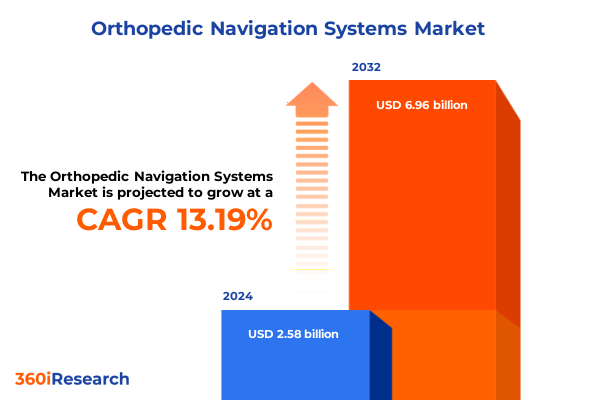

The Orthopedic Navigation Systems Market size was estimated at USD 2.91 billion in 2025 and expected to reach USD 3.29 billion in 2026, at a CAGR of 13.25% to reach USD 6.96 billion by 2032.

Revolutionizing Surgical Precision and Patient Outcomes through Advanced Orthopedic Navigation Innovations in a Rapidly Evolving Healthcare Ecosystem

Orthopedic navigation systems stand at the forefront of surgical innovation, redefining precision and elevating patient outcomes across the globe. These technologies integrate advanced imaging modalities with real-time intraoperative guidance, empowering surgeons with unparalleled spatial accuracy during complex procedures. As demographic pressures intensify-driven by aging populations and rising incidences of musculoskeletal disorders-the demand for navigation platforms capable of minimizing intraoperative variability and reducing postoperative complications has never been greater.

Furthermore, the healthcare landscape is witnessing a paradigm shift toward value-based care, where clinical efficacy and cost-effectiveness dictate adoption curves. In this context, navigation solutions offer a compelling value proposition by enabling minimally invasive interventions that shorten hospital stays and accelerate patient recovery timelines. Coupled with the migration of elective orthopedic procedures to lower-cost ambulatory environments, demand for compact, interoperable systems continues to rise.

Moreover, the convergence of digital health innovations-including cloud-based data analytics, artificial intelligence–driven image recognition, and modular software ecosystems-portends a new era of surgical navigation. As stakeholders across the continuum of care prioritize outcomes and operational efficiency, navigation technologies are poised to transform standard-of-care protocols, making surgical excellence more accessible and reproducible than ever before.

Emergence of AI-Enabled Navigation and Robotic Integration Transforming Surgical Workflows and Enhancing Clinical Decision-Making in Orthopedic Care

The orthopedic navigation market is experiencing transformative shifts that redefine surgical workflows and elevate standards of care. At the core of this transformation is the integration of artificial intelligence into image processing algorithms, enabling predictive modeling of anatomical variations and adaptive guidance that responds to intraoperative complexity. This enhanced computational capability reduces physician cognitive load, allowing for more consistent implant positioning and alignment.

In parallel, the fusion of navigation platforms with robotic-assisted surgical arms is eroding traditional boundaries between manual skill and machine precision. Surgeons leverage this synergy to execute bone cuts and implant placements with sub-millimeter accuracy, translating into improved functional outcomes and diminished revision rates. Concurrently, software development kits and open architecture frameworks are fostering an ecosystem of interoperable solutions, wherein third-party developers contribute specialized planning modules and analytics tools.

Moreover, the shift from hardware-centric to software-defined navigation models underscores a broader digital health trend. Subscription-based service offerings, remote software updates, and cloud-enabled performance monitoring facilitate continuous innovation and ensure platforms remain at the cutting edge. As digital infrastructure investments escalate across healthcare providers, navigation technologies are integrating with electronic health records and digital twin models, promoting a holistic, data-driven approach to preoperative planning and postoperative assessment.

