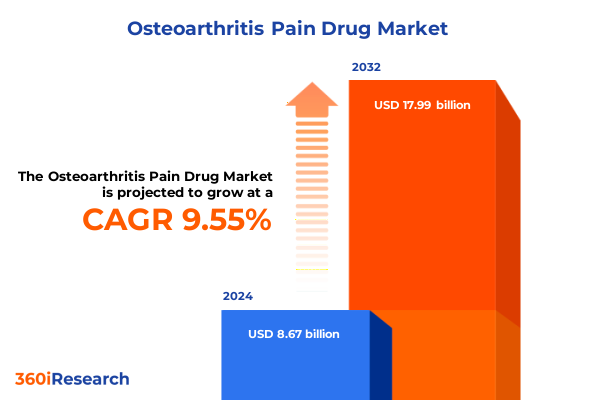

The Osteoarthritis Pain Drug Market size was estimated at USD 9.45 billion in 2025 and expected to reach USD 10.31 billion in 2026, at a CAGR of 9.62% to reach USD 17.99 billion by 2032.

Discover the Critical Challenges and Strategic Opportunities Shaping the Future of Osteoarthritis Pain Therapeutics in Global Healthcare

Osteoarthritis is a leading cause of chronic pain and disability, affecting tens of millions of adults in the United States and imposing a significant burden on healthcare systems and patient quality of life. Characterized by degeneration of cartilage and alterations to bone and synovium, the disease manifests in pain, stiffness, and loss of function that worsens over time. These progressive symptoms create persistent challenges for clinicians and patients alike, underscoring the urgent need for more effective and durable pain management options.

The landscape of osteoarthritis pain therapeutics is poised at a critical inflection point, shaped by rapid demographic shifts, evolving regulatory environments, and breakthroughs in pharmacology and drug delivery. This executive summary provides a concise yet comprehensive overview of current market dynamics, transformative trends, and strategic imperatives to guide stakeholders in life sciences, healthcare delivery, and policy. It distills complex data into actionable insights without delving into numerical projections, focusing instead on qualitative analysis of the forces reshaping the market.

By examining the interplay of product innovation, patient segmentation, distribution channels, geographic nuances, and policy developments-most notably the 2025 U.S. tariffs on active pharmaceutical ingredients and medical imports-this summary equips decision-makers with the context needed for informed strategy development. The content that follows highlights segmentation nuances across product types, routes of administration, end users, age groups, and disease severity, all against a backdrop of shifting regulatory and tariff landscapes. Leaders will find clear, targeted recommendations grounded in rigorous research best practices to navigate current challenges and seize emerging opportunities.

This introduction sets the stage for a deeper exploration of the transformative shifts affecting osteoarthritis pain drug development, the cumulative impact of U.S. trade measures, key market segmentation insights, regional variations, competitive dynamics, and actionable recommendations. By integrating these perspectives, stakeholders can better align their investments, R&D priorities, and commercial strategies with the evolving needs of patients and the healthcare ecosystem.

Analyzing the Groundbreaking Trends and Technological Innovations Revolutionizing Osteoarthritis Treatment and Patient Care Pathways in Response to Rising Demands

The osteoarthritis pain drug market is undergoing a paradigm shift driven by multiple converging factors that transcend traditional pharmaceutical development. An aging population in developed and emerging economies is exerting unprecedented demand on pain management therapies; with more than 73 percent of global osteoarthritis patients over the age of 55 and the U.S. alone reporting over 32 million affected adults, the demographic imperative for novel treatments has never been clearer. At the same time, the prevalence of obesity and metabolic comorbidities has magnified disease incidence, prompting pharmaceutical companies to target both symptomatic relief and disease-modifying approaches.

Technological innovation is reshaping the therapeutic toolkit for osteoarthritis pain. Injectable biotherapies, including cell-based and biologic agents, are transitioning from early-stage research into late-phase clinical trials as companies seek to address structural joint damage rather than solely masking symptoms. Personalized medicine and biomarker-driven development strategies are accelerating, enabling developers to tailor treatments by phenotypic and molecular characteristics. Digital health platforms and wearable technologies are also gaining traction, offering new paradigms for real-world monitoring of pain, mobility, and treatment adherence that can inform product positioning and post-marketing evidence generation.

