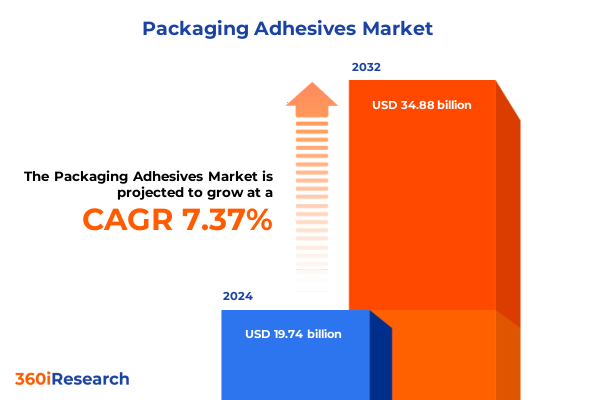

The Packaging Adhesives Market size was estimated at USD 21.21 billion in 2025 and expected to reach USD 22.84 billion in 2026, at a CAGR of 7.35% to reach USD 34.88 billion by 2032.

Emerging Dynamics and Critical Significance of Packaging Adhesives Driving Innovation and Sustainability in Contemporary Manufacturing Environments

The packaging adhesives industry has evolved into a critical enabler of modern manufacturing and distribution systems, driven by the accelerating demands of e-commerce, sustainability mandates, and lightweight packaging trends. As global supply chains continue to adapt, adhesives have emerged as the silent workhorse that ensures product integrity, reduces waste, and supports the shift toward flexible materials. Furthermore, the convergence of consumer expectations for eco-friendly solutions with regulatory pressures for lower emissions has propelled adhesive formulators to innovate beyond traditional solvent-based technologies.

In this dynamic environment, companies are compelled to reassess their adhesive choices in pursuit of faster line speeds, enhanced bond strength, and improved recyclability. Moreover, digitalization in manufacturing processes has introduced new opportunities for precision dispensing, quality monitoring, and predictive maintenance in adhesive application equipment. Consequently, stakeholders across the value chain-from resin suppliers and formulators to brand owners and contract packagers-are collaborating to optimize performance while minimizing environmental footprints.

Unveiling Fundamental Transformative Shifts Reshaping Packaging Adhesive Landscape Through Technological Advances and Environmental Imperatives

The packaging adhesives landscape is undergoing fundamental transformative shifts, propelled by breakthroughs in material science and heightened environmental stewardship. In recent years, the emergence of bio-based polymers and radiation-curing technologies has challenged conventional solvent-based formulations, yielding adhesives that cure rapidly, emit negligible volatile organic compounds, and facilitate recycling streams. Meanwhile, reactive chemistries are being reformulated to enhance moisture resistance and withstand extreme temperature variations, a necessity in diverse distribution channels.

Concurrently, automation and digital integration have redefined application precision, with smart dispensing systems leveraging real-time analytics to adjust adhesive volume and placement dynamically. In addition, partnerships between chemical innovators and machinery OEMs are fostering seamless integration of new formulations into high-speed production lines. As a result, companies that embrace these transformative shifts gain a competitive edge by accelerating product launches, reducing energy consumption, and meeting stringent sustainability targets set by brand owners and regulators alike.

Evolving Ramifications of United States 2025 Tariff Measures on Packaging Adhesives Supply Chains and Cost Structures Amid Global Trade Tensions

The imposition of United States tariff measures throughout 2025 has had evolving ramifications on packaging adhesives' raw material sourcing, cost structures, and supply chain configurations. In particular, duties affecting petrochemical feedstocks and specialty polymers have contributed to increased procurement costs, prompting formulators to explore alternative suppliers and to negotiate volume-based contract terms. Consequently, some manufacturers have accelerated efforts to qualify domestic or non-tariffed feedstock sources, thereby mitigating exposure to trade volatility.

Moreover, the complexity of customs classifications for adhesive chemistries and ancillary components has elevated compliance burdens, leading companies to invest in enhanced trade analytics and tariff engineering strategies. As a result, nearshoring and regional distribution hubs have gained traction as means to reduce lead times and buffer against unforeseen duty rate fluctuations. Ultimately, the cumulative impact of these tariffs underscores the need for agile procurement frameworks, diversified supplier portfolios, and proactive engagement with trade policy stakeholders to sustain margin integrity.

