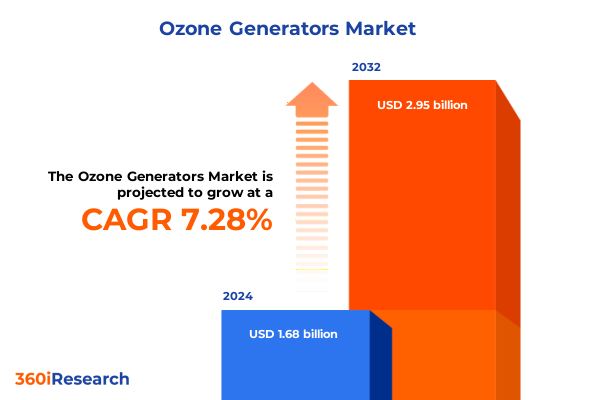

The Ozone Generators Market size was estimated at USD 1.79 billion in 2025 and expected to reach USD 1.91 billion in 2026, at a CAGR of 7.36% to reach USD 2.95 billion by 2032.

Introduction to the Emerging Role of Ozone Generators in Addressing Air and Water Quality Challenges Amid Intensifying Environmental Pressures

The ozone generator industry is emerging as a critical enabler of sustainable air and water treatment solutions as environmental challenges intensify globally. Recent data indicate that 39% of Americans, or over 131 million people, are exposed to unhealthy levels of air pollution, driven by factors such as wildfire smoke, urban emissions, and extreme weather events. This underscores the urgency for technologies that deliver effective contaminant removal while aligning with heightened regulatory standards.

Simultaneously, water quality concerns are propelling the adoption of advanced disinfectant methods beyond traditional chlorination. The U.S. Environmental Protection Agency’s Stage 1 and Stage 2 Disinfectants and Disinfection Byproducts Rules have catalyzed interest in ozone as a primary disinfectant, owing to its ability to reduce organic contaminants, control taste and odor, and limit byproduct formation under stringent drinking water regulations. These rules emphasize a future where multi-barrier disinfection strategies increasingly integrate ozone systems to achieve compliance without compromising safety or efficacy.

In tandem with regulatory drivers, climatic trends such as prolonged drought and extreme heat events are aggravating pollutant concentrations and challenging conventional treatment infrastructures. Wildfire smoke episodes have been shown to exacerbate ozone and particulate levels, prompting renewed focus on robust air purification measures across residential, commercial, and industrial settings. As stakeholder demand for cleaner air and water continues to rise, ozone generators stand poised to bridge performance gaps and enable more resilient environmental management frameworks.

Uncovering Transformative Shifts in Ozone Generator Technology, Adoption Patterns, and Market Dynamics Reshaping the Industry Landscape

The last several years have witnessed transformative shifts in ozone generator technologies and adoption patterns, reshaping the competitive and regulatory dynamics of the sector. Advances in generator design-spanning dielectric barrier discharge (DBD) configurations, cold plasma systems, and UV-based ozone generation-have yielded more compact, energy-efficient units capable of precise flow control and higher ozone concentrations. These innovations are enabling seamless integration into HVAC platforms, industrial process lines, and modular water treatment skids, thereby broadening application possibilities far beyond traditional centralized treatment plants.

Equally significant is the convergence of digitalization and automation within ozone systems. Modern generators leverage smart controls, remote monitoring, and predictive analytics to optimize performance, reduce downtime, and minimize operational costs. Real-time feedback on feed-gas quality, chamber temperature, and ozone output now informs dynamic adjustment protocols, ensuring consistent disinfection efficacy under varying load conditions. This trend aligns with broader Industry 4.0 imperatives and is accelerating as end-users seek turnkey solutions with built-in safeguards and data-driven maintenance strategies.

