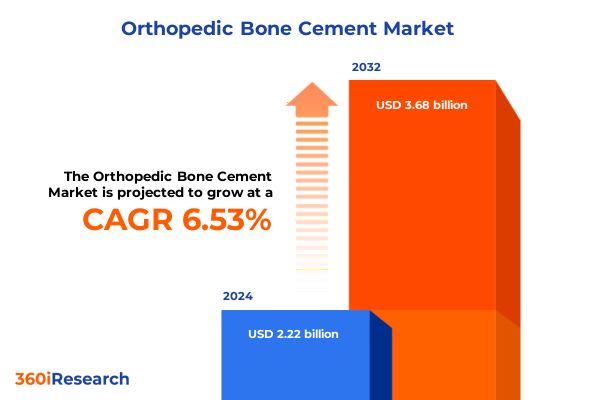

The Orthopedic Bone Cement Market size was estimated at USD 2.36 billion in 2025 and expected to reach USD 2.52 billion in 2026, at a CAGR of 6.54% to reach USD 3.68 billion by 2032.

Revealing the Transformative Power of Innovative Orthopedic Bone Cement to Elevate Surgical Precision and Accelerate Patient Rehabilitation

Orthopedic bone cement has been a cornerstone in surgical interventions for decades, serving as the critical bridge between prosthetic components and host bone structures. Originally developed in the 1960s to anchor hip implants, polymethyl methacrylate (PMMA) cement rapidly gained prominence due to its mechanical stability and ease of handling. Over time, the spectrum of formulations has broadened to include antibiotic-loaded variants, calcium phosphate alternatives, and urethane-modified composites, each designed to address specific clinical challenges. Consequently, bone cement has evolved from a passive filler to an active contributor to patient outcomes, markedly reducing infection rates, improving implant longevity, and enhancing post-operative recovery trajectories.

In recent years, the intersection of materials science and surgical technology has propelled bone cement to new frontiers of performance and versatility. Innovations in particle size distribution, exothermic reaction control, and bioactive additive integration have collectively refined setting times, exotherm profiles, and bone-cement interfacial bonding. At the same time, emerging clinical protocols for vertebroplasty kyphoplasty and minimally invasive trauma fixation have underscored the need for specialized formulations that balance injectability with mechanical integrity. As a result, stakeholders from surgeons to procurement teams are reevaluating their material selections, weighing traditional acrylic options against advanced calcium phosphate systems for osteoconductivity benefits.

With global demographic shifts toward an aging population and increasing prevalence of degenerative joint diseases, the role of bone cement in orthopedic care has never been more pivotal. The drive to optimize surgical workflows, mitigate post-operative complications, and address value-based care imperatives has intensified demand for cements that deliver both functional and economic advantages. Therefore, this analysis establishes the foundational context for understanding how material innovations, clinical applications, and evolving healthcare priorities converge to define the current state and future trajectory of the orthopedic bone cement ecosystem.

Identifying Critical Shifts Reshaping the Orthopedic Bone Cement Market Fuelled by Technological Advancements Regulatory Dynamics and Clinical Practice Trends

As the orthopedic bone cement arena advances, several transformative forces are simultaneously reshaping the competitive and clinical landscape. Technological breakthroughs in material science now enable precise modulation of mechanical strength, thermal profiles, and bioactivity, with urethane-modified PMMA demonstrating improved fatigue resistance and reduced curing temperatures to safeguard adjacent tissues. Furthermore, calcium phosphate formulations, traditionally valued for osteoconductivity, have been refined to offer better handling characteristics and faster resorption rates, aligning with the needs of spine surgery and bone void filling procedures.

Complementing these materials innovations, digital tools such as real-time mixing systems and integrated surgical planning platforms are streamlining cement preparation and delivery. These platforms provide predictive modeling of cement flow and heat generation within bone cavities, thereby enhancing procedural safety and consistency. Concurrently, regulatory frameworks are tightening around medical device manufacturing standards, prompting manufacturers to invest in quality management systems that align with both FDA guidance and international MDR requirements.

On the clinical front, an uptick in minimally invasive procedures is driving demand for cements with superior injectability and controlled viscosity. Surgeons engaged in vertebroplasty kyphoplasty and percutaneous fracture fixation now require materials that can be delivered via narrow cannulas while maintaining adherence to irregular trabecular structures. At the same time, increasing emphasis on antimicrobial stewardship has accelerated the adoption of antibiotic-loaded cements, which reduce prosthetic joint infections without contributing to systemic antibiotic resistance. Collectively, these shifts underscore a broader industry pivot toward integrated, high-performance solutions that deliver tangible clinical value alongside operational efficiencies.

