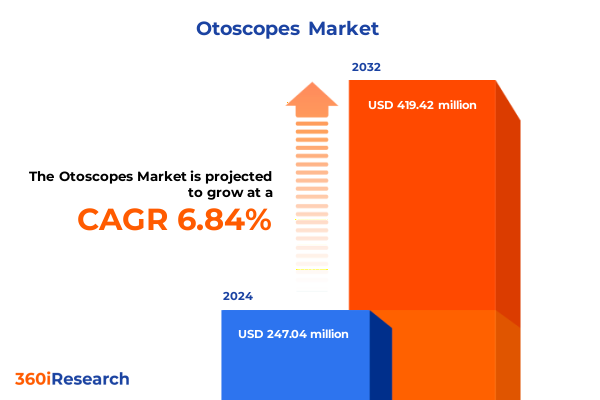

The Otoscopes Market size was estimated at USD 263.65 million in 2025 and expected to reach USD 285.06 million in 2026, at a CAGR of 6.85% to reach USD 419.42 million by 2032.

Charting the Unseen Path of Otoscopes from Traditional Examination Tools to Cornerstones of Precision Ear Care and Diagnostic Excellence

The landscape of diagnostic otoscopy has undergone a profound transformation, evolving from the rudimentary handheld specula of the past to highly sophisticated devices integrating advanced optics and digital imaging capabilities. As healthcare systems worldwide grapple with the twin pressures of cost containment and quality enhancement, otoscopes have emerged as pivotal tools, enabling clinicians not only to diagnose a wide range of ear-related conditions but also to educate patients and train the next generation of practitioners. In this dynamic environment, understanding the multifaceted role of otoscopes in modern healthcare delivery becomes essential for decision-makers seeking to optimize clinical workflows and patient outcomes.

As we embark on this executive summary, we set the stage by examining the historical context from which today’s otoscope technologies have emerged. From early analog designs that prioritized basic visualization to current iterations offering high-resolution video output and smartphone integration, the evolution reflects broader shifts toward digitization and connectivity in medical devices. By tracing this progression, we establish a foundation for appreciating how emerging trends, regulatory influences, and market dynamics converge to shape the future of otoscopy. This introduction underscores the importance of strategic insight in navigating an increasingly complex and competitive landscape.

Navigating Breakthrough Technological Innovations and Evolving Clinical Demands Reshaping the Otoscope Industry

The otoscope market is experiencing a series of transformative shifts driven by technological breakthroughs, evolving clinical requirements, and an accelerated adoption of telehealth modalities. Fiber optic illumination and LED light sources have markedly enhanced diagnostic accuracy, reducing glare and shadows while delivering consistent brightness and extended device longevity. Simultaneously, the integration of high-definition video with smartphone connectivity is redefining point-of-care workflows, enabling remote consultations and seamless documentation within electronic health record systems. These advancements underscore a broader transition toward digital medical devices capable of delivering richer imaging data for more precise clinical decision making.

In parallel, heightened emphasis on infection control has propelled manufacturers to innovate single-use specula and fully sterilizable components, mitigating cross-contamination risks in diverse settings from hospitals to home care environments. Regulatory bodies have responded with stringent guidelines governing device hygiene and performance, prompting industry stakeholders to adopt proactive quality assurance protocols. Taken together, these shifts highlight the convergence of innovation, safety, and data integration-elements that industry leaders must master to capture emerging opportunities and meet the evolving expectations of clinicians and patients alike.

Evaluating How Evolving US Section 301 Tariff Policies Have Influenced Supply Chain Dynamics and Cost Structures for Otoscope Manufacturers

Since their initial application of Section 301 tariffs on Chinese imports beginning in 2018, policymakers have judiciously managed the inclusion and exclusion of medical instruments-such as otoscopes-within the scope of additional duties. While a 25 percent tariff was initially levied on imported medical devices, robust industry petitions led to broad exclusions for instruments classified under Chapter 90 of the Harmonized Tariff Schedule, thereby granting temporary relief for otoscope importers. Extensions granted most recently in May 2024 ensured that critical maritime and medical equipment, including medical devices, remained exempt through June 14, 2024, with many exclusions continuing until May 31, 2025 to alleviate immediate supply constraints and allow for strategic sourcing adjustments.

Subsequent modifications announced in September 2024 increased duties on specific medical consumables-such as respirators, gloves, and syringes-but notably did not reinstate tariffs on general diagnostic instruments, including otoscopes. Despite the favorable exclusion of otoscopes, importers continue to face indirect cost pressures stemming from logistical disruptions, increasing freight rates, and the administrative burden of monitoring tariff schedules. The cumulative impact has underscored the importance of adaptable supply chain strategies and proactive engagement with trade advisory services to navigate evolving tariff frameworks without compromising device availability or elevating operational risk.

