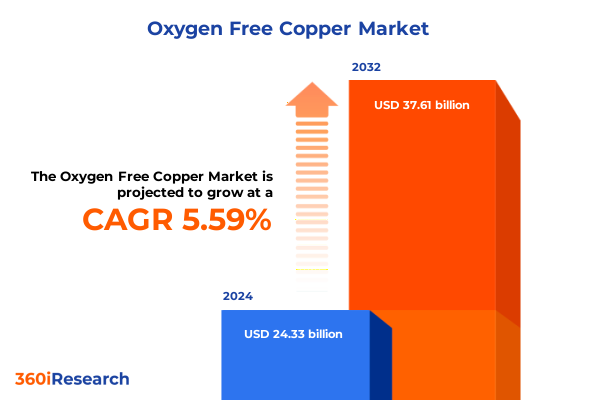

The Oxygen Free Copper Market size was estimated at USD 25.69 billion in 2025 and expected to reach USD 27.01 billion in 2026, at a CAGR of 5.59% to reach USD 37.61 billion by 2032.

Understanding the Strategic Importance of Oxygen Free Copper Amidst Evolving Industrial Applications and Rapid Technological Innovation

Oxygen free copper occupies a pivotal position in modern manufacturing and technological advancement, prized for its exceptional electrical and thermal conductivity. Its purity level, exceeding 99.95% copper content, underpins critical applications ranging from high-frequency electronics to precision scientific instrumentation. In industries where signal integrity and thermal performance are paramount, the absence of oxygen and related impurities ensures minimal electrochemical corrosion and superior ductility, extending component lifetimes and improving overall system reliability.

Recent waves of digital transformation across telecommunications, data centers, and electric vehicles have further elevated demand for oxygen free copper. As data throughput accelerates and power densities climb, engineers are increasingly specifying high-conductivity copper alloys to meet stringent performance thresholds. At the same time, sustainability goals and circular economy initiatives are driving material selection toward recyclability, with oxygen free copper’s straightforward smelting and refining processes facilitating closed-loop recovery. This executive summary elucidates the strategic value proposition of oxygen free copper amid a landscape defined by intensifying performance requirements, environmental stewardship mandates, and evolving supply chain dynamics.

Examining Key Disruptive Trends Reshaping the Oxygen Free Copper Market Dynamics and Global Supply Chain Structures Across Regulatory Environments

The oxygen free copper market has undergone transformative shifts as stakeholders grapple with shifting energy paradigms and global supply chain realignments. Decarbonization efforts have spurred electrification across transportation and power grids, positioning copper as a linchpin in renewable energy systems and electric vehicle motors. At the same time, geopolitical tensions and raw material nationalism have exposed vulnerabilities in critical metal supply chains, prompting end-users to forge strategic partnerships with reliable regional suppliers and invest in domestic refining capacity.

Concurrently, advancements in additive manufacturing and microfabrication have opened new horizons for copper utilization, enabling complex geometries and tailored alloy compositions that optimize thermal pathways in high-density electronics. This technological evolution has catalyzed synergy between material scientists and equipment manufacturers, driving iterative improvements in casting, drawing, and extrusion processes. The integration of real-time process monitoring and digital twin frameworks has boosted throughput and reduced scrap rates, reflecting a broader industry commitment to smart manufacturing.

In parallel, sustainability imperatives have intensified focus on lifecycle impacts, with traceability platforms and blockchain-enabled certification gaining traction. Manufacturers are embracing lower-emission copper refining methods and prioritizing recycled feedstock to minimize environmental footprints. As a result, end-users and regulators alike are demanding transparency across the metal value chain, accelerating the adoption of carbon accounting and eco-labeling that directly influence procurement decisions.

Analyzing the Comprehensive Effects of the 2025 United States Import Tariffs on Oxygen Free Copper Supply Chains and Market Resilience

In July 2025, the U.S. government announced a sweeping 50% tariff on all imported copper products, citing national security concerns and the need to revitalize domestic metal production, with effective implementation set for August 1, 2025. The policy leverages Section 232 of the Trade Expansion Act to address perceived vulnerabilities in refined copper and derivative goods critical to defense, energy, and telecommunications sectors. This decision followed a comprehensive investigation that underscored the strategic importance of a secure, resilient domestic copper supply chain.

