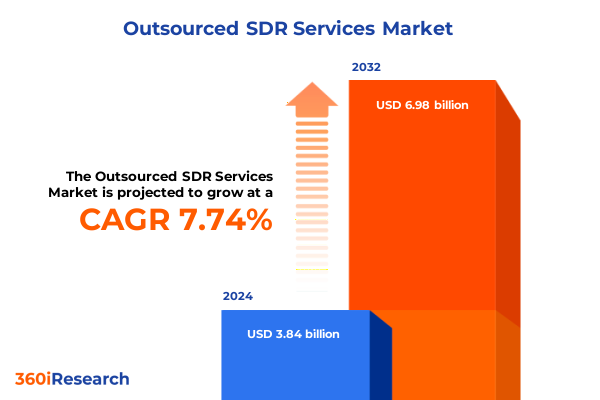

The Outsourced SDR Services Market size was estimated at USD 4.09 billion in 2025 and expected to reach USD 4.42 billion in 2026, at a CAGR of 7.92% to reach USD 6.98 billion by 2032.

Unlocking Sales Growth Through Expert Outsourced SDR Services That Empower Organizations to Scale Prospecting and Drive Revenue Expansion

Outsourced sales development representative services have evolved into a strategic imperative for organizations aiming to accelerate lead generation and amplify revenue pipelines without overextending internal resources. As market dynamics become increasingly complex, sales and marketing teams face mounting pressure to generate high-quality opportunities while managing costs and optimizing talent allocation. These services bridge the gap between top-of-funnel prospecting and middle-of-funnel qualification, enabling companies to maintain focus on core competencies while leveraging specialized expertise in outreach, nurturing, and appointment setting.

The adoption of outsourced SDR solutions is driven by the need for scalability, agility, and access to advanced technologies without large upfront investments. Modern providers deploy integrated platforms combining data management, digital engagement, and telemarketing, backed by performance-based models that align incentives around measurable outcomes. Consequently, business leaders can rapidly adapt to shifting buyer behaviors, emerging communication channels, and evolving compliance requirements.

This executive summary distills key trends, segmentation insights, and regional dynamics shaping the outsourced SDR market. It also offers actionable recommendations for leaders seeking to harness these services effectively, benchmarks competitive landscapes, and outlines the research methodology employed. By presenting a cohesive view of market opportunities and challenges, this section sets the stage for deeper analysis on transformative factors, tariff impacts, and strategic priorities.

Navigating the Evolving Sales Landscape as Digital Transformation and AI Revolutionize Demand Generation and Customer Engagement Strategies

The landscape for sales development is undergoing transformative shifts as digital innovation and evolving buyer expectations redefine prospect engagement strategies. Artificial intelligence and machine learning algorithms now enable predictive lead scoring, hyper-personalized outreach, and dynamic content optimization, driving efficiency gains across the pipeline. At the same time, the proliferation of channels-from email and social media to conversational chatbots-has necessitated omnichannel orchestration, compelling providers to integrate disparate touchpoints into unified workflows.

Furthermore, remote and hybrid work models have altered talent deployment and training methodologies. Outsourced SDR teams are increasingly distributed, supported by virtual collaboration tools and real-time performance dashboards. This shift has democratized access to specialized skill sets, allowing organizations of all sizes to tap into global talent pools while maintaining compliance with data privacy regulations. Consequently, agility in engagement strategies has become a key differentiator, as providers that can rapidly onboard new agents or pivot outreach tactics gain a competitive edge.

In addition, tighter regulations around data security and consent-driven marketing have elevated the importance of ethical outreach practices. Providers are investing in robust governance frameworks and third-party certifications to reassure clients and prospects. Taken together, these transformative trends herald a new era in demand generation, where technological innovation, regulatory stewardship, and buyer-centricity converge to reshape how outsourced SDR services deliver value.

