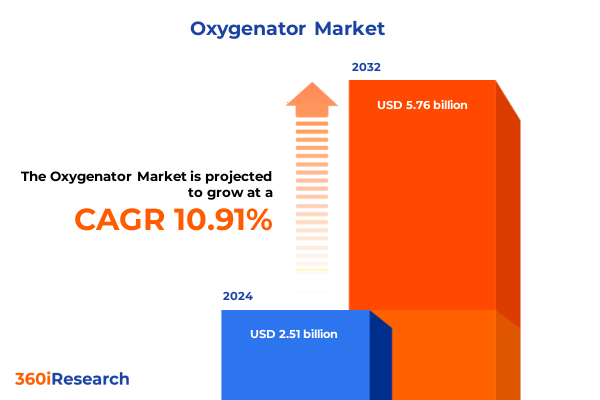

The Oxygenator Market size was estimated at USD 2.78 billion in 2025 and expected to reach USD 3.09 billion in 2026, at a CAGR of 10.94% to reach USD 5.76 billion by 2032.

Evolving Clinical Needs And Regulatory Mandates Are Redefining Oxygenator Market Dynamics In Critical Care Applications

The global oxygenator market has evolved significantly under the influence of demographic shifts, surgical advancements, and heightened emphasis on critical care infrastructure. Rising incidences of cardiovascular and respiratory disorders drive sustained demand for effective extracorporeal oxygenation support. Concurrently, technological breakthroughs have enabled more efficient, biocompatible, and user-friendly devices that improve patient outcomes and streamline clinical workflows.

In recent years, clinical practitioners have prioritized patient safety and ease of use, prompting a wave of innovations in oxygenator design, materials, and sensor integration. At the same time, regulatory agencies have intensified scrutiny on device performance, mandating rigorous validation and post-market surveillance protocols. As a result, manufacturers face the dual challenge of accelerating innovation cycles while ensuring compliance with evolving global standards. This introduction sets the stage for a deeper exploration of the transformative forces reshaping the oxygenator landscape, equipping stakeholders with foundational context for strategic decision-making.

Breakthrough Materials Analytics And Digital Monitoring Transform Device Efficacy And Clinical Protocols In Oxygenation Strategies

The oxygenator market landscape is undergoing transformative shifts driven by converging trends in device miniaturization, digital integration, and personalized therapy. Advances in materials science have yielded coating technologies that enhance hemocompatibility and reduce thrombogenic risk, while novel fiber geometries optimize gas transfer efficiency. In parallel, digital health solutions are enabling real-time monitoring of blood flow, oxygenation levels, and device integrity, paving the way for predictive maintenance and remote diagnostics.

Moreover, clinical protocols are shifting toward minimally invasive extracorporeal support and ambulation-friendly circuits, reflecting a broader move toward enhanced patient mobility and reduced ICU stays. Hybrid oxygenation platforms combining manual and automated control modalities cater to diverse procedural requirements, fostering adoption across ambulatory surgery centers and specialty clinics. Collectively, these technological and procedural shifts underscore a market in flux, where agility in product development and cross-functional collaboration between engineering, clinical, and regulatory teams becomes paramount.

Evaluating How The 2025 United States Tariffs On Medical Imports Reshape Supply Chains Resilience And Cost Management Paradigms

In early 2025, the United States government implemented a baseline 10% tariff on imports of medical components from China, while pausing previously proposed 25% tariffs on products originating from Canada and Mexico, signaling a complex trade environment for device manufacturers managing global supply chains. This policy adjustment has immediate implications for cost structures, as suppliers recalibrate sourcing strategies to mitigate increased duties and maintain competitive pricing within hospital procurement budgets.

Financial markets reacted swiftly to the tariff announcement, with major medical device equities experiencing downward pressure due to anticipated margin compression and supply chain reconfigurations. Prominent industry players reported decreased profit margin forecasts linked directly to increased import costs, prompting accelerated localization initiatives and cost-passing mechanisms such as price adjustments and strategic contract renegotiations. As healthcare providers face elevated expenditures, this cumulative tariff impact reshapes investment priorities and underscores the need for supply chain resilience.

