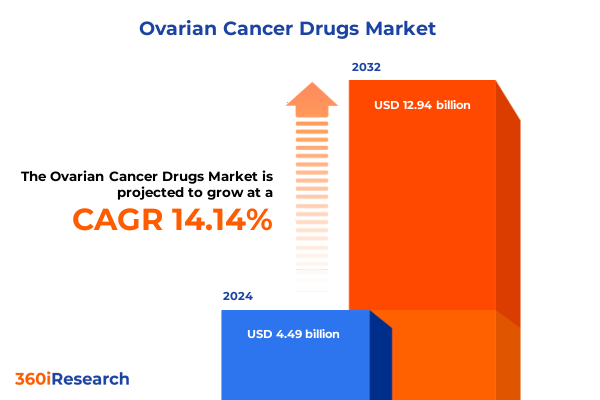

The Ovarian Cancer Drugs Market size was estimated at USD 5.13 billion in 2025 and expected to reach USD 5.80 billion in 2026, at a CAGR of 14.12% to reach USD 12.94 billion by 2032.

Understanding Ovarian Cancer Drug Landscape with Insights into Prevalence Challenges and the Urgent Need for Innovative Therapies

The burden of ovarian cancer remains significant despite gradual declines in incidence and mortality rates over recent decades. In 2025, the American Cancer Society projects approximately 20,890 new cases of ovarian cancer in the United States, with an estimated 12,730 women succumbing to the disease, underscoring its status as one of the deadliest gynecologic malignancies facing women today. Although death rates have decreased by over 43% since 1976 due to advances in treatment and early detection efforts, the disease still claims more lives than any other cancer of the female reproductive system.

Ovarian cancer’s clinical complexity is reflected in its diverse histologic subtypes, which drive variations in prognosis and therapeutic response. Epithelial ovarian cancer accounts for over 95% of all ovarian malignancies and is further subdivided into high-grade serous, low-grade serous, endometrioid, mucinous, and clear cell variants, each with distinct molecular characteristics and treatment pathways. Less common subtypes, including germ cell tumors, small cell ovarian cancers, and stromal cell tumors, together comprise the remaining 5% of cases and often require specialized therapeutic approaches rooted in fertility preservation and hormonal modulation strategies. The predominance of late-stage diagnoses, coupled with high rates of recurrence, highlights the urgent need for innovative therapies and robust diagnostic tools to improve patient survival and quality of life.

Revolutionary Advances in Targeted Therapies Antibody-Drug Conjugates Immunotherapies and Precision Medicine Are Reshaping Ovarian Cancer Treatment

The treatment paradigm for ovarian cancer has shifted dramatically from reliance solely on cytotoxic chemotherapy to a more nuanced, precision-driven approach. Poly(ADP-ribose) polymerase (PARP) inhibitors have emerged as seminal targeted agents, exploiting defects in DNA damage repair pathways to induce tumor cell death. Olaparib, the first-in-class PARP inhibitor, received FDA approval for maintenance therapy in platinum-sensitive recurrent ovarian cancer following clinical trials demonstrating a median progression-free survival of 19.1 months compared to 5.5 months with placebo. Subsequent approvals have expanded its indications based on homologous recombination deficiency status, cementing PARP inhibitors as foundational in maintenance regimens for high-grade epithelial ovarian cancer.

Antibody-drug conjugates (ADCs) are redefining targeted delivery by coupling monoclonal antibodies with potent cytotoxic payloads. The approval of mirvetuximab soravtansine (Elahere) in March 2024 for folate receptor alpha-positive platinum-resistant epithelial ovarian cancer marked the first ADC in this setting, offering a survival benefit over traditional therapies while reducing off-target toxicity. The ADC approach not only delivers chemotherapy directly to tumor cells but also holds promise for expanding into earlier lines of treatment and combination therapies as research explores novel linker technologies and payloads.