The immediate market reaction was characterized by unprecedented arbitrage activity between CME and LME copper contracts. In anticipation of the levy, physical copper imports surged, with U.S. gateways receiving over 540,000 metric tons of refined copper and semi-finished products between March and May 2025. This pre-tariff stocking drained inventories on the LME and Shanghai Futures Exchange, triggering contango structures and widening the U.S. price premium over London benchmarks. Traders and end-users sought to insulate operations from looming cost increases, accelerating procurement cycles and straining global logistics networks.

Domestic inventory levels initially cushioned some immediate disruptions, with U.S. stockholding units reporting supplies sufficient for up to 12 months of projected consumption. However, specialist products such as oxygen free copper, which rely on precise refining and limited global fabrication capacity, felt the tariff’s impact more acutely. Companies dependent on these high-purity alloys faced compressed delivery windows and elevated landed costs, prompting supply chain reprioritization and the exploration of secondary sourcing strategies.

Longer-term implications include a potential realignment of global copper flows. Emerging hubs in Asia and the Middle East have ramped up exports to non-U.S. markets, while U.S. smelters and refineries are poised to benefit from higher domestic throughput. Nonetheless, the structural gap between available smelting capacity and rising demand for high-performance copper products suggests that supply-chain decoupling will be gradual. Stakeholders navigating this environment must balance near-term cost management with strategic investments in domestic processing and recycling infrastructure.

Deriving Actionable Insights from Multi-Dimensional Segmentation of the Oxygen Free Copper Market Based on Product, Form, Process, End Use, and Distribution

A nuanced understanding of the oxygen free copper market emerges when dissecting its multi-layered segmentation, revealing differentiated growth drivers and risk profiles. Product type segmentation illustrates distinct dynamics between billets, cathodes, and wire rods; premium billets command a price premium driven by stricter tolerances, while continuous cast cathodes offer economies of scale suitable for large‐volume smelters and electrolytic cathodes support high-purity applications. High conductivity wire rod, with its precise composition and drawability, is increasingly specified in advanced electronic connectors, contrasting with standard wire rod preferred in conventional power cabling.

Form-based segmentation further illuminates divergent value pools. Rolled flake and atomized flake lead in specialty alloy applications, where surface area and morphology influence sintering and thermal management in power electronics. Granular powder finds traction in additive manufacturing, enabling localized copper deposition in complex assemblies, whereas round and flat rods retain prominence in traditional rail and busbar manufacturing. Insulated wire’s growth parallels the proliferation of data transmission corridors, while bare wire underscores foundational roles in building wiring and industrial distribution.

The manufacturing process dimension underscores continuous casting’s dominance in high-throughput operations, with extrusion processes gaining ground for custom profile development. Drawing remains essential for achieving fine-gauge conductors with tight dimensional control. Each process imparts unique microstructural characteristics that influence conductivity, tensile strength, and surface finish, guiding end-use selection.

End-use industry segmentation reveals the breadth of applications: aerospace and defense rely on oxygen free copper for critical avionics and radar components; automotive demand is bifurcated between passenger and commercial vehicle electrification platforms; construction emphasizes performance in residential, commercial, and infrastructure wiring; electrical and electronics cover consumer devices, industrial power equipment, and grid transmission assets; while telecom and data infrastructure capitalize on high-fidelity signal transmission. Lastly, distribution channel segmentation highlights the evolving role of direct sales for large OEMs, the enduring significance of distributors in regional markets, and the rapid ascent of online platforms facilitating just-in-time procurement.