Illuminating Strategic Segmentation Insights Across Adhesive Chemistry End Uses and Forms to Guide Precision Targeting in Packaging Adhesive Markets

An examination of adhesive type segmentation reveals a diverse landscape spanning hot melt, radiation curing, reactive, solvent based, and water based chemistries. Within hot melt offerings, ethylene vinyl acetate, polyolefin, and polyurethane variants cater to applications demanding rapid set times and strong peel adhesion, whereas solvent based formulas-subdivided into acrylic and rubber based-address scenarios requiring high strength and resistance to challenging substrates. In parallel, water based systems incorporating acrylic, polyvinyl acetate, and styrene butadiene rubber provide low-VOC alternatives aligned with environmental objectives.

Transitioning to end use industries, adhesives tailored for beverage, flexible, food, and paper and board packaging each embody distinct performance requirements, from moisture barrier integrity to print compatibility. Application types further refine these insights, with carton sealing, closure and labeling, pouch lamination, and tray forming each demanding precise rheological and thermal properties. Complementing these classifications, resin type segmentation highlights the prevalence of acrylic, EVA, polyolefin, and polyurethane backbones as foundational chemistries, while form factors-film, liquid, and solid-dictate handling, storage, and application methodologies. Together, these segmentation layers furnish stakeholders with a multidimensional perspective essential for targeted product development and market positioning.

This comprehensive research report categorizes the Packaging Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Adhesive Type

- End Use Industry

- Application Type

- Resin Type

Mapping Regional Trends in Packaging Adhesives to Identify Growth Trajectories and Regulatory Drivers Across Americas EMEA and Asia-Pacific

Regional dynamics in the packaging adhesives sector underscore distinct growth trajectories, shaped by regulatory landscapes and end-user demands. In the Americas, the rapid expansion of e-commerce and food delivery services has driven accelerated adoption of high-performance adhesives capable of sustaining integrity across varied transit conditions. Furthermore, stringent regulations governing volatile organic compound emissions have catalyzed a shift from solvent based to water based and radiation curing systems, prompting suppliers to reformulate legacy products.

Conversely, Europe, Middle East & Africa regions are characterized by rigorous sustainability mandates and extended producer responsibility directives, which incentivize bio-based adhesive development and closed-loop recycling processes. Investments in renewable feedstocks and energy-efficient curing technologies have become paramount for manufacturers seeking to comply with tightening carbon footprint targets. Meanwhile, the Asia-Pacific region continues to serve as both a major production hub and consumption hot spot, with rapid urbanization and expanding packaging industries fueling demand for versatile adhesives. Amid ongoing capacity expansions, competition among local and multinational players is intensifying, driving innovation in cost-effective yet environmentally compliant solutions.

This comprehensive research report examines key regions that drive the evolution of the Packaging Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Positioning of Leading Adhesive Manufacturers Reveals Strategic Innovation Alliances and Portfolio Diversification in Packaging Sector

Leading adhesive manufacturers are strategically positioning themselves through targeted innovation, collaborative alliances, and portfolio diversification to address evolving market needs. Certain global players have intensified investment in research partnerships with academic institutions to accelerate the development of next-generation bio-resins, while others have acquired specialty formulators to broaden their offerings in high-purity radiation curing adhesives. Moreover, cross-industry collaborations with packaging machinery firms are facilitating co-development of turnkey dispensing solutions that enhance production efficiency and minimize waste.

In parallel, tier-two suppliers are carving out niche segments-such as adhesives for ultra-lightweight packaging and cold-seal label applications-leveraging agile development cycles and regional manufacturing footprints. As competition intensifies, companies are differentiating through comprehensive service models, including on-site technical support, digital quality monitoring platforms, and lifecycle assessments. These strategic moves underscore the imperative for a balanced approach that combines cutting-edge chemistries with value-added services to secure long-term customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Packaging Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- Ashland Inc.

- Avery Dennison Corporation

- Dow Inc.

- Franklin International, Inc.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Huntsman Corporation

- Jowat SE

- Lord Corporation

- Mactac

- Mercury Adhesives Inc.

