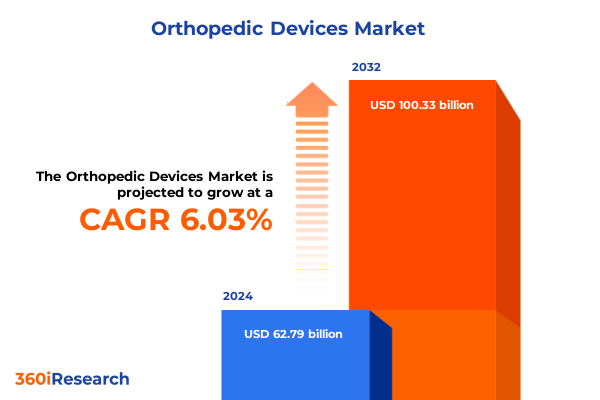

The Orthopedic Devices Market size was estimated at USD 66.37 billion in 2025 and expected to reach USD 70.22 billion in 2026, at a CAGR of 6.07% to reach USD 100.33 billion by 2032.

Emerging paradigms in orthopedic device innovation reshaping surgical outcomes and patient-centered care across global healthcare landscapes

Orthopedic devices have become integral to addressing the growing burden of musculoskeletal conditions as populations age and lifestyles evolve. With an estimated 21.2% of U.S. adults diagnosed with arthritis, demand for advanced surgical solutions is surging as joint degeneration and chronic pain increasingly impair quality of life. Simultaneously, heightened obesity rates and active lifestyles mean that individuals are seeking joint replacements earlier than in previous decades, a trend underscored by a rise in hip and knee procedures among patients aged 45 to 64 who no longer accept limitations on mobility.

Against this backdrop, healthcare providers are pursuing minimally invasive arthroscopy and patient-specific implants to improve outcomes while reducing hospital stays. Regulatory bodies, including the FDA’s Center for Devices and Radiological Health, are evolving their frameworks to accommodate additive manufacturing, AI-driven design validation, and enhanced post-market surveillance. This shifting paradigm demands that device manufacturers adopt agile development processes, integrate advanced materials science, and maintain rigorous quality assurance protocols. The collective impact of these forces is driving a critical inflection point in orthopedic device innovation, where clinical efficacy and patient-centered care intersect with strategic agility and regulatory compliance.

Disruptive technological innovations and evolving clinical standards driving a fundamental overhaul in orthopedic device development and patient care

The orthopedic device landscape is undergoing a profound transformation fueled by disruptive technologies and converging clinical imperatives. Additive manufacturing has matured from prototyping to scalable production, enabling the fabrication of patient-specific implants that conform precisely to individual anatomical geometries. Bioresorbable polymers such as polycaprolactone and nanostructured titanium alloys are being engineered to promote faster osseointegration and reduce postoperative complications, while AI algorithms automate design optimization by simulating mechanical performance under biological conditions.

Simultaneously, smart implants embedded with biosensors are delivering real-time biomechanical data from within the body. Early adopters like Zimmer Biomet’s smart knee systems leverage microelectronics to transmit gait and load metrics to clinicians, empowering proactive rehabilitation strategies and personalized follow-up care. This integration of digital health extends beyond implants; telemedicine platforms are increasingly used to monitor patient recovery remotely, enabling continuous engagement and reducing the need for in-person visits, particularly for mobility-impaired or geographically dispersed populations.

Furthermore, orthobiologics are gaining traction as adjuncts to traditional hardware approaches. Innovations in stem cell–based therapies, growth factor–enhanced bone graft substitutes, and bioactive scaffolds are enabling clinicians to harness the body’s intrinsic healing potential, thereby accelerating recovery and minimizing the need for revision surgeries. As these transformative shifts coalesce, surgical teams, device developers, and payers are reevaluating care pathways to integrate multimodal solutions that prioritize functional outcomes, cost efficiency, and long-term patient well-being.

Escalating trade tensions and tariff measures redefining cost structures and supply chain resilience in the United States orthopedic device sector

Trade policy volatility is exerting mounting pressure on the cost structures and supply chains that underpin orthopedic device production. In early 2025, the U.S. Trade Representative revived Section 301 tariffs on Class I and Class II medical devices sourced from China, imposing duties ranging from 7.5% to 25% on critical imports including cobalt-chrome alloys, PEEK polymers, and high-precision implants. Complementing these measures, tariffs on metals and components have inflated input costs for precision shoulder, elbow, and spinal implants, constraining margins and introducing delivery delays across surgical portfolios.

These cumulative levies have disproportionately affected smaller manufacturers and startups that lack the scale and diversification of industry leaders. Dependence on imported raw materials has manifested in extended lead times and higher inventory carrying costs, prompting acute supply chain inefficiencies. While vertically integrated firms and those with nearshore manufacturing footprints have absorbed some impacts, the broader sector faces upward cost pressures that may cascade to healthcare providers and patients. In response, strategic sourcing, supplier diversification, and selective reshoring initiatives have emerged as focal points for companies determined to bolster resilience and maintain competitive agility.