Analyzing the Collective Influence of Recent United States Tariff Policies on Raw Material Accessibility Production Costs and Value Chain Resilience in 2025

Entering 2025, the ripple effects of United States tariff measures on bone cement and its precursor chemicals have become increasingly tangible across the supply chain. Raw materials such as methyl methacrylate monomers, often sourced from international chemical producers, have encountered elevated duty burdens under Section 301 allocations, driving up input costs for domestic formulators. In response, several manufacturers have explored near-shoring of monomer production and strategic supplier partnerships to stabilize procurement pipelines.

Moreover, the imposition of duties on select calcium phosphate raw materials has prompted R&D teams to reexamine feedstock versatility, seeking alternative precursors or hybrid composite approaches that may circumvent tariff classifications. While these efforts have yielded promising lab-scale solutions, commercial-scale adoption remains contingent upon validation studies and regulatory clearances. Consequently, some small-to-mid-sized producers have encountered margin compression, which has, in turn, fueled consolidation discussions with larger global players possessing diversified raw material portfolios.

Despite these headwinds, the cumulative impact of tariffs has also catalyzed a broader strategic recalibration. Companies are accelerating value engineering efforts to optimize reaction efficiencies and reduce waste, thereby partially offsetting increased duty expenses. Simultaneously, advanced forecasting models that integrate tariff scenarios with production planning have become essential tools for supply chain resilience. Ultimately, while elevated trade barriers have introduced cost volatility, they have also served as a catalyst for operational innovation and risk mitigation strategies across the orthopedic bone cement industry.

Uncovering Core Insights from Multidimensional Segmentation to Illuminate Diverse Material Compositions Surgical Applications and Distribution Dynamics

A nuanced understanding of the orthopedic bone cement market emerges when the ecosystem is dissected through multiple segmentation lenses, revealing distinct performance criteria, application areas, and distribution pathways. Materials segmentation divides the landscape into Acrylic formulations-comprising PMMA and advanced urethane-modified variants-and Calcium Phosphate systems renowned for their enhanced osteoconductivity. Each material class presents trade-offs in mechanical strength, setting dynamics, and biological integration, making formulation choice a function of specific surgical requirements.

Expanding the view to application segmentation introduces major clinical domains such as Joint Replacement, with subcategories in hip, knee, and shoulder replacement, alongside Spine Surgery, Trauma Fixation-further split into bone void filling and fracture fixation-and vertebroplasty kyphoplasty procedures. These clinical use cases demand tailored handling properties, viscosity profiles, and additive chemistries to ensure cement performance aligns with anatomical and procedural nuances.

Further granularity arises when examining the end-user segmentation, which captures the roles of ambulatory surgical centers, hospitals, and orthopedic specialty clinics. Each care setting imposes unique purchasing criteria, from streamlined supply chain requirements in outpatient environments to comprehensive product portfolios for high-volume hospital operating rooms. In parallel, the technology segmentation distinguishes between antibiotic-loaded and non-antibiotic cements, reflecting a strategic bifurcation between infection prevention priorities and standard fixation applications. Lastly, the distribution channel segmentation contrasts direct sales models-favored by high-value formulations requiring clinical training support-with third-party distributors that enable wider geographic reach for commoditized products. Taken together, these segmentation insights illuminate the multifaceted decision matrix that underpins product development, marketing strategies, and customer engagement initiatives.

This comprehensive research report categorizes the Orthopedic Bone Cement market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Application

- End User

- Distribution Channel

Discerning Regional Market Variability to Highlight Differential Growth Drivers Healthcare Infrastructure Developments and Policy Frameworks across Key Geographies

Regional market dynamics for orthopedic bone cement exhibit pronounced variability driven by demographic trends, healthcare infrastructure maturity, and reimbursement policies. In the Americas, a robust network of high-end surgical centers and widespread insurance coverage underpin sustained demand for premium formulations, particularly in joint replacement and advanced vertebral procedures. The presence of established domestic manufacturers also fosters competitive pricing pressures and continuous product innovation.