- Mitsui Chemicals, Inc.

- Sika AG

- The Reynolds Company

- Wacker Chemie AG

Empowering Industry Leaders with Actionable Strategic Roadmaps to Navigate Disruptive Market Trends and Capitalize on Emerging Packaging Adhesive Opportunities

Industry leaders are advised to prioritize investment in bio-based and low-VOC adhesive technologies to align with accelerating regulatory and brand owner sustainability commitments. By reallocating R&D budgets toward green chemistries and scalable manufacturing processes, organizations can capture emerging demand while mitigating environmental compliance risks. Furthermore, diversifying supplier networks-encompassing domestic feedstocks and dual-source arrangements-will enhance supply chain resilience against tariff shocks and geopolitical disruptions.

In addition, digital transformation initiatives focused on smart dispensing, real-time quality monitoring, and data analytics should be pursued to optimize production uptime and reduce material waste. Collaborative partnerships with end users, machinery vendors, and industry associations can facilitate co-innovation, enabling faster market entry and tailored solutions. Finally, ongoing stakeholder engagement with policymakers and trade bodies will support constructive dialogue around tariff structures and sustainability incentives, ensuring that industry voices inform future regulatory developments.

Detailing Rigorous Research Methodology and Analytical Frameworks Employed to Ensure Comprehensive and Reliable Packaging Adhesive Market Insights

The research foundation is built upon a meticulous blend of qualitative and quantitative methodologies to deliver robust market insights. Initially, primary research was conducted through in-depth interviews with formulation scientists, procurement executives, and packaging engineers across key regions, complemented by end-user surveys to capture nuanced performance requirements. Concurrently, extensive secondary research encompassed product literature, industry white papers, and regulatory databases to validate evolving technology trends and compliance frameworks.

Subsequently, data triangulation techniques were employed to cross-verify findings, leveraging comparative analyses of public filings, patent landscapes, and trade statistics. Analytical frameworks such as SWOT and PESTLE were applied to assess competitive dynamics and external drivers, while segmentation modeling provided multi-layered market perspectives. This comprehensive approach ensures that the report’s conclusions and recommendations are underpinned by rigorous evidence and reflect the latest industry advancements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Packaging Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Packaging Adhesives Market, by Adhesive Type

- Packaging Adhesives Market, by End Use Industry

- Packaging Adhesives Market, by Application Type

- Packaging Adhesives Market, by Resin Type

- Packaging Adhesives Market, by Region

- Packaging Adhesives Market, by Group

- Packaging Adhesives Market, by Country

- United States Packaging Adhesives Market

- China Packaging Adhesives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Highlight Strategic Imperatives in the Evolving Packaging Adhesive Landscape

The synthesis of key findings underscores a packaging adhesives market at the nexus of technological innovation, environmental imperatives, and evolving trade landscapes. Transformative chemistries, including bio-based and radiation curing formulations, are redefining performance benchmarks while aligning with sustainability targets. At the same time, tariff measures in 2025 have highlighted the critical need for agile procurement strategies and diversified supply chains to safeguard competitiveness.

Segmentation analysis reveals the importance of customized solutions across adhesive types, end-use industries, applications, resin chemistries, and form factors, all of which inform targeted product development. Regional insights further emphasize the contrasting drivers in the Americas, EMEA, and Asia-Pacific, with each region offering distinct growth opportunities and regulatory challenges. In light of these dynamics, companies are recommended to adopt proactive innovation roadmaps, reinforce supply chain resilience, and engage collaboratively with stakeholders to navigate this evolving landscape effectively.

Connect Directly with Associate Director of Sales and Marketing to Secure Comprehensive Packaging Adhesive Market Research Insights and Drive Strategic Growth

To acquire a comprehensive understanding of the packaging adhesives market and to access in-depth strategic insights, please connect with Ketan Rohom, Associate Director of Sales and Marketing. By partnering directly with our sales leadership, you will gain immediate access to the full report, featuring granular regional breakdowns, detailed segmentation analysis, and actionable recommendations. Engage now to drive informed decisions that enhance competitive advantage, optimize supply chain resilience, and accelerate innovation roadmaps within your organization.

- How big is the Packaging Adhesives Market?

- What is the Packaging Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?