Environmental and health regulations are also evolving to recognize ozone’s merits relative to chemical disinfectants. Ozone’s rapid oxidative potential facilitates the removal of tough-to-treat contaminants, including emerging pollutants and algal toxins, while decreasing formation of regulated byproducts such as trihalomethanes and haloacetic acids. Concurrently, R&D efforts into surface plasma generation and advanced electrolytic cells are driving down energy consumption and improving longevity of critical components, positioning ozone generators as not only effective but also sustainable disinfection options. These cumulative shifts are redefining the growth trajectory of the industry and unlocking new market segments.

Assessing the Cumulative Impact of U.S. 2025 Tariff Policies on the Ozone Generator Supply Chain and Cost Structures

Trade policy developments in 2025 have introduced significant new cost pressures and supply chain complexities for ozone generator manufacturers and distributors. The implementation of universal “reciprocal tariffs” in early April imposed a baseline 10% levy on nearly all imported goods to the United States, including critical ozone generator components such as UV lamps, dielectric materials, and electronic control modules. This baseline tariff was layered atop existing duties, creating compound cost effects for firms sourcing from key manufacturing hubs in Asia and Europe.

Adding to this, country-specific tariff escalations have disproportionately affected Chinese-origin shipments. Tariffs on Chinese imports peaked at rates as high as 145%, later negotiated down to a structured 30% under a bilateral trade agreement in May 2025. The volatility of these rate adjustments has disrupted procurement planning and prompted lead-time extensions, as firms grapple with rate uncertainty and customs clearance delays. Manufacturers reliant on imported corona discharge tubes, power supply units, and specialized membranes have faced cost inflation of up to 25–30% in certain instances, compelling many to renegotiate supplier contracts or explore local alternatives.

The net impact of these tariff measures extends beyond raw material costs. With higher landed costs for imported subassemblies, end-product pricing adjustments have rippled through the distribution chain, affecting end-users in sectors ranging from municipal water treatment to food processing and healthcare. Consequently, supply chain resilience strategies-such as nearshoring, dual sourcing, and inventory buffering-have become priority initiatives. While these measures mitigate immediate disruptions, they also introduce new capital requirements and operational complexities, underlining the pressing need for trade-compliant supply networks and agile procurement frameworks.

Unveiling Key Segmentation Insights to Decode Application, End-User, Type, Technology, and Distribution Channel Priorities Across the Ozone Generator Market

A nuanced understanding of the ozone generator landscape emerges when deconstructing it across multiple segmentation dimensions. In application terms, air purification systems leverage HVAC-integrated generators to neutralize volatile organic compounds and airborne pathogens, while portable devices deliver targeted odor control; food and beverage operations employ ozone in processes like canning, dairy treatment, and bottled water sterilization; industrial processing segments utilize high-output units for chemical yields and textile bleaching; medical and pharmaceutical facilities depend on precise disinfection and sterilization protocols; and water treatment encompasses municipal distribution, swimming pool sanitation, and wastewater remediation.

End-user diversity further influences adoption patterns. Commercial sectors such as hotels, healthcare facilities, and restaurants prioritize continuous air quality management, whereas industrial entities including food processing plants and chemical manufacturers optimize ozone systems for product quality and compliance. Municipal utilities integrate large-scale ozone plants to meet tightening public health mandates, and residential consumers increasingly favor compact purifiers and small-office systems to address indoor air concerns.

Type-based segmentation highlights technological differentiation, with cold plasma generators offering low-temperature operation through dielectric barrier discharge and surface plasma methods, and corona discharge systems delivering variable ozone concentrations. Electrolytic models feature membrane and non-membrane designs that produce ozone directly from water, while UV radiation units span high, medium, and low power categories to balance energy use with output requirements.

Technology segmentation contrasts integrated systems, which embed generators within HVAC or water treatment frameworks, against standalone units designed for installation flexibility in fixed or portable formats. Distribution channels range from direct sales and OEM contracts to regional distributor networks and evolving e-commerce platforms, each channel shaping service, support, and pricing strategies.

