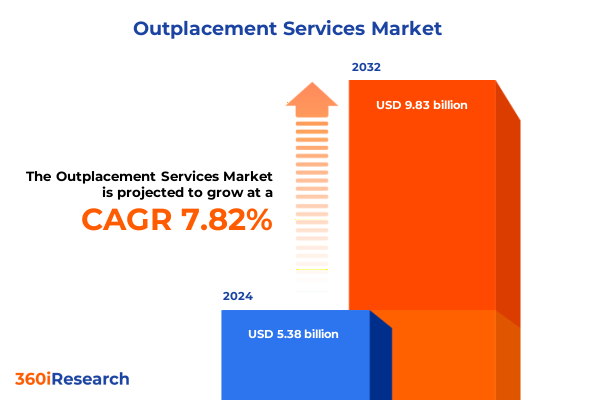

The Outplacement Services Market size was estimated at USD 5.78 billion in 2025 and expected to reach USD 6.22 billion in 2026, at a CAGR of 7.71% to reach USD 9.73 billion by 2032.

Emerging Dynamics Driving Demand for Comprehensive Outplacement Services in a Rapidly Evolving Corporate Transition Environment

In today’s rapidly transforming corporate environment, organizations face unprecedented challenges in supporting talent through periods of transition while maintaining operational resilience and employer brand integrity. As companies navigate geopolitical uncertainties, technological disruptions, and evolving workforce expectations, the demand for structured support mechanisms that guide departing employees toward meaningful next steps has never been greater. Modern outplacement services have evolved far beyond traditional resume distribution; they encompass a holistic suite of offerings designed to enhance skill acquisition, foster personal branding, and equip individuals with the tools to pursue fulfilling career trajectories.

This executive summary provides an overarching view of the forces reshaping the outplacement landscape and highlights critical factors that decision-makers must consider when selecting and implementing these solutions. It underscores the strategic significance of bespoke career transition counseling, data-driven coaching methodologies, and cutting-edge digital platforms in mitigating the human and financial costs of workforce realignments. By understanding these dynamics, leaders can better position their organizations to uphold ethical standards, bolster employee morale during change initiatives, and ultimately reinforce a reputation as an employer of choice in a competitive labor market.

Key Strategic Shifts Shaping the Modern Outplacement Industry Through Technological Innovation, Workforce Diversity, and Economic Resilience Trends

The landscape of career transition support has undergone transformative shifts propelled by digital acceleration, heightened expectations for personalization, and the growing imperative for agility in talent management. Technological innovation has introduced AI-powered career assessments and automated matching engines that streamline job search processes while delivering nuanced insights into transferable skills. Concurrently, the proliferation of remote work has expanded geographic boundaries for both service providers and job seekers, necessitating hybrid delivery models that blend virtual coaching with high-touch, in-person interactions when needed.

Moreover, organizations are placing greater emphasis on inclusive workforce practices, recognizing that tailored outplacement solutions can address unique demographic needs and support diverse employee populations. These changes coincide with increased economic volatility, where forward-thinking companies have adopted proactive reskilling initiatives to anticipate shifts in demand across industry verticals. As a result, the outplacement sector is redefining best practices by integrating cross-functional collaboration among HR, learning and development, and external expert partners to deliver end-to-end transition experiences that are both empathetic and outcome-oriented.

Assessment of How 2025 United States Tariff Policies Are Reshaping Corporate Layoff Strategies Supply Chains and Outplacement Service Demands

In 2025, the cumulative effects of United States tariff policies have exerted a multifaceted influence on corporate restructuring decisions and, by extension, on the demand for outplacement services. Higher input costs in manufacturing and logistics have led many enterprises to recalibrate supply chains and optimize operational footprints, resulting in targeted reductions in workforce segments exposed to tariff volatility. This has amplified the need for comprehensive support programs that assist affected employees in navigating labor market disruptions.

Additionally, the ripple effects of tariff-driven reconfigurations have extended to industries reliant on global value chains, such as technology and automotive, where companies are balancing nearshoring initiatives with strategic headcount adjustments. Consequently, outplacement providers have adapted their offerings to include sector-specific coaching that addresses the complexities of trade policy impacts and cross-border career opportunities. In parallel, organizations are increasingly seeking data analytics capabilities from their outplacement partners to model potential workforce scenarios and align transition investments with broader cost-containment strategies, reinforcing the pivotal role of these services in corporate risk management.

