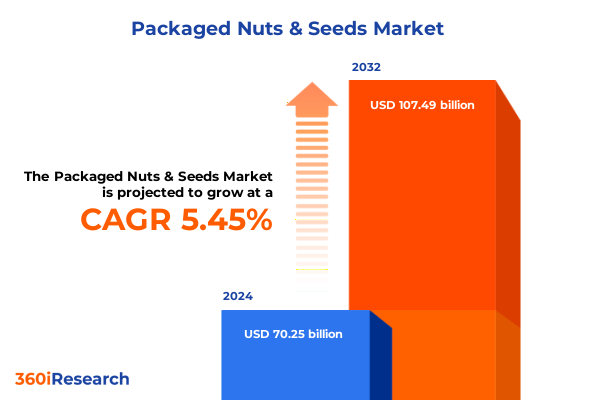

The Packaged Nuts & Seeds Market size was estimated at USD 74.07 billion in 2025 and expected to reach USD 78.10 billion in 2026, at a CAGR of 5.46% to reach USD 107.49 billion by 2032.

Discover how packaged nuts and seeds have evolved into a powerhouse snacking category driven by health trends, sustainability, and consumer demand

Packaged nuts and seeds have transcended traditional snack roles to become key dietary staples valued for their rich nutrient density, balanced healthy fats, and complete protein content. In 2023, the United States led global consumption by accounting for 26% of total packaged nut and seed volume sales, reflecting their widespread acceptance as both standalone snacks and versatile culinary ingredients.

This category continues to resonate as consumers increasingly prioritize health, wellness, and sustainability in their snack choices. Industry participants are responding by enhancing supply chain transparency, adopting clean-label practices, and pursuing premium certification standards for non-GMO, organic, and fair-trade products. Meanwhile, diversified retail channels-ranging from brick-and-mortar supermarkets and specialty outlets to online platforms and direct-to-consumer models-have expanded accessibility and driven deeper consumer engagement, reinforcing the category's resilience and growth potential.

Exploring major market transformations reshaping packaged nuts and seeds through flavor innovation, sustainability, and channel digitization

The packaged nuts and seeds sector is undergoing a phase of rapid transformation as manufacturers innovate to align with evolving consumer expectations. In 2025, around 36% of global product launches in the category focused on protein-enriched nut bars and omega-rich seed mixes, reflecting the prominence of functional nutrition in today’s marketplace. Concurrently, clean-label positioning has surged, with nearly four in ten new products launched devoid of artificial additives or preservatives to meet the growing demand for ingredient transparency and natural formulations.

Flavor innovation and premiumization remain central to differentiation strategies. Chili-lime, maple-cinnamon, and wasabi almonds together accounted for 28% of new flavored nut introductions in 2025, driving adventurous eating occasions and premium price points. Packaging innovations have also elevated consumer convenience: single-serve and resealable formats saw combined sales surpassing 500 million units worldwide in 2023, while online sales of nuts and seeds jumped by 34% year-on-year, underscoring digital channels as critical growth engines. Together, these shifts mark a definitive move toward experiential snacking experiences that blend health benefits with indulgent flavors and on-the-go convenience.

Examining the cumulative effects of newly implemented US trade tariffs on packaged nuts and seeds and their impacts on global supply chains

Beginning in early 2025, the United States introduced sweeping new tariffs that have reverberated throughout the packaged nuts and seeds supply chain. A baseline 10% tariff on all imported goods took effect on April 5, followed by country-specific rates-34% on Chinese imports, 20% on European Union goods, and up to 46% on products from Vietnam, among others-enforced as of April 9, 2025. These measures aimed to bolster domestic production but have driven substantial cost increases for imported raw materials and intermediate ingredients.

In response, key trading partners instituted retaliatory duties targeting U.S. exports. China imposed a 34% tariff on American nuts and seeds effective April 10, while the European Union’s planned 25% duty on U.S. almonds will come into force December 1, 2025, subject to ongoing negotiations and potential extensions of temporary reprieves. Canada, Mexico, and India also maintained or escalated duties on peanut products and tree nuts, complicating export routes and prompting industry associations to lobby for relief.

The cumulative impact of these tariff actions has been multifaceted. Input cost inflation has pressured manufacturers’ margins and, in many cases, led to price increases in retail channels. Supply chain teams have responded by diversifying sourcing into tariff-exempt regions where possible and accelerating near-sourcing initiatives. Simultaneously, domestic producers have pursued government support and explored strategic partnerships to mitigate the burden of reciprocal duties on U.S. nut and seed exports.

Gaining deep segmentation insights into the packaged nuts and seeds market through product types, channels, packaging, processing, end users, and flavors

The packaged nuts and seeds market presents a mosaic of opportunities and operational nuances when viewed through a segmentation lens. Across product types, in-shell nuts, mixed nuts & seeds, seeds, and shelled nuts each occupy distinct roles in consumer portfolios; seeds-including chia, flax, pumpkin, sesame, and sunflower-have emerged as functional ingredients in bakery and beverage formulations, while shelled nuts such as almonds, cashews, hazelnuts, peanuts, pecans, pistachios, and walnuts offer diverse taste profiles and nutritional attributes that appeal to both health-focused and gourmet segments.

