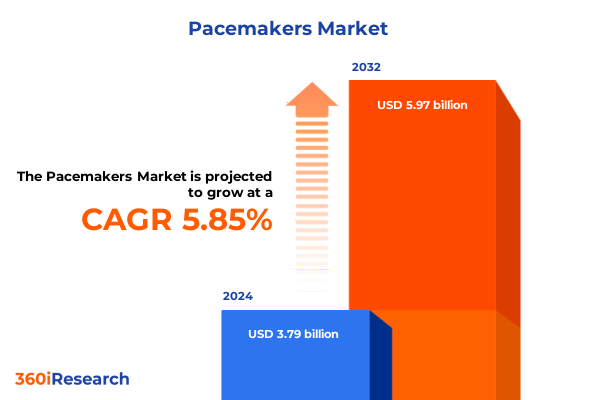

The Pacemakers Market size was estimated at USD 4.01 billion in 2025 and expected to reach USD 4.24 billion in 2026, at a CAGR of 5.87% to reach USD 5.97 billion by 2032.

Setting the stage for a thorough exploration of innovations regulatory influences and shifting clinical practices driving the pacemaker industry

The global pacemaker landscape has entered a dynamic era defined by groundbreaking innovations, evolving regulatory frameworks, and shifting patient care paradigms. As the prevalence of cardiac arrhythmias continues to rise, stakeholders across healthcare systems-from device manufacturers to clinicians and payers-seek a deeper understanding of the technological advances and market forces shaping the future of artificial cardiac pacing. This executive summary sets the stage for a systematic exploration of the critical drivers, challenges, and opportunities that define today’s pacemaker sector.

In uncovering these insights, the analysis draws on the latest clinical and industry developments without resorting to complex numerical projections. It examines the transformative potential of emerging device architectures, such as leadless systems and conditional pacing technologies, and considers how evolving reimbursement landscapes and cross-border regulatory environments influence adoption. By doing so, this report equips decision-makers with actionable knowledge to navigate the rapidly changing contours of cardiac rhythm management.

Examining how transformative breakthroughs in leadless dual-chamber and conditional pacing are redefining clinical outcomes and device paradigms

In recent years, the pacemaker sector has undergone transformative shifts driven by technological breakthroughs, clinical evidence, and market demands for minimally invasive solutions. Leadless pacemakers have emerged as a paradigm-changing innovation, eliminating leads and subcutaneous pockets to reduce procedural complications and accelerate patient recovery. Contemporary U.S. practice has shown significantly increased implantation rates of leadless devices, rising from just over 3,200 in 2016–2017 to nearly 12,000 by 2020, accompanied by consistently improved in-hospital mortality outcomes and stable complication rates.

Simultaneously, dual-chamber leadless platforms are redefining pacing strategies by enabling synchronized atrial and ventricular stimulation without transvenous leads. These systems leverage proprietary communication protocols to maintain AV synchrony, expanding leadless pacing indications to a broader patient cohort. In parallel, advances in conditional pacemaker technology permit devices to adapt pacing parameters in response to physiological activity, enhancing patient quality of life. These converging trends, supported by robust long-term registry data, underscore the sector’s rapid evolution and the imperative for stakeholders to reassess product portfolios and clinical pathways.

Analyzing the impact of the 2025 United States Section 301 tariff revisions on pacemaker supply chains procurement costs and strategic sourcing

The imposition of heightened tariff obligations on medical device imports has emerged as a critical consideration for manufacturers and healthcare providers alike. In early 2025, the United States Trade Representative finalized increases to Section 301 tariffs, affecting a spectrum of medical products, including certain pacemaker components and accessory devices. These tariff escalations, varying by country of origin, introduce new cost pressures and compel industry participants to reexamine supply chain configurations and procurement strategies.

As components for sophisticated cardiac rhythm management systems often originate from global manufacturing hubs, tariff-induced cost variability may accelerate efforts to diversify sourcing and localize production. Stakeholders are exploring nearshoring options and strategic partnerships to mitigate additional duties and sustain device affordability. Concurrently, healthcare organizations must anticipate potential budgetary impacts while engaging with payers to secure reimbursement frameworks that reflect these evolving import considerations.

