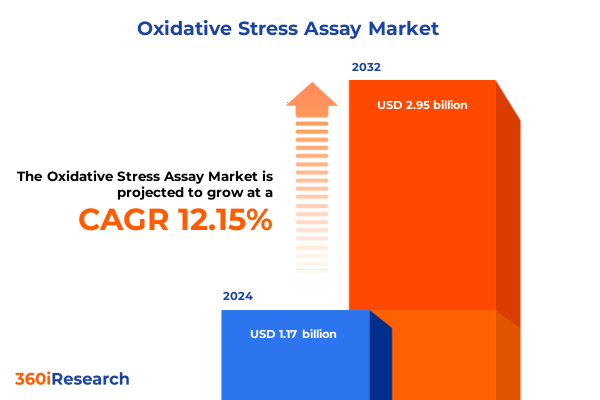

The Oxidative Stress Assay Market size was estimated at USD 1.31 billion in 2025 and expected to reach USD 1.46 billion in 2026, at a CAGR of 12.28% to reach USD 2.95 billion by 2032.

Unveiling the Critical Role of Oxidative Stress Assays in Modern Biomedical Research and Clinical Applications to Address Emerging Health Challenges

Oxidative stress assays have emerged as indispensable tools in unraveling the complex interplay between reactive oxygen species and biological systems. By quantifying markers such as malondialdehyde, 8-hydroxy-2′-deoxyguanosine, and glutathione levels, these assays offer a window into cellular redox homeostasis and the pathophysiology of diverse chronic diseases. Researchers rely on precise measurements of oxidative biomarkers to elucidate mechanisms of aging, neurodegeneration, cardiovascular dysfunction, and metabolic disorders. As molecular pathways of oxidative damage continue to be unraveled, the demand for robust analytical techniques has intensified across academic laboratories and clinical settings.

Given the multifaceted role of oxidative stress in drug efficacy, toxicity profiling, and biomarker discovery, stakeholders require assay platforms that combine sensitivity, specificity, and reproducibility. From bench scientists optimizing preclinical models to clinicians monitoring patient responses, the landscape of oxidative stress testing is evolving in parallel with broader trends in high-throughput screening and personalized medicine. This introduction establishes the scientific foundation and strategic relevance of oxidative stress assays, setting the stage for an exploration of technological innovations, regulatory influences, market dynamics, and actionable insights that follow.

Exploring How Technological Innovations and Evolving Research Paradigms Are Reshaping the Oxidative Stress Assay Market Across Academic and Industrial Sectors

Recent years have witnessed an unprecedented convergence of technological advancement and research paradigm shifts that are fundamentally reshaping the oxidative stress assay environment. Automated microplate readers with real-time kinetic capabilities now enable rapid quantification of reactive oxygen species in hundreds of samples simultaneously, driving efficiency gains in both academic and industrial laboratories. At the same time, the integration of multiplexed assay platforms offers simultaneous detection of multiple oxidative biomarkers, facilitating holistic understanding of cellular redox networks. These innovations are complemented by advances in miniaturized electrochemical sensors and lab-on-a-chip systems, which are lowering costs and expanding point-of-care diagnostic potential.

Beyond instrumentation, emerging research frameworks emphasize cell-based assays that leverage reporter gene technology and viability endpoints to bridge the gap between biochemical measurements and physiological relevance. Immunoassay formats such as chemiluminescence and electrochemiluminescence are achieving lower detection limits, while chromatographic techniques coupled with mass spectrometry are delivering unparalleled specificity. The proliferation of digital data pipelines and AI-driven analytics has further accelerated assay development cycles, enabling predictive modeling and virtual validation. Together, these transformative forces are redefining standards for assay performance and catalyzing the next generation of oxidative stress research.

Analyzing the Widespread Consequences of United States 2025 Tariff Policies on Supply Chains Production Costs and Strategic Planning in Oxidative Stress Assays

The introduction of new United States tariffs in 2025 has exerted considerable pressure on supply chains for oxidative stress assay components, particularly those sourced from overseas manufacturers. Increased duties on imported chromatography columns, electrochemical sensors, and microplate reader components have elevated production costs, leading many assay providers to revisit strategic sourcing and inventory management. For some organizations, the tariff-driven cost surge has prompted a shift toward domestic suppliers, while others have negotiated long-term contracts with multinational vendors to lock in favorable pricing structures.

Beyond procurement strategies, the tariff environment has spurred interest in vertical integration, with leading assay developers exploring in-house reagent production and instrument fabrication to mitigate exposure. These adjustments have required expanded capital investment but promise greater supply resilience and margin protection over the long term. Simultaneously, downstream end users have had to evaluate pricing reconfigurations and budgetary allocations, with diagnostic laboratories and pharmaceutical firms scrutinizing assay utilization to optimize cost-efficiency. In this context, stakeholder alignment on pricing, supply security, and collaborative partnerships has become paramount for sustaining growth and innovation in oxidative stress testing.