Comprehensive segmentation analysis reveals strategic growth avenues across device types material compositions patient demographics and clinical applications

A multidimensional segmentation lens reveals nuanced opportunities and challenges across the orthopedic device value chain. Device type segmentation highlights that joint reconstruction devices-particularly in hip and knee replacements-continue to attract high adoption due to proven clinical outcomes, while arthroscopy and trauma fixation tools garner momentum for minimally invasive procedures and acute fracture management. Spinal devices exhibit growth as non-fusion technologies expand indications, and orthobiologics demonstrate potential by enabling biologically driven repair pathways.

Material composition segmentation underscores the enduring dominance of titanium and stainless steel in load-bearing implants, counterbalanced by growing interest in novel ceramics such as zirconia for enhanced wear resistance. Polymers like UHMWPE remain integral to articulating surfaces, even as research focuses on bioresorbable composites to reduce long-term implant burden. Patient demographic segmentation reveals diverse clinical pathways: pediatric applications prioritize growth-accommodating systems, geriatric cohorts demand fracture prevention hardware, and adult segments emphasize joint pain relief and functional restoration.

Application-driven insights show that degenerative joint diseases and sports-related injuries continue to anchor procedural volumes, whereas congenital deformity corrections and metabolic bone disorder management are fueling demand for customized implants and specialized instruments. End-user segmentation spotlights hospitals and orthopedic specialty clinics as primary care settings, with ambulatory surgical centers capturing share through outpatient joint replacement and arthroscopic services. Meanwhile, online distribution channels are emerging as strategic adjuncts to traditional hospital procurement, especially for consumable supplies and ancillary products.

This comprehensive research report categorizes the Orthopedic Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Material Type

- Patient Type

- Fixation Type

- Application

- End User

- Distribution Channel

Distinct regional dynamics shaping orthopedic device adoption and market evolution across the Americas EMEA and AsiaPacific healthcare ecosystems

Regional dynamics play a critical role in shaping the adoption and diffusion of orthopedic technologies across global markets. In the Americas, established healthcare infrastructure, favorable reimbursement environments, and a high prevalence of musculoskeletal conditions underpin robust demand for advanced joint reconstruction and trauma management solutions. Market maturity also drives consolidation, with large hospital networks and integrated delivery models prioritizing evidence-based device selection and cost containment strategies.

In Europe, Middle East & Africa territories, regulatory harmonization under EU Medical Device Regulation and growing investments in healthcare modernization are catalyzing the uptake of 3D-printed implants and orthobiologics. At the same time, national tender processes and budgetary constraints necessitate careful product differentiation and lifecycle management to sustain competitive positioning and secure long-term procurement agreements.

Asia-Pacific markets are marked by rapid infrastructure expansion, rising medical tourism, and government initiatives to localize manufacturing. While cost sensitivity remains a defining factor, the region’s large patient volumes and increasing surgical capacity are driving scalable deployment of robotic-assisted surgery systems and low-cost implant alternatives. Collaborative ventures with domestic OEMs and technology transfer agreements are also on the rise as global players seek to balance affordability with innovation.

This comprehensive research report examines key regions that drive the evolution of the Orthopedic Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leadership and innovation profiles of major orthopedic device manufacturers highlighting strategic positioning partnerships and technological differentiation

Several global medtech companies are solidifying their leadership through continuous innovation, strategic collaborations, and expansive product portfolios. Stryker leverages its endoscopy and joint reconstruction franchises to deliver integrated surgical systems and digital solutions that streamline procedural workflows. Zimmer Biomet focuses on biologics and smart implant technologies, advancing sensor-enabled knee platforms that facilitate data-driven rehabilitation.

DePuy Synthes, part of Johnson & Johnson’s MedTech arm, integrates trauma fixation and spinal device offerings with orthobiologic adjuncts, capitalizing on cross-segment synergies. Medtronic’s spinal fusion devices benefit from investments in energy-based surgical tools that enhance procedural precision. Meanwhile, Smith & Nephew combines traditional trauma hardware with digital wound care and arthroscopic visualization systems, targeting outpatient orthopedic services.

Smaller innovators are also shaping the competitive landscape by focusing on niche applications, such as patient-matched craniofacial implants and bioactive scaffold materials. As a result, partnerships between incumbent leaders and agile startups are intensifying, aligning R&D capabilities with regulatory expertise to accelerate time to market and diversify product pipelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Orthopedic Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acumed LLC

- Argomedical AG

- Arthrex, Inc.

- Aspen Medical Products, LLC

- B. Braun Melsungen AG

- Bioventus LLC.