Unpacking Holistic Market Segmentation Reveals Intersection Of Product Types Control Systems Clinical Applications And Go To Market Modalities

Dissecting market segmentation unveils critical insights into the multifaceted demand drivers and adoption patterns across product offerings, technological control systems, and clinical usage scenarios. The market’s foundational architecture comprises bubble, hollow fiber, and membrane oxygenators, each differentiated further by efficiency profiles, disposability considerations, and anticoagulant coatings. Oscillating between standard and high-efficiency modalities, product developers leverage surface engineering to balance throughput with biocompatibility, while selection of disposable versus reusable hollow fiber modules caters to cost-conscious institutions and high-volume surgical centers alike.

Layered onto these core product distinctions, technology paradigms range from fully manual, foot- or hand-operated controls to hybrid semi-manual configurations and sophisticated automatic systems integrating electronic or pneumatic sensors. This spectrum enables customization across environments from high-acuity operating rooms to transport applications. Meanwhile, flow rate capabilities span micro- and mini-flow settings for neonatal care through enhanced, standard, and ultra-high throughput for complex adult support. Clinical applications in cardiopulmonary bypass, ECMO circuits, and specialized neonatal support further refine usage profiles, while sales channels from direct institutional agreements and OEM contracts through national, regional, and online distributors dictate go-to-market strategies. This segmentation mosaic highlights where unmet needs converge with growth opportunities, guiding targeted innovation roadmaps.

This comprehensive research report categorizes the Oxygenator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Flow Rate

- Application

- End User

- Sales Channel

Comparative Regional Evolution In Infrastructure Reimbursement And Regulatory Drivers Shaping Oxygenator Adoption Across Key Global Markets

Regional dynamics exert a profound influence on oxygenator market trajectories, reflecting disparities in healthcare infrastructure, regulatory frameworks, and reimbursement mechanisms. In the Americas, robust hospital networks and increasing elective cardiac procedures fuel demand for next-generation biocompatible oxygenators, while favorable reimbursement policies accelerate capital investment in extracorporeal support technologies. Conversely, supply chain digitization and telehealth expansions are carving new channels for aftermarket services and remote monitoring solutions.

Across Europe, the Middle East, and Africa, heterogeneous healthcare systems and evolving regulatory harmonization initiatives shape purchasing behaviors. Western European markets exhibit high acceptance of advanced sensor-based automatic control platforms, supported by stringent patient safety mandates, whereas emerging economies prioritize cost-effectiveness and modular system flexibility. In the Asia-Pacific region, demographic pressures from aging populations and government-led infrastructure development spur investment in hospital capacity, driving opportunities for compact, portable oxygenation modules. These regional insights underscore the strategic imperative of aligning product portfolios and market entry tactics with localized clinical and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Oxygenator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Emphasizing Collaborative R&d Manufacturing Diversification And Service Ecosystem Expansion

Leading organizations in the oxygenator segment demonstrate a consistent emphasis on collaborative innovation, strategic manufacturing partnerships, and differentiated value propositions. Industry frontrunners are investing heavily in R&D collaborations with academic centers, leveraging advanced polymer science and computational fluid dynamics to optimize oxygenator fiber performance. Manufacturing alliances across geographies enable dual-sourcing strategies that mitigate tariff exposure and align production footprints with target markets.

Key players are also expanding service ecosystems by integrating remote performance monitoring and predictive maintenance platforms, fostering recurring revenue streams beyond initial equipment sales. Strategic acquisitions and joint ventures remain prevalent pathways to bolster capabilities in sensor miniaturization and continuous blood parameter analysis. In addition, forward-looking competitors are exploring bioengineered membrane coatings with antimicrobial and anti-inflammatory functionalities, signaling the next wave of product differentiation in the oxygenation landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oxygenator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Medical Co., Ltd.

- Fresenius SE & Co. KGaA

- Getinge AB

- LivaNova PLC

- MC3 Group, Inc.

- Medos Medizintechnik AG

- Medtronic plc

- Nikkiso Co., Ltd.