Illuminating Key Segmentation Across Product Types Technologies End Users Applications and Distribution Channels That Shape Oxidative Stress Assay Adoption

Segmentation analysis reveals nuanced insights into the oxidative stress assay landscape that inform targeted product development and marketing strategies. Within product types, the instruments and accessories category encompasses chromatography systems, electrochemical analyzers, and microplate readers, each serving distinct analytical needs. Whereas chromatography systems deliver molecular specificity for discrete oxidative biomarkers, electrochemical analyzers provide rapid redox potential measurements, and microplate readers support high-throughput colorimetric, fluorometric, and luminometric assays as part of reagent kits. In parallel, the kits and reagents segment offers flexible assay formats, with colorimetric approaches valued for simplicity, fluorometric techniques prized for sensitivity, and luminometric methods employed for low-level detection.

Technology-driven segmentation further delineates the market by foundational assay principles. Cell based assays, including viability assays and reporter gene systems, bridge biochemical readouts with cellular responses to oxidative stress. Chromatographic assays leverage techniques such as GC-MS, HPLC, and LC-MS to enable high-resolution analysis of oxidative metabolites. Electrochemical assays employ both amperometric and voltammetric approaches to monitor redox dynamics, while enzymatic assays-categorized into catalase-based and peroxidase-based formats-facilitate enzymatic turnover measurements. Immunoassays, comprising CLIA, ECLIA, and ELISA, continue to deliver robust sensitivity for protein oxidation markers. End user segmentation encompasses academic and research institutes, contract research organizations, diagnostic laboratories, and pharmaceutical and biotech firms, each driving distinct demand profiles. Applications span clinical diagnostics, drug discovery and development, environmental monitoring, and food safety testing, reflecting the broad relevance of oxidative stress assays. Distribution channels include direct sales models, distributor networks, and online platforms, illustrating the diverse pathways through which assay solutions reach end users.

This comprehensive research report categorizes the Oxidative Stress Assay market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Distribution Channel

Unveiling Regional Dynamics and Emerging Trends in the Americas Europe Middle East Africa and Asia Pacific Impacting Oxidative Stress Assay Deployment

Regional dynamics exert a profound influence on the development, adoption, and regulatory oversight of oxidative stress assays. In the Americas, robust funding streams from government agencies and private foundations fuel cutting-edge research institutions and biotechnology firms. North America, in particular, leads in assay standardization efforts, facilitated by clear regulatory frameworks and established clinical validation pathways. Meanwhile, Latin American markets are emerging as prospective sites for contract research activities and localized manufacturing initiatives.

In Europe, Middle East & Africa, assay deployment reflects a mosaic of regulatory regimes and research capabilities. Western European countries emphasize compliance with stringent in vitro diagnostic regulations, driving demand for validated assay kits and integrated platforms. Across the Middle East, strategic investments in healthcare infrastructure are fostering uptake of advanced diagnostic tools, while African markets exhibit growing interest in environmental monitoring and affordability-driven assay solutions. Asia-Pacific stands out for its rapid industrial expansion and large-scale pharmaceutical R&D pipelines. China, India, Japan, and Southeast Asian nations are increasingly investing in local assay manufacturing, digital laboratory ecosystems, and public-private partnerships to support both clinical and environmental applications.

This comprehensive research report examines key regions that drive the evolution of the Oxidative Stress Assay market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Innovations Partnerships and Competitive Strategies Shaping the Future of Oxidative Stress Assay Commercialization

Leading corporations in the oxidative stress assay arena are distinguished by their relentless investment in research and development, strategic alliances, and comprehensive product portfolios. Thermo Fisher Scientific continues to expand its immunoassay and chromatography offerings through acquisitions and internal innovation, enhancing capabilities in mass spectrometry-based oxidative biomarker analysis. Agilent Technologies leverages its expertise in electrified chromatography systems to develop next-generation columns and detectors tailored for redox metabolite characterization. Bio-Rad Laboratories focuses on multiplex immunoassay platforms, integrating digital readouts and cloud-based analytics for rapid data interpretation.

At the same time, PerkinElmer is advancing high-throughput screening solutions by combining automated microplate readers with fluorescence lifetime measurement modules, while Danaher Corporation employs a portfolio strategy that spans enzymatic, cell-based, and electrochemical methodologies. Collaboration between instrument manufacturers and reagent developers has intensified, resulting in turnkey platforms that streamline assay workflows. These competitive strategies underscore a broader industry commitment to performance enhancement, user-centric design, and seamless integration with laboratory information management systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oxidative Stress Assay market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abcam plc

- Bio-Techne Corporation

- BioVision, Inc.

- Cayman Chemical Company

- Enzo Life Sciences, Inc.

