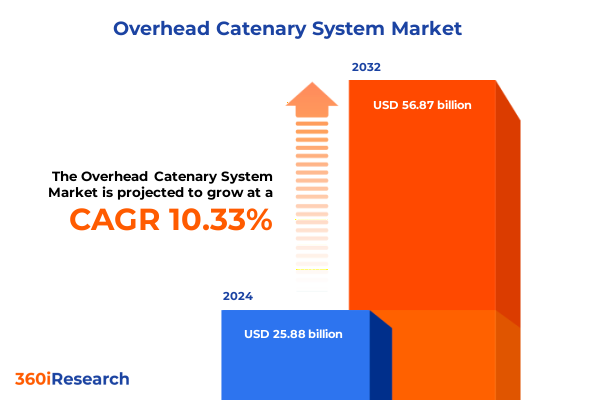

The Overhead Catenary System Market size was estimated at USD 28.46 billion in 2025 and expected to reach USD 31.34 billion in 2026, at a CAGR of 10.39% to reach USD 56.87 billion by 2032.

Establishing the Strategic Importance of Overhead Catenary Systems in Driving Sustainable, Efficient, and Modernized Rail Electrification Worldwide

Overhead catenary systems form the backbone of modern electrified railways, enabling efficient power transmission that supports high-speed, commuter, and urban transit networks worldwide. As rail operators confront the dual pressures of environmental sustainability and rising passenger volumes, the reliability and performance of overhead infrastructure have never been more critical. Transformations in materials, design, and digital monitoring are coalescing to redefine how catenary assets are specified, installed, and maintained.

This executive summary distills the most salient findings from a detailed market analysis, offering decision-makers a concise yet comprehensive view of the dynamic forces shaping overhead catenary systems. By highlighting recent policy shifts, technological breakthroughs, and key market segmentation, the report equips stakeholders with the context needed to navigate complex procurement and operational landscapes.

Through an authoritative narrative that spans tariff implications, regional growth differentials, and actionable recommendations, this overview lays the groundwork for informed strategy development. Readers will gain clarity on critical market drivers and emerging trends, positioning their organizations to capitalize on the accelerating shift toward fully electrified rail networks.

Unveiling the Major Technological and Operational Transformations Reshaping Overhead Catenary Systems for Next-Generation Rail Networks

Rail electrification is entering a new era of performance enhancement driven by advanced materials and higher operating speeds. Contemporary high-speed corridors exceed 500 kilometers per hour, necessitating contact wire alloys and tensioning systems engineered for extreme dynamic loads and minimal sag. Composite conductors are increasingly adopted to replace traditional copper and steel components, offering lighter weight, superior corrosion resistance, and extended maintenance intervals. These material innovations support more resilient catenary networks capable of withstanding harsher environmental conditions and fluctuating thermal expansion cycles.

Simultaneously, digital transformation is revolutionizing condition monitoring and asset management within overhead systems. Networks of real-time sensors embedded along headspans, messenger wires, and insulators feed centralized analytics platforms that apply machine learning algorithms to predict wear and detect anomalies. This shift from reactive repairs to proactive interventions significantly reduces unplanned outages and optimizes resource allocation for maintenance crews, translating into measurable lifecycle cost reductions and enhanced system availability.

The convergence of hardware innovations and digital service offerings has given rise to integrated solutions that bundle design, installation, and long-term support under unified performance contracts. By leveraging modular catenary units and scalable control architectures, infrastructure owners can tailor electrification projects to specific operational profiles-from dense urban tram lines to high-voltage intercity links. This integrated approach enhances network flexibility, accelerates deployment timelines, and fosters collaborative partnerships among equipment suppliers, system integrators, and transit authorities.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Overhead Catenary Supply Chains and Cost Structures

Effective March 12, 2025, the United States Government imposed a uniform 25 percent tariff on all steel and aluminum imports under Section 232, extending coverage to derivative products unless manufactured domestically at the melt or pour origin. This measure directly affects structural elements of overhead catenary systems, including support structures, messenger wires, and contact components, increasing raw material costs across the supply chain.

In parallel, targeted 25 percent duties on freight rail shipments of steel-intensive commodities have disrupted cross-border logistics, adding significant tariff burdens to rail freight operations valued at over $200 billion annually. The sharp rise in input costs for rail carriers and component manufacturers has prompted urgent supply chain recalibrations, with many operators accelerating purchases ahead of tariff escalation and diversifying sourcing to mitigate near-term margin erosion.

These tariff shocks are intensifying the trend toward domestic production and local content strategies. Manufacturers are exploring onshore rolling of contact wire and assembly of support structures within U.S. facilities to secure tariff exemptions and ensure compliance with Buy America regulations. Meanwhile, contract renegotiations and strategic inventory positioning are underway to buffer against ongoing policy uncertainty, ensuring uninterrupted project delivery for electrification initiatives.