Uncovering critical segmentation insights across product types power sources clinical environments technologies and pacing modes driving tailored pacemaker strategies

Diverse market requirements emerge when considering the full spectrum of pacemaker offerings by product modality, power architecture, clinical setting, device intelligence, and pacing configuration. Product categories range from external systems, deployed as permanent or temporary solutions, to fully implantable platforms that serve chronic conditions. Within these implantable portfolios, power source considerations split between non-rechargeable units designed for straightforward replacement cycles and rechargeable systems optimized for longevity.

Clinical utilization spans ambulatory surgical centers that perform outpatient implant procedures, specialized cardiac centers focused on complex arrhythmia management, and both private and public hospital environments where high-volume device programs reside. Technologically, devices fall under conditional platforms that adjust pacing responsiveness to physiological cues, contrasted with non‐conditional units that deliver fixed-rate stimulation. Pacing modes further diversify offerings into biventricular configurations-with or without integrated defibrillation-and dual chamber systems, including DDD and DDI protocols, alongside single chamber solutions targeting atrial and ventricular chambers independently. This extensive segmentation framework informs targeted product development and market entry strategies.

This comprehensive research report categorizes the Pacemakers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- Technology

- Mode

- Application

- End User

Assessing regional variances and strategic avenues in pacemaker deployment across the Americas Europe Middle East & Africa and Asia-Pacific markets

Regional dynamics illustrate that pacemaker adoption and innovation diffuse unevenly across key global markets. In the Americas, robust reimbursement policies, extensive clinical trial networks, and established device manufacturers drive early adoption of advanced pacing platforms. Meanwhile, Europe, Middle East & Africa hosts a heterogeneous regulatory landscape where country‐level health system priorities influence device approvals and procurement cycles; the region’s emphasis on cost containment often fosters competitive tendering processes.

Conversely, Asia-Pacific markets demonstrate a surge in demand for minimally invasive device options, spurred by demographic shifts, rising cardiovascular disease incidence, and targeted government investments in healthcare infrastructure. These regional profiles underscore the necessity for manufacturers to tailor market-entry tactics, pricing models, and clinical engagement initiatives to local policy regimes and care delivery ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Pacemakers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading manufacturers and their strategic initiatives forging innovations partnerships and competitive positioning in the pacemaker ecosystem

A cadre of global and specialized players anchors the competitive landscape, pursuing robust pipelines and strategic collaborations to capture emerging opportunities. Medtronic, a longstanding innovator, continues to iterate on its transcatheter pacing offerings, securing regulatory clearances for next-generation leadless systems. Abbott has forged partnerships with leading research centers, notably advancing its dual-chamber leadless platform following FDA approval and translating clinical trial momentum into European and U.S. market launches.

Boston Scientific, Biotronik, and EBR Systems drive competitive differentiation through investments in miniaturization, battery chemistry, and expanded device interoperability. Collaborative research programs with academic institutions and cross-industry alliances underpin efforts to refine conditional pacing algorithms and integrate remote monitoring intelligence. Together, these corporate initiatives shape a rapidly evolving competitive battleground where agility in innovation and regulatory navigation determines market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pacemakers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- Braile Biomedica Industria Comercio e Representacoes LTDA

- Centro de Construcción de Cardioestimuladores del Uruguay S.A.

- Cook Medical LLC

- EBR Systems, Inc.

- Galix Biomedical Instrumentation, Inc.

- Izhevsk Mechanical Plant

- Lepu Medical Technology (Beijing) Co., Ltd.

- LivaNova PLC

- Medico S.p.A.

- Medived Innovations Private Limited

- Medtronic plc

- MicroPort Scientific Corporation

- Oscor, Inc.

- Osypka Medical GmbH

- Schiller AG

- Shree Pacetronix Ltd.

- Spacelabs Healthcare, Inc.

