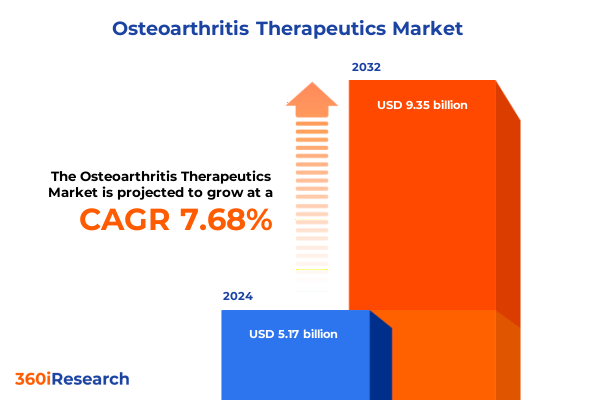

The Osteoarthritis Therapeutics Market size was estimated at USD 5.55 billion in 2025 and expected to reach USD 5.97 billion in 2026, at a CAGR of 7.72% to reach USD 9.35 billion by 2032.

Unveiling the Pervasive Burden and Evolving Therapeutic Frontiers in Osteoarthritis Care Amidst Rising Demands and Innovation Pressures

Osteoarthritis stands as the most common form of arthritis worldwide, inflicting a substantial burden on individuals and health systems alike. According to the World Health Organization, over 528 million people globally were living with osteoarthritis in 2019, reflecting a dramatic increase of 113 percent since 1990 as populations age and obesity rates rise. In the United States alone, nearly one in five adults aged 18 and older had a diagnosed form of arthritis in 2022, with osteoarthritis accounting for the majority of those cases and contributing to more than $300 billion in combined medical care costs and lost earnings annually.

Despite the pervasive prevalence of osteoarthritis, treatment approaches have historically focused on symptomatic relief rather than disease modification. Traditional management has revolved around nonsteroidal anti-inflammatory drugs (NSAIDs) to alleviate pain, followed by intra-articular injections and, in advanced cases, surgical interventions such as arthroscopy or joint replacement. However, these measures often fail to address the underlying degenerative processes in cartilage and bone, leaving a significant unmet need for therapies that can both restore joint function and slow disease progression.

Harnessing Breakthrough Innovations from Regenerative Medicine to Digital Health That Are Redefining Osteoarthritis Treatment Paradigms

In recent years, the osteoarthritis landscape has witnessed a surge of innovation driven by regenerative medicine. Stem cell therapies, often using mesenchymal stem cells to promote cartilage repair, are undergoing rapid clinical exploration across Asia-Pacific markets. Cognitive Market Research reports that the Asia-Pacific stem cell therapy segment for osteoarthritis was valued at USD 6.79 million in 2024 and is projected to grow at a compound annual growth rate of 27.6 percent through 2031, underscoring the region’s commitment to adopting advanced biotherapies. Parallel to stem cell approaches, platelet-rich plasma (PRP) protocols and tissue engineering strategies are redefining prospects for tissue regeneration and functional restoration.

Concurrently, digital health solutions are reshaping how osteoarthritis is monitored and managed. The digital therapeutics market is forecasted to expand at an annual rate of 25–27 percent by 2029, propelled by AI-driven algorithms and wearable devices that deliver personalized interventions and remote monitoring capabilities. Cutting-edge research into knee joint digital twins, which integrate qMRI biomarkers and machine learning to create virtual models of joint physiology, offers promise for precision-guided therapy selection and progression prediction. Together, these regenerative and digital modalities are converging to forge personalized care pathways that transcend the limitations of conventional treatments.

Analyzing the Cumulative Impact of Escalating 2025 U.S. Tariff Policies on Osteoarthritis Therapeutics Supply Chains and Cost Structures

The introduction of sweeping U.S. tariffs in 2025 has imposed levies ranging from 20 to 25 percent on active pharmaceutical ingredients sourced from China and India, along with 15 percent duties on medical packaging imports and 25 percent on large-scale manufacturing equipment such as tablet presses and lyophilization units. In addition, a uniform 10 percent global tariff applied to nearly all imports as of April has elevated costs across the supply chain, compelling manufacturers to reassess sourcing strategies and inflationary pressures on production.