Distribution channels extend from traditional convenience stores and supermarkets & hypermarkets to specialty retail, food service, and fast-growing online platforms. Each channel demands bespoke strategies, whether leveraging impulse placements at checkout, premium branding in specialty aisles, or subscription models and direct-to-consumer bundles in digital marketplaces. Packaging types-ranging from cost-efficient bulk formats to premium jars & cans, flexible pouches & bags, and single-serve packs-address variables of price point, portion control, and consumer convenience.

Processing methods further differentiate offerings, with raw and roasted variants catering to clean-label and indulgence narratives; within roasted products, dry roasting emphasizes natural flavor, while oil roasting supports richer, coated profiles. End users span the food industry, where nuts and seeds serve as functional ingredients; food service, which integrates these products into menu innovations; and household, where shelf-stable snacks satisfy at-home consumption trends. Finally, flavor segmentation across flavored, salted, and unsalted options, including subcategories of savory, spicy, and sweet, underscores the continued importance of taste customization in driving product trial and loyalty.

This comprehensive research report categorizes the Packaged Nuts & Seeds market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Processing Method

- Flavor

- Distribution Channel

- End User

Uncovering regional dynamics across the Americas; Europe, Middle East and Africa; and Asia-Pacific shaping the packaged nuts and seeds industry

Regional dynamics play a pivotal role in shaping market trajectories for packaged nuts and seeds. In the Americas, led by the United States, robust health and wellness trends have driven premiumization and private-label expansion, with North America contributing 26% of global packaged nut and seed volume in 2023. Retailers in the region have ramped up exclusive flavor collaborations and sustainability pledges to capture discerning consumers.

Europe, the Middle East & Africa (EMEA) displays heterogeneous demand patterns: Western European markets emphasize organic and allergen-free certifications, while Middle Eastern and African regions balance growing affluence with price sensitivity. Trade partnerships within the EU and shifting regulatory frameworks for labeling and food safety inform product development and market entry strategies.

Asia-Pacific stands out for its rapid growth, accounting for 32% of global volume sales in 2023, propelled by rising disposable incomes and the emergence of local nut processing hubs in India, Vietnam, and China. Digital commerce growth and urbanization have enabled niche Western-style blends to find traction alongside traditional seed-based snacks, positioning APAC as a bellwether for future innovation cycles.

This comprehensive research report examines key regions that drive the evolution of the Packaged Nuts & Seeds market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry players and their strategic innovations in product development, sustainability, and market expansion within packaged nuts and seeds

Among the leading players driving category evolution, Blue Diamond Growers remains at the forefront of almond innovation. In November 2024, the cooperative launched “Almonds and More,” its inaugural mixed nuts line, integrating signature honey-roasted, smoked, and sea salt almond flavors with cashew and pistachio blends to meet consumers’ appetite for premium, protein-packed snacking options.

Wonderful® Pistachios, America’s #1 snack nut brand, continues to expand its No Shells™ portfolio. In February 2025, it introduced No Shells Unsalted, targeting the sodium-reduction trend among 36% of adults actively lowering salt intake, while simultaneously noting that 37% of pistachio consumers now incorporate pistachios as culinary ingredients-a year-over-year seven-point increase. In April 2025, the brand added a trending Dill Pickle flavor to its lineup, underscoring its agility in leveraging social media and cultural trends to drive incremental sales.

Archer Daniels Midland (ADM) has distinguished itself through sustainability leadership. Its global regenerative agriculture initiative surpassed 2.8 million enrolled acres in 2023 and has set an ambitious target of 5 million acres by 2025, earning ADM recognition in innovation awards and reflecting its commitment to soil health, biodiversity, and climate impact reduction.

Hormel Foods, owner of the PLANTERS brand, has innovated with the 2024 launch of Planters® Nut Duos-a first-to-market format combining two nut varieties with dual flavors. Selections such as Buffalo Cashews & Ranch Almonds and Parmesan Cheese Cashews & Peppercorn Pistachios exemplify the brand’s strategy to pioneer flavor-driven experiences while tapping into nostalgic taste pairings and convenience packaging.

This comprehensive research report delivers an in-depth overview of the principal market players in the Packaged Nuts & Seeds market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanta Seeds Pty Ltd

- American Nuts LLC

- Archer Daniels Midland Company

- Bayer AG

- Blue Diamond Growers, Inc.

- Diamond Foods, LLC

- DuPont de Nemours, Inc.

- HBS Foods Limited

- Hines Nut Company

- Hormel Foods Corporation

- Intersnack Group GmbH & Co. KG

- ITC Limited

- JBC Food Corporation

- John B. Sanfilippo & Son, Inc.

- Kanegrade Limited

- Kraft Heinz Company

- Mariani Nut Company

- McCormick & Company, Inc.