Critical Segmentation Perspectives Revealing How Diverse Client Profiles Influence Tailored Outplacement Solutions Across Multiple Service and Industry Dimensions

Analyzing the breadth of offerings reveals that the market now delivers an integrated spectrum of career transition counseling, interview preparation, job search coaching, resume writing services, skill assessment and enhancement, social media and personal branding, and training and skill development in a cohesive framework. This comprehensive approach ensures that individual needs-whether refining professional narratives, enhancing core competencies, or establishing a digital presence-are met through synchronized delivery.

From an organizational perspective, large enterprises often leverage extensive global platforms that incorporate advanced analytics and dedicated account teams. In contrast, medium and small enterprises prioritize agile providers capable of customizing programs to align with localized workforce dynamics and budget constraints. The choice of service delivery mode-hybrid, in-person, or fully online-further influences client satisfaction, with hybrid solutions emerging as a preferred balance between accessibility and personalized engagement.

Differentiate by service type reveals a dynamic interplay between executive outplacement tailored for senior leaders, group programs designed to support entire departments, and individual packages focused on one-on-one coaching. Corporate clients and individual end users each bring distinct expectations, with organizations seeking scalability and compliance, while personal subscribers value immediacy and depth of mentorship. Industry vertical segmentation underscores the nuanced requirements within banking, financial services, and insurance, education, healthcare, IT and telecommunications, manufacturing, and retail, where regulatory considerations and skill shortages shape the nature and intensity of transition services provided.

This comprehensive research report categorizes the Outplacement Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Delivery Model

- Program Duration

- Service Channel

- End-Users

- Industry Vertical

Regional Demand Dynamics Unveiling Growth Opportunities and Strategic Considerations for Outplacement Services Across Major Global Economic Zones

Regional dynamics illustrate that outplacement demand in the Americas continues to be driven by robust corporate governance frameworks, strong labor protections, and a culture of employer responsibility toward transitioning employees. These factors have supported sophisticated program designs and have encouraged the integration of local job market insights into career transition curricula. Meanwhile, Europe, Middle East and Africa represent a mosaic of regulatory environments and cultural approaches to workforce change, prompting providers to deliver multilingual platforms and region-specific coaching methodologies to address variance in worker rights and labor mobility.

In the Asia-Pacific region, rapid economic growth and digital adoption have accelerated the emergence of online-centric outplacement models that cater to a tech-savvy population eager to upskill and pivot roles swiftly. Governments in several APAC markets have also introduced incentives aimed at enhancing workforce resilience, which in turn has elevated collaboration between public employment services and private sector outplacement firms. As these regional ecosystems evolve, leading providers are forging strategic partnerships with local institutions, crafting programs that not only reflect global best practices but also resonate with cultural expectations and regulatory mandates.

This comprehensive research report examines key regions that drive the evolution of the Outplacement Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Overview Highlighting Market Leading Outplacement Providers Their Strategic Differentiation and Value Propositions Driving Industry Evolution

Within the competitive landscape, a select group of global providers has distinguished itself through the development of proprietary digital platforms that leverage AI-driven career mapping, personalized learning pathways, and predictive job market analytics. These companies invest heavily in technology to ensure seamless user experiences and robust data security, appealing to corporate clients with stringent compliance requirements. At the same time, boutique firms have capitalized on specialized expertise-such as executive coaching or industry-specific placement networks-to deliver high-touch engagement that resonates with niche segments of the market.

Strategic differentiation also emerges from alliances between outplacement specialists and complementary service providers, including LMS developers, assessment tool vendors, and professional networking communities. These partnerships broaden the scope of service offerings, enabling clients to access multi-faceted transition ecosystems. Value propositions are further enhanced by flexible pricing models that accommodate flat-fee arrangements, subscription-based access, and outcome-linked payment structures, reinforcing the critical importance of aligning cost frameworks with client risk appetites and program objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Outplacement Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adecco Group AG

- ManpowerGroup Inc.

- Randstad Enterprise

- Mercer LLC

- Hays PLC

- Korn Ferry

- IMPACT Group by Acosta Inc.

- Challenger, Gray & Christmas, Inc.

- VelvetJobs LLC

- Hudson Global, Inc.

- Career Partners International LLC

- ADP, Inc.

- Agilec

- Airswift Holdings Limited

- Arthur J. Gallagher & Co.

- Canada Career Counselling

- Career Compass Canada

- Career Star Group

- CareerPro Inc.

- Chiumento Limited

- CMS Career Management Solutions Inc.

- Daily Muse Inc.

- Feldman Daxon Partners Inc.