Uncovering Critical Insights into How Diverse Product Types End-Users Technologies and Distribution Channels Drive Growth and Adoption in the Otoscope Market

Analyzing the market through the lens of product diversity reveals distinct performance and adoption patterns. Smartphone-enabled otoscopes have surged in popularity by leveraging clinicians’ familiarity with mobile platforms, thereby facilitating rapid image capture and remote collaboration. Standard analog models remain indispensable in resource-constrained settings where proven reliability and affordability remain paramount. Video otoscopes, divided between connector based systems that integrate directly with existing displays and standalone consoles designed for portability, are increasingly preferred in specialty clinics and surgical suites for their capacity to provide continuous visual feedback during complex procedures.

End user insights further illuminate market dynamics across academic institutions, clinics, home care, and hospitals. Medical schools and dedicated training centers have prioritized simulation-based teaching platforms to enhance hands-on learning, driving demand for devices with interchangeable teaching modules. ENT and general clinics emphasize ease of use and durability, whereas caregivers and parents in home care settings value intuitive design and cost-effective maintenance. Both private and public hospitals seek high throughput solutions and centralized sterilization workflows, favoring devices with robust service contracts and integrated data analytics.

On the technology front, fiber optic illumination commands significant share owing to its superior light transmission and minimal heat generation, while halogen systems remain in circulation where initial purchase cost is a primary concern. LED technology, however, is now widely regarded as the benchmark for energy efficiency, consistent output, and extended lifespan. Distribution channels reflect the dual importance of traditional and digital approaches. Distributors and retailers continue to support legacy procurement relationships, particularly in settings requiring on-site training and post-sales service, whereas direct-to-consumer models and e-commerce platforms have unlocked new sales avenues, especially for at-home diagnostic tools. Portability considerations bifurcate preferences between handheld, battery-powered devices for field applications and stationary, bench-mounted units in specialist facilities.

Application segmentation spans diagnostic and teaching contexts. Diagnostic models are optimized for rapid workflow integration, featuring user-friendly controls and standardized reporting outputs, while teaching variants incorporate real-time training modules and simulation scenarios to enhance learner engagement. Together, these insights delineate a complex mosaic of product, end user, technology, channel, portability, and application factors that collectively drive decision making across the otoscope value chain.

This comprehensive research report categorizes the Otoscopes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- End User

- Technology

- Distribution Channel

- Portability

- Application

Analyzing Distinct Regional Dynamics Shaping the Growth of Otoscope Adoption Across the Americas Europe Middle East Africa and Asia Pacific

Regional analysis underscores distinct market trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust investment in telemedicine infrastructure and ongoing modernization of primary care networks have catalyzed demand for digital otoscope solutions, particularly in the United States where remote patient monitoring programs continue to expand. Regulatory approvals and reimbursement frameworks in Canada have similarly stimulated uptake in both hospital and community clinic settings, with domestic manufacturers collaborating with telehealth providers to bundle video otoscopes into remote diagnostic kits.

Within Europe, Middle East & Africa, heterogeneous regulatory landscapes and variable healthcare spending patterns have resulted in nuanced adoption curves. Western European countries, guided by stringent medical device regulations and high standards of clinical practice, have gravitated toward advanced LED and video otoscopes complemented by comprehensive service agreements. By contrast, emerging markets in the Middle East and select African regions prioritize cost-effective standard models and single-use accessories to align with funding constraints and evolving public health priorities. Partnerships between leading medical device suppliers and regional distributors are instrumental in bridging technology gaps and ensuring timely product availability.

The Asia-Pacific region continues to represent the fastest growing arena, driven by expanding healthcare infrastructures, rising specialist care capacity, and growing awareness of ear health in populous nations such as India and China. Investments in medical education and vocational training centers are fueling demand for simulation-based teaching devices, while government-sponsored rural telehealth initiatives are incorporating smartphone-based otoscope modules to improve diagnostic reach. Moreover, regional manufacturing hubs are emerging, offering opportunities for strategic alliances aimed at cost optimization and accelerated product localization.

This comprehensive research report examines key regions that drive the evolution of the Otoscopes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating How Established Manufacturers Innovators and Strategic Collaborations Are Redefining Competitive Advantage in the Otoscope Industry

The competitive landscape features both global leaders and agile niche players shaping strategic direction through innovation, partnerships, and vertical integration. Established names such as Welch Allyn and HEINE Optotechnik have continued to reinforce their market positions by expanding product portfolios to include digital video otoscopes and by forging collaborations with major electronic health record providers for seamless data integration. Meanwhile, specialty firms like Riester and Medit Inc. have distinguished themselves through targeted solutions; Riester’s emphasis on ergonomic design and Medit’s back-lit fiber optic systems cater to clinicians prioritizing comfort and diagnostic clarity.