Assessing the Cumulative Effects of 2025 United States Tariff Policies on Outsourced Sales Development Operations and Cost Structures

United States tariff policies implemented in 2025 have had a cumulative impact on outsourced sales development operations, influencing cost structures, vendor strategies, and global resource allocation. Tariffs on imported hardware and communication equipment have prompted providers to reassess technology procurement, leading some to partner with domestic manufacturers or shift deployment models to cloud-native solutions that reduce dependency on physical infrastructure. As a result, capital expenditure burdens have been alleviated, but operating costs have incrementally risen due to altered service pricing dynamics.

Simultaneously, levies on select service contracts have affected offshore outsourcing hubs, where labor arbitrage was a core value proposition. Some providers have absorbed additional charges to maintain competitive pricing, while others have realigned capacity toward nearshore or onshore delivery centers. This realignment has driven investments in training local talent and enhancing platform automation to mitigate rising wage inflation. Consequently, clients are witnessing a subtle shift from purely cost-driven outsourcing toward models that emphasize service quality, transparency, and strategic collaboration.

Moreover, tariff-induced supply chain adjustments have reinforced the case for diversification. Providers are increasingly integrating multi-regional delivery frameworks to hedge against future policy shifts and geopolitical uncertainties. These adaptive measures underscore the resilience of outsourced SDR services, demonstrating that a combination of flexible engagement models and strategic sourcing can offset external economic pressures while preserving performance and growth objectives.

Revealing Actionable Segmentation Insights Driving Market Adoption Across Industry Verticals, Company Sizes, Engagement Models, and Service Offerings

A granular segmentation analysis uncovers how market dynamics vary across industry verticals, company sizes, engagement models, and service types, yielding actionable insights for providers and buyers alike. In banking, financial services, and insurance, performance-based engagement models are gaining traction as firms demand accountability tied directly to qualified lead volumes. Healthcare organizations, meanwhile, prioritize full-time equivalent structures to ensure consistency and compliance in outreach activities, especially when navigating stringent patient privacy regulations. Information technology and telecom companies often favor project-based arrangements when launching new product lines or targeting specialized market segments, leveraging short-term bursts of capacity for maximum flexibility.

Manufacturing firms increasingly rely on robust data management capabilities to maintain accurate prospect databases and streamline territory assignments, while retail ecommerce businesses gravitate toward digital outreach for rapid, personalized customer acquisition. When considering company size, enterprise clients demand end-to-end pipeline management, integrating every stage from appointment setting through opportunity handoff, whereas midmarket firms often segment services into standalone modules, such as lead generation or data cleansing, to align with evolving budgets. Small and medium enterprises typically engage on performance-based or project-based terms, seeking measurable ROI without long-term commitments.

Delving deeper into service types, appointment setting remains a foundational offering, but its efficacy is amplified by seamless data management and pipeline management oversight. Lead generation, bifurcated into digital outreach and telemarketing, underscores the importance of omnichannel strategies: digital channels drive scale and efficiency, while voice-based campaigns deliver deeper engagement and relationship building. These insights highlight the necessity of customizing engagement frameworks to fit each buyer’s unique requirements and growth ambitions.

This comprehensive research report categorizes the Outsourced SDR Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Engagement Model

- Company Size

- End User

Unpacking Regional Dynamics Shaping Outsourced SDR Service Adoption Trends and Growth Patterns Across the Americas, EMEA, and Asia-Pacific Territories

Geographic dynamics exert a profound influence on how organizations adopt and implement outsourced SDR services, reflecting regional business cultures, regulatory landscapes, and economic conditions. In the Americas, the United States and Canada lead adoption, with a mature ecosystem of providers offering sophisticated platforms and premium talent pools. Latin American markets are emerging as strategic nearshore hubs, benefiting from favorable time zones and multilingual capabilities, especially for US-based firms seeking cost-effective yet close-proximity delivery.

