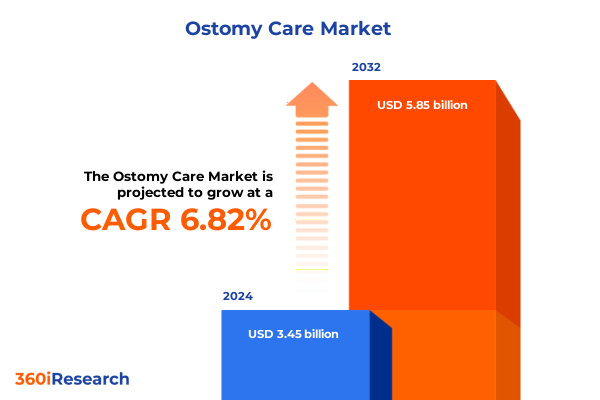

The Ostomy Care Market size was estimated at USD 3.65 billion in 2025 and expected to reach USD 3.86 billion in 2026, at a CAGR of 6.97% to reach USD 5.85 billion by 2032.

Setting the Stage for Future Ostomy Care Excellence by Examining Demographic Trends Driving Clinical Demand and Evolving Patient Support Strategies

Ostomy care encompasses the comprehensive support and medical products required for individuals who have undergone surgical procedures such as colostomy, ileostomy, or urostomy, creating an external opening of the bowel or urinary tract through the abdominal wall. These interventions, often necessitated by conditions ranging from colorectal cancer to inflammatory diseases, introduce complex self-care demands on patients and caregivers. Multidisciplinary clinical teams and specialised ostomy nurses play a pivotal role in guiding patients through the postoperative period, ensuring that stoma appliances, skin barriers, and accessory products are selected and applied correctly to prevent complications. The critical nature of this care continuum underscores the importance of a robust market ecosystem that can address evolving clinical needs while enhancing patient quality of life.

Cutting-Edge Transformations Redefining Ostomy Care Through Digital Health Innovation, Advanced Materials, and Patient-Centered Service Models

The landscape of ostomy care is being reshaped by transformative innovations that extend far beyond incremental product enhancements. First, the integration of advanced materials in skin barrier formulations has elevated peristomal protection and adhesion, with modern hydrocolloid wafers demonstrating superior comfort and reduced skin trauma compared to traditional options (Adhesive forces of various hydrocolloid wafers were shown to significantly impact peristomal skin health, reducing dermatologic changes when adhesive force was optimised). Complementing material science advances, the incorporation of skin-friendly acrylates into barrier adhesives has further improved wear time and patient satisfaction without compromising skin integrity.

Simultaneously, digital health technologies are revolutionising patient monitoring and support. Smartphone-enabled sensors and connected applications now enable real-time tracking of ostomy pouch fullness, leakage risk, and skin condition, facilitating timely interventions and remote consultations that align with value-based care models where outcomes and cost-efficiency are prioritised (Numerous studies demonstrate that telemedicine interventions for ostomy patients improve self-efficacy and reduce complication rates through extended support, with one meta-analysis recommending longer-duration programmes for optimal benefit).

Regulatory and reimbursement shifts are also catalyzing the move toward home-based care. As health systems incentivise ambulatory surgical centers and home health agencies for postoperative management, distribution channels are evolving to prioritise mail-order services and telepharmacy partnerships, expanding patient access while challenging traditional hospital-based supply chains.

Finally, growing environmental awareness is driving early efforts toward sustainable ostomy solutions. While fully biodegradable products remain an aspirational goal, manufacturers are exploring recyclable packaging and eco-conscious component design to address healthcare’s broader sustainability imperatives. Collectively, these forces are forging a new paradigm where clinical efficacy, patient empowerment, and environmental stewardship converge.

Assessing the Ripple Effects of 2025 United States Tariff Policies on Ostomy Device Supplies, Healthcare Providers, and Patient Affordability

The recent escalation of United States tariffs on medical device imports under Section 301 has introduced significant cost pressures across the ostomy care supply chain. In September 2024, the U.S. Trade Representative imposed additional 25% tariffs on respirators and facemasks and 100% tariffs on syringes and needles, with further increases slated through 2026 affecting a range of consumable medical devices imported from China (Section 301 tariff increases are scheduled to escalate from 25% to 50% on respirators and facemasks and from 50% to 100% on rubber gloves and related products by January 2026). As many ostomy pouches, skin barriers, and fixation accessories rely on components sourced internationally, these duties are projected to inflate procurement costs for distributors and healthcare providers.

