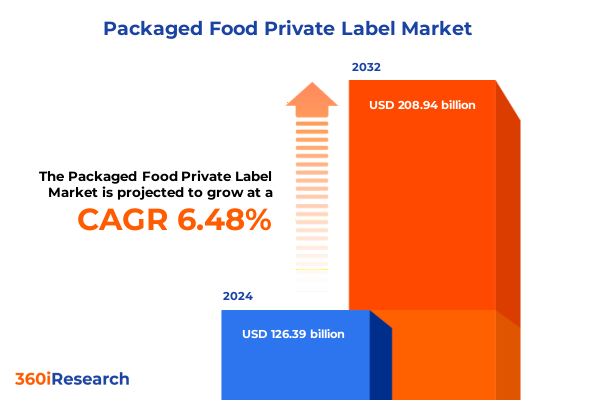

The Packaged Food Private Label Market size was estimated at USD 134.76 billion in 2025 and expected to reach USD 142.29 billion in 2026, at a CAGR of 6.46% to reach USD 208.94 billion by 2032.

Unveiling the Dynamics and Strategic Importance of the Packaged Food Private Label Sector Amidst Evolving Consumer Preferences and Market Forces Driving Growth

The private label packaged food sector has experienced remarkable evolution as both consumer expectations and retail dynamics shift at an accelerated pace. Far beyond offering budget-friendly alternatives, private label brands now compete directly with national and global name brands on quality, innovation, and sustainability. In recent years, private label offerings have transcended commodity status to embody bespoke formulations, health-forward ingredients, and premium positioning. As retailers seek to enhance margins and differentiate their assortments, the intersection of value, quality, and consumer trust has become the defining battleground for private label portfolios.

This transformation is being driven by a confluence of factors, including increasing consumer demand for transparency, the rise of health and wellness priorities, and a growing appetite for experiential flavors and exotic ingredients. Retailers have responded by investing heavily in product development, adopting agile supply chain solutions, and forging deeper partnerships with co-manufacturers. As a result, private label brands now benefit from advanced R&D capabilities, premium ingredient sourcing, and novel packaging formats that were once the exclusive domain of established name brands.

Amidst this escalating competitive environment, stakeholders in the private label packed food arena must navigate a complex web of market forces-from raw material volatility and regulatory shifts to technological disruption and evolving distribution channels. Understanding these dynamics at an executive level is critical for charting strategic courses that balance cost-efficiency with consumer-centric innovation. In this summary, we outline the key drivers, challenges, and strategic imperatives shaping the present and future of the packaged food private label landscape

Exploring the Transformative Shifts Reshaping Private Label Packaged Foods Through Technological Innovation Sustainability Trends and Consumer Behavioral Evolution

The packaged food private label landscape is being reshaped by a series of transformative shifts that are redefining how products are conceived, produced, and consumed. Digitalization stands at the forefront of this evolution, enabling retailers to harness advanced analytics for hyper-targeted product development and dynamic pricing strategies. From predictive demand forecasting to AI-driven quality control, technology is streamlining R&D pipelines and accelerating time-to-market for innovative formulations that resonate with discerning consumers.

Concurrently, sustainability has emerged as a non-negotiable imperative, influencing everything from ingredient selection to packaging architecture. Biodegradable pouches and recyclable containers are fast becoming standard expectations, while regenerative agriculture partnerships and carbon footprint labeling drive brand differentiation. These green initiatives not only satisfy consumer conscience but also open new avenues for cost optimization as circular economy principles reduce waste and enhance resource efficiency.

At the same time, evolving consumer behavior-marked by increased online grocery adoption and the blurring of meal occasions-has prompted private label brands to explore omnichannel formats and ready-to-eat concepts. Subscription-based meal kits, value-added snacks, and functional beverage lines are gaining traction as private label lines expand beyond traditional store shelves. Ultimately, these transformative trends underscore the necessity for agility; private label stakeholders who integrate technological innovation, green credentials, and consumer convenience into their core strategies will secure a sustained competitive edge

Assessing the Cumulative Impact of 2025 United States Tariffs on Foreign Sourced Ingredients and Packaging Materials in Private Label Packaged Food Suppliers

The implementation of elevated United States tariffs in 2025 has introduced pronounced cost pressures across the private label packaged food supply chain. Tariffs on imported steel and aluminum have raised the cost of cans, lids, and closures, while levies on select plastics have filtered downstream into expenses for pouches and rigid trays. Beyond metal and polymer inputs, tariffs on agricultural commodities-including soy, palm oil, and certain grains-have strained ingredient sourcing strategies, prompting manufacturers to reassess global procurement networks and negotiate more aggressive contracts with domestic growers.