These policy shifts have triggered a wave of onshoring investments among leading pharmaceutical corporations. AstraZeneca committed USD 50 billion through 2030 to expand domestic manufacturing and R&D facilities, while Biogen announced a USD 2 billion augmentation of its North Carolina operations in anticipation of possible 200 percent drug tariffs under Section 232 investigations. Yet in the short term, elevated import duties have already translated into price hikes for generic medications, with independent analysis warning of up to a 15 percent increase in costs for hospitals and health systems and exacerbating existing drug shortage risks.

Uncovering In-Depth Segmentation Insights Highlighting Targeted Strategies Across Treatment Modalities, Administration Routes, End Users & Distribution Channels

The osteoarthritis therapeutics field exhibits nuanced trends across treatment types, revealing stronger momentum in minimally invasive and non-pharmacologic approaches. Complementary therapies such as acupuncture and nutritional supplements are gaining traction among patients seeking holistic management, while drug therapies continue to pivot toward targeted injections like hyaluronic acid over traditional NSAIDs. Physical therapy remains a mainstay, benefiting from increasingly sophisticated rehabilitation protocols, and evolving surgical techniques such as femoral and tibial osteotomy offer joint-preserving options that delay the need for total replacement.

Consideration of administration routes highlights a clear shift toward injectable and transdermal delivery systems that optimize local bioavailability and reduce systemic side effects. Injectable viscosupplementation and corticosteroid formulations are experiencing robust adoption, even as oral agents remain vital for long-term maintenance. Meanwhile, the rise of online pharmacies is transforming distribution dynamics, complementing established hospital and retail channels while enabling timely access to essential therapies.

Within end-user segments, specialized clinics and rehabilitation centers are expanding their service portfolios to incorporate advanced biologics and digital monitoring tools, reflecting an emphasis on multidisciplinary care. Hospitals continue to drive high-volume interventions, particularly arthroplasty, yet outpatient settings are increasingly favored for early-stage management. Together, these segmentation insights underscore the importance of tailored strategies that align therapeutic modalities, delivery routes, care settings, and distribution models to evolving patient and provider preferences.

This comprehensive research report categorizes the Osteoarthritis Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Route of Administration

- End-User

- Distribution Channel

Diving into Critical Regional Perspectives That Shape Osteoarthritis Therapeutics Demand Dynamics Across the Americas, EMEA, and Asia-Pacific

In the Americas, the United States dominates innovation and commercial activity, buoyed by substantial R&D investments, robust reimbursement frameworks, and a growing emphasis on value-based care. Canada and Latin America are advancing through partnerships that localize manufacturing and adapt Western-developed protocols to regional healthcare infrastructures. Overall, changing demographics and rising healthcare expenditures are catalyzing broader adoption of both established and emerging osteoarthritis treatments across the hemisphere.

The Europe, Middle East, and Africa (EMEA) region is characterized by diverse regulatory environments that balance cost containment with incentives for novel therapies. Western European markets leverage centralized approvals and health technology assessments to streamline access, while emerging markets in Eastern Europe and the Gulf Cooperation Council emphasize local clinical trials and capacity building. Price controls in multiple European countries, however, necessitate careful pricing strategies to ensure sustainability across the value chain.

Asia-Pacific has emerged as the fastest-growing regional market, driven by a combination of rising disease prevalence and proactive investments in advanced therapies. China’s accelerating urbanization and expanding healthcare budgets are fostering the adoption of injectables and biologics, while Japan and South Korea focus on integrating regenerative medicine into standard care pathways. India and Southeast Asia are building manufacturing capabilities for both small-molecule and large-molecule therapeutics, positioning the region as a critical hub for global supply and innovation.

This comprehensive research report examines key regions that drive the evolution of the Osteoarthritis Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gaining Strategic Company-Level Insights from Pioneers and Disruptors Driving Innovation in Osteoarthritis Therapeutics Across the Globe

Pfizer and Eli Lilly’s long-standing collaboration on NGF inhibitors, notably tanezumab, has faced setbacks due to safety concerns over rapidly progressive osteoarthritis, leading to FDA panel rejections despite demonstrated efficacy in pain and function endpoints. Concurrently, AstraZeneca and Biogen have prioritized large-scale domestic manufacturing expansions, underscoring a strategic pivot toward resilient supply chains. Established device manufacturers such as Stryker and Zimmer Biomet continue to refine joint replacement technologies with advanced biomaterials and robotic-assisted platforms, maintaining their leadership in surgical interventions.

