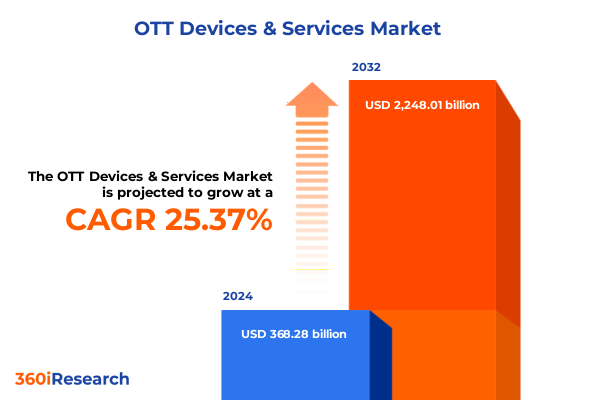

The OTT Devices & Services Market size was estimated at USD 459.28 billion in 2025 and expected to reach USD 572.78 billion in 2026, at a CAGR of 25.46% to reach USD 2,248.01 billion by 2032.

Exploring the Dynamic Interplay of Technological Innovation Consumer Behavior and Market Forces in the Evolving Over-the-Top Devices and Services Ecosystem

In an era defined by relentless technological progress and shifting consumer preferences, the over-the-top devices and services ecosystem stands at an unprecedented crossroads. Emerging network capabilities, evolving content formats, and a growing appetite for on-demand experiences have converged to reshape the ways audiences access, consume, and interact with digital entertainment. As media fragmentation deepens, traditional distribution models give way to a horizontal landscape in which devices, platforms, and content interconnect across boundaries that once separated screens and services. Consequently, stakeholders ranging from hardware manufacturers to content aggregators and advertisers must recalibrate strategies to align with this fluid environment.

Against this backdrop of rapid change, an executive summary offers a critical compass for decision-makers aiming to navigate complexity and identify high-impact opportunities. By synthesizing the latest technological innovations, regulatory shifts, and consumer behaviors, this overview foregrounds the imperatives that will define competitive differentiation in the coming years. It emphasizes not only the transformative shifts underway but also the strategic lens through which industry participants can anticipate disruption, mitigate risk, and unlock long-term value. As such, the introduction sets the stage for a rigorous journey through market dynamics, offering a concise yet robust foundation for informed action within the OTT devices and services space.

Unveiling the Pivotal Transformations in Content Delivery User Engagement and Monetization Redefining the OTT Devices and Services Landscape

Over the past decade, the OTT devices and services ecosystem has experienced tectonic realignments that continue to redefine how content is delivered and monetized. The advent of high-speed broadband and 5G connectivity has accelerated the shift from linear broadcasting to IP-based streaming, empowering consumers to engage with media on their own terms and schedules. Concurrently, advancements in artificial intelligence and data analytics have unlocked new possibilities for personalized content discovery and recommendation engines, ensuring that audiences receive highly relevant programming tailored to their preferences.

Innovation in hardware has equally catalyzed market transformation. Leading manufacturers have integrated smart capabilities into televisions, gaming consoles, and streaming media players, blurring the lines between home entertainment and interactive experiences. Similarly, the ubiquity of smartphones and tablets has established these handheld devices as primary gateways for video-on-demand, live streaming, and music services. As a result, competition for consumer attention has intensified, prompting service providers to innovate through value-added features-such as offline playback, multi-screen synchronization, and immersive audio formats-to secure loyalty and increase average revenue per user.

Amid these technical advances, shifting content paradigms have reconfigured revenue structures. Subscription models coexist alongside ad-supported tiers, microtransactions, and premium event offerings, signaling a departure from one-size-fits-all monolithic packages. This pluralistic approach to monetization reflects an industry in search of balance between accessibility and profitability, challenging incumbents to refine go-to-market strategies with agility and precision.

Assessing the Aggregate Effects of 2025 United States Tariff Policies on Supply Chains Manufacturing Costs and Competitive Dynamics in the OTT Device Sector

In 2025, a new chapter of complexity emerged as the United States implemented targeted tariffs on imported electronic components and finished hardware integral to OTT device manufacturing. These measures aimed to bolster domestic production, but they have also introduced nuanced ripple effects across global supply chains. Manufacturers reliant on overseas assembly have faced elevated input costs, prompting a recalibration of build strategies and vendor negotiations. As procurement costs climbed, many downstream stakeholders absorbed portions of the increases, resulting in modest price adjustments for end consumers and compressing margins for device makers and platform operators alike.

