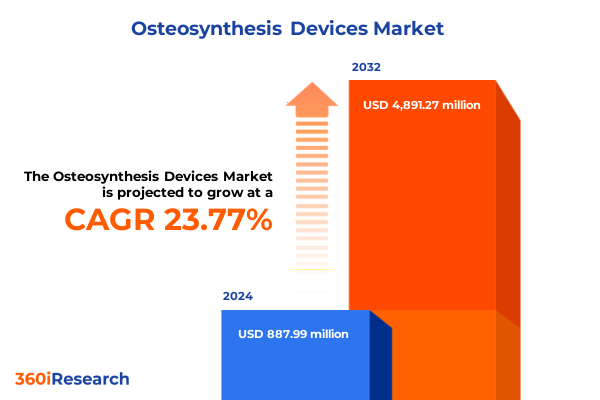

The Osteosynthesis Devices Market size was estimated at USD 1.09 billion in 2025 and expected to reach USD 1.35 billion in 2026, at a CAGR of 23.83% to reach USD 4.89 billion by 2032.

Exploring the Critical Role and Evolution of Osteosynthesis Devices in Modern Orthopedic Care to Set the Stage for Comprehensive Market Analysis

Osteosynthesis devices have become indispensable tools in modern orthopedic care, providing surgeons with reliable solutions to stabilize fractures and facilitate bone healing. From the earliest external fixation frames to sophisticated intramedullary nails and locking plate systems, these implants have evolved significantly, reflecting advances in materials science, biomechanics, and surgical techniques. The integration of biocompatible alloys and polymers has minimized adverse reactions while improving mechanical strength, enabling more predictable outcomes for patients of all ages.

As the global population ages and the incidence of high-energy trauma rises, demand for osteosynthesis solutions continues to surge. Innovations in device design and manufacturing processes are reshaping the landscape, paving the way for minimally invasive approaches and patient-specific implants. This introduction establishes the context for a detailed examination of the forces driving change in the osteosynthesis devices market, setting the stage for insights into technological breakthroughs, regulatory pressures, and market dynamics that are defining the trajectory of this crucial sector.

Uncovering the Transformative Technological and Clinical Shifts Reshaping the Osteosynthesis Devices Landscape in Patient-Centric Orthopedic Solutions

In recent years, the osteosynthesis devices market has experienced transformative shifts driven by rapid technological innovation and evolving clinical needs. Additive manufacturing techniques now enable the production of patient-specific plates and nails that conform precisely to complex anatomies, reducing intraoperative adjustments and improving surgical fit and stability. Artificial intelligence–driven preoperative planning platforms analyze imaging data to recommend optimal fixation strategies, enhancing surgical precision and shortening procedure times. These technological advancements are complemented by the introduction of bioactive coatings and resorbable polymers that actively promote bone regeneration while eliminating the need for hardware removal at maturity.

At the same time, minimally invasive surgical approaches are gaining traction, fostering the development of low-profile implants designed for percutaneous implantation through small incisions. Integration of real-time intraoperative navigation and sensor-enabled “smart” implants provides surgeons with continuous feedback on load distribution and alignment, allowing for adjustments that optimize healing trajectories. This convergence of digital tools and advanced materials is fundamentally redefining patient care pathways, resulting in shorter hospital stays, faster rehabilitation, and reduced complication rates. As these shifts accelerate, stakeholders across the value chain must adapt to new clinical protocols and supply chain models that prioritize agility and customization.

Evaluating the Cumulative Impact of United States Tariffs Implemented in 2025 on Supply Chains Costs and Strategic Positioning of Osteosynthesis Devices

Throughout 2025, a series of tariff actions in the United States has exerted significant pressure on manufacturers of osteosynthesis implants by increasing raw material costs and complicating global supply chains. In March, the expansion of Section 232 tariffs eliminated country exemptions for steel and aluminum imports and extended higher duties to downstream products, marking a notable escalation in trade policy. Just weeks later, a presidential proclamation raised steel and aluminum tariffs from 25% to 50% ad valorem, affecting derivative articles critical to implant fabrication and prompting urgent reassessment of sourcing strategies.

These measures compound existing levies on components imported from key manufacturing hubs, imposing additional duties on critical items such as specialized screws and fixation plates that integrate Chinese-sourced alloys and precision-formed polymers. Industry stakeholders warn that sustained high tariffs-reaching as much as 145% on select components-could disrupt implant production and lead to supply shortages, ultimately risking patient care continuity. In response, leading orthopedic device companies are pursuing dual strategies of onshoring key fabrication steps and negotiating expanded tariff exclusions, seeking to stabilize costs while maintaining quality standards.

