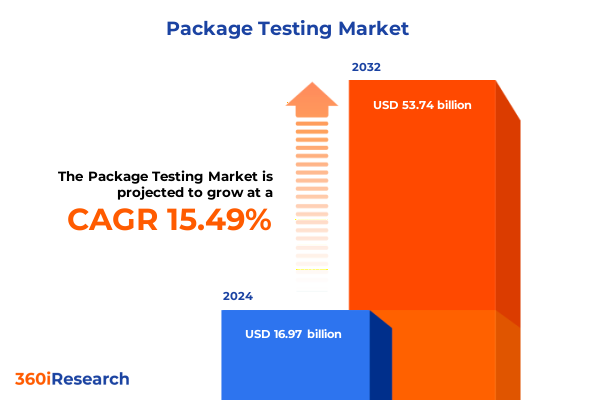

The Package Testing Market size was estimated at USD 19.66 billion in 2025 and expected to reach USD 22.78 billion in 2026, at a CAGR of 15.44% to reach USD 53.74 billion by 2032.

Establishing a Foundation for Understanding How Modern Packaging Testing Underpins Product Safety, Regulatory Compliance, and Market Competitiveness

In a rapidly evolving global marketplace, robust packaging testing has become essential for ensuring product integrity, consumer safety, and compliance with stringent regulations. Advances in materials science and supply chain complexity demand a testing framework that is both agile and rigorous. This introduction lays the foundation by highlighting how evolving regulatory requirements, heightened consumer expectations, and intensifying sustainability mandates have converged to make packaging testing a strategic imperative for manufacturers, brands, and retailers alike.

Regulatory agencies around the world are driving transformative change through updated standards that address modern material challenges. For instance, the U.S. Pharmacopoeia’s revised Chapter <1031> on biocompatibility now encompasses a broader range of plastic and elastomeric packaging components, emphasizing risk-based material classification and advanced in vitro tests to assess cytotoxicity and irritation. Simultaneously, the Keep Food Containers Safe from PFAS Act of 2024 prohibits intentional additions of PFAS in food packaging, effective January 1, 2025, compelling organizations to reassess material formulations and testing protocols.

Beyond composition safeguards, traceability requirements under the Drug Supply Chain Security Act’s final phase will demand unit-level serialization for all prescription drug packaging by November 2025. This enhancement not only strengthens safety and fraud prevention measures but also necessitates sophisticated track-and-trace testing and verification procedures to validate serialization technologies and data integrity. As this report unfolds, the introduction underscores why understanding these multifaceted drivers is crucial for mastering the intricacies of modern packaging testing.

Identifying the Most Influential Technological, Regulatory, and Consumer-Driven Disruptions Reshaping the Packaging Testing Landscape Today

Technological breakthroughs and shifting regulatory landscapes are forging a new era in packaging testing. Automation and digitalization are at the forefront, with AI-enabled systems streamlining leak detection and real-time data analytics enhancing testing precision. Leading laboratories now integrate IoT sensors to continuously monitor environmental simulations, while blockchain-based track-and-trace solutions are being piloted to ensure end-to-end transparency in pharmaceutical serialization processes. These innovations are not merely incremental improvements; they represent a paradigm shift toward predictive and preventive testing models that can anticipate failures before they occur.

Simultaneously, sustainability and safety mandates are reshaping material evaluation protocols. The PFAS ban under H.R. 9864 has accelerated the adoption of biodegradable and recyclable materials, requiring rigorous leachability and long-term aging tests to validate compliance and performance under real-world conditions. Regulatory agencies, such as the FDA, are also tightening allergen disclosure and expiration date standards, prompting the introduction of new testing methodologies for chemical leachability and dynamic shelf-life assessments. Together, these technological and regulatory shifts are transforming the packaging testing ecosystem into a high-stakes battleground for innovation.

Evaluating the Broad and Ongoing Consequences of New United States Tariffs on Packaging Materials, Supply Chains, and Testing Procedures in 2025

The 2025 wave of U.S. tariffs has reverberated across packaging supply chains, exerting significant pressure on material costs and testing workflows. The reinstatement of a 25% duty on steel and aluminum imports, coupled with the elimination of country-specific exemptions, has driven raw material prices upward and extended lead times for critical testing components such as metal closures, drums, and aerosol cans. Concurrently, resin imports used in packaging production are now subject to a 25% tariff, compelling manufacturers to either absorb escalating costs or pass them through, which in turn has raised the operational expenses associated with environmental and chemical testing equipment.

Further compounding the challenge, the baseline 10% tariff on most imported goods, effective April 2025, and the steep 145% effective rate on certain Chinese imports have disrupted sourcing strategies and amplified supply chain uncertainty. Testing laboratories and packaging manufacturers have faced strained domestic capacity, prolonging turnaround times for critical tests such as compression, drop, and vibration evaluations. In response, industry stakeholders are diversifying supplier networks and exploring alternative materials to mitigate inflationary impacts. The cumulative effect of these tariff measures has underscored the importance of agile cost-management strategies and proactive supply chain risk assessments to maintain testing efficacy and ensure uninterrupted project timelines.