Beyond manufacturing expenses, the tariffs have reshaped competitive dynamics among international and domestic players. Companies with vertically integrated production capabilities have been better positioned to mitigate cost pressures, while those reliant on third-party assemblers in tariff-sensitive jurisdictions have encountered headwinds. In response, several firms have accelerated onshoring initiatives or diversified their manufacturing footprints across markets with more favorable trade accords, seeking to preserve operational resilience and cost efficiency. As supply chain architectures evolve, partnerships between device producers, component suppliers, and logistics providers have grown increasingly strategic, emphasizing agility and regulatory foresight.

Despite these challenges, the broader industry has leveraged the tariff-driven moment to reevaluate sourcing practices and invest in advanced manufacturing technologies. From robotics-enabled assembly lines to modular component designs that facilitate regional customization, the cumulative impact of U.S. tariff policies has catalyzed a wave of supply chain innovation. The resulting landscape underscores the importance of strategic planning and cross-functional collaboration to navigate rising trade barriers and sustain long-term growth.

Deriving Strategic Insights from Device Service Content Revenue and End User Segmentation Influencing Growth Trajectories in the OTT Market

A deep dive into segmentation reveals critical drivers and nuanced performance trends across device categories, content offerings, and revenue models. When examined by device type-including gaming consoles, laptops and PCs, set-top boxes, smart televisions, smartphones and tablets, and streaming media players-it becomes clear that consumer preferences vary substantially by age cohort and usage scenario. Younger demographics gravitate toward mobile-first platforms and gaming consoles for interactive entertainment, while family units often favor smart TVs and set-top boxes for shared viewing experiences. Streaming media players continue to gain traction as cost-effective upgrade paths for legacy television sets, signaling that device affordability and ease of integration will remain decisive factors in the years ahead.

Similarly, service type segmentation highlights evolving consumption behaviors across live streaming, OTT music streaming, and video-on-demand. The resurgence of live sports and event broadcasting has driven renewed interest in live streaming offerings, prompting service providers to invest in low-latency delivery and interactive features such as live polls and integrated social feeds. Concurrently, music and audio streaming platforms have embraced podcast and audiobook extensions, broadening engagement and diversifying revenue streams. Video-on-demand services, buoyed by exclusive original programming and franchise expansions, continue to command significant mindshare, yet they face mounting pressure to differentiate through content quality and user experience innovations.

Content type segmentation further underscores these dynamics across movies, music and audio, sports, and television shows. While movies remain a staple driver of subscription sign-ups, episodic television has emerged as the linchpin of binge-watch culture, with cliffhanger-driven series generating sustained engagement and community discourse. Sports rights, long a lucrative but capital-intensive proposition, have spurred the adoption of hybrid monetization, blending subscription tiers with premium pay-per-view events. In contrast, music and audio content benefit from pervasive usage in both residential and commercial contexts, reinforcing their status as foundational segments within a diversified service portfolio.

Revenue source segmentation illuminates the tension between accessibility and monetization, as advertising-based video-on-demand, subscription video-on-demand, and transactional video-on-demand each occupy distinct strategic positions. AVOD offerings cater to price-sensitive audiences and advertisers seeking targeted inventory, SVOD maintains its status as the primary engine for subscriber growth, and TVOD accommodates episodic or event-specific purchases, driving incremental transactional income. End user segmentation draws a clear distinction between commercial consumers-encompassing environments such as airports, hotels, and restaurants-and residential subscribers. Commercial deployments demand robust enterprise management and content licensing agreements, while residential adoption hinges on seamless setup experiences, bundled incentives, and loyalty programs that foster retention.

This comprehensive research report categorizes the OTT Devices & Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Service Type

- Content Type

- Revenue Source

- End User

Comparing Regional Variations Across the Americas Europe Middle East Africa and Asia Pacific Driving Diversification in OTT Device and Service Consumption

Distinct regional contours define the global OTT devices and services market, with each geography exhibiting unique adoption drivers and competitive landscapes. Within the Americas, high broadband penetration and mature streaming ecosystems have propelled a race for subscriber expansion and content localization. Market leaders continuously refine their platforms to align with regional language preferences and cultural nuances, while smaller players explore niche content verticals to carve out defensible positions. North America, in particular, remains a bellwether for technological trial and uptake, setting precedents for interface design, interactive feature rollouts, and hybrid monetization experiments.