Specialty biotechs like Anika Therapeutics and Bioventus are capitalizing on viscosupplementation and orthobiologic segments, leveraging proprietary hyaluronic acid and growth factor formulations. Meanwhile, Regeneron’s fasinumab and other next-generation NGF candidates remain in late-stage development, reflecting ongoing interest in non-opioid pain modalities. As key players diversify pipelines through strategic partnerships and acquisitions, the competitive landscape is evolving toward integrated solutions that blend pharmacologic, biologic, and digital components.

This comprehensive research report delivers an in-depth overview of the principal market players in the Osteoarthritis Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- Boehringer Ingelheim International GmbH

- Cipla Ltd.

- Eli Lilly and Company

- Endo International plc

- Ferring B.V.

- Fidia Farmaceutici S.p.A

- GlaxoSmithKline PLC

- Johnson & Johnson Services Inc.

- Merck & Co.

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Presenting Actionable Strategic Recommendations to Empower Industry Leaders in Navigating Osteoarthritis Therapeutic Innovation and Market Challenges

Industry leaders should prioritize the integration of regenerative platforms with digital monitoring frameworks to deliver personalized, outcomes-focused care pathways. By fostering public-private collaborations, stakeholders can accelerate clinical validation and drive reimbursement models that recognize long-term value over episodic interventions. In addition, diversifying geographically dispersed manufacturing networks will mitigate tariff-related disruptions and enhance supply resilience.

Investments in real-world evidence generation and health economics research will be critical to securing formulary placements and payer support. Organizations are advised to cultivate multidisciplinary capabilities, combining rheumatology, physical therapy, and digital health expertise to offer comprehensive service offerings. Finally, proactive policy engagement at both national and international levels will shape favorable trade and regulatory environments, empowering smoother market access for cutting-edge therapies.

Exploring the Rigorous Research Methodology Underpinning Comprehensive Insights into Osteoarthritis Therapeutic Developments

This report synthesizes insights from a robust research methodology combining primary interviews with key opinion leaders across clinical, regulatory, and commercial domains, alongside comprehensive secondary research from peer-reviewed journals, regulatory filings, and industry publications. Quantitative data were triangulated through analyses of clinical trial registries, public health databases, and corporate disclosures. All findings underwent expert validation through advisory board reviews to ensure accuracy, relevance, and actionable value for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Osteoarthritis Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Osteoarthritis Therapeutics Market, by Treatment Type

- Osteoarthritis Therapeutics Market, by Route of Administration

- Osteoarthritis Therapeutics Market, by End-User

- Osteoarthritis Therapeutics Market, by Distribution Channel

- Osteoarthritis Therapeutics Market, by Region

- Osteoarthritis Therapeutics Market, by Group

- Osteoarthritis Therapeutics Market, by Country

- United States Osteoarthritis Therapeutics Market

- China Osteoarthritis Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Key Takeaways and Future Outlook for Stakeholders in the Evolving Osteoarthritis Therapeutic Arena

The analysis underscores a transformative phase in osteoarthritis therapeutics, where regenerative innovations and digital health solutions converge to address long-standing unmet needs. Despite headwinds from tariff-induced cost pressures and safety challenges in emerging drug classes, strategic investments and a collaborative ecosystem are poised to reshape treatment paradigms. Stakeholders equipped with this intelligence can navigate the complexities of segmentation, regional dynamics, and competitive positioning to capitalize on growth opportunities and drive sustainable patient outcomes.

Take Action Today by Connecting with Ketan Rohom to Secure Critical Osteoarthritis Therapeutic Market Insights for Informed Decision-Making

Engaging with this comprehensive analysis marks the first step toward transforming your strategic approach to osteoarthritis therapeutics. To access the full breadth of data-driven insights and expert evaluations, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to discuss report acquisition and tailor solutions that align with your organizational priorities.

- How big is the Osteoarthritis Therapeutics Market?

- What is the Osteoarthritis Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?