Uncovering Critical Insights Across Packaging Material, Testing Type, Application, Packaging Format, and Distribution Channel Segmentations

A nuanced examination of market segments reveals distinct demands and performance criteria. Packaging materials, spanning glass varieties like borosilicate and soda lime to metals such as aluminum and steel, each require specialized testing protocols to validate strength, clarity, and chemical inertness. Paperboard packaging, whether corrugated or folding cartons, demands rigorous mechanical testing to confirm stacking integrity and impact resistance. Plastics-from HDPE and LDPE to PET, PP, and PVC-undergo complex migration and permeability assessments, ensuring that barrier properties meet food safety and pharmaceutical requirements. These material-specific insights provide a foundation for targeted testing strategies that balance performance objectives and cost considerations.

In parallel, the diversity of test types-chemical assays for leak and migration analysis, environmental simulations covering aging, humidity, temperature, and UV exposure, along with mechanical evaluations like compression, drop, shock, and vibration-underscores the importance of comprehensive test matrices. Application-specific needs further complicate this landscape. Cosmetics packaging must balance aesthetic appeal with barrier protection for colorants, fragrances, and skincare formulations, while electronics packaging requires stringent environmental controls for batteries, semiconductors, and consumer devices. Food and beverage containers need to withstand thermal cycling and moisture challenges for liquids, dairy, and snack items, and pharmaceutical packs must guarantee sterility and dosage integrity for ophthalmic, parenteral, and solid-dose products.

Moreover, the choice between flexible pouches, films, and bags; rigid bottles, jars, and containers; or semi-rigid trays and clamshells directly influences test selection and interpretation. Finally, distribution channel nuances-from direct-to-consumer e-commerce shipments requiring robust shock and vibration testing to wholesale bulk transport emphasizing stacking strength-shape tailored testing approaches. Synthesizing these segmentation layers yields key insights for aligning test plans with product design, supply chain logistics, and end-user expectations.

This comprehensive research report categorizes the Package Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Material

- Test Type

- Application

- Packaging Type

Highlighting Regional Dynamics That Drive Packaging Testing Demand Across North and South America, EMEA, and the Asia-Pacific Regions

Regional dynamics play a pivotal role in shaping the demand for packaging testing services worldwide. In the Americas, stringent regulatory frameworks and a mature manufacturing base have elevated expectations for quality assurance and compliance. North American regulators continue to refine guidelines on material safety and traceability, prompting U.S. and Canadian firms to invest heavily in validation and certification processes. Latin American markets, while still developing, are experiencing rapid growth in consumer packaged goods, creating emerging opportunities for localized testing services that combine global standards with regional expertise.

Europe, the Middle East, and Africa (EMEA) reflect a mosaic of regulatory environments. The European Union’s focus on circular economy principles and chemical restrictions, particularly through the Packaging and Packaging Waste Directive, has accelerated the shift toward sustainable materials. Middle Eastern markets are diversifying from oil-dependent economies, investing in food processing and pharmaceutical sectors that require rigorous packaging validation. In Africa, the rise of e-commerce and improved infrastructure are generating demand for mechanical durability and environmental resilience testing, positioning specialized local labs to support multinational and indigenous brands.

Asia-Pacific continues to be a powerhouse for manufacturing and innovation. Established hubs like Japan and South Korea lead in advanced material development and high-precision testing, while China’s industry realignment toward higher-value applications has increased the need for sophisticated barrier and migration assessments. Southeast Asia and India are experiencing accelerated consumer demand, particularly in food and beverage and pharmaceuticals, driving investment in regional testing facilities to meet both domestic and export requirements. Across all regions, the interplay of local regulations, supply chain dynamics, and market maturity informs tailored testing solutions that ensure safety, compliance, and performance.

This comprehensive research report examines key regions that drive the evolution of the Package Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Leading Certification and Testing Firms Are Innovating, Consolidating, and Expanding to Meet Evolving Packaging Testing Demands

The competitive landscape features a mix of multinational giants and specialized niche players, each leveraging unique strengths to capture market share. Swiss-based SGS has reported robust full-year sales growth driven by its focus on sustainability testing and global network expansion. In 2024, SGS raised sales by 2.6% to CHF 6.79 billion, while boosting operating income by 7.1%, underscoring the value of its targeted acquisitions and service diversification. Meanwhile, French firm Bureau Veritas pursued strategic consolidation moves, including advanced packaging integrity services and aborted talks with Intertek to prioritize a merger with SGS, reflecting a broader consolidation trend in the testing and certification sector.

