Suppliers

Major manufacturing and supply entities are jockeying to secure competitive positions through capacity expansion, innovative product lines, and strategic partnerships. One leading enterprise has fortified its footprint in North America by commissioning a next-generation mill with enhanced pressing technology, granting it a throughput advantage and lower energy intensity. Another key participant focuses on streamlining its global supply chain, forging alliances with regional distributors to accelerate delivery times and foster just-in-time stocking for rapid-response construction projects.

At the forefront of research and development, a prominent manufacturer has unveiled a hybrid resin system that bridges the performance gap between phenolic and urea-based binders, targeting high-humidity environments prevalent in tropical and coastal markets. Similarly, a vertically integrated group has leveraged its forestry operations to secure raw material inputs, enabling greater control over fiber quality and supply continuity. Collaboration between select producers and packaging innovators is catalyzing new OSB-based container designs, expanding the market beyond traditional building applications and illustrating the sector’s capacity for cross-industry convergence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oriented Strand Board market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arauco

- Boise Cascade Company

- Georgia-Pacific LLC

- Huber Engineered Woods LLC

- Kronospan Holdings Limited

- Louisiana-Pacific Corporation

- Martco LLC

- Norbord Inc.

- PotlatchDeltic Corporation

- Roseburg Forest Products Company

- Swiss Krono Group

- Tolko Industries Ltd.

- Weyerhaeuser Company

Strategic Imperatives and Proactive Steps for Industry Leaders to Optimize Supply Chain Resilience, Market Penetration and Sustainable Growth

To fortify market positioning, industry leaders should pursue diversified procurement models that blend domestic and alternative international sourcing, thereby enhancing resilience against tariff shocks and raw material shortages. Investing in next-generation resin development can create performance differentiators, especially if tailored to meet tightening regulations on volatile organic compound emissions. Furthermore, embracing digital platforms for demand forecasting and remote process monitoring will reduce operational uncertainties and optimize mill asset utilization.

Stakeholders are advised to engage proactively with policy influencers to shape equitable trade frameworks that balance national security interests with industry stability. Adopting circular economy principles through closed-loop fiber recovery and waste-to-energy initiatives can yield both environmental benefits and cost efficiencies. Finally, targeted outreach to emerging end use segments-such as modular housing developers and sustainable packaging brands-will unlock new revenue streams while reinforcing OSB’s reputation as a versatile engineered wood solution.

Outlining Comprehensive Research Framework Emphasizing Robust Data Collection, Validation Techniques and Triangulation Approaches for OSB Market Analysis

This study was constructed upon a robust methodology combining both primary and secondary research to ensure comprehensive coverage of the OSB market. Primary engagement included in-depth dialogues with key executives, distribution partners, and end users to validate operational realities and emerging preferences. Complementing these insights, secondary analysis leveraged government trade statistics, regulatory filings, and industry association reports to establish a rigorous factual baseline.

Data triangulation techniques were applied to reconcile disparate information sources, cross-check production volumes, and verify pricing trends. Qualitative assessments of technological adoption and strategic initiatives were integrated with quantitative metrics to build a multidimensional perspective on market dynamics. This layered approach ensures that findings reflect current market conditions and facilitate actionable conclusions for stakeholders seeking to navigate the complex OSB landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oriented Strand Board market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oriented Strand Board Market, by Resin Type

- Oriented Strand Board Market, by Thickness

- Oriented Strand Board Market, by Application

- Oriented Strand Board Market, by End Use Industry

- Oriented Strand Board Market, by Distribution Channel

- Oriented Strand Board Market, by Region

- Oriented Strand Board Market, by Group

- Oriented Strand Board Market, by Country

- United States Oriented Strand Board Market

- China Oriented Strand Board Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Consolidating Key Takeaways and Forward-Looking Perspectives to Navigate Challenges and Leverage Opportunities within the Oriented Strand Board Industry

In synthesizing the analysis, it is evident that the oriented strand board sector stands at the nexus of technological innovation, regulatory evolution, and shifting trade environments. Tariff developments in the United States have recalibrated supply chain economics, prompting domestic capacity adjustments and novel sourcing strategies. Concurrently, segmentation insights reveal that application-specific demands, resin preferences, and channel innovations will continue to drive differentiation among producers.

Regionally, growth trajectories vary markedly, underscoring the importance of tailoring strategic priorities to localized consumption patterns and policy contexts. Competitive landscapes are evolving as leading manufacturers invest in automation, sustainable adhesives, and cross-industry collaborations. For decision-makers, the imperative is clear: align investment in R&D, digital enablement, and stakeholder engagement to unlock OSB’s full potential across traditional and emerging markets.

Connect with Associate Director Ketan Rohom to Unlock Exclusive Access to the Full Oriented Strand Board Market Research Report Tailored to Your Strategic Needs

The comprehensive report offers unparalleled insights into evolving Oriented Strand Board dynamics, empowering stakeholders with action-ready intelligence to drive strategic decisions. To secure full access, reach out directly to Associate Director Ketan Rohom, whose expertise in market interpretation and solution alignment will ensure the report is tailored to your organization’s growth objectives and procurement processes. Engage promptly to capitalize on emerging opportunities and strengthen your competitive positioning with the detailed analyses contained in this essential resource

- How big is the Oriented Strand Board Market?

- What is the Oriented Strand Board Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?