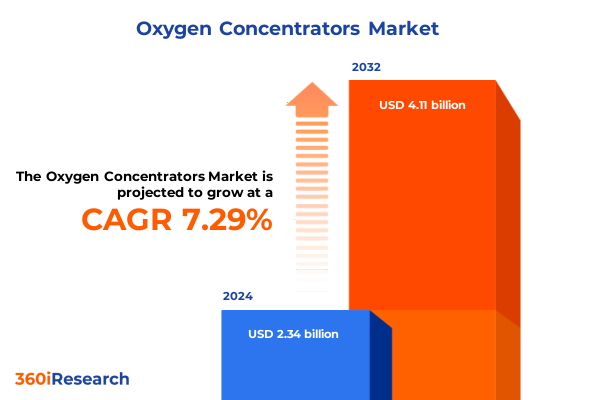

The Oxygen Concentrators Market size was estimated at USD 2.50 billion in 2025 and expected to reach USD 2.67 billion in 2026, at a CAGR of 7.36% to reach USD 4.11 billion by 2032.

Understanding the Critical Role of Oxygen Concentrators in Modern Healthcare Delivery, Therapeutic Advancements, and Expanding Homecare Environments

In recent years, oxygen concentrators have emerged as a cornerstone of respiratory care management, offering targeted oxygen delivery to patients with varying degrees of hypoxemia. Chronic obstructive pulmonary disease (COPD) remains a primary driver of demand, affecting nearly 3.8% of US adults in 2023, equivalent to millions of individuals requiring supplemental oxygen therapy to maintain optimal blood oxygen levels and quality of life.

Meanwhile, beyond COPD, the incidence of interstitial lung diseases, pulmonary fibrosis, and post-viral respiratory complications has broadened the clinical applications of oxygen concentrators. Home oxygen therapy, once limited to stationary systems in clinical settings, now includes a diverse array of portable units that enable patients to stay active and reduce hospital readmissions. These developments have been supported by evolving clinical guidelines from key professional societies emphasizing individualized oxygen titration and monitoring.

Exploring the Technological Advancements and Care Delivery Shifts That Are Redefining the Global Oxygen Concentrator Market

Over the past half decade, the landscape of oxygen concentrator technology has been reshaped by a confluence of healthcare delivery innovations and demographic shifts. The COVID-19 pandemic, in particular, acted as a catalyst for rapid product development, revealing gaps in device resilience under extreme conditions and prompting collaborations between humanitarian organizations and manufacturers to produce robust, energy-efficient models suitable for remote and resource-limited environments. Consequently, Pulse Swing Adsorption (PSA) concentrators have been optimized for lower power consumption and enhanced portability, addressing the needs of both urban homecare patients and those in rural areas with unreliable electricity access.

In parallel, integration with telehealth platforms and digital monitoring tools has elevated patient engagement and compliance. Smart concentrators equipped with real-time data transmission capabilities now enable clinician oversight of oxygen saturation trends and device performance, reducing emergency interventions and supporting value-based care models. These transformative shifts have laid the foundation for next-generation systems that balance technological sophistication with user-centric design and affordability.

Assessing the Layered Effects of United States Tariff Measures on Oxygen Concentrator Imports and Supply Chain Resilience in 2025

Historically, oxygen concentrators imported from China were exempt from additional Section 301 tariffs due to their classification as critical medical equipment, safeguarding continuity of supply amid global health emergencies. However, a pivotal customs ruling effective March 4, 2025 introduced a 20% ad valorem rate on Chinese and Hong Kong-origin portable oxygen concentrators under HTS subheading 9019.20.0000, reflecting bracing trade policy shifts aimed at reciprocal tariff measures. This development marked a significant departure from previous exclusions and underscored the escalating complexity of international medical device trade relations.

Moreover, prominent industry players have signaled the wider impact of tariff volatility on profitability and supply chain strategies. For instance, a leading Dutch healthcare technology firm forecasted a net hit between €250 million and €300 million in 2025 attributable to tariffs and trade tensions, prompting accelerated localization of production in key markets to mitigate cost inflation and ensure product availability. Taken together, these layered policy actions have introduced renewed considerations around sourcing, pricing, and strategic manufacturing footprint decisions for oxygen concentrator stakeholders.

Uncovering Critical Segmentation Insights Across Power Sources, Device Types, Delivery Modes, Channels, and End Users Driving Market Nuances

The oxygen concentrator market is defined by a multifaceted segmentation framework that intricately shapes competitive dynamics and user preferences. Power source classification bifurcates offerings into battery-driven options designed for high mobility, and electrically powered units that deliver uninterrupted oxygen flow at higher capacities, addressing varying patient mobility and usage duration requirements. Concurrently, device typology spans portable systems embraced for ambulatory care and stationary hubs favored in institutional settings; the former cohort further subdivides into battery-powered and mains-powered variants to align autonomy with operational reliability.