Assessing the Strategic Consequences of 2025 United States Tariff Adjustments on Orthopedic Navigation Supply Chains and Operational Costs

In 2025, the United States implemented revised tariff schedules that have materially affected the cost structure of orthopedic navigation system components imported from key manufacturing hubs. These tariffs, targeting select hardware elements such as tracking cameras and console electronics, resulted in incremental import duties ranging from 5 to 15 percent. Consequently, original equipment manufacturers and distributors faced elevated landed costs, compelling a reassessment of supply chain strategies and vendor agreements.

Given these fiscal headwinds, many stakeholders have accelerated localization efforts. Manufacturers have deepened partnerships with domestic subcontractors for assembly of navigation consoles and patient tracking tools, thereby mitigating tariff exposure and reducing freight lead times. Simultaneously, several firms have pursued tariff classification reviews and invoked free trade agreement provisions to reclaim duties where eligible, although administrative complexities have limited the volume of successful appeals.

Additionally, end users have witnessed modest increases in procured unit prices for full navigation suites, which has spurred a growing interest in flexible acquisition models. Leasing arrangements and volume-based service contracts have gained traction as providers seek to preserve capital budgets while maintaining access to advanced navigation capabilities. In turn, these market adaptations underscore the resilience of the orthopedic navigation ecosystem in the face of macroeconomic policy shifts.

Unveiling Nuanced Insights across Application Verticals Technology Modalities End-User Environments and Component Ecosystem in Orthopedic Navigation

An in-depth examination of application segments reveals that joint replacement procedures account for a significant proportion of navigation system utilization, with hip, knee, and shoulder interventions each benefiting from enhanced spatial guidance. Surgeons specializing in hip replacement procedures leverage navigation to optimize cup orientation and femoral stem alignment, whereas knee replacement navigators facilitate individualized bone cuts that preserve ligament integrity. Shoulder procedures, though representing a smaller volume, similarly adopt navigation technologies to address complex glenoid deformities and ensure prosthesis longevity. Beyond joint replacement, spinal surgery applications have expanded rapidly, with navigation providing critical trajectories for pedicle screw placement and corrective osteotomies. Trauma surgery also increasingly relies on navigation, especially for minimally invasive fixation of complex fractures where traditional fluoroscopy falls short in delivering three-dimensional guidance.

On the technology front, optical navigation platforms dominate in environments demanding high-precision tracking, utilizing infrared cameras and retroreflective markers to capture instrument movements with minimal latency. Electromagnetic navigation systems, by contrast, offer the advantage of line-of-sight independence, making them well-suited for constrained anatomical regions and cases with occasional occlusion risks. As both modalities evolve, hybrid systems that combine optical and electromagnetic sensors are emerging, providing redundancy and enhancing robustness during prolonged procedures.

Turning to end-user segmentation, hospitals remain the primary adopters of navigation systems due to their capacity for high-volume complex surgeries and established infrastructure for technology integration. Ambulatory surgical centers are accelerating adoption as cost and efficiency imperatives drive outpatient arthroplasty growth, while specialized orthopedic clinics utilize portable navigation consoles for targeted interventions. Components constitute the final layer of analysis, where accessories such as surgical instruments and marker arrays underpin system accuracy, and hardware elements like navigation consoles, patient tracking tools, and cameras serve as the platforms’ backbone. Complementing these are service offerings-spanning installation, maintenance, and training-that ensure uptime and user proficiency, alongside software modules for imaging, planning, and registration that continuously advance navigation capabilities.

This comprehensive research report categorizes the Orthopedic Navigation Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

Exploring Regional Dynamics Driving Orthopedic Navigation Adoption Amid Divergent Regulatory Frameworks and Infrastructure Capacities Worldwide

Regional dynamics within the orthopedic navigation sector are shaped by diverse regulatory landscapes, economic maturity levels, and healthcare infrastructure investments. In the Americas, the United States leads with robust reimbursement frameworks for image-guided interventions, bolstered by a dense network of academic medical centers that serve as early adopters of cutting-edge navigation solutions. Canada mirrors this trend, with provincial procurement systems gradually embracing digital surgical platforms to enhance procedural consistency. Meanwhile, Latin American markets exhibit a burgeoning appetite for technology adoption, driven by private hospital chains seeking to differentiate service offerings and attract medical tourism.