These cumulative tariff burdens have compelled private label producers to adopt a multifaceted response. Some have shifted a larger proportion of raw material procurement toward domestic suppliers, balancing increased domestic prices against tariff-induced surcharges. Others have leveraged formulation optimization techniques-such as ingredient substitution and advanced blending protocols-to maintain quality while mitigating cost escalations. Despite these measures, margin compression remains a significant concern, particularly for economy-tier price segments where consumer price sensitivity is highest.

Looking ahead, the persistence of tariff-related inflations underscores the importance of proactive supply chain resilience. Stakeholders are exploring strategic alliances with regional co-manufacturers, investing in nearshoring initiatives, and evaluating tariff engineering solutions to insulate their portfolios from further geopolitical volatility. By diversifying sourcing footprints and embedding agility into procurement processes, private label operators can navigate tariff headwinds while preserving the value proposition that underpins consumer trust

Decoding the Comprehensive Segmentation Landscape of Product Types Distribution Channels Packaging Preferences Price Tiers and End User Dynamics

A nuanced comprehension of market segmentation reveals critical pathways to capturing consumer preferences and optimizing portfolio performance. Within product type categories, bakery products demonstrate robust growth driven by on-the-go formats like bread, buns, and rolls complementing indulgent niches such as cakes and pastries. Beverages follow a dual trajectory: demand for functional bottled water and cold-pressed juices is intersecting with sustained interest in carbonated soft drinks and premium tea and coffee offerings. Confectionery lines are being revitalized through clean-label candy variants and rich dark chocolate assortments, while dairy products continue to expand in butter, cheese, milk, and yogurt subsegments that appeal to both health-focused and gourmet consumers. Frozen food portfolios leverage the convenience of ready-to-eat meals alongside the freshness of frozen vegetables and the indulgence of ice cream and dessert innovations. Pantry items have evolved through artisanal baking ingredients, curated canned goods, and specialty grains, pasta, sauces, and condiments that cater to home chefs, whereas snack offerings have diversified far beyond basic chips to include flavorful popcorn blends and pretzels with sophisticated seasoning profiles.

Distribution channel insights reveal that convenience stores and discount formats maintain importance for quick-purchase needs and value-driven assortments. At the same time, online retail channels-spanning direct-to-consumer platforms, e-commerce marketplaces, and retailer websites-are growing at unprecedented rates as digital grocery becomes mainstream. Supermarkets and hypermarkets remain the epicenters for broad range cultivation, and wholesale clubs with both cash-and-carry and warehouse club formats continue enabling bulk purchasing strategies among value-conscious shoppers.

Packaging type segmentation underscores a shift toward eco-conscious designs, with paper and plastic bags coexisting alongside glass and PET bottles. Corrugated boxes and folding cartons serve diverse merchandising requirements, while aluminum and steel cans balance recyclability with cost. Jars-both glass and plastic-enhance perceived freshness for premium lines. Simultaneously, price tier differentiation highlights the enduring resilience of economy options, the steady appeal of mid-range value propositions, and growing consumer willingness to trade up to premium labels that signal superior quality. Across end users, foodservice operators and household consumers alike are increasingly relying on private label innovations to meet evolving demand thresholds and budget constraints

This comprehensive research report categorizes the Packaged Food Private Label market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Packaging Type

- End User

Illuminating Regional Dynamics in Packaged Food Private Label Markets Across Americas Europe Middle East Africa and Asia Pacific Economic and Cultural Drivers

Regional dynamics across the packaged food private label space illuminate divergent consumer behaviors, regulatory landscapes, and competitive structures. In the Americas, scale economies and mature retail infrastructures enable high-volume private label penetration; domestic ingredient sourcing is bolstered by extensive agriculture networks, while North American retailers experiment with premium sub-brands and localized flavor profiles to deepen customer loyalty. Conversely, Latin American markets are witnessing rising interest in economy and mid-range private labels as consumers perceive private store brands to offer reliable quality at accessible price points.