- EpiGentek Group, Inc.

- Merck KGaA

- PerkinElmer, Inc.

- Promega Corporation

- Qiagen N.V.

- Thermo Fisher Scientific Inc.

Delivering Strategic Recommendations for Industry Leaders to Enhance Innovation Optimize Operations Amid Challenges in the Oxidative Stress Assay Market

To maintain a leadership position in a rapidly evolving market, industry stakeholders should prioritize investment in advanced automation and digitalization technologies that enable high-throughput, reproducible results with minimal manual intervention. Establishing resilient supply chain frameworks through diversified supplier relationships and regional manufacturing partnerships will mitigate tariff-related cost volatility and ensure uninterrupted access to critical reagents and components. Engaging in collaborative research with academic centers and contract research organizations can accelerate the validation of novel assay formats and foster early adoption in clinical and industrial settings.

Moreover, companies should tailor product portfolios to capitalize on emerging applications in food safety testing and environmental monitoring, where regulatory scrutiny on oxidative contaminants is intensifying. Developing multiplexed assay kits that integrate oxidative stress markers with complementary biomarkers will address growing demand for holistic profiling solutions. Finally, reinforcing customer support infrastructures and offering flexible training programs will enhance user proficiency, drive loyalty, and differentiate offerings in an increasingly competitive landscape.

Detailing the Robust Research Methodology Integrating Quantitative Data Qualitative Insights Primary and Secondary Sources And Rigorous Validation Techniques

The research methodology underpinning this executive summary integrates both primary and secondary data collection techniques to ensure analytical rigor and practical relevance. Primary data was gathered through structured interviews with key opinion leaders across academic, clinical, and industrial spheres, supplemented by detailed surveys of end users to capture real-world preferences and pain points. Secondary research encompassed a comprehensive review of scientific literature, patent filings, regulatory documents, and industry whitepapers to contextualize technological progress and policy developments.

Quantitative data sets were normalized and benchmarked across comparable assay platforms, while qualitative insights were systematically coded to identify thematic trends and emerging use cases. Validation of findings was achieved through expert panel discussions and triangulation of multiple information sources, enhancing the credibility of strategic recommendations. This multifaceted approach delivers a balanced perspective that bridges high-level market intelligence with actionable insights tailored to diverse stakeholder requirements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oxidative Stress Assay market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oxidative Stress Assay Market, by Product Type

- Oxidative Stress Assay Market, by Technology

- Oxidative Stress Assay Market, by Application

- Oxidative Stress Assay Market, by End User

- Oxidative Stress Assay Market, by Distribution Channel

- Oxidative Stress Assay Market, by Region

- Oxidative Stress Assay Market, by Group

- Oxidative Stress Assay Market, by Country

- United States Oxidative Stress Assay Market

- China Oxidative Stress Assay Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings Strategic Implications And Forward Looking Perspectives to Empower Stakeholders in Advancing Oxidative Stress Assay Innovations

In synthesizing the foregoing analyses, several key themes emerge as central to future success in the oxidative stress assay domain. Technological innovation, particularly in multiplexed platforms and digital integration, will continue to redefine performance benchmarks. Simultaneously, adaptive supply chain strategies and responsiveness to geopolitical developments are critical to sustaining operational resilience. Robust segmentation insights underscore the need for differentiated product offerings that address specific end user requirements, while regional dynamics highlight opportunities for localized investment and strategic partnerships.

Looking ahead, stakeholders must balance short-term cost management with long-term innovation trajectories, leveraging collaborative networks to expedite assay validation and market entry. Continuous monitoring of regulatory shifts and tariff landscapes will inform agile decision-making, and proactive engagement with customers will uncover evolving application vistas. By embracing an integrated approach that combines scientific excellence with strategic acumen, organizations can unlock the full potential of oxidative stress assays and contribute meaningfully to advancements in healthcare, environmental stewardship, and industrial quality assurance.

Encouraging Readers to Connect with Ketan Rohom Associate Director Sales and Marketing to Obtain the Oxidative Stress Assay Market Research Report

To secure detailed insights that underpin strategic decision making and gain a competitive advantage, readers are encouraged to reach out directly to Ketan Rohom, whose expertise in sales and marketing ensures seamless access to the full market research report. Engaging with Ketan will provide immediate guidance on report contents, customizable data sections, and tailored recommendations to address unique organizational challenges. By obtaining the comprehensive document, stakeholders will benefit from an integrated perspective that encompasses technological innovations, tariff impact analyses, regional dynamics, and sector-specific segmentation insights. This proactive step not only streamlines procurement but also fosters ongoing collaboration, enabling real-time updates and support as market conditions evolve. Connect today to transform high-level research into actionable strategies and position your organization at the forefront of oxidative stress assay development.

- How big is the Oxidative Stress Assay Market?

- What is the Oxidative Stress Assay Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?