This comprehensive research report categorizes the Ozone Generators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Distribution Channel

- End-User

- Application

Illuminating Regional Trends Highlighting the Americas, Europe Middle East & Africa, and Asia-Pacific Dynamics in the Ozone Generator Ecosystem

Regional market dynamics are proving to be as distinct as the regulatory environments, infrastructure maturity, and environmental challenges that define them. In the Americas, stringent Clean Air Act standards and the emerging Safe Drinking Water Rule revision have propelled municipalities toward advanced oxidation pathways, with ozone generators playing a pivotal role in PFAS mitigation and microbial control. Renewable energy incentives are also enabling hybrid systems that pair ozone with solar-powered electrolytic modules, particularly in remote communities facing grid constraints.

Europe, the Middle East, and Africa (EMEA) show parallel momentum driven by the European Union’s Water Framework Directive, which emphasizes nutrient reduction and chemical-free disinfection. Utilities in northern Europe are pioneering full-scale ozone treatment trains augmented by biological filtration to manage organic loads, while Middle Eastern water-scarce nations deploy compact, high-capacity units for desalination brine conditioning and algae toxin removal. Africa’s urban centers are experimenting with mobile ozone solutions to address intermittent water access and contamination risks.

Asia-Pacific continues to exhibit the fastest growth rates, fueled by industrial expansion, rising F&B processing volumes, and public health imperatives following pandemic lessons. Governments across China, India, and Southeast Asia are incentivizing domestic production of ozone generator components to alleviate supply chain tensions. Meanwhile, pilot programs in Australia’s dairy belt demonstrate the efficacy of UV-ozone hybrid reactors for process water reuse, highlighting a commitment to circular economy principles and wastewater valorization.

This comprehensive research report examines key regions that drive the evolution of the Ozone Generators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves by Leading Ozone Generator Manufacturers Driving Innovation, Partnerships, and Market Consolidation

Key players are rapidly evolving their portfolios and partnerships to stay ahead in a competitive and innovation-driven market. Veolia’s Ozonia brand has cemented leadership through iterative improvements to its Intelligent Gap System+ technology, delivering record ozone capacities while slashing energy consumption via SmartO3 controls. Veolia’s recent integration of the Ozonia Membrel MkV electrolytic platform underscores the trend toward membrane-based ozone generation for ultrapure water loops.

Suez has bolstered its advanced oxidation offerings through targeted acquisitions and joint ventures, enhancing its capacity to deliver turnkey municipal treatment solutions. SUEZ’s redox partnerships and modular skid systems appeal to growing demand for decentralized sanitation applications. Meanwhile, Evoqua’s proprietary UV-ozone hybrid modules have gained traction in industrial process water markets, and its collaboration with semiconductor manufacturers illustrates the strategic pivot toward high-purity niche sectors.

Among emerging contenders, H2O Innovation has secured multiple contracts in North America through agile project execution and customized skid designs, reflecting a shift toward local engineering support. ITT Inc.’s acquisition of Blakers Pump Engineers and Ecolab’s merger with Nalco have injected new scale and distribution reach into their respective disinfection portfolios. Consolidation remains a defining theme, as these and other strategic moves-including Degrémont’s AmeriWater acquisition-shape a landscape where differentiation hinges on technological leadership and integrated service capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ozone Generators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Absolute Ozone Pty Ltd

- Absolute Systems Inc

- Conmea Ozone AB

- De Nora S.p.A.

- Industrie De Nora S.p.A.

- METAWATER Co., Ltd. (

- Novair Ozone Technology AG

- Ozone Solutions, LLC

- OzonePure, Inc.

- SUEZ Water Technologies & Solutions

- Toshiba Corporation

Actionable Recommendations for Industry Leaders to Strengthen Supply Chain Resilience, Operational Excellence, and Strategic Partnerships in a Dynamic Market

Industry leaders should prioritize enhancing supply chain flexibility by diversifying sourcing across multiple regions and investing in nearshore manufacturing hubs to mitigate tariff-driven cost volatility. Establishing long-term agreements with component suppliers can secure preferential access to critical materials and stabilize input costs in an uncertain trade environment.