On the regulatory front, agencies in the U.S. and Europe are signaling greater openness to innovative trial designs-including adaptive protocols and patient-reported outcome measures-that could streamline approval pathways for both established mechanisms and novel modalities. At the same time, heightened scrutiny around drug safety and long-term risk-benefit profiles is driving more robust post-approval surveillance frameworks. Stakeholders are navigating a complex matrix of incentives and requirements that demand agility, collaboration, and forward-looking regulatory intelligence.

Financial and strategic shifts among leading pharmaceutical companies further underscore the market’s transformation. Recent announcements of multi-billion-dollar investments in U.S. manufacturing capacity and international licensing partnerships reflect both the need to secure supply chains in light of tariff threats and the recognition that osteoarthritis remains a substantial unmet need with significant commercial potential. Together, these trends are redefining the competitive landscape and carving new pathways for therapeutic differentiation in osteoarthritis pain management.

Evaluating the Far-Reaching Cumulative Effects of 2025 United States Tariff Policies on Osteoarthritis Pain Drug Supply Chains and Costs

In April 2025, the United States introduced a 10 percent global tariff on nearly all imported goods-including critical healthcare inputs like active pharmaceutical ingredients-aiming to bolster domestic manufacturing and reduce reliance on foreign sources. This blanket duty has catalyzed cost pressures for generics and branded drug makers alike, forcing supply chain reassessments and strategic sourcing shifts to mitigate margin erosion and ensure continuity of patient access. Concurrently, reciprocal tariffs of up to 245 percent on Chinese imports, notably those containing APIs, have compounded the inflationary impact on production costs for pain management compounds that rely on Chinese‐sourced intermediates.

Although pharmaceuticals were initially exempted from reciprocal tariffs under a temporary White House directive, speculation persists that these exclusions may be revisited as part of broader Section 232 national security assessments. Industry analysts warn that any extension of duties to finished drug products would have disproportionate effects on generic drug manufacturers, whose slim margins leave them uniquely vulnerable to cost shocks. The United States Pharmacopeia has cautioned that sudden tariff impositions could trigger supply disruptions, manufacturing discontinuations, and localized shortages, undermining treatment availability for millions of patients with osteoarthritis pain.

Beyond production inputs, tariffs on pharmaceutical equipment, medical packaging, and validation instruments have introduced downstream delays in drug release timelines. Companies are accelerating evaluations of onshoring options, nearshoring partnerships, and API synthesis agreements to avoid potential duty escalations. These strategic moves are occurring amid a backdrop of ongoing policy debate over the long-term desirability of reshoring versus the economic feasibility and regulatory compliance costs of establishing or expanding U.S. manufacturing sites.

The cumulative impact of these 2025 tariff measures has thus created a dual mandate for osteoarthritis pain drug developers: optimize global supply networks to minimize exposure to import duties while investing in resilient domestic manufacturing capabilities. This balancing act is becoming a defining feature of commercial and operational strategies in a market where cost management, risk mitigation, and patient-centric access are intrinsically linked.

Uncovering Deep Segmentation Insights Illustrating Diverse Product Types, Administration Routes, Channels, and Patient Profiles in OA Therapeutics Market

The osteoarthritis pain drug landscape is characterized by a rich tapestry of therapeutic classes that span fast-acting anti-inflammatory steroids, targeted Cyclooxygenase 2 inhibitors, broad-spectrum nonsteroidal anti-inflammatory drugs, symptomatic slow-acting agents designed to modify disease progression, and advanced viscosupplements that restore joint lubrication. Each category exhibits unique pharmacodynamic properties and patient response profiles, underpinning differentiated positioning strategies across the clinical continuum. The portfolio of injectable options encompasses both intra-articular injections tailored to joint-specific delivery and intramuscular formulations that address systemic inflammation, while oral therapies offer capsules, liquids, and tablets that cater to patient convenience and adherence considerations. Topical preparations further diversify choice, with formulations in cream, gel, and transdermal patch enabling localized pain relief without systemic exposure.