Industry stakeholders including the American Hospital Association have cautioned that elevated import levies could amplify hospital supply budgets by up to 15%, particularly for high-volume items like skin barriers and pouches (Hospitals spend over $146.9 billion annually on medical supplies, and tariff increments on semiconductors and critical materials are anticipated to exacerbate financial strain). Early contractual safeguards may partially buffer immediate price shocks, but long-term agreements will likely embed higher unit costs, ultimately affecting patient co-pays and insurance premiums.

Major medical technology companies have quantified the toll: Johnson & Johnson forecasts approximately $400 million in 2025 tariff-related expenses in its MedTech division, citing duties on aluminum, steel, and Chinese imports, which may constrain R&D investment and product affordability (Johnson & Johnson expects $400 million of tariff impact in 2025, driven primarily by U.S. and retaliatory Chinese duties on key medical device components). In response, manufacturers are advocating for tariff carve-outs on essential healthcare products to safeguard supply chain resilience and protect patient access.

In parallel, some providers have formed crisis response teams to renegotiate vendor contracts and explore alternative sourcing or domestic manufacturing partnerships. However, such strategic pivots require capital investment and may not fully substitute for established import networks, underscoring the need for policy clarity and targeted exemptions for ostomy-related consumables.

Uncovering Critical Market Segmentation Insights Across Product Types, Materials, Applications, End Users, and Distribution Channels

The ostomy care market can be understood through distinct layers of segmentation that capture both product and patient dynamics. From a product type perspective, the landscape encompasses Accessories such as belts, deodorants, and skin wipes; Fixation Devices including adhesives and strips; Ostomy Pouches, differentiated by disposable versus reusable formats; and Skin Barriers, available in convex and flat profiles. Material distinctions further refine this view, with products formulated from hydrocolloid substrates or skin-friendly acrylate adhesives that directly influence wear performance and skin outcomes. Within the clinical spectrum, application-driven segmentation groups care solutions by colostomy, ileostomy, and urostomy procedures, reflecting divergent patient requirements. The end-user dimension highlights the roles of ambulatory surgical centers, home care settings, and hospital environments in shaping procurement patterns. Finally, distribution channels ranging from hospital pharmacies to online and retail pharmacy outlets determine the accessibility and speed of product delivery to patients and institutions alike.

This comprehensive research report categorizes the Ostomy Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application Type

- End User

- Distribution Channel

Navigating Regional Dynamics Influencing Ostomy Care Adoption and Accessibility Across the Americas, EMEA, and Asia-Pacific Jurisdictions

Regional variations in ostomy care adoption and infrastructure profoundly influence market maturity and growth trajectories. In the Americas, robust reimbursement frameworks and high awareness of ostomy management best practices have fostered widespread integration of advanced appliances and telehealth programmes, particularly in the United States and Canada. Europe, Middle East & Africa markets exhibit heterogeneity, with Western Europe demonstrating early uptake of digital support tools and premium barrier technologies, while emerging EMEA regions are characterized by evolving healthcare policies and affordability concerns that temper premium product penetration. Asia-Pacific presents a dual narrative: mature markets like Japan and Australia lead in innovative device adoption and home-based care models, whereas growth in emerging APAC countries is being propelled by expanding insurance coverage, rising procedure rates aligned with aging populations, and investments in community-based ostomy nursing services. These regional dynamics underscore the importance of tailored market strategies that align product portfolios and distribution partnerships with local regulatory, economic, and cultural contexts.

This comprehensive research report examines key regions that drive the evolution of the Ostomy Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Driving Ostomy Care Innovation Through Strategic Product Launches, Digital Solutions, and Collaborative Ecosystems

Major players in the ostomy care market are actively deploying product innovations and strategic collaborations to strengthen their competitive positioning. Coloplast, for example, received UK reimbursement approval for Heylo™, the world’s first digital leakage notification system, which combines a sensor layer, Bluetooth-enabled transmitter, and smartphone app to alert users to potential leaks and enhance peace of mind (Coloplast launched Heylo™, a sensor-enabled leakage notification system, with national reimbursement in the UK as of July 1, 2024). Convatec has responded with the introduction of Esteem Body™ with Leak Defense™, a one-piece soft convex ostomy system portfolio leveraging gold-standard adhesives and an 8-shaped pouch design to minimize sag and optimize seal integrity, initially in Italy and then the U.S. in April 2024 (Convatec launched Esteem Body™ with Leak Defense™ in the U.S. in April 2024, advancing soft convex solutions for diverse body types).

Hollister is enhancing its patient education and support ecosystem through digital initiatives like the Ostomy Journey Companion App, which offers targeted tips, educational content, and secure messaging for U.S. residents navigating the pre- and post-surgical ostomy journey (Hollister’s Ostomy Journey Companion App provides staged educational content, product reminders, and community resources to support ostomates from pre-surgery through recovery). Collectively, these strategic moves illustrate a broader industry shift toward comprehensive care models that blend innovative product design with digital engagement and evidence-based patient support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ostomy Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcare Co., Ltd.