Across Europe, the Middle East, and Africa, regulatory diversity and varying infrastructure maturity present a complex tapestry of opportunities and challenges. Western Europe’s developed markets showcase advanced converged offerings that integrate live television with OTT on unified user interfaces, whereas many regions in the Middle East and Africa are in the early stages of both network expansion and digital adoption. In these emerging markets, affordable hardware, flexible payment models, and locally relevant content serve as catalysts for initial growth. Cross-border streaming has also stimulated content exchange, underscoring the potential for pan-regional licensing agreements that balance global scale with localized appeal.

The Asia-Pacific region encapsulates the broadest spectrum of market maturity, from highly sophisticated urban centers in East Asia to nascent streaming communities in parts of South and Southeast Asia. Mobile-first consumption is particularly pronounced, driven by widespread smartphone usage and the popularity of short-form video platforms. Moreover, local champions have leveraged deep content libraries and integrated super-app functionalities to solidify their market position. At the same time, international service providers maintain a strong presence through strategic partnerships and co-production ventures that align global franchises with regional storytelling traditions. This dynamic environment fosters continuous innovation in content delivery, payment integration, and user engagement methodologies.

This comprehensive research report examines key regions that drive the evolution of the OTT Devices & Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Initiatives from Leading Players Shaping the Competitive Landscape of OTT Devices and Services

Several key players have emerged at the forefront of shaping the competitive tableau in OTT devices and services by aligning technological leadership with strategic partnerships and content investments. A leading consumer electronics manufacturer has leveraged its extensive distribution channels and integrated operating environment to drive mass adoption of smart televisions and streaming media players, emphasizing seamless voice control and IoT interoperability. Meanwhile, a dominant e-commerce and cloud services provider has expanded its subscription offering into original content production, harnessing data analytics to refine algorithmic recommendations and drive higher engagement metrics.

In the software arena, a major mobile operating system developer has deepened its foothold by pre-installing proprietary streaming applications on smartphones and tablets, forging alliances with telco operators to bundle subscription credits. A global search and advertising giant continues to invest in a tailored streaming stick, optimizing its recommendation engine to capture viewer behavior across both free and premium tiers. Furthermore, specialized gaming console vendors have differentiated through interactive entertainment ecosystems, incorporating live game streaming and community features to extend user dwell time and broaden service monetization beyond traditional subscription revenues.

Emerging disruptors have also demonstrated agility by targeting niche segments with curated content libraries, gamified engagement features, and flexible payment structures. These newer entrants often partner with local content creators and venue operators to serve commercial deployments such as hospitality and travel hubs, thereby unlocking adjacent revenue streams. Across the board, competitive success hinges on the ability to blend hardware innovation, service versatility, content richness, and data-driven personalization to meet the evolving needs of diverse customer cohorts.

This comprehensive research report delivers an in-depth overview of the principal market players in the OTT Devices & Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akamai Technologies, Inc.

- Alphabet Inc.

- Amazon.com, Inc.

- Apple Inc.

- Bharti Airtel Limited

- Brightcove, Inc.

- BT Group

- Cisco Systems, Inc.

- Crunchyroll LLC by Sony Group Corporation

- EchoStar Corporation

- Freesat Limited

- Gospell Digital Technology Co., Ltd.

- Haivision Inc.

- iQIYI, Inc.

- Kaltura, Inc.

- KWIKmotion

- Microsoft Corporation

- MUBI Inc.

- Netflix, Inc.

- Rakuten Viki

- Roku Inc.

- Setplex LLC

- Tencent Holdings Ltd.

- The Walt Disney Company

- Voot by Viacom18 Media Private Limited

- Warner Bros. Discovery, Inc.

- Wowza Media Systems, LLC

Equipping Industry Leaders with Actionable Strategic Roadmaps to Capitalize on Emerging Opportunities and Mitigate Risks in the OTT Ecosystem

To capitalize on emerging opportunities and mitigate prevailing risks, industry leaders should adopt a multi-pronged strategic agenda that spans technology, content, and commercial execution. First, investing in modular and scalable device architectures will enable rapid feature rollouts and localized customization, ensuring resilience against supply chain disruptions and tariff fluctuations. By integrating artificial intelligence capabilities at the edge, manufacturers can deliver enhanced user experiences such as voice navigation, contextual recommendations, and advanced security measures without overburdening centralized infrastructure.