- Nipro Corporation

- Terumo Corporation

Implementing Integrated Innovation Manufacturing Flexibility And Regulatory Advocacy To Strengthen Competitive Positioning In Oxygenation Devices

To capitalize on emerging opportunities and mitigate evolving risks within the oxygenator sector, industry leaders should prioritize a multi-pronged strategic approach. First, fostering cross-functional innovation hubs that integrate clinical feedback, regulatory expertise, and engineering talent can accelerate development cycles and enhance device safety profiles. Additionally, establishing flexible manufacturing networks with localized assembly lines will reduce tariff burdens and shorten time-to-market in key regions.

Concurrent investment in data-driven after-sales service platforms can generate predictable revenue and strengthen client relationships through performance-driven maintenance models. Engaging proactively with regulatory bodies to advocate for equitable tariff exemptions and streamlined approval pathways will further secure market access. Finally, cultivating strategic alliances with healthcare providers and payers to demonstrate clinical and economic value can underpin adoption of premium oxygenator solutions, thereby driving sustainable competitive advantage.

Deploying A Multi Source Data Fusion Framework Enhanced By Expert Validation To Ensure Robust Analysis And Strategic Relevance

The research methodology underpinning this analysis combined primary stakeholder interviews, secondary data aggregation, and rigorous qualitative validation. Primary engagements included consultations with clinical practitioners, procurement officers, and device engineers to capture real-world usage insights and unmet needs across diverse care settings. Secondary research encompassed peer-reviewed journals, regulatory filings, and public financial disclosures to triangulate technology trends and company strategies.

Subsequent data synthesis employed advanced thematic analysis techniques to identify convergence points across segmentation dimensions and regional variances. Validation workshops with subject matter experts ensured the accuracy of interpretations and the relevance of strategic recommendations. This integrated framework ensures robustness, objectivity, and actionable clarity, providing stakeholders with a dependable foundation for decision-making in the rapidly evolving oxygenator market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oxygenator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oxygenator Market, by Technology

- Oxygenator Market, by Product Type

- Oxygenator Market, by Flow Rate

- Oxygenator Market, by Application

- Oxygenator Market, by End User

- Oxygenator Market, by Sales Channel

- Oxygenator Market, by Region

- Oxygenator Market, by Group

- Oxygenator Market, by Country

- United States Oxygenator Market

- China Oxygenator Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Synthesizing Core Insights Highlights The Imperative Of Supply Chain Resilience Technological Differentiation And Service Innovation In Oxygenator Markets

The convergence of technological innovation, shifting clinical paradigms, and evolving trade policies underscores a dynamic and consequential moment for the oxygenator market. As device architectures become more sophisticated, integrating advanced materials and digital controls, manufacturers must navigate complex segmentation landscapes and diverse regional requirements to remain competitive. The imposition of new tariffs accentuates the strategic importance of supply chain resilience and localized manufacturing, while collaborative service offerings represent key differentiators that drive customer loyalty and revenue stability.

Ultimately, stakeholders who embrace integrated development models, proactive regulatory engagement, and data-centric service expansions will be best positioned to capitalize on emerging clinical demands and deliver measurable patient benefits. The insights detailed herein offer a comprehensive roadmap for informed decision-making, enabling organizations to anticipate market shifts and align resources with high-impact growth areas.

Unlock Strategic Competitive Intelligence And Expert Guidance By Contacting Associate Director Sales Marketing For Oxygenator Market Research

Engaging with an industry expert opens the door to tailored insights and strategic guidance that align with specific organizational objectives. By partnering with an Associate Director specializing in Sales & Marketing, prospective clients gain access to bespoke intelligence on competitive positioning, regulatory shifts, and innovation roadmaps. Direct engagement ensures clarity on report deliverables, customization options, and post-purchase support, facilitating seamless integration of findings into strategic planning. Empowering decision-makers with actionable data accelerates implementation timelines and maximizes return on investment in the dynamic medical device landscape. To secure the full oxygenator market research report and unlock these advantages, reach out to Ketan Rohom, Associate Director, Sales & Marketing, and take the first step toward informed strategic leadership.

- How big is the Oxygenator Market?

- What is the Oxygenator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?