- ZOLL Medical Corporation

- ООО «Кардиоэлектроника»

Delivering actionable strategies to optimize supply chains drive evidence-based innovations and reinforce collaboration for sustained leadership in pacemaker development

Industry leaders must adopt a multifaceted approach to thrive amid regulatory and technological upheaval. Prioritizing flexible supply chain architectures can mitigate tariff exposure, reduce lead times, and enable scalable responses to market fluctuations. Strategic investments in regional manufacturing hubs and contract development partnerships will fortify resilience and balance cost considerations with quality imperatives.

Concurrently, aligning product development roadmaps with clinical evidence generation-leveraging real-world data registries and post-approval studies-will accelerate payor acceptance and clinician adoption. Organizations should also explore modular device architectures that accommodate evolving clinical guidelines for conditional pacing and multi-chamber synchronization. Finally, forging cross-sector collaborations with digital health providers can enhance patient monitoring ecosystems, unlocking new reimbursement pathways and fostering patient-centric care models.

Detailing the robust research methodology blending secondary data synthesis primary stakeholder engagement and scenario analyses for reliable pacemaker insights

This analysis integrates a rigorous combination of secondary and primary research methodologies to ensure comprehensive and unbiased conclusions. The secondary research phase encompassed a systematic review of peer-reviewed journals, regulatory filings, industry publications, and trade association reports. Clinical trends were validated through publications indexed in authoritative databases and interactions with key opinion leaders in electrophysiology.

Primary research included structured interviews with device executives, procurement specialists, and clinical practitioners, supplemented by surveys capturing real-time adoption insights. Data triangulation techniques reconciled quantitative and qualitative inputs, while scenario analyses evaluated potential supply chain disruptions and regulatory shifts. This layered approach ensures the findings reflect both broad market dynamics and nuanced stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pacemakers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pacemakers Market, by Product Type

- Pacemakers Market, by Power Source

- Pacemakers Market, by Technology

- Pacemakers Market, by Mode

- Pacemakers Market, by Application

- Pacemakers Market, by End User

- Pacemakers Market, by Region

- Pacemakers Market, by Group

- Pacemakers Market, by Country

- United States Pacemakers Market

- China Pacemakers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing essential findings and strategic imperatives illuminating the interconnected trends defining the future trajectory of pacemaker innovation

The pacemaker sector stands at a pivotal juncture where innovation imperatives converge with complex trade considerations and diverse market needs. Technological advances in leadless and conditional pacing systems promise to enhance patient outcomes, yet supply chain and tariff pressures introduce layers of operational risk. Comprehensive segmentation illuminates the varied demands of external and implantable modalities, power architectures, clinical settings, and pacing configurations, while regional analyses underscore the importance of tailored market strategies.

As key players accelerate product development and evidence generation, the most successful organizations will balance agility with strategic foresight-optimizing manufacturing footprints, engaging diverse clinical ecosystems, and harnessing data-driven decision-making. These interwoven dynamics chart the course for the next wave of pacemaker innovation and set the stage for sustained market leadership.

Take decisive steps to elevate your strategic insights by engaging with Associate Director Ketan Rohom and unlocking this comprehensive pacemaker market report

Engaging with Associate Director Ketan Rohom ensures you will receive dedicated guidance and seamless support tailored to your organization's strategic needs in the cardiac rhythm management sector. By securing this comprehensive market research report, decision-makers gain exclusive access to in-depth analyses of the pacemaker landscape, including transformational technology trends, tariff impacts, segmentation implications, regional dynamics, and competitive profiles. Leverage these insights to refine your product roadmap, optimize supply chain strategies, and capitalize on growth opportunities.

Act now to elevate your market intelligence and enhance your competitive positioning. Reach out to Ketan Rohom to discuss customized licensing options, bulk purchasing discounts, and bespoke consulting engagements designed to accelerate your success in the evolving pacemaker market. Take this step to empower your organization with data-driven clarity and strategic foresight for sustained leadership.

- How big is the Pacemakers Market?

- What is the Pacemakers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?