Second, forging deeper alliances with content creators and network operators can secure differentiated programming and distribution breadth. Co-production partnerships that blend global IP with authentic regional narratives will resonate strongly with local audiences, while tiered monetization structures-balancing ad-supported, subscription, and transactional offerings-allow for agile response to shifting consumer willingness to pay. Additionally, embedding commerce and social features within streaming interfaces can unlock incremental revenue streams and foster community engagement, both in residential and commercial environments.

Finally, operational excellence demands robust data governance frameworks and agile go-to-market processes. Leveraging real-time analytics to track user journeys and content performance empowers continuous optimization of interface designs and promotional campaigns. At the same time, streamlined firmware update mechanisms and remote diagnostics will reduce maintenance overhead for commercial deployments, elevating uptime and guest satisfaction across airports, hotels, and dining establishments. Through this holistic approach, industry leaders can transform insights into tangible growth and sustained competitive advantage.

Detailing the Rigorous Multi-Modal Research Framework Combining Qualitative and Quantitative Techniques Underpinning OTT Device and Service Analysis

This study employs a comprehensive multi-modal research design combining primary and secondary data collection methods to ensure analytical rigor and industry relevance. Primary research comprised in-depth interviews with senior executives across device manufacturers, service providers, content studios, and distribution partners, supplemented by on-site observations of commercial deployments in hospitality and travel venues. These qualitative insights were triangulated with survey data capturing consumer attitudes, device preferences, and service utilization patterns, yielding a nuanced understanding of user behavior and market drivers.

Secondary research involved the systematic review of regulatory filings, tariff schedules, and corporate financial disclosures to assess the implications of the 2025 United States tariff measures on production costs and supply chain architectures. Industry reports, white papers, and patent registries provided further context for technological innovation trends, while public domain statistical databases furnished macroeconomic indicators and digital infrastructure metrics across regions. All data inputs underwent rigorous validation through cross-referencing and anomaly detection protocols to ensure consistency and reliability.

Analytical frameworks were applied to segment the market by device type, service type, content category, revenue model, and end user, enabling targeted benchmarking and trend mapping. Scenario analysis explored potential futures under varying regulatory and technological adoption trajectories, while sensitivity testing quantified the relative impact of key drivers such as tariff shifts and network upgrades. The result is a robust, evidence-based foundation that supports strategic decision-making across diverse stakeholder groups.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our OTT Devices & Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- OTT Devices & Services Market, by Device Type

- OTT Devices & Services Market, by Service Type

- OTT Devices & Services Market, by Content Type

- OTT Devices & Services Market, by Revenue Source

- OTT Devices & Services Market, by End User

- OTT Devices & Services Market, by Region

- OTT Devices & Services Market, by Group

- OTT Devices & Services Market, by Country

- United States OTT Devices & Services Market

- China OTT Devices & Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Strategic Implications to Inform Decision Making in the Fast Evolving OTT Devices and Services Arena

The convergence of rapid technological innovation, evolving consumer behaviors, and shifting regulatory landscapes has created a rich yet complex environment for OTT devices and services. Key takeaways underscore the critical importance of agility in both product development and go-to-market strategies, as stakeholders must continuously adapt to emerging network capabilities, content consumption patterns, and trade policy changes. The segmentation analysis highlights that growth cannot be pursued through a monolithic approach; instead, targeted strategies that address the unique needs of device categories, service types, content genres, revenue streams, and user cohorts will drive sustainable performance.

Regional insights reveal that a one-size-fits-all model is untenable. Success in mature markets depends on differentiated feature sets and localized content, whereas emerging regions demand affordability, flexible payment mechanisms, and infrastructure alignment. Competitive benchmarking illustrates that market leaders excel by blending hardware excellence with service innovation, while disruptors succeed through niche specialization and agile execution. These lessons collectively point to a strategic imperative: leaders must harness data-driven personalization, modular hardware design, and collaborative content partnerships to navigate uncertainty and capture growth.

In essence, the OTT devices and services landscape rewards those who can synthesize market intelligence into decisive action. By integrating the insights and methodologies outlined in this summary, executives are equipped to align investments, partnerships, and product roadmaps with the evolving contours of the global streaming ecosystem, setting the stage for long-term differentiation and value creation.

Engage with Ketan Rohom to Secure Exclusive Market Research That Powers Strategic Growth in OTT Devices and Services

If you’re ready to translate strategic insights into market-leading performance, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your copy of the comprehensive OTT Devices and Services market research report and gain the competitive edge you need to thrive.

- How big is the OTT Devices & Services Market?

- What is the OTT Devices & Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?