Operational excellence can be achieved by embracing real-time monitoring platforms that integrate ozone generator performance metrics with predictive maintenance tools. This will reduce downtime, optimize energy usage, and extend system lifecycles, ultimately strengthening the return on investment for end-users.

Strategic collaborations between technology providers and system integrators will be essential to develop turnkey solutions tailored to specific verticals, such as pharmaceuticals and food processing. By co-creating application-specific modules, companies can capture higher value and differentiate offerings in crowded markets.

Finally, active engagement with regulatory bodies and participation in industry consortia will ensure alignment with emerging environmental standards and safeguard market access. Organizations that proactively shape policy dialogues and contribute to standards development will be better positioned to expedite product approvals and gain competitive advantage.

Comprehensive Research Methodology Combining Secondary Analysis, Expert Interviews, and Quantitative Validation to Ensure Insightful and Reliable Findings

This research integrates a rigorous mixed-methodology approach to ensure depth, accuracy, and reliability of findings. Secondary research involved comprehensive review of regulatory documents, industry standards, and peer-reviewed publications from government and academic sources. Key regulatory frameworks examined include U.S. EPA disinfection rules and international water quality directives, supplemented by environmental health reports from nonprofit entities.

Primary research comprised in-depth interviews and executive surveys with leading equipment manufacturers, technology providers, end-users across key sectors, and regulatory experts. These engagements provided nuanced perspectives on market drivers, technological challenges, and strategic priorities, enabling triangulation of quantitative and qualitative data.

Data validation protocols included cross-referencing company disclosures, tariff schedules, and supply chain indices, complemented by expert panel reviews. Statistical analysis techniques were applied to map cost impacts, adoption rates, and regional variations. Final report development adhered to stringent editorial and quality control processes to ensure clarity, coherence, and actionable insight for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ozone Generators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ozone Generators Market, by Type

- Ozone Generators Market, by Technology

- Ozone Generators Market, by Distribution Channel

- Ozone Generators Market, by End-User

- Ozone Generators Market, by Application

- Ozone Generators Market, by Region

- Ozone Generators Market, by Group

- Ozone Generators Market, by Country

- United States Ozone Generators Market

- China Ozone Generators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3816 ]

Conclusion Reflecting on Strategic Imperatives and Technological Innovations Driving the Future of the Ozone Generators Market

As environmental imperatives and regulatory landscapes continue to evolve, ozone generator technology emerges as a versatile and powerful solution for air and water quality management. From cutting-edge cold plasma and electrolytic systems to intelligent controls and hybrid reactor designs, the sector is characterized by rapid innovation and dynamic collaboration among leading manufacturers.

Trade policy shifts in 2025 have underscored the critical importance of supply chain agility and geographic diversification, prompting industry participants to reconfigure sourcing strategies and fortify inventory planning. Meanwhile, regional variations in adoption patterns-shaped by public health mandates, water scarcity concerns, and industrial growth trajectories-highlight the need for tailored approaches to system design and deployment.

Looking ahead, the convergence of sustainability goals, digital transformation, and circular economy principles will further propel the integration of ozone systems into holistic environmental management frameworks. Companies that excel in operational excellence, strategic partnerships, and policy engagement will secure leadership positions in this expanding market. Ultimately, ozone generators represent both a technological imperative and a strategic opportunity for stakeholders committed to safer, cleaner, and more resilient air and water systems.

Connect Directly with Ketan Rohom for a Comprehensive Ozone Generators Market Report to Elevate Strategic Decision-Making

For tailored insights, detailed data breakdowns, and a comprehensive exploration of the ozone generators market, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full market research report and empower your strategic decision-making.

- How big is the Ozone Generators Market?

- What is the Ozone Generators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?