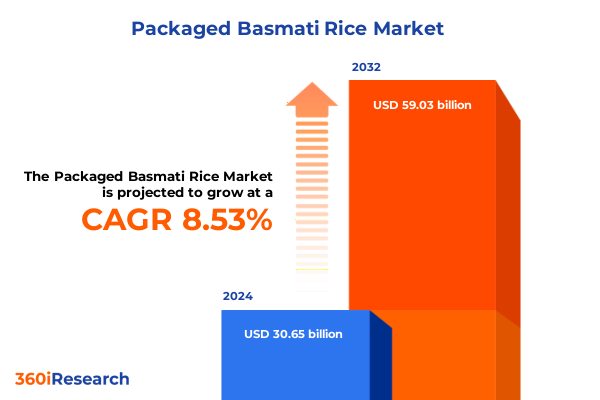

The Packaged Basmati Rice Market size was estimated at USD 33.16 billion in 2025 and expected to reach USD 35.87 billion in 2026, at a CAGR of 8.58% to reach USD 59.03 billion by 2032.

Discover how evolving consumer preferences and supply chain innovations are redefining the packaged Basmati rice market landscape

The packaged Basmati rice market has witnessed remarkable evolution over recent years, driven by shifting consumer lifestyles and rising demand for convenience. As urban populations expand and time-pressed consumers seek quality yet hassle-free meal solutions, packaged Basmati rice has emerged as a reliable choice that balances heritage with modern needs. Global supply chains have adapted to meet these changing demands, and producers have increasingly focused on assuring authenticity, traceability, and premium positioning to appeal to discerning buyers.

Against this backdrop, our deep-dive analysis unpacks the underlying dynamics propelling the packaged Basmati segment, illuminating both established patterns and emergent trends shaping the future landscape. By contextualizing these developments within broader socio-economic shifts and regulatory frameworks, we present a holistic view that equips industry stakeholders to anticipate opportunities and navigate potential headwinds with confidence.

Explore the seismic shifts in digital adoption sustainability innovation and packaging technology that are redefining how packaged Basmati rice reaches consumers

Over the past few years, the packaged Basmati rice landscape has been reshaped by several transformative shifts. Digitally native consumers have accelerated the migration toward online retail channels, compelling traditional producers and distributors to optimize e-commerce platforms and digital marketing strategies. At the same time, major brick-and-mortar grocers have invested heavily in private label offerings to capture value-conscious shoppers while spotlighting premium and organic variants.

Simultaneously, sustainability imperatives have risen to the forefront. Producers are increasingly adopting eco-friendly packaging materials and carbon-efficient logistics solutions to meet corporate responsibility goals and consumer expectations. Innovation in bag technologies, such as resealable features and moisture-barrier layers, has further enhanced product shelf life and convenience. As a result, the market has become more segmented and competitive, with clear winners emerging on the strength of their digital engagement, sustainability credentials, and packaging ingenuity.

Unpack the ripple effects from US import duties on the packaged Basmati rice supply chain and pricing dynamics in 2025

The imposition of new tariffs in early 2025 by the United States on select rice-producing nations has had a cumulative impact across the packaged Basmati rice supply chain. Higher import duties have translated into increased landed costs, prompting wholesalers and retailers to reassess pricing strategies and cost absorption methods. While some specialists in premium and organic segments have been able to pass on a portion of the surcharge to end users, others-especially those focusing on economy and standard price points-have had to negotiate tighter margins to maintain shelf competitiveness.

Moreover, longer lead times at ports and heightened customs scrutiny have introduced operational friction, compelling importers to build greater buffer stocks. This strategic buffer has helped mitigate the risk of stockouts but has also tied up working capital, influencing procurement cycles and inventory management paradigms. Consequently, companies with agile supply chain networks and diversified source geographies have fared better in containing cost escalations and service disruptions.