Immunotherapy, once limited by modest single-agent response rates in ovarian cancer, is gaining traction through synergistic combinations. The Phase 3 KEYNOTE-B96 trial demonstrated that pembrolizumab in combination with paclitaxel, with or without bevacizumab, achieved statistically significant improvements in progression-free and overall survival in platinum-resistant recurrent ovarian cancer, marking a milestone for checkpoint blockade in this disease. Further, the KEYLYNK-001 trial paired pembrolizumab with chemotherapy followed by maintenance olaparib, reporting a clinically meaningful PFS advantage in BRCA non-mutated advanced ovarian cancer. These advances underscore the momentum behind biomarker-driven immuno-oncology strategies and the potential to integrate multiple targeted modalities into cohesive, patient-centric regimens.

Assessing the Far-Reaching Effects of 2025 United States Tariff Policies on Pharmaceutical Supply Chains and Ovarian Cancer Drug Access

Beginning in April 2025, the United States imposed a broad 10% global tariff on nearly all imported goods, including active pharmaceutical ingredients (APIs) and critical medical technologies, aimed at reshoring production and bolstering domestic manufacturing capacity. Concurrently, reciprocal tariffs as high as 25% on Chinese APIs and 20% on Indian imports have been levied, directly impacting the cost structures of drugmakers that rely on these markets for bulk oncology APIs such as platinum agents and taxanes.

This policy shift has spotlighted the U.S. pharmaceutical industry’s deep dependence on offshore supply chains. Approximately 70% of APIs used in generic drug manufacturing are sourced from China, either directly or via intermediaries in India, creating a vulnerability that ripples through production pipelines. Oncology therapeutics, including paclitaxel and carboplatin, are particularly susceptible, as even marginal increases in raw material costs can disproportionately affect profit margins for both branded and generic manufacturers.

Healthcare stakeholders have voiced concerns about potential drug shortages and price spikes. The American Society of Health-System Pharmacists has requested targeted exemptions for critical APIs and finished medications to avert disruptions in patient care, highlighting that thin profit margins for many generic injectables leave little room to absorb tariff-driven cost shocks. Historical precedent, such as the heparin shortages tied to past trade tensions, illustrates how tariffs can jeopardize access to lifesaving treatments and underscores the need for calibrated policy measures to maintain supply chain resilience.

Unveiling Critical Insights across Disease Subtypes Treatment Modalities Therapeutic Classes Administration Routes Distribution Channels and End-User Profiles

Ovarian cancer treatments are stratified across multiple dimensions, beginning with disease classification. Epithelial ovarian cancer, encompassing serous, endometrioid, mucinous, and clear cell subtypes, dominates the clinical landscape, while germ cell tumors, small cell ovarian cancers, and stromal cell tumors account for the remaining fraction and often necessitate specialized therapeutic approaches that balance efficacy with fertility preservation considerations. Treatment modalities range from established cytotoxic chemotherapy regimens to evolving immunotherapies and targeted agents, each aligned with specific histologic and molecular characteristics such as BRCA mutation status or homologous recombination proficiency.

Within targeted therapies, angiogenesis inhibitors have long supplemented platinum-based chemotherapy, while PARP inhibitors have reshaped maintenance paradigms by exploiting DNA repair vulnerabilities. The emergence of PD-L1 inhibitors further broadens the arsenal, enabling combination strategies designed to overcome immune resistance. Therapeutic delivery routes also reflect this evolution, with intravenous infusions remaining standard for many monoclonal antibodies and cellular therapies, even as the oral bioavailability of PARP inhibitors and kinase inhibitors enhances patient convenience and compliance. Distribution channels and end-user settings mirror these dynamics: hospital pharmacies facilitate inpatient administrations of complex biologics, online pharmacies extend continuity of oral regimens, and retail outlets support outpatient access, with care delivered across specialized cancer centers, community clinics, and general hospitals.