This comprehensive research report categorizes the Oxygen Free Copper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Manufacturing Process

- End Use Industry

- Distribution Channel

Uncovering Regional Market Characteristics and Growth Drivers for Oxygen Free Copper Across Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics in the oxygen free copper market are shaped by varying demand drivers, infrastructure maturity levels, and supply chain configurations. In the Americas, a resurgence of domestic mining and refining projects aligns with national security priorities, bolstering near-term output for high-purity copper products. The region’s advanced fabrication capabilities support robust aerospace, defense, and electric vehicle sectors, although logistical constraints in remote mining districts underscore ongoing supply volatility.

Across Europe, the Middle East, and Africa, policy frameworks promoting carbon reduction and circular economy models drive investment in recycling and secondary smelting capacity. The European Union’s stringent emissions standards incentivize low-emission copper refining, while Middle Eastern hubs leverage integrated refining complexes to serve both local industrial clusters and export markets. African nations with abundant ore bodies are forging strategic partnerships to develop in-country value chains, though regulatory uncertainty and infrastructure deficits pose challenges.

In the Asia-Pacific region, the convergence of rapid urbanization, digital infrastructure roll-out, and expanding renewable energy portfolios propels copper consumption. East Asian refiners, benefiting from vertically integrated supply chains, maintain dominant positions in global copper alloys, and Southeast Asia’s emerging manufacturing clusters generate new demand for specialty grades. Simultaneously, initiatives in Australia and the Pacific islands to upgrade mining and smelting operations aim to capture greater value from indigenous resources.

This comprehensive research report examines key regions that drive the evolution of the Oxygen Free Copper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Oxygen Free Copper Producers and Technology Innovators Driving Market Competitiveness and Value Creation

Leading companies in the oxygen free copper domain distinguish themselves through strategic integration, technological innovation, and sustainability commitments. Established global smelters have invested in next-generation refining technologies, such as advanced solvent extraction and high-efficiency vacuum casting, to reduce energy intensity and enhance purity levels. Technology providers specializing in continuous casting and precision drawing equipment have collaborated with material scientists to deliver customized solutions that minimize defects and optimize grain structure.

Emerging players from regions with recent capacity expansions leverage modern facilities to produce high-purity copper with lower carbon footprints. These entrants often adopt modular plant designs and digital control systems, enabling rapid scale-up and agile response to evolving product specifications. Strategic joint ventures between upstream miners and downstream fabricators are creating integrated platforms that improve traceability and cost efficiency, mitigating feedstock price volatility.

Across the value chain, ecosystem participants are forming consortia to develop standardized environmental and quality certifications for oxygen free copper. Such collaboration enhances market transparency, simplifies compliance for multinational end-users, and promotes widespread adoption of best practices. Companies that excel in aligning operational excellence with environmental stewardship are positioned to capture premium segments of the market and foster long-term partnerships with leading original equipment manufacturers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oxygen Free Copper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurubis AG

- Furukawa Electric Co., Ltd.

- Global Brass and Copper Holdings, Inc.

- Hitachi Metals, Ltd.

- Hussey Copper Ltd.

- KGHM Polska Miedź S.A.

- Luvata Oy

- Makin Metal Powders Ltd.

- Mitsubishi Materials Corporation

- Mitsui Mining & Smelting Co., Ltd.

- NGK Insulators, Ltd.

- Ningbo Jintian Copper Group Co., Ltd.

- Sam Dong Co., Ltd.

- Shanghai Metal Corporation

- Vale S.A.

- Wieland-Werke AG

Strategic Recommendations for Industry Leaders to Optimize Supply Chains Enhance Sustainability and Foster Innovation in Oxygen Free Copper

Industry leaders must adopt a trio of strategic priorities to thrive amid intensifying competition and regulatory pressures. First, investments in supply chain visibility and risk analytics enable proactive management of raw material sourcing, ensuring continuity of high-purity feedstocks under dynamic geopolitical conditions. By leveraging digital platforms and predictive modeling, organizations can preempt disruptions and optimize inventory levels across multiple tiers of the value chain.

Second, embedding sustainability criteria within procurement and production processes aligns operations with corporate responsibility targets and customer expectations. Transitioning to low-emission refining methods, incorporating recycled copper in primary production loops, and pursuing third-party environmental certifications not only reduce carbon footprints but also reinforce brand credibility among eco-conscious stakeholders.

