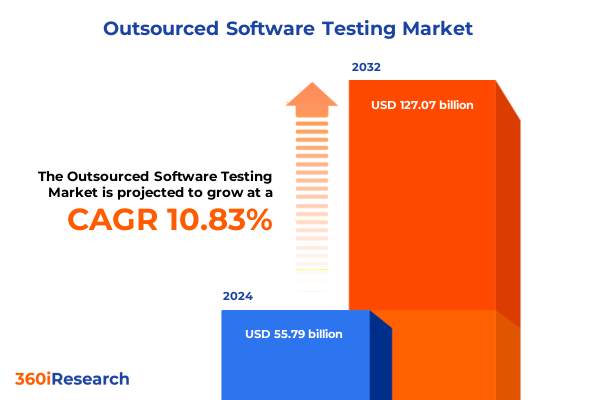

The Outsourced Software Testing Market size was estimated at USD 61.85 billion in 2025 and expected to reach USD 68.10 billion in 2026, at a CAGR of 10.83% to reach USD 127.07 billion by 2032.

Uncovering the Strategic Importance and Rising Demand for Outsourced Software Testing in an Era of Digital Complexity and Accelerated Product Release Cycles

Outsourced software testing has emerged as a strategic imperative for organizations navigating the complexities of digital transformation, rapid release cadences, and heightened expectations for software reliability. As enterprises accelerate product development timelines, in-house testing teams often face resource constraints, skills gaps, and mounting pressure to maintain quality. Outsourcing testing functions offloads operational burdens and enables specialist providers to leverage dedicated expertise, cutting-edge tools, and scalable testing environments. These partnerships allow businesses to focus on core competencies while ensuring thorough validation of features across diverse use cases.

Moreover, the proliferation of cloud-native architectures, mobile applications, and connected devices has increased the surface area for potential defects, reinforcing the need for specialized testing strategies. By engaging external testing partners, organizations gain access to advanced automation frameworks, specialized security testing protocols, and performance environments that mirror real-world user scenarios. The resulting synergy between internal product teams and testing specialists fosters continuous quality assurance, mitigates release risks, and drives customer satisfaction. In this context, outsourced software testing transcends a cost-containment measure to become a catalyst for innovation and speed to market.

Embracing Technological Innovations and Methodological Overhauls That Are Redefining the Paradigm of Outsourced Software Testing Delivery and Outcomes

The landscape of outsourced software testing is undergoing fundamental shifts driven by the integration of emerging technologies and progressive development methodologies. Artificial intelligence and machine learning are augmenting traditional test automation by enabling predictive analytics, intelligent test case generation, and adaptive testing algorithms. As a result, providers are transitioning from static script-based frameworks toward dynamic, self-learning platforms capable of optimizing test suites in real time. Concurrently, the shift-left paradigm is gaining traction, embedding testing activities earlier in the software development lifecycle to uncover defects sooner and reduce remediation costs.

In parallel, the adoption of continuous integration and continuous delivery pipelines demands that testing processes evolve to support rapid, iterative deployments. Testing specialists are embedding quality gates within automated workflows, ensuring that each code change passes rigorous performance, security, and compatibility validations before promotion. Furthermore, remote and distributed team models have accelerated the adoption of cloud-based testing labs, enabling geographically dispersed resources to collaborate seamlessly. Collectively, these transformative shifts are redefining the expectations for both clients and providers, emphasizing agility, intelligence, and end-to-end accountability in outsourced testing engagements.

Assessing the Broad-Spectrum Effects of 2025 United States Trade Tariffs on the Operational Dynamics and Cost Structures of Outsourced Software Testing Providers

The imposition of new United States trade tariffs in 2025 has exerted a cumulative influence on the cost structures and operational dynamics of outsourced software testing providers. With levies affecting both hardware imports destined for testing labs and certain categories of software services, providers have experienced incremental increases in overall delivery expenses. These added costs have prompted strategic realignments, including renegotiating vendor contracts, optimizing procurement channels, and migrating testing infrastructure to tariff-exempt jurisdictions or cloud platforms to minimize duty exposure.

As service costs have evolved, providers have had to balance price adjustments with competitive pressures and client budget constraints. Consequently, some testing specialists have expanded nearshore delivery hubs in Mexico and Central America, where labor costs remain favorable and tariff impacts are limited. Others have intensified the use of cloud-native testing infrastructure, leveraging global data center footprints to bypass hardware duties while scaling capacity on demand. Clients, in turn, have adapted by diversifying their provider portfolios, emphasizing transparent cost breakdowns and value-added capabilities when selecting outsourced testing partners.