Deriving Strategic Insights from Multifaceted Segmentations of Overhead Catenary Systems across Components, End Users, Types, Voltages, and Applications

The market for overhead catenary systems is carefully dissected across multiple dimensions to reveal nuanced insights into component demand, end-user requirements, system architecture, voltage preferences, and application niches. Analysis of component distribution highlights the critical interplay between contact wire formulations, hardware and fittings durability, insulator performance under varied environmental stresses, messenger wire tension profiles, and support structure engineering. Tailoring each element enhances overall system reliability and lifecycle cost efficiency.

End-user segmentation underscores divergent investment priorities across commuter rail lines seeking frequent-service resiliency, freight corridors optimizing for heavy-load endurance, high-speed networks demanding ultralight tension and minimal electrical losses, and urban transit systems balancing safety with minimal maintenance footprints. Understanding these distinct operational imperatives guides suppliers in developing specialized catenary packages that address service frequency, load cycles, and network density.

Drilling deeper, system type classification reveals a growing preference for composite catenary assemblies in retrofit scenarios, while conventional single-wire solutions-split between suspension and trolley configurations-remain prevalent in standard electrification projects. Rigid catenary innovations, both insulated and non-insulated, cater to tunnel and bridge environments where spatial constraints and safety mandates necessitate more compact, vandal-resistant installations.

Voltage segmentation captures clear geographic and service-level patterns, with AC 25 kV dominating high-speed corridors, DC 1.5 kV prevalent in intercity and regional networks, and DC 750 V preferred for metro, tram, and trolleybus systems. Each voltage class shapes conductor sizing, insulation requirements, and substation configuration.

Finally, application analysis demonstrates distinct procurement cycles and equipment standards for light rail, rail electrification megaprojects, historic tram restorations, and trolleybus corridors, revealing opportunities for technology transfer and standard harmonization across modes.

This comprehensive research report categorizes the Overhead Catenary System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Configuration

- Component

- Voltage Range

- Application

- Project Type

- Sales Channel

Distilling Key Regional Dynamics Shaping Overhead Catenary Adoption across the Americas, Europe, Middle East & Africa, and Asia-Pacific Regions

Regional market dynamics for overhead catenary systems are shaped by divergent infrastructure priorities, policy frameworks, and funding mechanisms across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, public and private investments converge on commuter rail upgrades and intercity electrification corridors, with an emphasis on modernizing aging infrastructure and meeting stringent emissions targets. Federal incentives and state-level programs drive project pipelines, although variable permitting processes can extend deployment timelines.

Across Europe, the Middle East & Africa region, mature high-speed and urban networks coexist with vast electrification potential in emerging markets. The European Union’s commitment to reducing greenhouse gas emissions by 55 percent by 2030 bolsters funding for electrified rail projects and innovative catenary solutions. Simultaneously, Gulf Cooperation Council countries and North African transit authorities are prioritizing sustainable mobility solutions to alleviate urban congestion and support tourism-driven connectivity.

Asia-Pacific stands at the forefront of high-velocity rail deployment and network expansion, with China, Japan, and South Korea driving cutting-edge overhead system development, while India and Southeast Asian economies embark on ambitious electrification programs. Rapid urbanization, government-backed infrastructure lending, and technology licensing agreements fuel a robust appetite for turnkey catenary installations and local manufacturing partnerships.

This comprehensive research report examines key regions that drive the evolution of the Overhead Catenary System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Collaboration, and Competitive Excellence in Overhead Catenary Solutions Worldwide

The competitive landscape for overhead catenary solutions is defined by a blend of global engineering leaders, specialized material innovators, and regional integrators. Major electrification equipment providers are forging strategic alliances with track infrastructure companies to deliver turnkey systems, leveraging their geographic scale to offer integrated design, supply, installation, and service packages.

Material science pioneers continue to advance novel conductor alloys and polymer composite insulators, collaborating with sensor technology firms to embed real-time monitoring into critical components. Such partnerships expand the service offering from pure equipment supply toward predictive maintenance agreements that encompass hardware warranties, data analytics subscriptions, and performance guarantees.

Regional incumbents in Asia-Pacific and EMEA enhance local content and compliance capabilities through joint ventures with domestic manufacturers, ensuring alignment with civil procurement requirements and reducing lead times. Similarly, North American integrators align with rail operators and regulatory bodies to tailor catenary architectures to local safety standards, environmental conditions, and network configurations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Overhead Catenary System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- ALSTOM Holdings

- Alucast Iran Co.

- Bonomi

- CRRC Corporation Limited

- Engie Ineo

- Furrer+Frey

- Hitachi, Ltd.

- Kiepe Electric GmbH

- Kummler+Matter

- Lamifil NV

- MAC Products, Inc.