Within the Europe, Middle East, and Africa region, Western European markets lead in both premium private label innovation and sustainability initiatives, with carbon-neutral packaging and organic ingredient lines proliferating. Meanwhile, discount retail models in Central and Eastern Europe continue to drive volume growth for private label staples. Middle Eastern and African markets exhibit a blend of import-driven ingredients and nascent local manufacturing, prompting a hybrid approach where private label suppliers balance cost imperatives with import regulations and shifting consumer preferences for traditional flavors.

Asia-Pacific markets underscore the profound impact of e-commerce adoption and nascent retail modernization efforts. In developed markets such as Japan and Australia, private label penetration is growing through premium health-focused lines, while Southeast Asian markets are expanding mid-range and economy private label tiers to accommodate rapidly urbanizing populations. Across the region, partnerships between global co-manufacturers and local grocery chains are facilitating tailored product formulations that resonate with regional taste profiles and purchasing power variations

This comprehensive research report examines key regions that drive the evolution of the Packaged Food Private Label market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Private Label Packaged Food Manufacturers and Retail Partners Highlighting Competitive Strategies Innovations and Collaborative Growth Initiatives

The competitive landscape of packaged food private label has coalesced around both leading retailers and specialized co-manufacturers. Major grocery chains such as Kroger, Walmart, Target, and Costco have leveraged their scale to invest in in-house brands that range from economy to premium tiers. Each of these retail giants has activated targeted marketing campaigns, cross-category brand extensions, and exclusive assortment strategies to fortify private label positioning. Meanwhile, hard discounters like Aldi and Lidl continue to innovate with limited-edition product drops and streamlined SKUs that reinforce consumer perception of high quality at aggressive price points.

On the manufacturing front, co-packers and ingredient specialists play a pivotal role in elevating private label offerings. Companies that specialize in dairy proteins, plant-based emulsifiers, and clean-label preservative systems have enabled private label lines to match or exceed the taste and shelf life benchmarks of national brands. Similarly, packaging innovators offering recyclable pouches, molded fiber trays, and lightweight glass alternatives have allowed retailers to align private label assortments with corporate sustainability goals.

These collaborations have resulted in stronger private label portfolios capable of rapid iteration and agile reformulation. As retailers and their manufacturing partners deepen data-driven relationships-with shared access to consumer feedback, point-of-sale analytics, and supply chain traceability-leading private label programs are poised to capture incremental market share and redefine competitive boundaries

This comprehensive research report delivers an in-depth overview of the principal market players in the Packaged Food Private Label market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aldi Inc.

- Archer Daniels Midland Company

- B&G Foods, Inc.

- Cargill Inc.

- Costco Wholesale Corporation

- Danone S.A.

- Dollar General Corporation

- Gaffney Foods

- Gehl Foods, LLC

- General Mills, Inc.

- Hain Celestial Group, Inc.

- Hinkle Fine Foods, Inc.

- Hormel Foods Corporation

- Ingredion Incorporated

- J&J Snack Foods Corp.

- Jeff’s Famous Foods, Inc.

- McCormick & Company, Incorporated

- Monogram Food Solutions LLC

- PepsiCo, Inc.

- Pilgrim's Pride Corporation

- Post Holdings, Inc.

- Spectrum Brands Holdings, Inc.

- SunOpta Inc.

- Target Corporation

- Tattooed Chef, Inc.

- The J.M. Smucker Company

- The Kraft Heinz Company

- Trader Joe’s

- TreeHouse Foods, Inc.

- Walgreens Boots Alliance, Inc.

- Walmart Inc.

Strategic and Actionable Recommendations for Private Label Packaged Food Industry Leaders to Drive Innovation Enhance Margin and Strengthen Market Positioning

Industry leaders must prioritize a series of strategic initiatives to harness the private label opportunity and future-proof their operations. First, integrating end-to-end digital traceability solutions will enhance supply chain transparency, enabling rapid identification of raw material origins, compliance with evolving food safety regulations, and improved risk management during disruptions. By leveraging blockchain-based systems and IoT-enabled monitoring, stakeholders can drive consumer trust and operational efficiency simultaneously.

Second, embedding sustainability into product lifecycles-from regenerative agriculture sourcing to recyclable and compostable packaging-will not only resonate with eco-conscious consumers but also yield long-term cost savings through waste reduction and material optimization. Companies should explore partnerships with packaging reinvention startups and invest in lifecycle assessment tools to quantify environmental impact and communicate verifiable green credentials.