Across Europe, Middle East & Africa, Western European economies showcase a preference for high-compliance models, where data sovereignty and GDPR alignment are paramount. Providers in these markets emphasize localized teams and certifications to meet stringent privacy mandates. Meanwhile, Middle Eastern and African enterprises are in earlier stages of outsourcing maturity, prioritizing scalable digital outreach solutions that can be rapidly deployed to support growth in sectors such as financial services and technology.

In the Asia-Pacific region, diverse market maturity levels present both challenges and opportunities. Established economies like Japan and Australia favor integrated pipeline management offerings with deep domain expertise, whereas high-growth markets such as India and Southeast Asia serve as cost-efficient talent pools for global providers. Companies here leverage a blend of automation-driven workflows and manual telemarketing to balance efficiency with personalized engagement. Regulatory nuances, such as data localization requirements in China, further shape delivery architectures, driving hybrid onshore-offshore models that reconcile performance with compliance.

This comprehensive research report examines key regions that drive the evolution of the Outsourced SDR Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Key Market Players and Strategic Differentiators That Define Competitive Leadership in the Outsourced Sales Development Services Ecosystem

The competitive landscape for outsourced sales development services is characterized by a mix of global leaders, specialized boutiques, and emerging challengers, each differentiating through technology, vertical focus, or pricing models. Established multinational providers leverage extensive delivery footprints and proprietary platforms that integrate CRM systems, predictive analytics, and omnichannel outreach capabilities. Their scale enables significant R&D investments, driving continuous enhancements in automation and artificial intelligence.

Conversely, boutique firms carve niches by offering specialized vertical expertise or customized service packages. These agile players excel at rapidly tailoring outreach strategies to vertical-specific buyers, whether in highly regulated industries or emerging markets. Their deep domain knowledge often translates into higher conversion rates and richer qualification outcomes, appealing to midmarket and enterprise segments seeking bespoke solutions.

A third category of mid-tier challengers and innovative startups is disrupting traditional models through flexible pricing structures and platform-agnostic integrations. By offering performance-based engagements and transparent reporting, they attract clients focused on measurable ROI and real-time visibility. Certain emerging providers are piloting blockchain-enabled data verification and decentralized talent networks to enhance trust and scalability. This diversification of provider profiles underscores the importance of aligning strategic priorities with partner capabilities rather than defaulting to lowest-cost options.

This comprehensive research report delivers an in-depth overview of the principal market players in the Outsourced SDR Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AltiSales

- Callbox Inc.

- CIENCE Technologies

- CloudTask

- EBQ

- JumpCrew

- Leadium

- LevelUp Leads

- MarketStar

- Martal Group

- memoryBlue

- Operatix

- Sales Focus Inc.

- Salespanel

- SalesRoads

- Social Bloom

- The Sales Factory

Strategic Recommendations for Executives to Leverage Market Trends, Optimize Resource Allocation, and Enhance Sales Pipeline Performance Through Outsourced Services

To navigate the evolving outsourced SDR landscape successfully, industry leaders should adopt a series of strategic initiatives that leverage both market trends and organizational strengths. First, investing in predictive analytics and artificial intelligence technologies can significantly enhance lead scoring accuracy and outreach personalization, enabling teams to focus on high-propensity prospects. Simultaneously, adopting a diversified engagement model portfolio-ranging from full-time equivalent to performance-based and project-based structures-allows companies to optimize resource allocation based on campaign objectives and budget considerations.

Furthermore, strengthening data governance frameworks and ensuring compliance with global privacy regulations will be critical as regulatory scrutiny intensifies. Establishing clear protocols for data handling, consent management, and security audits builds client trust and mitigates legal risks. In parallel, developing vertical-specific capabilities-such as dedicated teams for banking, healthcare, and retail ecommerce-enables providers to deliver domain-rich insights and tailored messaging that resonate with target audiences.