Deriving Actionable Market Intelligence from Multidimensional Segmentation of Service Types, Delivery Models, Technologies, Engagement Modes, and End Users

Insights derived from a multidimensional segmentation of the outsourced software testing market reveal nuanced demand patterns and service preferences. Providers specializing in functional testing continue to attract clients seeking robust validation of business-critical features, while performance testing services see heightened uptake from organizations prioritizing user experience under peak loads. Security testing remains a critical component for enterprises handling sensitive data, driving engagements dedicated to vulnerability assessments and penetration testing. Meanwhile, test automation has matured into a de facto requirement for iterative development models, and usability testing garners increasing attention to ensure seamless customer interactions.

In terms of delivery models, managed services arrangements have become the preferred route for end users desiring end-to-end accountability and predictable service levels, whereas staff augmentation appeals to teams requiring rapid scalability and targeted skill infusion. Project-based engagements remain prevalent for well-defined testing scopes or time-bound initiatives. On the technology front, cloud applications dominate testing volumes, supported by infrastructure, platform, and software as a service variants. Mobile application testing continues to diversify across Android, cross-platform, and iOS environments, while embedded systems and web applications each retain strategic significance in specialized industries. Testing stages vary from early unit and integration tests to comprehensive system and user acceptance assessments, reflecting the importance of continuous validation throughout development. Engagement models span hybrid, offshore, and onsite formats, enabling tailored resource allocations. End-user industries from automotive to retail exhibit distinct testing requirements, with banking, capital markets, and insurance driving rigorous compliance checks, and hospitals, clinics, and pharmaceuticals demanding stringent regulatory validations. Large enterprises leverage extensive testing portfolios to safeguard brand reputation, while small and medium enterprises focus resources on critical application scenarios to optimize quality within limited budgets.

This comprehensive research report categorizes the Outsourced Software Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Delivery Model

- Technology

- Testing Stage

- Engagement Model

- End-User Industry

- Organization Size

Analyzing Geographic Trends and Regional Nuances Shaping the Demand, Delivery Strategies, and Regulatory Considerations for Outsourced Testing Worldwide

Regional dynamics in outsourced software testing are shaped by varying stages of digital maturity, regulatory frameworks, and talent ecosystems. In the Americas, the United States leads demand driven by sophisticated adoption of cloud-native architectures, continuous delivery workflows, and stringent data privacy laws. Canada has emerged as a growth frontier for nearshore testing hubs, combining proximity with bilingual resources to serve North American markets efficiently. Latin American countries such as Brazil and Colombia present emerging opportunities, bolstered by government incentives and investments in technology skills development.

Europe, the Middle East, and Africa exhibit a mosaic of testing practices influenced by diverse regulatory regimes and industry sectors. Western European nations maintain strong demand for security and compliance testing within finance and healthcare verticals, while Eastern European hubs offer cost-competitive talent pools and thriving developer communities. The Middle East accelerates digitization initiatives, driving requirements for performance and customer experience testing, particularly in e-commerce and government services. Africa’s testing landscape, though nascent, benefits from increasing internet penetration, the rise of fintech solutions, and ongoing investments in digital infrastructure. In the Asia-Pacific region, mature markets such as Japan, Australia, and South Korea show robust demand for advanced testing services, while China and India continue to lead in volume-based engagements supported by expansive talent pools. Southeast Asian economies, including Vietnam and the Philippines, are intensifying partnerships with global providers, leveraging cultural affinity and cost efficiencies to capture a growing share of outsourced testing mandates.

This comprehensive research report examines key regions that drive the evolution of the Outsourced Software Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Service Providers and Emerging Specialists Driving Innovation, Competitive Differentiation, and Collaborative Ecosystems in Software Testing

Leading global testing providers differentiate through comprehensive service portfolios, strategic alliances, and investments in automation and security platforms. Established system integrators have expanded their QA practices by acquiring niche testing specialists and integrating test automation toolchains into enterprise DevOps ecosystems. Concurrently, pure-play testing firms have forged partnerships with technology vendors to embed testing accelerators within popular CI/CD tools, enhancing speed and coverage. Security-focused providers have capitalized on escalating cyber threats by developing specialized threat modeling and ethical hacking offerings, often collaborating with cybersecurity software vendors for seamless integration.

Emerging companies are carving out distinct market positions by targeting vertical niches or offering modular testing solutions that cater to agile teams. These firms emphasize co-innovation models, inviting clients to participate in prototype testing labs and pilot programs that validate new methodologies. Some mid-tier specialists focus exclusively on user experience and accessibility testing, leveraging behavioral analytics and real-user monitoring to deliver insights that transcend traditional functional validations. Together, these diverse provider archetypes drive competitive intensity and foster continual innovation in service delivery, tool development, and partnership ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Outsourced Software Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- BrowserStack Pvt Ltd

- Capgemini SE

- Cigniti Technologies Limited

- Cognizant Technology Solutions Corporation

- DXC Technology Company

- HCL Technologies Limited

- ImpactQA Services Private Limited

- Infosys Limited

- International Business Machines Corporation

- KiwiQA Services Private Limited

- Original Software

- Qualitest India Private Limited

- RTTS Real-Time Technology Solutions, Inc.