Finally, fostering continuous innovation through collaborative research partnerships accelerates the development of next-generation copper alloys and fabrication techniques. Engagements between material scientists, equipment OEMs, and end-users lead to iterative advancements in conductivity, formability, and surface integrity, unlocking new high-value applications. By prioritizing modular production and digital quality control, companies can scale customized offerings rapidly, capturing emerging opportunities in sectors like quantum computing, 5G infrastructure, and hydrogen energy.

Detangling the Research Methodology Behind the Comprehensive Analysis of Oxygen Free Copper Market Dynamics and Insights Generation

The insights presented in this report derive from a rigorous, multi-pronged research methodology designed to capture the full spectrum of market dynamics. Primary research involved in-depth interviews with key stakeholders, including smelter executives, material engineers, supply chain managers, and end-user procurement specialists. These qualitative engagements illuminated operational challenges, technology adoption rates, and evolving specification requirements across major application areas.

Complementing primary data, extensive secondary research encompassed analysis of publicly available documents, trade association publications, government regulatory filings, and specialty materials journals. Process flow diagrams, techno-economic assessments of refining methods, and patent landscape reviews provided granularity on process efficiencies and emerging technologies.

Quantitative modeling techniques were applied to integrate segmentation dimensions, calibrate consumption patterns by industry vertical, and simulate the impact of external variables such as tariffs, energy pricing shifts, and sustainability mandates. Scenario analyses evaluated potential supply-demand imbalances under varying assumptions, while sensitivity testing assessed the resilience of key market segments to cost shocks and policy changes.

This methodological framework ensured a balanced synthesis of qualitative insights and quantitative rigor, delivering a comprehensive perspective on the oxygen free copper market’s structural drivers, competitive landscape, and future trajectory.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oxygen Free Copper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oxygen Free Copper Market, by Product Type

- Oxygen Free Copper Market, by Form

- Oxygen Free Copper Market, by Manufacturing Process

- Oxygen Free Copper Market, by End Use Industry

- Oxygen Free Copper Market, by Distribution Channel

- Oxygen Free Copper Market, by Region

- Oxygen Free Copper Market, by Group

- Oxygen Free Copper Market, by Country

- United States Oxygen Free Copper Market

- China Oxygen Free Copper Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Summarizing Key Findings and Future Imperatives for Stakeholders Navigating the Oxygen Free Copper Market Amidst Evolving Industry Challenges

This executive summary has surfaced the critical forces shaping oxygen free copper markets, from transformative industrial trends and policy levers to nuanced segmentation and regional dynamics. Stakeholders are urged to recognize the interplay between decarbonization imperatives, digital manufacturing innovations, and geopolitical realignments that collectively drive material specifications and sourcing strategies.

The 2025 U.S. tariff initiative underscores the growing influence of trade policy on supply chain resilience, particularly for high-purity products like oxygen free copper. As domestic refining capacity evolves, market actors must balance immediate risk mitigation with long-term investments in processing technologies and circular economy frameworks. Likewise, segment-specific insights reveal that differentiated approaches are essential, whether serving premium aerospace applications or high-volume power cabling requirements.

Strategic action will hinge on integrating advanced analytics, sustainable practices, and collaborative innovation to navigate an increasingly complex landscape. By leveraging robust methodological foundations and targeted industry intelligence, decision-makers can position their organizations to capture emerging opportunities and mitigate disruptions. The future growth of oxygen free copper will favor those who anticipate technological inflection points, align with environmental mandates, and cultivate resilient, agile supply networks.

Contact Ketan Rohom to Acquire the In-Depth Oxygen Free Copper Market Research Report and Drive Strategic Advantage in Your Organization

Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report on oxygen free copper. Don’t miss the opportunity to leverage in-depth analysis, segmentation insights, and actionable recommendations tailored to empower strategic decision-making within your organization. Connect today to explore customized licensing options and begin unlocking competitive advantage through the most current and authoritative intelligence available.

- How big is the Oxygen Free Copper Market?

- What is the Oxygen Free Copper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?