Decoding the Diverse Segmentation Landscape of the Osteosynthesis Devices Market Across Device Types Applications Materials End Users and Surgery Types

The osteosynthesis devices market is characterized by a multi-layered segmentation framework that guides strategic decision-making across product, application, material, end user, and surgical approach dimensions. Device type segmentation encompasses external fixation systems, intramedullary nails, plates, screws, and spinal rods, each with specialized subcategories such as circular, hybrid, and uniplanar fixators; cannulated and solid nails; dynamic compression, locking, and reconstruction plates; cancellous, cortical, and locking screws; and both precontoured and straight spinal rods. Application segmentation captures clinical contexts ranging from craniomaxillofacial and spinal fixation to extremity and trauma procedures, with further granularity for lower and upper limb treatments including femur, tibia, humerus, radial, and ulnar interventions.

Material segmentation drives product innovation through the use of stainless steel, titanium alloys, and emerging biodegradable polymer systems such as polyglycolic and polylactic acids, enabling designs that support gradual load transfer and resorption over time. End user segmentation reflects the growing role of ambulatory surgical centers alongside traditional hospital settings, influencing device portability, sterilization protocols, and inventory management practices. Finally, surgical approach segmentation differentiates between minimally invasive techniques-incorporating arthroscopy-assisted and percutaneous methods-and open surgery, highlighting a shift toward reduced surgical footprints and accelerated patient recovery. Collectively, these segmentation insights reveal the nuanced requirements that must be addressed by manufacturers and healthcare providers alike to optimize patient outcomes and operational efficiency.

This comprehensive research report categorizes the Osteosynthesis Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Material

- Surgery Type

- Application

- End User

Gaining Strategic Perspective Through Key Regional Insights Spanning the Americas Europe Middle East Africa and the Asia-Pacific in Osteosynthesis Devices

Regional dynamics play a pivotal role in shaping the demand and adoption of osteosynthesis devices, with notable variations observed across the Americas, EMEA (Europe, Middle East, and Africa), and the Asia-Pacific region. In the Americas, advanced healthcare infrastructure and high hospital expenditure drive strong uptake of cutting-edge fixation systems, especially in North America, where regulatory frameworks support rapid integration of innovative implant technologies. Clinical preferences in this region tend toward minimally invasive procedures, fueling demand for low-profile intramedullary nails and locking plate solutions.

Within the Europe, Middle East, and Africa region, market growth is influenced by a diverse mix of mature Western European healthcare markets, emerging opportunities in the Middle East, and evolving public health investments across Africa. Price sensitivity coexists with a strong focus on clinical efficacy, prompting manufacturers to offer tiered product portfolios that balance advanced features with cost considerations. In the Asia-Pacific region, rising healthcare spending, expanding surgical capacity, and a growing middle-class patient base drive rapid adoption of both standard and high-end osteosynthesis devices. Local production hubs are emerging to meet surging demand, supported by government initiatives to boost domestic medical manufacturing and reduce reliance on imports.

This comprehensive research report examines key regions that drive the evolution of the Osteosynthesis Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players and Their Strategic Initiatives Driving Innovation Partnerships and Competitive Dynamics in the Osteosynthesis Devices Arena

The competitive landscape of the osteosynthesis devices market is dominated by established global medtech firms alongside innovative specialized players. DePuy Synthes (Johnson & Johnson) remains at the forefront through its extensive portfolio of plates, screws, and nails, bolstered by ongoing investment in 3D-printed personalized implants and augmented reality surgical planning tools. Stryker has advanced its spinal rod offerings and external fixation systems by integrating smart sensor technologies that monitor in vivo load distribution, positioning the company as a leader in connected orthopedic solutions. Zimmer Biomet is strengthening its market presence through strategic acquisitions and partnerships that expand its biodegradable polymer implant pipeline and accelerate clinical validation.

Meanwhile, Medtronic and Smith & Nephew are intensifying R&D efforts in minimally invasive devices and bioactive surface coatings to enhance osseointegration and reduce infection risks. B. Braun and smaller innovators such as Arthrex and Globus Medical are capturing niche segments by offering tailored product lines for pediatric and sports-medicine applications, supported by targeted surgeon training programs and digital education platforms. These competitive dynamics underscore the importance of both technological differentiation and strategic collaboration in sustaining growth and responding to evolving clinical and regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Osteosynthesis Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acumed LLC

- Arthrex, Inc.

- B. Braun Melsungen AG

- CONMED Corporation

- Gauthier Biomedical Inc.