- B. Braun Melsungen AG

- Coloplast A/S

- ConvaTec Group PLC

- Cymed Group Limited

- Hollister Incorporated

- Marlen Manufacturing & Development Co.

- Pelican Healthcare Limited

- Salts Healthcare Ltd

- Stealth Products Inc.

- Torbot Group Inc.

- Welland Medical Limited

Actionable Strategic Recommendations to Empower Industry Leaders in Enhancing Ostomy Care Outcomes, Operational Efficiency, and Market Penetration

Industry leaders can capitalize on evolving market conditions by pursuing a series of targeted actions. First, investing in next-generation skin barrier research-particularly hydrocolloid and acrylate formulations optimized for extended wear and minimized skin complications-will address core patient needs and differentiate product portfolios. Concurrently, expanding digital health platforms to integrate sensor-based monitoring, telehealth consultations, and predictive analytics can strengthen patient adherence and clinical outcomes while creating stickiness across care ecosystems. On the supply side, engaging proactively with policymakers to secure tariff exemptions or incentives for essential ostomy components will help stabilize pricing and safeguard reimbursement rates. Manufacturers and distributors should also explore nearshoring or dual sourcing strategies to mitigate import exposure and maintain supply continuity. Finally, forging partnerships with patient advocacy groups and professional nursing societies can amplify education efforts, reduce stigma, and accelerate the adoption of holistic care pathways. By aligning innovation, policy advocacy, and stakeholder engagement, industry participants can drive sustainable growth and enhanced patient value.

Robust Multimethod Research Methodology Integrating Secondary Data, Expert Interviews, and Rigorous Validation to Ensure Analytical Integrity

This analysis employed a rigorous multimethod research approach to ensure validity and comprehensiveness. Secondary research included examination of regulatory filings, tariff schedules, and industry press releases, supplemented by peer-reviewed studies from clinical and public health databases such as PubMed for insights on telemedicine efficacy and skin barrier performance. Key news sources and business press, including the USTR Section 301 announcements and corporate financial disclosures, provided current context on trade policy impacts and corporate cost projections. Primary qualitative inputs were triangulated through expert consultations with ostomy care clinicians, supply chain managers, and patient advocates, enabling real-world validation of emerging trends. Data synthesis was conducted using a structured framework that cross-references segmentation, regional, and competitive dimensions, with iterative reviews by technical editors to maintain analytical rigor and clarity. This methodology underpins the strategic insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ostomy Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ostomy Care Market, by Product Type

- Ostomy Care Market, by Material Type

- Ostomy Care Market, by Application Type

- Ostomy Care Market, by End User

- Ostomy Care Market, by Distribution Channel

- Ostomy Care Market, by Region

- Ostomy Care Market, by Group

- Ostomy Care Market, by Country

- United States Ostomy Care Market

- China Ostomy Care Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Synthesis of Insights Highlighting the Convergence of Demographic, Technological, and Policy Trends Shaping Future Ostomy Care

The convergence of demographic shifts, technological breakthroughs, and policy dynamics is reshaping the ostomy care landscape in profound ways. An aging population alongside rising colorectal cancer and inflammatory disease incidence has elevated demand for advanced pouching systems and skin care solutions. At the same time, digital health innovations empower patients and providers with proactive monitoring, telehealth support, and data-driven care pathways. Trade policies and tariff fluctuations underscore the importance of resilient supply strategies and proactive policy engagement to maintain affordability and access. Segmentation insights reveal nuanced requirements across product types, materials, applications, end users, and distribution channels, while regional analysis highlights the need for tailored go-to-market approaches. Leading companies are responding with differentiated product introductions, integrated digital platforms, and partnerships that reflect a shift toward patient-centric ecosystems. By synthesizing these insights, stakeholders can navigate complexity, unlock growth opportunities, and ultimately enhance outcomes for ostomy patients worldwide.

Take the Next Step Toward Comprehensive Ostomy Care Insights and Connect with Ketan Rohom to Unlock the Full Market Research Report

Unlock unparalleled visibility into the ostomy care market and empower your strategic decisions by accessing our in-depth report. Connect with Ketan Rohom, our Associate Director of Sales & Marketing, to explore how detailed market insights, competitive analyses, and trend forecasts can elevate your organizational objectives. Don’t miss this opportunity to gain a comprehensive understanding of evolving market dynamics, identify actionable growth opportunities, and secure your competitive edge. Reach out today to request a tailored proposal and begin leveraging data-driven research to drive your success.

- How big is the Ostomy Care Market?

- What is the Ostomy Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?