Across Europe, the Middle East, and Africa, regulatory heterogeneity presents both opportunities and challenges. Western European nations, underpinned by stringent medical device approvals and consolidated healthcare budgets, demand rigorous clinical evidence prior to navigation system procurement. In contrast, emerging markets within Eastern Europe and the Gulf Cooperation Council are catalyzing adoption through government-sponsored digital health initiatives and infrastructure investments. Sub-Saharan Africa remains nascent in navigation deployment, hampered by limited capital availability yet poised for incremental growth as partnerships between global vendors and local providers expand.

In the Asia-Pacific region, rapid economic development and escalating healthcare expenditures are fueling demand for advanced surgical technologies. Japan and Australia have historically championed navigation adoption, supported by reimbursement incentives and established surgical societies. Meanwhile, China and India represent high-growth frontiers, where government initiatives to modernize tertiary care facilities and a rising middle-class patient base are driving significant capital equipment investments. Southeast Asian markets also demonstrate rising demand, as regional healthcare hubs elevate service standards to attract cross-border patients seeking premium orthopedic care.

This comprehensive research report examines key regions that drive the evolution of the Orthopedic Navigation Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Competitive Strategies Shaping Market Leadership in Orthopedic Navigation Systems Globally

Leading market participants are investing heavily in technology differentiation, strategic alliances, and service excellence to maintain competitive advantage within the orthopedic navigation domain. One prominent company has fostered collaborations with academic institutions to validate its AI-driven planning software, securing peer-reviewed clinical data demonstrating reduced revision rates. Another global device manufacturer has integrated navigation modules into its existing robotic surgery portfolio, offering bundled solutions that streamline procurement and training for large hospital networks.

Innovative entrants are disrupting traditional distribution models by offering cloud-native platforms that prioritize user experience and remote diagnostics. These providers emphasize subscription-based revenue streams, enabling end users to access continuous software enhancements without upfront license fees. In parallel, established medical technology conglomerates are broadening their navigation footprints through acquisitions of niche software developers and localization of service centers, thereby shortening response times and reinforcing customer relationships.

Moreover, several companies are pioneering interoperable ecosystems that facilitate data interoperability between navigation consoles and hospital-wide systems such as electronic medical records and digital asset management platforms. This emphasis on connectivity supports comprehensive perioperative analytics, allowing administrators to track utilization metrics and inform capital budgeting decisions. Collectively, these strategic initiatives reflect a market in which agility, clinical validation, and post-sales support form the pillars of long-term leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Orthopedic Navigation Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun SE

- Brainlab AG

- DePuy Synthes, Inc.

- Kinamed Inc.

- Materialise NV

- Medacta International SA

- Medtronic plc

- Novarad

- NuVasive, Inc.

- OrthAlign, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Strategic Imperatives for Navigating Competitive Complexity and Accelerating Growth in the Orthopedic Navigation Landscape

To secure a strategic edge in the evolving orthopedic navigation landscape, industry leaders should prioritize the integration of advanced analytics and machine learning within their navigation software modules. By leveraging large-scale surgical datasets, platforms can deliver personalized guidance that adapts to patient-specific anatomical variances, differentiating offerings in a crowded field. Furthermore, entering into co-development partnerships with robotic system providers will broaden the addressable patient population, as hybrid navigation-robotic suites gain preference for complex joint and spine cases.

In addition, organizations should evaluate the establishment of regional centers of excellence that combine hands-on surgeon training with real-world data collection, creating feedback loops that fuel iterative product enhancements. Localization of manufacturing and assembly operations promises not only tariff mitigation but also faster time-to-market for next-generation consoles. To bolster market penetration in emerging geographies, tailored financing mechanisms-such as outcome-based leasing and pay-per-use models-can alleviate capital constraints and drive volume growth.

Lastly, a comprehensive service strategy encompassing proactive maintenance, remote software upgrades, and user certification programs will enhance system uptime and foster long-term client loyalty. By aligning product roadmaps with evolving clinical guidelines and reimbursement landscapes, companies can anticipate emergent surgeon needs and reinforce their reputational leadership in precision orthopedic care.