Delivery mode segmentation further refines product positioning through continuous flow configurations, which can be tailored via adjustable flow settings or fixed flow parameters for precise oxygen titration, alongside pulse flow solutions that offer efficiency gains through single-pulse or multiple-pulse dosing techniques. Distribution channel analysis reveals an increasingly omnichannel approach, where traditional brick-and-mortar medical equipment distributors coexist with digital avenues; online channels leverage e-commerce platforms and manufacturer websites to streamline procurement while preserving brand engagement. Finally, end-user distinction-spanning homecare patients seeking convenience and cost management and hospital systems prioritizing clinical oversight and bulk deployments-drives tailored product development, service models, and support infrastructure.

This comprehensive research report categorizes the Oxygen Concentrators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Power Source

- Type

- Delivery Mode

- Flow Rate

- Application

- End User

- Distribution Channel

Highlighting Regional Variations in Oxygen Concentrator Demand and Adoption Trends Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Regions

In the Americas, robust healthcare infrastructure and established reimbursement pathways have positioned North America as a leading market. The United States, accounting for a substantial share of global device demand, benefits from Medicare and private insurer policies that partially offset costs of home oxygen therapy, fueling sustained device adoption and aftermarket services. Canada’s provincially managed healthcare systems similarly facilitate access to oxygen concentrators through standardized coverage frameworks, although regional funding disparities can influence device selection and utilization patterns.

Across Europe, the Middle East, and Africa, regulatory harmonization within the European Union has encouraged innovation and expedited market entry, even as disparate healthcare spending levels exist between member states. European markets prioritize devices with advanced digital interfaces aligned with telemedicine initiatives, while emerging Middle Eastern and African economies represent nascent adoption zones, where government-led health infrastructure investments and partnerships are beginning to bridge accessibility gaps.

Asia-Pacific markets display dynamic growth trajectories driven by aging populations and rising respiratory disease prevalence. Nations such as China and India are rapidly scaling both manufacturing capacity and domestic consumption, supported by government incentives for medical device production and public health campaigns to combat air pollution–related conditions. In parallel, developed APAC economies like Japan and Australia demonstrate early uptake of smart concentrators, with telehealth integration becoming increasingly common to serve dispersed patient populations.

This comprehensive research report examines key regions that drive the evolution of the Oxygen Concentrators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Oxygen Concentrator Manufacturers, Competitive Differentiation Strategies, and Market Positioning in a Rapidly Evolving Landscape

Market leadership in the oxygen concentrator domain is characterized by a blend of heritage brands and agile challengers advancing distinct value propositions. A preeminent healthcare technology conglomerate has underscored supply chain localization to mitigate tariff exposures and enhance cost efficiencies across its global operations, reinforcing its core position in premium and clinical-grade systems. Complementing this, a pure-play portable device specialist has achieved top-tier market position through strategic alliances in the Asia-Pacific region, investing in local manufacturing partnerships to secure distribution channels and adapt product features to regional use cases.

Meanwhile, mid-sized incumbents emphasize modular design architectures and multitier product portfolios, leveraging continuous and pulse flow hybridization to address both homecare and institutional requirements. Credit-driven collaborations between component suppliers and final assemblers have accelerated the roll-out of lightweight, energy-preserving compressors and smart monitoring modules. This confluence of differentiated manufacturing strategies, regulatory compliance, and digital ecosystems underscores the competitive contours that industry players navigate to optimize market share and margin resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oxygen Concentrators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products Inc.

- AirSep Corporation

- Alveonic Systems

- ARYA BioMed Corp.

- Belluscura plc

- Caire Inc. by Niterra Group

- Chaban Medical Ltd.

- Cobham Limited

- DeVilbiss Healthcare GmbH

- Drägerwerk AG & Co. KGaA

- Exceleron Medical, Inc.

- Fisher & Paykel Healthcare Corporation Limited

- GCE Group AB

- GPC Medical Ltd.

- GVS S.p.A.

- Inogen Inc.

- Invacare Corporation

- Koninklijke Philips N.V.

- Lincare Holdings Inc.

- Linde PLC

- Lufaith Technology Co., Ltd.

- Microteck Systems & Solution

- Miracle International Co., Ltd.

- NGK Spark Plug Co., Ltd.

- NIDEK Medical Products Inc.

- Nidek Medical Products, Inc.

- O2 Concepts, LLC

- OxyGo, LLC

- ResMed Inc.

- Satcon Medical

- Shenyang Canta Medical Tech. Co., Ltd.