This comprehensive research report categorizes the Ovarian Cancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cancer Type

- Treatment Type

- Therapeutic Class

- Route Of Administration

- Distribution Channel

- End User

Examining Regional Variations in Adoption Regulatory Landscapes Manufacturing Capacities and Market Dynamics across Key Global Territories

In the Americas, the United States leads in the rapid uptake of novel ovarian cancer therapies, supported by the FDA’s streamlined approval pathways and robust payer frameworks that facilitate access to high-cost interventions. Domestic investment in manufacturing and R&D is intensifying in response to tariff pressures, prompting several major companies to expand U.S. facilities for API synthesis and formulation. The Canada market likewise demonstrates strong demand for PARP inhibitors and immuno-oncology combinations, underpinned by provincial reimbursement decisions that balance cost-effectiveness with clinical outcomes.

Europe, the Middle East, and Africa exhibit heterogeneous market dynamics shaped by regulatory harmonization under the EMA and variable healthcare infrastructure across emerging economies. The EMA’s 2024 recommendation for olaparib maintenance therapy expanded options for BRCA-mutated patients in EU member states, while countries in the Middle East and North Africa are strengthening local oncology capabilities through public-private partnerships and technology transfer agreements. Access programs and tiered pricing mechanisms are vital for ensuring affordability in resource-constrained settings, even as local clinical trials contribute region-specific safety and efficacy data.

In Asia-Pacific, growing healthcare investments and rising cancer incidence are driving significant demand for ovarian cancer treatments. Japan’s National Health Insurance system rapidly incorporates PARP inhibitors and ADCs following timely regulatory approvals, while China’s domestic API production capacity supports cost-effective generic drug manufacturing. However, pricing controls and reimbursement negotiations in markets such as India and Southeast Asia influence the timing of novel therapy introductions. Partnerships between global pharmaceutical companies and regional CDMOs are becoming increasingly strategic, enabling faster localization of production and adherence to evolving regulatory standards across multiple jurisdictions.

This comprehensive research report examines key regions that drive the evolution of the Ovarian Cancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation Through Breakthrough Therapies Strategic Partnerships and Robust Research Pipelines in Ovarian Cancer Drug Sector

AstraZeneca has maintained leadership in the ovarian cancer market through the sustained success of olaparib (Lynparza), bolstered by strategic label expansions and collaborative trials combining PARP inhibition with immunotherapies and angiogenesis inhibitors. GSK, following its acquisition of Tesaro, has championed niraparib as a cornerstone for maintenance therapy across both platinum-sensitive and HRD-positive patient segments, reinforcing its global footprint. AbbVie’s full approval of mirvetuximab soravtansine highlights its growing presence in the antibody-drug conjugate space, while Merck’s momentum with pembrolizumab combinations signals an evolving immuno-oncology approach in platinum-resistant settings.

Emerging players and contract development manufacturers are shaping competitive dynamics by enabling scalable production and innovative pipelines. Clovis Oncology continues to advance rucaparib in novel combination studies, while companies like ImmunoGen are pioneering next-generation ADC platforms. At the same time, biologics CDMOs such as WuXi Biologics are expanding capacity with large-scale fermenters to meet surging demand for complex biologic therapies, reflecting an industry-wide shift toward outsourced capabilities and agile manufacturing models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ovarian Cancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- Aravive, Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Clovis Oncology, Inc.

- Compugen Ltd.

- GlaxoSmithKline plc

- ImmunoGen, Inc.

- Johnson & Johnson

- Merck & Co., Inc.

- Mersana Therapeutics, Inc.

- Novartis AG

- Oncxerna Therapeutics, Inc.

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Roche Holding AG

- Sutro Biopharma, Inc.

- Tesaro, Inc.

- Zentalis Pharmaceuticals, Inc.

Strategic Action Plans for Industry Stakeholders to Navigate Emerging Challenges Opportunities and Drive Sustainable Growth in Ovarian Cancer Drug Development

To navigate the evolving trade environment, pharmaceutical companies should diversify API sourcing by adopting “China+1” and reshoring strategies to mitigate tariff risks and maintain supply continuity. Engaging early with policymakers and industry associations can secure critical tariff exemptions for essential oncology ingredients, while strategic investments in domestic API and drug formulation facilities can shore up long-term resilience and cost stability.