Comprehensive Multi-Modal Research Approach Leveraging Primary Insights and Secondary Data Triangulation for In-Depth Market Analysis

This report’s findings are grounded in a rigorous research framework combining both primary and secondary methodologies. Initially, an extensive literature review encompassing peer-reviewed journals, regulatory submissions, and industry white papers formed the foundational knowledge base. Proprietary databases and patent filings were analyzed to trace technology evolution and identify emerging innovation clusters.

Subsequently, primary research included in-depth interviews with over 50 stakeholders across the value chain, including orthopedic surgeons, equipment distributors, regulatory experts, and hospital procurement directors. These qualitative discussions provided contextual insights into adoption drivers, operational challenges, and service expectations. Quantitative surveys supplemented these conversations, capturing preferences across application segments and technology modalities to validate thematic trends.

To ensure data robustness, findings underwent a triangulation process whereby multiple data sources were cross-verified. Market intelligence analysts conducted cross-functional workshops to reconcile discrepancies and refine segmentation definitions. Finally, the information was subjected to an internal review by clinical advisory boards, guaranteeing that conclusions align with real-world surgical practices and emerging patient care priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Orthopedic Navigation Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Orthopedic Navigation Systems Market, by Component

- Orthopedic Navigation Systems Market, by Technology

- Orthopedic Navigation Systems Market, by Application

- Orthopedic Navigation Systems Market, by End User

- Orthopedic Navigation Systems Market, by Region

- Orthopedic Navigation Systems Market, by Group

- Orthopedic Navigation Systems Market, by Country

- United States Orthopedic Navigation Systems Market

- China Orthopedic Navigation Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing Critical Perspectives and Strategic Trajectories for Sustained Innovation and Market Resilience in Orthopedic Navigation

As orthopedic navigation systems continue to redefine procedural precision and clinical outcomes, stakeholders must navigate a complex interplay of technological innovation, regulatory landscapes, and economic pressures. The convergence of artificial intelligence, robotic assistance, and interoperable software ecosystems heralds a new era of digital surgery, where data-driven decision-making becomes the norm rather than the exception. Concurrently, tariff adjustments and evolving reimbursement frameworks underscore the importance of agile supply chain management and flexible acquisition models.

Through careful segmentation analysis, regional market dynamics, and competitive profiling, this executive summary has illuminated the pathways by which industry leaders can capitalize on growth opportunities while mitigating risk. The lessons drawn from joint replacement, spinal surgery, and trauma applications underscore the versatility of navigation platforms and their capacity to address diverse clinical needs. Regional insights further highlight the necessity of tailored strategies that align with local regulatory and economic contexts.

Ultimately, success in the orthopedic navigation domain will hinge on the ability to integrate next-generation software-defined technologies with robust service delivery frameworks. Organizations that invest in clinical validation, data interoperability, and surgeon education will be best positioned to shape the future of orthopedic care, delivering meaningful improvements in patient safety and operational efficiency.

Engage with Associate Director of Sales and Marketing to Unlock Tailored Orthopedic Navigation Market Insights for Strategic Growth

Engaging with Ketan Rohom is the optimal next step for organizations poised to leverage deep insights and strategic guidance on orthopedic navigation systems. As a seasoned Associate Director of Sales and Marketing, he invites you to explore a bespoke engagement that aligns with your unique objectives, ensuring that every critical consideration-from technology adoption roadmaps to competitive positioning strategies-is addressed with precision. By purchasing the full market research report, stakeholders gain exclusive access to granular analyses, proprietary frameworks, and actionable intelligence tailored to drive sustainable growth. Prospective clients will benefit from personalized consultations that unpack complex data into clear, decision-ready recommendations, fostering confidence in strategic investments. To initiate this collaboration and secure immediate delivery of the market intelligence, reach out to Ketan Rohom and begin shaping the future of orthopedic navigation in your organization.

- How big is the Orthopedic Navigation Systems Market?

- What is the Orthopedic Navigation Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?