- Silverline Meditech Pvt. Ltd.

- Teijin Limited

- Vapotherm, Inc.

- Ventec Life Systems, Inc.

- VitalAire Canada Inc.

- WEINMANN Emergency Medical Technology GmbH + Co. KG

- Yuwell-Jiangsu Yuyue medical equipment & supply Co., Ltd.

Proposing Actionable Strategies for Industry Leaders to Navigate Trade, Technology, and Regulatory Challenges in the Oxygen Concentrator Sector

To navigate the fluid trade environment, industry leaders should proactively diversify supply chains by establishing multiple sourcing nodes and regional assembly hubs, thereby diffusing tariff risks and enhancing logistical responsiveness. Simultaneously, prioritizing investments in advanced battery chemistries and compact compressor systems will bolster product differentiation and align with the escalating demand for high-mobility therapeutic solutions. Engaging directly with regulatory bodies to advocate for medical device tariff exemptions or relief measures can further secure critical equipment pipelines and reduce landed costs.

Moreover, forging strategic partnerships with telehealth providers and embracing interoperable digital platforms will not only strengthen post-sale service ecosystems but also unlock new reimbursement models anchored in remote patient monitoring metrics. In tandem, refining go-to-market strategies through targeted e-commerce integration and optimizing channel incentives can enhance market penetration in both mature and emerging regions. Collectively, these actionable imperatives can equip industry stakeholders to deliver patient-centric innovations while safeguarding operational agility.

Detailing the Robust Research Methodology Integrating Primary Interviews, Secondary Data, and Triangulation Techniques for Market Analysis

The research methodology underpinning this analysis integrates both primary and secondary research pillars to deliver comprehensive market insights. Primary data was gathered through semi-structured interviews with key opinion leaders, clinical practitioners, and senior executives across manufacturing, distribution, and policymaking spheres, enabling nuanced understanding of device performance, user preferences, and regulatory trends. Meanwhile, secondary research encompassed systematic reviews of peer-reviewed journals, government publications, and industry reports, including trade rulings and public health data sets.

Moreover, trade and tariff dynamics were rigorously examined by analyzing Federal Registry notices, customs rulings, and official policy announcements to quantify impacts on import duties and supply chain strategies. Data triangulation was employed to validate findings across multiple sources, ensuring both contextual relevance and analytical robustness. This mixed-method approach offers stakeholders a transparent framework for interpreting market drivers, barriers, and strategic opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oxygen Concentrators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oxygen Concentrators Market, by Power Source

- Oxygen Concentrators Market, by Type

- Oxygen Concentrators Market, by Delivery Mode

- Oxygen Concentrators Market, by Flow Rate

- Oxygen Concentrators Market, by Application

- Oxygen Concentrators Market, by End User

- Oxygen Concentrators Market, by Distribution Channel

- Oxygen Concentrators Market, by Region

- Oxygen Concentrators Market, by Group

- Oxygen Concentrators Market, by Country

- United States Oxygen Concentrators Market

- China Oxygen Concentrators Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Summarizing Core Findings and Strategic Implications That Will Guide Stakeholder Decision-Making in the Evolving Oxygen Concentrator Landscape

Through an exploration of clinical, technological, and policy landscapes, this executive summary underscores the critical intersection between respiratory care needs and market dynamics shaping oxygen concentrator deployment. The convergence of demographic trends, such as aging populations and rising chronic respiratory conditions, with rapid product innovation highlights a pivotal moment for market evolution. Simultaneously, the emergence of new tariff regimes and competitive recalibrations compels stakeholders to adopt agile supply chain and localization strategies.

Furthermore, segmentation insights reveal the complexity inherent in balancing patient mobility, flow requirements, and distribution preferences, while regional analyses emphasize the varied maturity and growth opportunities across Americas, EMEA, and Asia-Pacific markets. Ultimately, success in this domain will hinge upon the ability to integrate cutting-edge technologies, forge regulatory alliances, and deliver tailored solutions that enhance patient outcomes and operational resilience.

Connect with Ketan Rohom for In-Depth Insights and Exclusive Access to the Comprehensive Oxygen Concentrator Market Research Report

As you seek to deepen your understanding of the oxygen concentrator market landscape and secure a competitive edge, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to access the full market research report. By partnering with Ketan, you will gain exclusive insights into device-level segmentation, tariff analyses, regional growth strategies, and actionable recommendations tailored to your organizational priorities. Connect today to unlock comprehensive data-driven guidance that will inform decision-making, accelerate market entry, and optimize product portfolios in this rapidly evolving sector.

- How big is the Oxygen Concentrators Market?

- What is the Oxygen Concentrators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?