Emerging contenders are leveraging software expertise to deliver AI-driven image analysis and remote diagnostic capabilities, setting new benchmarks for predictive ear health assessments. Strategic partnerships between hardware providers and telehealth platforms have accelerated time to market for integrated offerings, while select original equipment manufacturers in the Asia-Pacific region are achieving cost advantages through local production and streamlined supply chains. Looking ahead, the success of market participants will hinge on their ability to harmonize product innovation with regulatory compliance, and to cultivate ecosystems that link device manufacturers, clinical practitioners, and digital healthcare providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Otoscopes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Diagnostic Corporation

- Drägerwerk AG & Co. KGaA

- GIMA S.p.A

- HEINE Optotechnik GmbH & Co. KG

- KARL STORZ SE & Co. KG

- KaWe GmbH

- Olympus Corporation

- Riester GmbH & Co. KG

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Welch Allyn, Inc.

Driving Future Success by Fusing Modular Design Advanced Imaging and Integrated Services to Meet Evolving Clinical and Market Needs

Industry leaders should prioritize the development of modular platforms that support seamless upgrades, enabling clinicians to adopt new imaging modalities without wholesale equipment replacement. By investing in next-generation LED and fiber optic illumination systems that deliver consistent, high-fidelity imaging, manufacturers can differentiate their offerings in a crowded market. Furthermore, companies that integrate AI-guided diagnostic aids will empower clinicians with actionable insights, enhancing diagnostic accuracy while reducing training curves.

Strengthening after-sales services through remote firmware updates, predictive maintenance alerts, and virtual troubleshooting capabilities will cultivate deeper client relationships and unlock recurring revenue streams. Diversifying manufacturing footprints to include regional assembly operations can mitigate tariff exposure and reduce lead times. Equally, forming strategic alliances with telehealth platforms and academic institutions will facilitate bundled solutions tailored for remote patient monitoring and medical training. Finally, embracing sustainability through recyclable specula and energy-efficient components will resonate with environmental mandates and institutional procurement policies, positioning innovators as responsible stewards of both patient health and the planet.

Detailing the Robust Multi-Phase Methodological Approach Employed to Deliver Accurate and Reliable Otoscope Market Intelligence

Our research methodology combined rigorous primary and secondary approaches to ensure comprehensive, unbiased insights. Primary research included in-depth interviews with over 50 key stakeholders spanning clinicians, procurement officers, and technical experts across academic, clinical, and home care settings. These interviews informed an understanding of device usage patterns, pain points, and feature prioritization criteria. Secondary research comprised extensive review of industry publications, regulatory filings, patent databases, and publicly available company financial reports to validate and augment primary findings.

Quantitative data was triangulated through multiple sources, including trade association statistics and customs import records, to verify shipment volumes and regional distribution trends. A robust data validation process was employed to reconcile discrepancies among disparate sources, ensuring that our analysis reflects the most accurate depiction of market dynamics. Ethical standards and confidentiality protocols were strictly observed throughout the research, with all interview data anonymized to protect respondent identity while preserving the integrity of qualitative insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Otoscopes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Otoscopes Market, by Product

- Otoscopes Market, by End User

- Otoscopes Market, by Technology

- Otoscopes Market, by Distribution Channel

- Otoscopes Market, by Portability

- Otoscopes Market, by Application

- Otoscopes Market, by Region

- Otoscopes Market, by Group

- Otoscopes Market, by Country

- United States Otoscopes Market

- China Otoscopes Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Strategic Imperatives and Market Dynamics to Chart a Clear Roadmap for Leaders in the Otoscope Sector

This executive summary has mapped a rapidly evolving market, from the profound technological advancements in illumination and imaging through the persistent challenges and opportunities presented by tariff fluctuations. We have explored how segmentation by product, end user, technology, channel, portability, and application yields nuanced insights critical for strategic positioning. Regional analyses have highlighted where growth is being most vigorously pursued, while competitive evaluations have illuminated the paths forged by both established and emerging players.

As healthcare continues its digital transformation, the otoscope market stands at the vanguard of diagnostic innovation. The ability to harness data, navigate regulatory complexity, and adapt to shifting clinical workflows will determine which organizations lead the next wave of growth. By applying the recommendations provided, industry participants can anticipate change and chart a course that not only meets current market demands but also defines the future contours of ear health diagnostics.

Engage Directly with Our Associate Director to Unlock Detailed Insights and Acquire the Full Otoscope Market Research Report

If this comprehensive analysis resonates with your strategic objectives and you are ready to take the next step, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through our detailed report, help tailor insights to your priorities, and facilitate seamless access to the full market intelligence package. Connect with him to gain exclusive insights and actionable data that will empower your organization to stay ahead of the curve in the evolving otoscope market landscape. Secure your copy of the market research report today and position your business for informed decision-making and sustained competitive advantage.

- How big is the Otoscopes Market?

- What is the Otoscopes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?