- Nuts.com, LLC

- Olam International Limited

- Select Harvests Limited

- SunOpta Inc.

- Sun‑Maid Growers of California, Inc.

- Syngenta AG

- The Wonderful Company LLC

Actionable recommendations empowering industry leaders to capitalize on evolving consumer trends and navigate market complexities in nuts and seeds

To capitalize on the sector’s momentum, industry leaders should prioritize consumer-centric innovation by expanding functional product lines that offer protein enrichment, fiber fortification, and clean-label assurances. Investing in flavor platforms that blend familiar tastes with regional and cultural influences can drive trial and premiumization.

Resilience in sourcing is equally critical. Companies should diversify supplier networks across tariff-exempt regions, bolster near-sourcing strategies, and deepen collaborations with agricultural partners to secure stable raw material flows and manage cost volatility. Embracing regenerative agriculture and sustainable farming partnerships will not only mitigate environmental risks but also reinforce brand credentials among eco-conscious consumers.

In distribution, an omnichannel presence that integrates premium specialty retail, targeted e-commerce with subscription and bundle offerings, and on-site experiential promotions can address diverse purchasing behaviors. Tailoring packaging formats-such as single-serve pouches for convenience, resealable premium cans for at-home consumption, and bulk SKU for food service-will optimize shelf space and meet precise consumer needs.

Finally, continuous monitoring of global trade policies and active engagement with industry associations will be indispensable for navigating tariff uncertainties and safeguarding export opportunities. By aligning innovation, sustainability, and strategic agility, industry leaders can unlock new growth trajectories in this dynamic marketplace.

Robust research methodology combining primary interviews, industry data analysis, and comprehensive secondary research to illuminate nuts and seeds market insights

This research leveraged a robust methodology to deliver a comprehensive view of the packaged nuts and seeds landscape. Primary interviews were conducted with executives and sourcing specialists from top manufacturers, cooperative boards, and major retailers to capture firsthand insights on market dynamics, innovation pipelines, and supply chain strategies.

Secondary research integrated global trade databases, government tariff schedules, and regulatory filings to map recent policy shifts and their implications on cost structures. Proprietary industry databases were analyzed to quantify product launch trends, flavor innovation rates, and packaging format adoption across key regions.

The segmentation framework was developed through a synthesis of company disclosures, retail audit data, and consumer panel studies, ensuring granularity in product type, channel, packaging, processing method, end use, and flavor profiles. Regional analysis combined economic indicators, consumption statistics, and e-commerce trends to elucidate high-growth geographies and emerging market entry points.

Finally, company case studies were assembled from press releases, financial reports, and industry publications to highlight leading players’ strategies in product development, sustainability initiatives, and channel expansion. This mixed-methods approach ensures that the findings and recommendations reflect both quantitative rigor and qualitative depth.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Packaged Nuts & Seeds market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Packaged Nuts & Seeds Market, by Product Type

- Packaged Nuts & Seeds Market, by Packaging Type

- Packaged Nuts & Seeds Market, by Processing Method

- Packaged Nuts & Seeds Market, by Flavor

- Packaged Nuts & Seeds Market, by Distribution Channel

- Packaged Nuts & Seeds Market, by End User

- Packaged Nuts & Seeds Market, by Region

- Packaged Nuts & Seeds Market, by Group

- Packaged Nuts & Seeds Market, by Country

- United States Packaged Nuts & Seeds Market

- China Packaged Nuts & Seeds Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding perspectives on the critical trends, opportunities, and challenges defining the future landscape of the packaged nuts and seeds sector

The packaged nuts and seeds market stands at a critical inflection point, defined by converging trends in health, sustainability, and technological integration. While evolving consumer preferences propel demand for functional, flavor-forward innovations, the industry must remain vigilant to geopolitical and trade-related headwinds.

Adapting segmentation strategies to align with nuanced channel requirements-whether through retail partnerships, direct-to-consumer platforms, or food service collaborations-will be essential to capture incremental share. Simultaneously, companies that embed sustainability across sourcing and production will secure both cost resilience and brand trust amid intensifying environmental scrutiny.

Corporate agility in responding to rapid flavor cycles, regulatory shifts, and evolving distribution models will differentiate winners in this marketplace. By fusing data-driven insights with strategic foresight, stakeholders can harness the sector’s growth potential while mitigating risk.

As the sector continues to expand and diversify, the intersection of innovation, supply chain resilience, and consumer engagement will define sustainable success in the global packaged nuts and seeds landscape.

Contact Associate Director Ketan Rohom today to secure the comprehensive packaged nuts and seeds market research report and drive strategic decisions

Don’t miss the opportunity to gain a competitive edge in the rapidly evolving packaged nuts and seeds landscape. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to obtain the full market research report. His expertise will guide you in accessing in-depth analyses, proprietary data, and actionable insights tailored to your strategic objectives. Engage with Ketan today to secure your copy, equip your team with critical intelligence, and chart a course for sustained growth in this dynamic sector.

- How big is the Packaged Nuts & Seeds Market?

- What is the Packaged Nuts & Seeds Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?