- Softtek S.A. de C.V.

- Tata Consultancy Services Limited

- TestFort Group

- TestingXperts Private Limited

- Testlio OÜ

- Wipro Limited

Implementing Strategic Imperatives and Operational Best Practices to Elevate Testing Quality, Accelerate Time to Market, and Maximize Cost Efficiency

Industry leaders should prioritize the integration of advanced test automation and intelligent analytics to accelerate testing cycles while maintaining thorough coverage. By investing in AI-driven frameworks that generate predictive risk assessments and adaptive test scripts, organizations can minimize manual intervention and focus on edge-case scenarios that demand human insight. Additionally, establishing a continuous testing culture-where quality gates are embedded within development pipelines-ensures that feedback loops remain tight and defects are addressed at their inception.

Moreover, expanding hybrid delivery models that blend offshore efficiencies with nearshore proximity can optimize costs without sacrificing responsiveness. Cultivating deep partnerships with cloud service providers enables scalable test environments free from heavy capital expenditure, thereby enhancing agility. Leaders should also reinforce cybersecurity and performance testing capabilities to address evolving threat landscapes and user expectations. Finally, investing in workforce development-through upskilling programs in automation, security, and DevOps methodologies-will fortify organizational resilience and position teams to adapt swiftly to emerging testing paradigms.

Applying a Robust, Multiphase Research Framework Incorporating Primary Interviews, Secondary Analysis, and Methodological Validation for Accurate Market Insights

This research applies a rigorous, multistage methodology to ensure comprehensive and reliable market insights. Primary data collection involved structured interviews with senior QA managers, testing service leaders, and IT executives across key industries. These engagements provided firsthand perspectives on evolving requirements, service expectations, and investment priorities. Concurrently, secondary data sources-including industry journals, practitioner forums, and public financial disclosures-were analyzed to validate trends and contextualize strategic shifts.

Data triangulation was achieved through cross-verification of primary inputs with secondary research findings, ensuring consistency in observed patterns. Qualitative insights were supplemented by case study reviews to illustrate successful testing transformations and best-practice deployments. To uphold analytical integrity, all findings underwent peer review by subject matter experts, and methodological assumptions were documented transparently. This structured approach delivers a balanced and nuanced understanding of the outsourced software testing landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Outsourced Software Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Outsourced Software Testing Market, by Service Type

- Outsourced Software Testing Market, by Delivery Model

- Outsourced Software Testing Market, by Technology

- Outsourced Software Testing Market, by Testing Stage

- Outsourced Software Testing Market, by Engagement Model

- Outsourced Software Testing Market, by End-User Industry

- Outsourced Software Testing Market, by Organization Size

- Outsourced Software Testing Market, by Region

- Outsourced Software Testing Market, by Group

- Outsourced Software Testing Market, by Country

- United States Outsourced Software Testing Market

- China Outsourced Software Testing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesizing Critical Findings and Emphasizing the Imperative for Continuous Innovation and Strategic Adaptation in Outsourced Software Testing

The evidence presented underscores that outsourced software testing has evolved far beyond a cost arbitrage strategy; it is now a strategic enabler of quality, innovation, and speed. Providers and clients that embrace intelligent automation, continuous validation, and flexible delivery models are best positioned to navigate an increasingly complex software ecosystem. Regional distinctions and tariff-driven cost pressures have prompted creative adaptations in infrastructure and sourcing, highlighting the importance of agility and strategic foresight.

As the market continues to mature, organizations must remain vigilant to emerging technologies, shifting regulatory landscapes, and evolving user expectations. By leveraging the insights detailed throughout this report-spanning segmentation nuances, regional dynamics, and provider capabilities-stakeholders can craft informed strategies that safeguard quality while supporting rapid innovation. Ultimately, the confluence of technology evolution, methodological rigor, and strategic partnerships will define the next chapter of outsourced software testing excellence.

Engage with Ketan Rohom to Secure Comprehensive Market Intelligence and Tailored Strategic Guidance for Outsourced Software Testing Investments

We invite decision makers eager to harness a deep understanding of outsourced software testing to reach out for an exclusive engagement with Ketan Rohom, Associate Director, Sales & Marketing. This direct discussion offers an opportunity to explore tailored options, obtain complementary insights into emerging trends, and clarify how the comprehensive report can address your organization’s unique challenges. Our meticulous approach ensures that each strategic recommendation aligns with your business objectives and operational realities.

Schedule a personalized consultation today to unlock access to proprietary data, case examples, and advanced implementation frameworks. Partnering with Ketan Rohom guarantees not only a detailed briefing on the full research deliverable but also guidance on maximizing return on investment and integrating leading practices into your quality assurance operations. Secure your competitive advantage by acting now to acquire the definitive market research report on outsourced software testing.

- How big is the Outsourced Software Testing Market?

- What is the Outsourced Software Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?