Conversely, the Europe, Middle East & Africa region presents a heterogeneous mosaic of regulatory environments and economic capabilities. Western European nations benefit from harmonized medical device regulations and high per-capita surgical volumes, creating a conducive environment for early adoption of antibiotic-loaded and next-generation bone cement technologies. In contrast, emerging markets within the Middle East and Africa prioritize cost-efficient solutions and value-based procurement, often relying on localized manufacturing partnerships to bridge affordability and quality.

Meanwhile, the Asia-Pacific arena is characterized by rapid healthcare infrastructure expansion, particularly in China and India, where increasing procedural volumes and government-backed hospital upgrades fuel market growth. Local players are leveraging strategic alliances and technology transfers to capture market share, while multinational companies adapt their portfolios to meet diverse regulatory and economic conditions. This region’s emphasis on scalable manufacturing, coupled with rising clinician training initiatives, positions Asia-Pacific as a critical growth frontier in the global orthopedic bone cement landscape.

This comprehensive research report examines key regions that drive the evolution of the Orthopedic Bone Cement market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Industry Players to Outline Competitive Positioning Collaborative Initiatives Technological Portfolios and Market Differentiators in Bone Cement

Within the global orthopedic bone cement space, several leading companies have distinguished themselves through strategic R&D investments, targeted mergers and acquisitions, and comprehensive product portfolios. Established chemical manufacturers have leveraged their polymer expertise to fine-tune PMMA formulations, while specialized medical device firms have introduced antibiotic-loaded cements with proprietary release mechanisms to address infection risks. Collaborative initiatives between material science innovators and surgical equipment providers are further blurring the lines between consumables and instrumentation platforms.

Simultaneously, a wave of consolidation has elevated smaller regional players by integrating them into the corporate structures of global conglomerates. These acquisitions not only expand geographic reach but also enhance the parent companies’ capabilities in novel material development and regulatory navigation. Some manufacturers are forging alliances with contract research organizations to expedite clinical evaluations and secure faster market entry, particularly for calcium phosphate-based and urethane-modified cement variants.

Moreover, a growing number of companies are adopting digital engagement strategies, offering surgeon training modules, surgical planning apps, and remote monitoring services that complement their bone cement offerings. By aligning product performance with user experience and post-market data collection, these companies are creating more holistic value propositions that extend beyond traditional product sales. As competition intensifies, the ability to bundle high-performance formulations with ancillary clinical and digital solutions is emerging as a key differentiator in this dynamic market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Orthopedic Bone Cement market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arthrex Inc.

- B. Braun Melsungen AG

- Baxter International Inc.

- Cardinal Health, Inc.

- DJO, LLC

- Exactech, Inc.

- Globus Medical, Inc.

- Heraeus Medical GmbH

- Johnson & Johnson

- Medtronic plc

- Nicomed NV

- Orthofix Medical Inc.

- SCANOS

- Smith & Nephew plc

- Stryker Corporation

- Subiton LABORATORIOS SL S.A

- Tecres S.p.A.

- TEIJIN PHARMA LIMITED

- Zimmer Biomet Holdings, Inc.

Outlining Pragmatic Strategic Actions for Industry Leaders to Harness Emerging Opportunities Mitigate Risks and Solidify Leadership in the Orthopedic Bone Cement Ecosystem

To navigate the evolving orthopedic bone cement landscape, industry leaders should prioritize a structured approach that balances innovation with operational agility. First, directing R&D resources toward next-generation material chemistries-such as bioactive additives and low-exotherm urethane-modified resins-can position companies at the forefront of clinical performance and safety. Parallel investment in digital surgical planning integration will amplify the perceived value of these advanced formulations.

Second, evaluating strategic partnerships or joint ventures with domestic chemical producers and contract manufacturers can mitigate tariff-driven raw material risks and bolster supply chain resilience. Such alliances should emphasize technology transfer agreements that enable localized production of critical feedstocks, reducing dependency on volatile import markets.

Third, companies should refine their go-to-market frameworks by aligning distribution models with product complexity: direct sales channels for high-value, technically demanding cements, and distributor networks for standardized, non-antibiotic formulations targeting cost-sensitive segments. Concurrently, building robust surgeon education and support programs will accelerate adoption curves and strengthen brand loyalty.

Finally, a proactive engagement with evolving regulatory landscapes and reimbursement bodies will ensure that novel bone cement technologies secure timely approvals and appropriate coverage. By embedding these strategic imperatives within a cohesive execution plan, leaders can convert emerging opportunities into sustained competitive advantage in the orthopedic bone cement ecosystem.