Additionally, forging strategic partnerships with technology vendors and co-innovation with clients can accelerate service differentiation. By co-developing custom tooling or integration connectors, organizations can streamline workflows and drive mutual value. Finally, implementing agile contract terms that facilitate rapid scaling up or down ensures resilience in the face of economic fluctuations and policy shifts. Taken together, these recommendations offer a roadmap for executives aiming to extract maximum value from outsourced SDR investments.

Detailing a Rigorous Research Methodology Combining Primary Interviews, Quantitative Surveys, and Data Triangulation for Unbiased Market Intelligence

The findings presented in this report are grounded in a rigorous research methodology designed to deliver reliable and unbiased market intelligence. Primary research formed the cornerstone of our approach, incorporating in-depth interviews with senior decision-makers, sales leaders, and service providers across diverse industry verticals. These qualitative conversations provided nuanced perspectives on adoption drivers, operational challenges, and innovation priorities.

Complementing these insights, a comprehensive quantitative survey was conducted with a broad sample of buyers and vendors, capturing statistical data on engagement models, service preferences, and regional deployment strategies. The survey instrument was meticulously crafted to ensure representativeness across enterprise, midmarket, and small and medium enterprise segments. To bolster data integrity, responses underwent multiple rounds of validation and consistency checks.

Secondary research efforts involved analyzing company disclosures, press releases, industry white papers, and technology partner documentation to contextualize primary findings and identify emerging trends. Data triangulation was achieved by cross-referencing multiple sources to reconcile discrepancies and confirm key insights. Finally, internal review workshops with subject matter experts and charting exercises ensured that the final deliverables accurately reflect current market realities and future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Outsourced SDR Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Outsourced SDR Services Market, by Service Type

- Outsourced SDR Services Market, by Engagement Model

- Outsourced SDR Services Market, by Company Size

- Outsourced SDR Services Market, by End User

- Outsourced SDR Services Market, by Region

- Outsourced SDR Services Market, by Group

- Outsourced SDR Services Market, by Country

- United States Outsourced SDR Services Market

- China Outsourced SDR Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Core Findings to Provide a Clear Vision of How Outsourced SDR Services Will Evolve and Drive Business Outcomes in the Near Future

The evolution of outsourced SDR services is reshaping how organizations approach demand generation, lead qualification, and pipeline acceleration. Transformative shifts driven by digital innovation, AI-powered personalization, and omnichannel orchestration underscore the growing sophistication of sales development strategies. Meanwhile, the cumulative effects of 2025 tariff policies have prompted providers and buyers to reexamine cost structures, supply chain dependencies, and delivery models to maintain competitiveness and resilience.

Segmentation and regional analyses reveal that market preferences vary significantly based on industry vertical, company size, engagement model, and geographic considerations. Leaders who tailor their approaches to these nuanced dynamics gain a strategic advantage, whether by deploying performance-based frameworks in financial services, ensuring GDPR-compliant delivery in EMEA, or leveraging nearshore talent in the Americas. The competitive arena continues to diversify, with global incumbents, specialized boutiques, and agile challengers each contributing unique value propositions.

By adhering to the actionable recommendations outlined, industry executives can harness predictive technologies, cultivate vertical expertise, and implement flexible contracting models that align costs with outcomes. Ongoing monitoring of regulatory developments, buyer behaviors, and technological advancements will be essential to sustaining momentum. Ultimately, this report provides a comprehensive foundation for decision-makers to navigate uncertainty, capitalize on emerging opportunities, and accelerate sales growth through outsourced SDR services.

Engage with Our Associate Director to Access Comprehensive Market Research Insights and Elevate Your Outsourced SDR Strategy Today

To explore how these insights can transform your sales development approach and gain exclusive access to comprehensive data, contact Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the full market research report. Ketan can guide you through report features, customization options, and strategic consultations designed to align findings with your organizational priorities. Take decisive action today to leverage the latest intelligence on outsourced SDR services and drive measurable growth across your pipeline.

- How big is the Outsourced SDR Services Market?

- What is the Outsourced SDR Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?