In research and development, prioritizing biomarker-driven clinical trials and forging alliances with diagnostic developers will accelerate patient stratification and optimize therapeutic responses. Leveraging real-world evidence platforms and digital health tools can provide actionable insights into treatment effectiveness and safety, supporting regulatory submissions and payer negotiations. Collaborative ventures with academic institutions and biotechnology startups can also expand innovation pipelines and distribute risk across multiple assets.

From a commercialization standpoint, aligning value-based pricing models with outcomes-based rebates and patient access programs will help secure formulary placements and reimbursement approvals in diverse markets. Deploying targeted educational initiatives for healthcare providers and patient advocacy partnerships can enhance trial enrollment and facilitate therapy adoption, ensuring that novel treatments reach the patients who stand to benefit most.

Detailed Research Framework Integrating Secondary Insights Primary Interviews Clinical Data Regulatory Filings and Supply Chain Analyses to Ensure Rigor

This research integrates a multi-phase methodology combining extensive secondary research and primary stakeholder insights. Secondary sources included peer-reviewed journals, regulatory agency publications from the FDA and EMA, clinical trial registries, and accredited news outlets. A systematic review of recent approvals, label expansions, and tariff policy documents provided foundational context for regulatory and commercial analyses.

Primary research comprised interviews with oncology key opinion leaders, manufacturing and supply chain experts, and payers to validate market trends and identify pipeline opportunities. Quantitative data on incidence rates, drug approvals, and manufacturing capacity were triangulated with qualitative assessments to ensure robustness.

Supply chain evaluations leveraged import-export databases and customs tariff schedules to model the impact of trade policies on API sourcing and drug production. All findings underwent rigorous internal review to confirm accuracy, relevancy, and alignment with industry developments as of July 2025.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ovarian Cancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ovarian Cancer Drugs Market, by Cancer Type

- Ovarian Cancer Drugs Market, by Treatment Type

- Ovarian Cancer Drugs Market, by Therapeutic Class

- Ovarian Cancer Drugs Market, by Route Of Administration

- Ovarian Cancer Drugs Market, by Distribution Channel

- Ovarian Cancer Drugs Market, by End User

- Ovarian Cancer Drugs Market, by Region

- Ovarian Cancer Drugs Market, by Group

- Ovarian Cancer Drugs Market, by Country

- United States Ovarian Cancer Drugs Market

- China Ovarian Cancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Strategic Perspectives to Chart the Next Frontier in Ovarian Cancer Drug Innovation and Patient Care

The ovarian cancer drug landscape is undergoing a profound transformation, driven by the integration of targeted therapies, antibody-drug conjugates, and immuno-oncology regimens that collectively redefine treatment standards. Evolving tariff policies underscore the imperative for resilient supply chains, while segmentation insights reveal the nuanced demands of diverse patient subpopulations and care settings.

Regional dynamics highlight disparate adoption patterns shaped by regulatory frameworks, reimbursement environments, and local manufacturing capabilities. Leading pharmaceutical companies continue to reinforce their positions through strategic collaborations and pipeline diversification, while emerging suppliers and CDMOs play a crucial role in meeting the escalating demand for complex biologics and small molecules.

Looking ahead, industry stakeholders equipped with actionable strategies-ranging from diversified sourcing and biomarker-driven development to value-based commercial models-will be best positioned to capitalize on growth opportunities, enhance patient outcomes, and navigate the challenges of a dynamic global marketplace.

Connect with Associate Director Ketan Rohom to Secure Exclusive Access to Comprehensive Ovarian Cancer Drug Market Research and Insights

Don’t miss the opportunity to access an in-depth exploration of ovarian cancer drug market dynamics, complete with detailed segmentation, region-specific analyses, and actionable insights. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through the exclusive findings and support your strategic decision-making. Reach out today to secure your copy and stay ahead in this rapidly evolving field.

- How big is the Ovarian Cancer Drugs Market?

- What is the Ovarian Cancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?