Detailing a Robust Research Framework Employing Rigorous Methodologies Data Triangulation and Expert Validation to Ensure Comprehensive and Credible Market Intelligence

The research methodology underpinning this analysis integrates both primary and secondary approaches to deliver comprehensive and reliable insights. Initially, an extensive secondary review of peer-reviewed literature, industry publications, and regulatory databases provided foundational context regarding material science advancements, clinical applications, and policy developments. This was complemented by an in-depth examination of company filings, patent portfolios, and trade publications to map competitive dynamics and R&D trajectories.

To validate and enrich secondary findings, primary research was conducted through structured interviews with orthopedic surgeons, hospital procurement leaders, and R&D executives within material science firms. These expert consultations offered firsthand perspectives on product performance criteria, purchasing drivers, and emerging clinical protocols. Additionally, data triangulation techniques were employed to reconcile quantitative shipment data, tariff schedules, and pricing trends, ensuring consistency across disparate sources.

Finally, iterative data validation workshops were convened with industry stakeholders to refine key thematic conclusions, challenge assumptions, and prioritize actionable insights. This rigorous methodological framework-combining systematic literature reviews, expert engagements, and multi-source data verification-ensures that the resulting market intelligence is both credible and directly applicable to strategic decision-making in the orthopedic bone cement domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Orthopedic Bone Cement market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Orthopedic Bone Cement Market, by Type

- Orthopedic Bone Cement Market, by Technology

- Orthopedic Bone Cement Market, by Application

- Orthopedic Bone Cement Market, by End User

- Orthopedic Bone Cement Market, by Distribution Channel

- Orthopedic Bone Cement Market, by Region

- Orthopedic Bone Cement Market, by Group

- Orthopedic Bone Cement Market, by Country

- United States Orthopedic Bone Cement Market

- China Orthopedic Bone Cement Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Critical Findings Emphasizing Core Trends Strategic Imperatives and Anticipated Industry Trajectories within the Orthopedic Bone Cement Domain

The comprehensive exploration of the orthopedic bone cement sector reveals a convergence of material breakthroughs, clinical practice evolution, and strategic imperatives driven by supply chain volatility. Advanced acrylic formulations, including PMMA and urethane-modified variants, are redefining mechanical and thermal performance expectations, while calcium phosphate systems continue to gain traction for their osseointegration advantages. In parallel, the rising prominence of minimally invasive procedures and antibiotic-loaded technologies underscores the industry’s commitment to enhancing patient outcomes and procedural safety.

Tariff-induced raw material cost pressures have served as a catalyst for supply chain innovation, prompting companies to pursue near-shoring strategies and value engineering initiatives. This dynamic interplay between trade policy and operational adaptation exemplifies the broader market resilience that industry participants must cultivate. Furthermore, segmentation insights highlight the importance of aligning product offerings with the nuanced requirements of joint replacement, spine surgery, trauma fixation, and vertebroplasty kyphoplasty procedures, as well as the distinct procurement environments of ambulatory surgical centers, hospitals, and specialty orthopedic clinics.

Regional analyses underscore the Americas’ demand for premium, innovation-driven solutions, the EMEA region’s regulatory complexity and cost sensitivity, and Asia-Pacific’s rapid infrastructure build-out and local partnership models. Meanwhile, key companies are differentiating through integrated digital solutions, strategic alliances, and streamlined R&D pipelines. Taken together, these multifaceted trends, challenges, and strategic considerations form the basis for the actionable recommendations provided, charting a course toward sustained growth and leadership in the orthopedic bone cement market.

Engage with Ketan Rohom to Access the Definitive Orthopedic Bone Cement Market Research Report Empowering Your Strategic Decision Making and Market Planning

For an in-depth exploration of the orthopedic bone cement market landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing. By engaging directly, you will gain privileged access to the complete market intelligence report that distills critical insights, strategic analyses, and actionable recommendations tailored for decision-makers. Empower your organization’s planning and investment strategies with a resource that decodes emerging trends, tariff impacts, and segmentation dynamics. Connect with Ketan today to secure the definitive study that will underpin your competitive advantage in the orthopedic bone cement domain and guide your next phases of growth.

- How big is the Orthopedic Bone Cement Market?

- What is the Orthopedic Bone Cement Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?