In commercial rollout, the distribution network features hospital pharmacies as critical hubs for administering advanced injectables and monitoring high-risk patients, online pharmacies that leverage digital channels to expand access to oral and topical interventions, and retail pharmacies serving as the primary point of care for routine refills and physician-prescribed regimens. The interplay among these channels determines regimen accessibility, patient education touchpoints, and co-pay structures, all of which influence treatment uptake and persistence.

Patient demographics in the osteoarthritis space display marked variations in therapeutic preference and clinical need across age segments: adolescents under eighteen often require specialized dosing protocols and monitoring in the context of juvenile-onset arthritis, adults aged eighteen to sixty-four prioritize balancing work-life responsibilities with symptom control, and the elderly population, aged sixty-five and above, frequently contends with polypharmacy considerations and comorbid cardiovascular or metabolic conditions that shape product selection. Disease severity further refines market segmentation, as individuals with mild symptoms may favor nonprescription topical relief or over-the-counter adjuncts, while moderate and severe cases often necessitate prescription-grade NSAIDs, steroid injections, or slow-acting compounds with longer onset profiles.

Understanding these segmentation layers is vital for life science teams aiming to align drug development, pricing, and marketing strategies with unmet clinical needs. By mapping the convergence of product type, administration route, distribution channel, end user, patient age group, and severity level, organizations can prioritize targeted value propositions, optimize resource allocation, and enhance patient outcomes across diverse subpopulations.

This comprehensive research report categorizes the Osteoarthritis Pain Drug market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Route Of Administration

- Patient Age Group

- Disease Severity

- End User

- Distribution Channel

Assessing the Distinct Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific Osteoarthritis Drug Markets

The Americas region-anchored by the United States and Canada-remains the largest and most mature market for osteoarthritis pain drugs, driven by robust healthcare infrastructure, high per-capita spending, and a growing geriatric patient base. Advanced reimbursement frameworks and well-established physician networks support rapid adoption of innovative therapies, while digital health initiatives in the U.S. are facilitating remote monitoring and value-based care models. Latin American countries, though exhibiting slower uptake of high-cost biologics, are investing in generics and biosimilars to broaden patient access and control system costs.

In Europe, the Middle East, and Africa, diverse regulatory environments and varying levels of healthcare maturity define market dynamics. Western European markets leverage centralized approval pathways and strong private-public partnerships, enabling swift commercialization of next-generation injectables and disease-modifying agents. In contrast, markets in Eastern Europe, the Middle East, and Africa face supply chain challenges and cost constraints that favor generic NSAIDs and locally produced viscosupplements. Across the region, health technology assessments and value-based procurement are gaining prominence, forcing manufacturers to demonstrate real-world effectiveness and cost-effectiveness of new therapies.

The Asia-Pacific region is experiencing the fastest compound annual growth rate, fueled by demographic shifts, rising disposable incomes, and expanding healthcare access. Aging populations in Japan, South Korea, and Australia are driving demand for personalized pain management, while emerging markets such as China and India are investing heavily in domestic R&D and forming licensing partnerships with multinational firms. Government initiatives to improve rural healthcare and telemedicine platforms are also broadening the treatment base, creating opportunities for oral and topical products that can be distributed through e-pharmacies and primary care clinics.

Understanding these regional intricacies is critical for global life science organizations. Tailored market entry strategies, flexible pricing models, and locally relevant patient support programs are essential to navigate heterogeneous regulatory landscapes and diverse payer environments. By aligning commercial plans with regional healthcare priorities, companies can optimize resource deployment and maximize patient reach.

This comprehensive research report examines key regions that drive the evolution of the Osteoarthritis Pain Drug market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Key Industry Players Driving Innovation and Market Leadership in Osteoarthritis Pain Therapies Through Strategic R&D and Partnerships

Several leading pharmaceutical companies are at the forefront of osteoarthritis pain drug innovation, each leveraging distinct strengths in R&D pipelines, strategic partnerships, and manufacturing capabilities. AstraZeneca has announced extensive investments in U.S. manufacturing capacity to safeguard supply chains against tariff volatility and accelerate clinical development for novel pain modulators and biologics. Pfizer and Novartis continue to explore next-generation COX-2 inhibitors and symptomatic slow-acting agents, investing in long-term safety studies to differentiate their offerings in an increasingly competitive landscape.