- Boston Scientific Corporation

- Conformis, Inc.

- Enovis Corporation

- Essity Health & Medical

- GE HealthCare Technologies Inc.

- Globus Medical

- Invibio Ltd by Victrex PLC

- Johnson & Johnson Services, Inc.

- Medacta International SA

- Medartis Holding AG

- Medtronic PLC

- Meril Life Sciences Pvt. Ltd.

- Microport Scientific Corporation

- Orthofix US LLC

- restor3d, Inc

- Smith & Nephew PLC

- Stryker Corporation

- TriMed Inc.

- Zimmer Biomet Holdings, Inc.

Strategic imperatives for industry leaders to navigate regulatory complexities enhance supply chain agility and accelerate innovation in orthopedic devices

To navigate the complex interplay of technological evolution, regulatory demands, and geopolitical pressures, industry leaders should adopt a multifaceted strategy. First, enhancing supply chain resilience through nearshore partnerships and supplier diversification will mitigate tariff-induced cost volatility and reduce lead-time dependencies. Second, prioritizing modular platform design and leveraging digital twins will enable rapid customization of devices while maintaining economies of scale.

Third, fostering strategic alliances with biotech firms and academic institutions can accelerate the translation of orthobiologic and material science breakthroughs into clinically validated products. Fourth, investing in robust post-market surveillance and real-world evidence programs will support regulatory submissions and strengthen payer negotiations by demonstrating long-term safety and cost-effectiveness. Finally, cultivating patient-centric service models that integrate telemedicine and remote monitoring will differentiate offerings, improve adherence, and expand access across diverse care settings.

Robust mixed method research design integrating secondary data analysis primary stakeholder interviews and expert validation for orthopedic device market insights

This research synthesizes insights from a comprehensive mixed-method approach. Secondary data were systematically gathered from peer-reviewed literature, government publications, and industry white papers to establish foundational market dynamics. Concurrently, a structured series of in-depth interviews was conducted with key opinion leaders, including orthopedic surgeons, hospital procurement managers, regulatory specialists, and supply chain executives, to capture firsthand perspectives on emerging trends and pain points.

Quantitative validation was achieved through survey data analysis from representative healthcare institutions across major regions, facilitating cross-segmentation comparisons and thematic corroboration. Data triangulation was further reinforced by expert workshops that reviewed preliminary findings and provided iterative feedback on segmentation frameworks, competitive positioning, and actionable recommendations. This multidimensional methodology ensures robust, evidence-based insights that inform strategic planning and investment decisions in the orthopedic device sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Orthopedic Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Orthopedic Devices Market, by Device Type

- Orthopedic Devices Market, by Material Type

- Orthopedic Devices Market, by Patient Type

- Orthopedic Devices Market, by Fixation Type

- Orthopedic Devices Market, by Application

- Orthopedic Devices Market, by End User

- Orthopedic Devices Market, by Distribution Channel

- Orthopedic Devices Market, by Region

- Orthopedic Devices Market, by Group

- Orthopedic Devices Market, by Country

- United States Orthopedic Devices Market

- China Orthopedic Devices Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesis of market dynamics underscores the imperative for adaptive strategies collaboration and technological investment in orthopedic device development

The orthopedic device sector stands at an inflection point driven by converging technological innovations, shifting regulatory landscapes, and evolving patient expectations. Advanced manufacturing techniques, including additive processes and AI-enabled design, are unlocking new frontiers in device customization and performance. At the same time, tariff pressures and supply chain disruptions are underscoring the importance of resilience and agility in procurement and production strategies.

By understanding the multifaceted segmentation dynamics, regional nuances, and competitive imperatives, stakeholders can craft informed strategies to seize growth opportunities and mitigate risks. Collaboration across industry segments-from device manufacturers to healthcare providers and payers-will be pivotal in delivering value-based solutions that improve patient outcomes and sustain economic viability. As the market continues to evolve, adaptive leadership, evidence-based decision-making, and strategic partnerships will define the next era of orthopedic device innovation and market expansion.

Connect with Ketan Rohom to unlock the full orthopedic device market research report and empower your strategic decision-making with precise insights

To gain comprehensive insights and elevate your strategic initiatives in the dynamic orthopedic device market, connect with Ketan Rohom, Associate Director of Sales & Marketing. By partnering directly, you will unlock access to the full market research report, featuring in-depth competitive analyses, regulatory intelligence, and actionable strategic recommendations customized to your organization’s objectives. Embark on a transformative journey to refine your product pipeline, optimize supply chain resilience, and capitalize on emerging opportunities in device innovation. Reach out to secure unparalleled support and precision-driven insights that will empower your leadership and drive impactful decision-making.

- How big is the Orthopedic Devices Market?

- What is the Orthopedic Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?