Intertek, a UK-based leader, continues to invest in digital client portals and mobile monitoring applications that offer real-time visibility into test progress and results, meeting growing demands for transparency and rapid turnaround. Eurofins Scientific has expanded its footprint in sustainable packaging testing, focusing on plant-based plastics and advanced barrier coatings to capture eco-conscious segments. Meanwhile, Mérieux Nutrisciences has introduced specialized assays for food packaging coatings, targeting contamination prevention in high-risk applications. Across the board, these leading companies are differentiating through advanced analytics, digital integration, and targeted geographic expansions to serve diverse client needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Package Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Berlin Packaging LLC

- Bureau Veritas SA

- DDL, Inc.

- Duropack GmbH

- Eurofins Scientific SE

- Intertek Group plc

- MTS Systems Corporation

- National Technical Systems, Inc.

- Nefab Group

- Owens-Illinois, Inc.

- Pira International Ltd

- SGS SA

- Smithers Pira

- Sonoco Products Company

- Tetra Pak International SA

- UL LLC

- Westpak, Inc.

Offering Strategic and Tactical Recommendations to Help Packaging Testing Leaders Address Tariff Pressures, Regulatory Changes, and Technological Innovation

To navigate the complex intersection of regulatory shifts, tariff pressures, and technological advancements, industry leaders should adopt a multifaceted strategy. First, diversifying supplier portfolios for raw materials and testing equipment will mitigate the impact of fluctuating tariffs on steel, aluminum, and resin imports. Establishing regional procurement hubs in tariff-free zones can further insulate operations from cost volatility. Second, investing in digital test management platforms and AI-driven analytics will improve efficiency, enable predictive maintenance of equipment, and deliver actionable insights to reduce time-to-market and enhance quality assurance processes.

Third, strengthening partnerships with regulators and certification bodies will ensure early alignment with upcoming standards and facilitate smoother compliance pathways. Proactively engaging in pilot programs for PFAS-free materials and serialization technologies can position organizations as innovators and reduce time needed for post-launch validation. Finally, prioritizing sustainability by incorporating circular economy principles into packaging and testing protocols will satisfy both regulatory mandates and consumer preferences. Embracing eco-testing services for biodegradable materials and leveraging life-cycle assessment tools will drive competitive differentiation in an increasingly green-focused market.

Detailing the Rigorous Research Methodology Employed to Gather, Validate, and Synthesize Data for a Comprehensive Packaging Testing Market Analysis

This study integrates a rigorous, multi-step research methodology to ensure the accuracy and relevance of its findings. Secondary research entailed an exhaustive review of regulatory documents, industry publications, and authoritative news sources to map the evolving landscape of packaging testing standards and tariff measures. Primary research included interviews with industry experts, lab directors, and procurement managers to validate trends and gather nuanced perspectives on operational challenges and opportunities.

Data triangulation methods were applied to reconcile insights from diverse sources, ensuring robust conclusions. Qualitative assessments were complemented by quantitative analysis of available performance indicators, such as lead times, test turnaround metrics, and cost variables. The segmentation framework-spanning material, test type, application, packaging format, and distribution channel-guided structured data collection to yield actionable insights tailored to specific market needs. Finally, internal peer reviews and expert panels validated the report’s recommendations, ensuring rigor and practical applicability for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Package Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Package Testing Market, by Packaging Material

- Package Testing Market, by Test Type

- Package Testing Market, by Application

- Package Testing Market, by Packaging Type

- Package Testing Market, by Region

- Package Testing Market, by Group

- Package Testing Market, by Country

- United States Package Testing Market

- China Package Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Summarizing Core Findings and Emphasizing the Strategic Imperatives for Stakeholders in the Evolving Packaging Testing Ecosystem

This executive summary has illuminated the multifaceted forces reshaping the packaging testing domain, from stringent regulatory reforms to the disruptive effects of new U.S. tariffs and the advent of advanced testing technologies. By dissecting segmentation nuances and regional dynamics, it underscores the critical need for agile strategies that align testing protocols with material innovations, market demands, and compliance frameworks.

The insights presented highlight the imperative for industry leaders to embrace digital transformation, diversify supply chains, and forge collaborative relationships with regulatory bodies and technology partners. As testing laboratories and packaging manufacturers grapple with cost pressures and evolving standards, proactive adaptation will determine competitive positioning and operational resilience. Ultimately, the capacity to anticipate change, optimize testing workflows, and leverage emerging technologies will define success in a landscape where safety, sustainability, and speed are paramount.

Connect with Ketan Rohom Associate Director of Sales and Marketing to Access the Full In-Depth Packaging Testing Market Research and Empower Data-Driven Decisions

To gain full access to the comprehensive market insights, strategic data, and detailed analyses presented in this report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding industry decision-makers ensures you receive personalized support to align this research with your specific business objectives. Engage now to secure your competitive edge and make data-driven choices that propel your packaging testing initiatives forward.

- How big is the Package Testing Market?

- What is the Package Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?