Gain deep segmentation insights into consumer behavior channel preferences and product differentiation driving packaged Basmati rice uptake

Insights into distribution channel performance reveal that while traditional trade remains a cornerstone in regional pockets with entrenched consumer habits, the momentum is clearly shifting toward online retail as digital literacy and internet penetration deepen. These platforms not only facilitate dynamic inventory management but also enable targeted promotions that drive trial among urban professionals seeking both convenience and premium authenticity. In parallel, supermarkets and hypermarkets continue to dominate in terms of volume throughput, yet they are diversifying assortments to spotlight specialized product types such as parboiled and raw Basmati variants, appealing to a spectrum of cooking preferences.

Product type differentiation between parboiled and raw offerings underscores evolving cooking habits, with parboiled variants gaining traction among consumers prioritizing faster preparation and resilient grain structure, while raw Basmati remains the choice for those seeking the traditional aroma and delicate texture. Grain size orientation further accentuates consumer perceptions of quality, as extra long grain rice is frequently associated with authenticity and premium positioning, long grain appeals to everyday usage, and medium grain caters to households valuing cost-effective versatility. Packing innovations have also been pivotal, with formats ranging from compact 1-kilogram bags for single-household convenience to 10-kilogram options targeting bulk buyers and institutional foodservice clients.

Divergence across end user segments highlights that while household consumption continues to drive overall volume, the foodservice segment commands a growing share due to rising demand from quick-service restaurants and catering operators seeking consistent quality and supply reliability. Price range variation underscores a consumer tiering where economy grades serve value-focused shoppers, standard tiers dominate mainstream purchases, and premium priced products attract aficionado segments. Finally, the conventional versus organic spectrum has emerged as a key battleground, with health-conscious demographics exhibiting willingness to pay a premium for certified organic Basmati rice.

This comprehensive research report categorizes the Packaged Basmati Rice market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Grain Size

- Packaging Type

- Price Range

- Organic Status

- Distribution Channel

- End User

Explore contrasting regional demand drivers and sustainability priorities shaping the packaged Basmati rice market across major global territories

Regional performance in the Americas demonstrates a robust appetite for premium and organic packaged Basmati rice, driven by multicultural population centers in North America and growing appreciation for global flavors in Latin American urban markets. Consumers are willing to pay up for traceable supply chains and eco-friendly packaging, prompting key players to establish local warehousing and rapid distribution nodes.

Across Europe, the Middle East & Africa, a complex tapestry of preferences prevails; Northern and Western European markets place high emphasis on sustainability certifications and non-GMO assurances, while Middle Eastern markets exhibit strong heritage ties to Basmati traditions, fueling demand for authentic extra long grain rice. In Africa, emerging economies are increasingly accessible through modern trade channels, and in-store promotions remain a vital lever.

In the Asia-Pacific region, where rice is a dietary staple, the packaged Basmati segment is comparatively nascent but growing fast. Rising disposable incomes in Southeast Asia and urban India have driven interest in convenience-oriented formats. Key stakeholders are investing in premium packaging and branding to capture aspirational buyers transitioning from loose rice markets to packaged offerings.

This comprehensive research report examines key regions that drive the evolution of the Packaged Basmati Rice market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveil how agribusiness titans and agile niche brands are differentiating through sustainability traceability and strategic alliances

The competitive arena of packaged Basmati rice is populated by both established agribusiness giants and agile niche specialists. Leading multinationals leverage extensive supply networks and brand heritage to assure consistent quality, premium positioning, and broad distribution coverage. At the same time, smaller players have carved out defensible segments in the organic and single-origin spaces by investing in farm-to-fork traceability systems, artisanal branding, and close relationships with cultivators.

Several producers have distinguished themselves through innovations in sustainable sourcing and transparent certification practices, securing access to high-value retail and foodservice contracts. Meanwhile, strategic partnerships between rice exporters, co-packers, and regional distributors have enabled faster market penetration and cost-effective logistics, giving rise to new collaborative models that blend scale and specialization. The evolving competitive dynamics underscore the importance of agility, authenticity, and integrated value chains in capturing market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Packaged Basmati Rice market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adani Wilmar Limited

- American Rice, Inc.