- Globus Medical, Inc.

- GPC Medical Ltd.

- GS Medical LLC

- Johnson & Johnson Services, Inc.

- KLS Martin Group

- Lepu Medical Technology Co., Ltd

- Life Spine, Inc.

- LimaCorporate S.p.A. by Enovis Corporation

- Matrix Meditec Private Limited

- Medartis AG

- Medtronic plc

- Merete GmbH

- MicroPort Scientific Corporation

- Neosteo SAS

- NuVasive, Inc.

- Olympus Corporation

- Orthofix Medical Inc.

- Paragon 28 Inc.

- Pega Medical Inc.

- Smith & Nephew plc

- Stryker Corporation

- Tyber Medical LLC

- Wright Medical Group N.V.

- Zimmer Biomet Holdings, Inc.

Formulating Actionable Strategies and Practical Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in Osteosynthesis Devices

To thrive amid mounting regulatory pressures, tariff volatility, and shifting clinical preferences, industry leaders must adopt a proactive approach to supply chain resilience and product innovation. Prioritizing diversification of raw material procurement and securing long-term tariff exemptions can mitigate cost disruptions and maintain uninterrupted manufacturing. Simultaneously, expanding local production capabilities in key regions will reduce dependency on cross-border logistics and enhance responsiveness to regional demand fluctuations.

On the product front, accelerating the development of bioresorbable and sensor-enabled implants will address rising demand for personalized and connected orthopedic solutions. Collaborations with digital health providers to integrate real-time postoperative monitoring can strengthen value-based care propositions and differentiate device portfolios. Furthermore, forging partnerships with ambulatory surgical centers and hospital systems to offer tailored training and support programs will foster practitioner loyalty and drive adoption of advanced surgical techniques.

Detailing a Robust Research Methodology Leveraging Multi-Source Data Collection and Expert Validation to Ensure Rigorous Osteosynthesis Devices Market Analysis

This analysis was constructed through a multi-step research methodology that combined secondary data collection from reputable industry publications, regulatory filings, and trade press with primary insights gathered through in-depth interviews with orthopedic surgeons, supply chain specialists, and device manufacturers. Market segmentation frameworks were validated against corporate disclosures and clinical usage patterns, ensuring alignment with real-world practice.

Data triangulation was conducted by cross-referencing government trade statistics and tariff proclamations with cost-impact assessments from healthcare associations. Expert panel reviews provided qualitative validation of emerging trends and strategic imperatives, while case studies from leading clinical centers illuminated the practical implications of novel technologies. This rigorous approach ensures that the insights presented here reflect both macroeconomic forces and on-the-ground realities shaping the osteosynthesis devices market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Osteosynthesis Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Osteosynthesis Devices Market, by Device Type

- Osteosynthesis Devices Market, by Material

- Osteosynthesis Devices Market, by Surgery Type

- Osteosynthesis Devices Market, by Application

- Osteosynthesis Devices Market, by End User

- Osteosynthesis Devices Market, by Region

- Osteosynthesis Devices Market, by Group

- Osteosynthesis Devices Market, by Country

- United States Osteosynthesis Devices Market

- China Osteosynthesis Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Concluding Insights Highlighting Critical Takeaways and Strategic Implications to Navigate the Evolving Osteosynthesis Devices Market Landscape with Confidence

The osteosynthesis devices market stands at a pivotal juncture, shaped by technological innovation, evolving regulatory landscapes, and dynamic regional growth patterns. As manufacturers navigate heightened tariff environments and shifting clinical paradigms, the ability to deliver customized, high-performance implants will determine competitive positioning. Strategic investments in advanced materials, supply chain resilience, and digital integration are essential to meet the rising expectations of surgeons and patients alike.

By embracing a patient-centric approach and fostering collaborative partnerships across the healthcare ecosystem, industry stakeholders can unlock new avenues of growth and improve outcomes in fracture management. Continued focus on research, agile manufacturing, and proactive policy engagement will equip leaders to confidently address future challenges in this rapidly evolving sector.

Take the Next Step Towards In-Depth Market Intelligence by Partnering with Ketan Rohom to Access the Comprehensive Osteosynthesis Devices Research Report Today

Ready to leverage in-depth analysis and strategic insights tailored to the osteosynthesis devices market? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our comprehensive report can inform your decision-making and unlock new growth opportunities. Secure your access to critical data, expert commentary, and actionable recommendations by reaching out today, and ensure your organization stays ahead in this rapidly evolving industry.

- How big is the Osteosynthesis Devices Market?

- What is the Osteosynthesis Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?