- Gi Group Holding S.p.A.

- Kelly Services Inc.

- Keystone Partners

- Knightsbridge Robertson Surrette

- Talent Inc.

- The Barrett Group

- The Connor Consultancy by NFP UK Group

- Vision India Services Pvt. Ltd.

- Weapply Canada

Strategic Imperatives and Recommendations to Enhance Outplacement Service Efficacy and Drive Sustainable Competitive Advantage in a Disruptive Market

Industry leaders should prioritize investments in advanced analytics capabilities that forecast transition outcomes and guide resource allocation to areas of greatest impact. By harnessing data on job placement rates, time to reemployment, and skill demand trends, organizations can refine program components in real time and demonstrate tangible return on investment. Furthermore, cultivating strategic partnerships with educational institutions, certification bodies, and professional networks enriches content libraries and bolsters the credibility of upskilling modules.

To remain agile, providers must adopt modular delivery architectures that allow clients to mix and match services, from microlearning bursts and virtual mock interviews to peer-to-peer networking cohorts. Coupled with an emphasis on personalized coaching pathways informed by psychometric assessments, this approach fosters deeper engagement and delivers more meaningful career outcomes. Finally, embracing a continuous feedback loop-where participant satisfaction surveys, hiring manager insights, and post-transition performance metrics inform program evolution-ensures that outplacement solutions remain aligned with shifting workforce and market demands.

Robust Research Methodology Integrating Primary Insights Secondary Data Analysis and Rigorous Validation Techniques for Comprehensive Market Intelligence

This report synthesizes insights through a rigorous blend of primary and secondary research methodologies. In-depth interviews with senior HR executives, outplacement service leaders, and industry analysts provided firsthand perspectives on emerging trends, while surveys of program participants yielded quantitative data on satisfaction drivers and outcome metrics. Secondary sources, including corporate disclosures, government labor statistics, and peer-reviewed studies, supplemented the narrative with contextual background and historical benchmarks.

The research process incorporated market triangulation techniques to validate findings, cross-referencing different data sets to ensure consistency and reliability. Quality control measures, such as data cleaning protocols and expert panel reviews, reinforced the credibility of the conclusions drawn. By integrating diverse inputs and applying stringent analytical frameworks, the methodology ensures that the recommendations and insights presented herein reflect both the breadth and depth of the current outplacement services landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Outplacement Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Outplacement Services Market, by Service Type

- Outplacement Services Market, by Delivery Model

- Outplacement Services Market, by Program Duration

- Outplacement Services Market, by Service Channel

- Outplacement Services Market, by End-Users

- Outplacement Services Market, by Industry Vertical

- Outplacement Services Market, by Region

- Outplacement Services Market, by Group

- Outplacement Services Market, by Country

- United States Outplacement Services Market

- China Outplacement Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Executive Summary Conclusion Highlighting Key Insights Reinforcing Strategic Imperatives and Guiding Decision Makers Toward Effective Outplacement Strategies

The consolidation of strategic trends, policy impacts, segmentation analyses, and competitive dynamics underscores the critical role of outplacement services in mitigating transition risks and preserving organizational reputation. As tariff-driven supply chain realignments and technological disruptions continue to reshape labor markets, companies that commit to holistic, data-informed transition programs will emerge as leaders in workforce stewardship.

By leveraging segmentation insights and regional considerations, decision-makers can tailor delivery models to align with corporate cultures, regulatory environments, and employee preferences. Collaboration between HR teams, technology vendors, and educational partners will drive innovation in service design, while a relentless focus on measurable outcomes will validate the value proposition to stakeholders. Ultimately, organizations that embrace these imperatives will cultivate greater resilience, foster positive employer-employee relationships, and achieve a competitive advantage in talent management.

Empower Teams With Outplacement Insights by Procuring an In-Depth Report Through Consultation With Ketan Rohom Associate Director Sales Marketing

To capitalize on the momentum and secure a competitive edge in managing workforce transitions, engage directly with Ketan Rohom Associate Director Sales Marketing to explore an in-depth report tailored to your organization’s specific needs. This consultation provides a customized walk-through of the research findings, offering targeted insights and implementation guidance that align with your strategic priorities and operational realities. By partnering with an experienced advisor, you will gain clarity on how best to deploy outplacement resources, optimize transition programs, and safeguard your employer brand. Reach out today to arrange a personalized briefing that will empower your teams with the knowledge and tools required to navigate talent shifts confidently and effectively.

- How big is the Outplacement Services Market?

- What is the Outplacement Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?