Johnson & Johnson and Roche have distinguished themselves through advanced work in viscosupplement technology and targeted monoclonal antibodies, respectively, focusing on joint-specific delivery mechanisms that promise improved safety profiles and sustained efficacy. Emerging biotech innovators, including specialized firms working on cell-derived injectables and disease-modifying osteoarthritis drugs, are collaborating with academic centers like UCI Health to pioneer first-in-human trials of cell-based therapies designed to restore cartilage function rather than merely mitigate pain.

Generics and biosimilar manufacturers such as Viatris (formerly Mylan) and Teva are expanding their portfolios of off-patent steroids and nonsteroidal anti-inflammatory therapies, leveraging scale efficiencies to drive down patient costs in price-sensitive markets. Meanwhile, digital therapeutics startups are partnering with established drug makers to integrate mobile monitoring platforms and outcome-based reimbursement models, highlighting the increasing importance of real-world evidence in payer negotiations.

Together, these companies illustrate a highly dynamic competitive landscape where traditional pharmaceutical giants, agile biotechs, and generics producers all play pivotal roles. Strategic alliances, M&A activity, and licensing agreements continue to shape the innovation ecosystem, underscoring the importance of collaboration in advancing new therapeutic options for osteoarthritis pain management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Osteoarthritis Pain Drug market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Bayer AG

- GlaxoSmithKline plc

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Perrigo Company plc

- Pfizer Inc.

- Sandoz International GmbH

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Actionable Recommendations for Life Science Leaders to Navigate Market Disruptions and Seize Opportunities in Osteoarthritis Pain Drug Development

Industry leaders in osteoarthritis pain management must prioritize supply chain resilience to navigate the ongoing uncertainties created by 2025 tariff policies and global geopolitical tensions. This involves diversifying API sourcing locations, establishing strategic onshore or nearshore manufacturing partnerships, and engaging with government initiatives that incentivize domestic production. By adopting flexible procurement models and investing in real-time analytics for inventory and logistics, companies can mitigate cost fluctuations and safeguard patient access.

Pharmaceutical firms should also accelerate investment in differentiated pipelines that emphasize disease-modifying osteoarthritis drugs and advanced delivery systems. Engaging in collaborative research with academic institutions and biotech innovators can shorten development timelines and enhance therapeutic specificity. Moreover, incorporating patient-centric design elements-such as dosing flexibility for various age cohorts and comorbidity profiles-will strengthen market positioning and support favorable health technology assessments.

Commercial teams need to tailor region-specific go-to-market strategies that align with payer priorities and regulatory frameworks. In mature markets, demonstrating real-world outcomes and total cost of care improvements can unlock premium pricing and reimbursement pathways. In emerging economies, partnerships with local distributors and digital health platforms can extend reach while addressing cost–access trade-offs. Building robust patient support programs, including telemedicine follow-up and mobile adherence tools, will enhance treatment persistence and clinical outcomes.

Finally, executives should foster a culture of continuous market intelligence, leveraging data from digital therapeutics, social listening, and physician sentiment analysis to adapt rapidly to shifting trends. By integrating these actionable recommendations into corporate strategy, life science leaders can drive sustainable growth, optimize patient benefit, and secure leadership in the evolving osteoarthritis pain drug market.

Outlined Research Methodology Demonstrating Rigorous Primary and Secondary Data Collection Techniques Ensuring Analytical Precision and Market Clarity

This report is founded on a rigorous, multi-tiered research framework combining extensive secondary research with primary data collection to ensure both breadth and depth of analysis. Secondary sources included peer-reviewed journals, publicly available health agency publications such as the World Health Organization and U.S. Centers for Disease Control, and relevant policy documents outlining tariff regulations and trade developments. These sources provided foundational insights into epidemiology, regulatory shifts, and macroeconomic factors influencing osteoarthritis pain therapeutics.

Primary research was conducted through in-depth interviews and surveys with senior R&D executives, supply chain directors, clinical thought leaders, and market access specialists across leading pharmaceutical and biotech organizations. These qualitative insights were complemented by quantitative data gathered via anonymized surveys of prescribing physicians and patient focus groups, capturing real-world treatment patterns, adherence drivers, and unmet clinical needs. Data triangulation methodologies were applied to validate findings and reconcile discrepancies between secondary literature and stakeholder interviews.