Lastly, cultivating direct-to-consumer engagement through digital channels and personalized marketing will strengthen brand loyalty and uncover behavioral insights. Utilizing advanced analytics and AI-driven segmentation models allows private label players to tailor offerings to micro-demographics and anticipate emerging taste trends. By aligning agile product development sprints with real-time consumer feedback loops, private label brands can continuously refresh assortments, drive incremental sales, and outmaneuver traditional competitors

Outlining the Rigorous Research Methodology and Data Collection Framework Underpinning the Analysis of Packaged Food Private Label Markets

The insights presented in this summary are grounded in a rigorous, multi-phased research methodology designed to ensure both depth and reliability. Primary research efforts included structured interviews with C-suite executives at leading retail chains, in-depth discussions with co-manufacturers, and focus group sessions with end consumers to validate product perception and purchasing drivers. This qualitative data was complemented by extensive secondary research, analyzing trade publications, regulatory filings, and proprietary retail scanner data to capture emerging dynamics and market realignments.

Data triangulation was applied throughout the research process to cross-verify findings across multiple sources. Supply chain cost modeling was conducted using real-time commodity pricing feeds and tariff schedules to quantify the impact of geopolitical shifts. Meanwhile, packaging innovation assessments drew from patent analysis and supplier case studies to map the competitive landscape of eco-design solutions. Advanced analytics tools were employed to segment consumer behavior patterns and forecast potential adoption curves for new private label concepts.

By applying this comprehensive framework-spanning qualitative validation, quantitative modeling, and technology-driven analytics-the study delivers actionable insights that are both strategic in scope and operationally relevant. This robust methodology ensures that stakeholders can confidently translate the research into targeted initiatives that address immediate challenges and unlock sustainable growth

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Packaged Food Private Label market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Packaged Food Private Label Market, by Product Type

- Packaged Food Private Label Market, by Distribution Channel

- Packaged Food Private Label Market, by Packaging Type

- Packaged Food Private Label Market, by End User

- Packaged Food Private Label Market, by Region

- Packaged Food Private Label Market, by Group

- Packaged Food Private Label Market, by Country

- United States Packaged Food Private Label Market

- China Packaged Food Private Label Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Concluding Perspectives on the Future Trajectory of Private Label Packaged Foods Integrating Market Trends Strategic Imperatives and Opportunities for Stakeholders

In conclusion, the private label packaged food sector stands at a pivotal juncture where value-driven innovation and strategic agility define success. The convergence of digital technologies, sustainability imperatives, and evolving consumer preferences has elevated private label offerings to new heights of quality and differentiation. While geopolitical headwinds such as tariffs present tangible cost pressures, they also catalyze supply chain resilience and nearshoring strategies that strengthen domestic manufacturing ecosystems.

Segment-level insights underscore the importance of tailoring product portfolios to nuanced consumer demands-whether that means premium bakery indulgences, functional beverage innovations, or eco-friendly packaging formats. Regional analysis highlights distinct market maturation stages and cultural influences, guiding stakeholders in crafting localized approaches that resonate with target audiences across the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Looking forward, private label players who invest in advanced traceability, sustainable design, and direct consumer engagement will secure a competitive advantage in an increasingly crowded marketplace. As retailers and co-manufacturers deepen collaborative ecosystems, the capacity to swiftly iterate products based on real-world feedback will be the ultimate differentiator. By embracing these strategic imperatives, the private label packaged food industry is poised to capture new market share and deliver long-term value to both businesses and consumers

Empowering Informed Decisions with Direct Access to Specialized Packaged Food Private Label Insights through Ketan Rohom Associate Director Sales Marketing at 360iResearch

For a comprehensive deep dive into the evolving private label packaged food market and to leverage specialized insights for strategic growth, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan Rohom brings extensive expertise in packaged food research and can guide you through tailored solutions that align with your business objectives. Engaging with Ketan ensures you gain access to the full breadth of data, analysis, and forecasting needed to stay ahead in this competitive landscape. To secure your copy of the complete market research report or to discuss bespoke consulting opportunities, contact Ketan today and empower your organization with the actionable intelligence required to drive informed decision-making and unlock new growth avenues

- How big is the Packaged Food Private Label Market?

- What is the Packaged Food Private Label Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?