- Nexans SA

- NKT A/S

- nVent Electric plc

- Pandrol SAS

- Pfisterer Group

- PPS International

- Selco Manufacturing

- Siemens AG

- Stemmann-Technik

- Sugremin SA

- TE Connectivity Corporation

- Wabtec Corporation

Formulating Actionable Strategies for Industry Leaders to Enhance Supply Chain Resilience, Technological Adoption, and Sustainability in Catenary Systems

Industry leaders should prioritize deepening their digital capabilities by integrating IoT-enabled sensors, cloud analytics, and AI-driven maintenance platforms to transition from reactive to predictive servicing. Early adoption of condition-based monitoring reduces unplanned outages and optimizes resource allocation, delivering a clear competitive advantage in total cost of ownership metrics.

To buffer against ongoing policy and tariff uncertainties, stakeholders must diversify supply chains by establishing multiple sourcing tiers and nearshoring critical manufacturing steps. Pursuing local assembly partnerships and securing long-term agreements aligned with domestic content requirements will help mitigate cost volatility and ensure compliance with evolving trade regulations.

Collaboration across the value chain will be essential: equipment suppliers, infrastructure owners, and transit authorities need to co-develop modular, scalable catenary designs that can rapidly adapt to varying electrification scopes-from isolated tram networks to high-voltage intercity corridors. Leveraging public-private partnerships and innovation consortia can accelerate standards harmonization, reduce capital expenditure risks, and unlock access to new renewable energy integration programs.

Outlining a Rigorous, Multistage Research Methodology Ensuring Comprehensive Analysis of Overhead Catenary System Market Dynamics

This study employs a robust, multistage research methodology combining secondary research, primary interviews, and rigorous data triangulation to achieve a holistic perspective on the overhead catenary market. Secondary research included extensive review of industry publications, technical white papers, government infrastructure plans, and tariff notices to map regulatory and policy environments.

Primary research comprised in-depth interviews with rail electrification engineers, procurement directors at transit authorities, material science experts, and system integrators to validate segmentation parameters and material preferences. Input from these stakeholders provided qualitative insights into component performance benchmarks, maintenance practices, and procurement cycles.

Quantitative data was triangulated through cross-referencing supplier shipment statistics, government infrastructure funding disclosures, and freight tariff schedules. This approach ensured consistency between reported demand drivers and observed capital deployment trends. Finally, analytical frameworks were applied to segment the market by component, end-user, system type, voltage, and application, delivering a structured lens for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Overhead Catenary System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Overhead Catenary System Market, by System Configuration

- Overhead Catenary System Market, by Component

- Overhead Catenary System Market, by Voltage Range

- Overhead Catenary System Market, by Application

- Overhead Catenary System Market, by Project Type

- Overhead Catenary System Market, by Sales Channel

- Overhead Catenary System Market, by Region

- Overhead Catenary System Market, by Group

- Overhead Catenary System Market, by Country

- United States Overhead Catenary System Market

- China Overhead Catenary System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Reflections on the Imperative of Innovation, Collaboration, and Sustainability in Evolving Overhead Catenary Ecosystems

The imperative for advancing overhead catenary systems lies at the intersection of technological innovation, operational efficiency, and environmental stewardship. Evolution in material science, digital monitoring, and service delivery models is enabling rail operators to meet stringent sustainability mandates while enhancing reliability and reducing lifecycle costs.

Simultaneously, shifting trade policies and tariff regimes underscore the importance of supply chain agility and domestic content strategies. Organizations that proactively align their procurement, manufacturing, and partnership approaches will be best positioned to weather policy uncertainties and capitalize on emerging electrification investments.

By synthesizing the detailed segmentation insights, regional dynamics, and competitive landscapes presented, stakeholders can formulate strategies that harness the full potential of overhead catenary technologies. Collaboration among industry participants, regulators, and research institutions will remain critical to standardize practices and accelerate the adoption of next-generation electrification solutions.

Connect Directly with Ketan Rohom for a Personalized Review of the Comprehensive Overhead Catenary Market Report and Strategic Insights

Engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, offers a tailored opportunity to explore the full breadth of this comprehensive market research on overhead catenary systems. Through a personalized consultation, decision-makers can gain deeper insight into the critical dynamics shaping global rail electrification and discuss how the findings apply to their unique strategic initiatives.

During this dialogue, prospects will have the chance to request custom data slices, clarifications on segmentation analyses, and a focused review of regional and tariff-related impacts that directly align with their operational goals. This direct engagement ensures that stakeholders receive actionable intelligence designed to accelerate project timelines and optimize investment decisions.

Prospective clients are encouraged to reach out without delay to secure immediate access to the definitive report-packed with in-depth segmentation insights, regional overviews, and strategic recommendations. Connect with Ketan Rohom today to empower your team with the decisive data needed to lead in the electrified rail era

- How big is the Overhead Catenary System Market?

- What is the Overhead Catenary System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?