Furthermore, segmentation analyses employed standardized frameworks to map product types, routes of administration, distribution channels, patient age groups, and disease severity levels. Advanced analytical techniques, including scenario planning and sensitivity testing, were utilized to explore the potential implications of 2025 tariff scenarios and global market shifts. Geographic assessments leveraged regional case studies and payer landscape reviews to identify localized factors affecting market entry and growth.

All research activities adhered to stringent data governance and ethical guidelines, ensuring confidentiality and compliance with applicable regulations. The result is a comprehensive, practitioner-oriented body of knowledge designed to inform strategic decision-making and guide cross-functional teams in developing robust, patient-centric approaches to osteoarthritis pain management.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Osteoarthritis Pain Drug market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Osteoarthritis Pain Drug Market, by Product Type

- Osteoarthritis Pain Drug Market, by Route Of Administration

- Osteoarthritis Pain Drug Market, by Patient Age Group

- Osteoarthritis Pain Drug Market, by Disease Severity

- Osteoarthritis Pain Drug Market, by End User

- Osteoarthritis Pain Drug Market, by Distribution Channel

- Osteoarthritis Pain Drug Market, by Region

- Osteoarthritis Pain Drug Market, by Group

- Osteoarthritis Pain Drug Market, by Country

- United States Osteoarthritis Pain Drug Market

- China Osteoarthritis Pain Drug Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Reflections Emphasizing Integrated Strategies to Address Evolving Challenges and Propel Progress in Osteoarthritis Pain Management Therapeutics

The evolving landscape of osteoarthritis pain therapeutics demands an integrated approach that balances innovation with supply chain resilience, patient segmentation with tailored market strategies, and global growth aspirations with localized market realities. As demographic pressures, regulatory shifts, and tariff policies converge, stakeholders must remain agile, leveraging real-time insights and collaborative partnerships to navigate complexity.

By understanding the nuanced interplay among product types-from corticosteroids and COX-2 inhibitors to viscosupplements and cell-based therapies-and aligning them with the needs of diverse patient cohorts, life science organizations can craft differentiated value propositions that resonate with clinicians, payers, and patients. Regional market dynamics in the Americas, Europe, the Middle East, Africa, and Asia Pacific further underscore the necessity of bespoke commercial models that incorporate local reimbursement frameworks, infrastructure maturity, and digital health capabilities.

Key companies are already charting new territory through strategic investments, R&D collaborations, and supply chain diversification efforts, setting the stage for a new era in osteoarthritis treatment. As the market continues to evolve, leaders who embrace evidence-based decision-making, prioritize patient outcomes, and foster innovation ecosystems will be best positioned to drive sustainable growth and deliver meaningful improvements in quality of life.

Ultimately, the collective ambition to alleviate osteoarthritis pain and restore joint function hinges on a shared commitment to research excellence, operational agility, and patient-centred care. This report serves as a strategic compass for navigating the uncharted terrain ahead, offering a coherent roadmap to capitalize on emerging opportunities and surmount the challenges intrinsic to this critical therapeutic area.

Empowering Executive Decisions with Exclusive Insights—Partner with Ketan Rohom to Secure Your Comprehensive Osteoarthritis Pain Drug Market Research Report

To explore these comprehensive insights and gain a competitive edge in the osteoarthritis pain drug market, reach out to Ketan Rohom today. As Associate Director of Sales & Marketing, Ketan brings deep expertise in guiding organizations through complex therapeutic landscapes. By partnering with him, you can secure full access to the meticulously researched report offering actionable intelligence on market dynamics, segmentation nuances, regional considerations, company strategies, and regulatory shifts. Ketan will tailor a presentation of findings to your strategic needs, ensuring that your investment delivers maximum value and informs critical product development, market access, and commercial strategies. Don’t miss the opportunity to leverage this unparalleled resource-connect with Ketan Rohom to purchase your copy and start shaping your path to success in osteoarthritis pain therapeutics.

- How big is the Osteoarthritis Pain Drug Market?

- What is the Osteoarthritis Pain Drug Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?