- Amira Nature Foods Ltd.

- Ebro Foods, S.A.

- Kohinoor Foods Limited

- KRBL Limited

- LT Foods Limited

- Lundberg Family Farms, Inc.

- Sarveshwar Foods Ltd.

- Shivshakti International

- Shree Krishna Rice Mills

- Shree Patanjali Foods Ltd.

- Shri Mahavir Agritech

- Shri Rewa Rice Mills Pvt. Ltd.

- T. R. Agro Industries

- Tasty Bite by Mars, Incorporated

- Tata Consumer Products Ltd.

- Tilda Limited

- Tilda Ltd.

- Tropical Sun Foods

Actionable strategies for packaged Basmati rice leaders to enhance digital capabilities diversify sourcing and elevate sustainability credentials

Industry leaders are advised to prioritize digital ecosystem development, integrating e-commerce storefronts with data-driven demand forecasting tools to capture shifting consumer patterns in real time. To fortify resilience against tariff-induced cost shocks, organizations should diversify supplier portfolios across multiple origin countries while negotiating long-term procurement contracts that include currency-hedging clauses.

Elevating sustainability credentials through adoption of recyclable or compostable packaging and measurable carbon-footprint reporting will resonate with environmentally conscious consumers. Furthermore, investing in consumer education campaigns that highlight parboiling benefits and organic certification standards can accelerate adoption in value-added segments. Finally, collaborating with logistics partners to optimize inventory turnover and reduce lead times will enhance service reliability, positioning companies to respond nimbly to market fluctuations and emerging opportunities.

Learn about our robust multi-source research framework leveraging expert interviews empirical trade data and on-site validation

This analysis is grounded in a multifaceted research framework combining primary interviews with industry executives, supply chain managers, and retail category leads, complemented by secondary data from government trade agencies, customs records, and sustainability certification bodies. Qualitative insights were validated through on-site visits to processing facilities and distribution centers across core origin and consumption markets.

Quantitative inputs derive from proprietary databases capturing shipment volumes, pricing trends, and retailer assortment data, ensuring triangulation across multiple sources for accuracy. The methodological approach emphasizes transparency, with clear disclosure of data provenance, confidence levels for key inputs, and sensitivity analyses to stress-test assumptions related to tariff impacts and demand shifts. Rigorous peer review by sector specialists further underpins the robustness of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Packaged Basmati Rice market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Packaged Basmati Rice Market, by Product Type

- Packaged Basmati Rice Market, by Grain Size

- Packaged Basmati Rice Market, by Packaging Type

- Packaged Basmati Rice Market, by Price Range

- Packaged Basmati Rice Market, by Organic Status

- Packaged Basmati Rice Market, by Distribution Channel

- Packaged Basmati Rice Market, by End User

- Packaged Basmati Rice Market, by Region

- Packaged Basmati Rice Market, by Group

- Packaged Basmati Rice Market, by Country

- United States Packaged Basmati Rice Market

- China Packaged Basmati Rice Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Drawing together insights on consumer behavior regulatory headwinds and innovation to chart the future of packaged Basmati rice

The packaged Basmati rice market stands at a crossroads where evolving consumer demands, regulatory dynamics, and technological advancements intersect. Stakeholders who proactively embrace digital transformation, forge diversified sourcing networks, and uphold rigorous sustainability standards will be best positioned to thrive. Simultaneously, adaptability in segmentation focus-from premium organics to mainstream economy offerings-will be critical to capturing a broad swath of consumer cohorts.

As the industry continues to mature, those who weave together agility, authenticity, and strategic foresight will not only navigate the challenges of tariff volatility but also unlock the full potential of the burgeoning global appetite for quality packaged Basmati rice.

Connect with our Associate Director of Sales & Marketing to acquire the definitive packaged Basmati rice market research report

To explore tailored strategies and secure your competitive edge in the packaged Basmati rice market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, who will guide you through our comprehensive research offerings and customization options.

- How big is the Packaged Basmati Rice Market?

- What is the Packaged Basmati Rice Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?