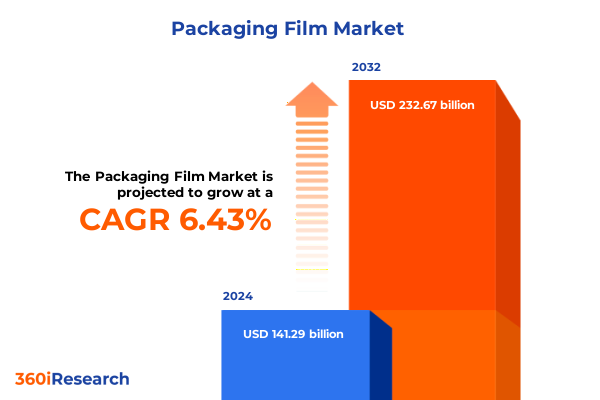

The Packaging Film Market size was estimated at USD 150.58 billion in 2025 and expected to reach USD 160.49 billion in 2026, at a CAGR of 6.41% to reach USD 232.67 billion by 2032.

Understanding the Crucial Role of Flexible Packaging Films in Modern Supply Chains Fueling Consumer Engagement Strategies and Innovative Product Differentiation

Packaging films have emerged as indispensable enablers of modern supply chains, balancing the demands of protection, preservation, and presentation. In an era marked by rapid technological advancements and shifting consumer preferences, the design and performance of film solutions profoundly influence product integrity, shelf life, and brand differentiation. From lightweight barrier films that extend perishables to sophisticated barrier formulations preventing moisture and oxygen ingress, the intrinsic versatility of these materials underpins a wide spectrum of industries, including food and beverage, pharmaceuticals, personal care, and industrial sectors.

As global commerce evolves toward just-in-time inventory management, digital printing and e-commerce packaging requirements are reshaping film specifications and production processes. Accordingly, packaging film suppliers are investing in advanced extrusion, lamination, and coating techniques to deliver enhanced functional properties such as antimicrobial activity, UV protection, and active packaging capabilities. These innovations dovetail with sustainability imperatives that call for recyclable, reusable, and compostable solutions capable of reducing environmental footprints without compromising performance.

Transitioning from conventional rigid forms to flexible film alternatives offers significant cost, weight, and carbon emission advantages. Therefore, understanding the pivotal role of flexible packaging films in modern supply chains is essential for decision-makers. By examining the latest material breakthroughs and manufacturing trends, stakeholders can anticipate emerging challenges and harness new opportunities to deliver high-impact, sustainable packaging solutions.

Identifying the Pivotal Market Forces and Emerging Technologies Reshaping the Packaging Film Industry Landscape Through Sustainability and Digital Innovation

The packaging film industry is undergoing transformative shifts driven by converging market forces and technological breakthroughs. Sustainability has emerged as a central axis of change, compelling manufacturers to adopt renewable feedstocks and circular economy principles. As a result, bio-based polymers and recyclable monomaterial constructions are supplanting traditional multilayer composites in many applications. This momentum is reinforced by regulatory actions worldwide that incentivize reduced single-use plastic waste and mandate recycled content thresholds, propelling the development of next-gen compostable and chemically recyclable films.

In parallel, the surge in e-commerce and direct-to-consumer distribution models is redefining packaging requirements. Enhanced tamper-evidence, lightweight yet puncture-resistant films, and integrated digital printing capabilities for variable data and branding are now table stakes. Furthermore, advances in smart and active packaging-such as embedded sensors and oxygen scavengers-are cementing packaging film’s role as an interactive interface between brands and end consumers. These innovations not only extend shelf life and ensure safety but also deepen consumer engagement through QR codes, NFC tags, and personalized messaging.

Moreover, the adoption of Industry 4.0 practices within film manufacturing facilities is accelerating process optimization. Real-time monitoring, AI-driven quality control, and predictive maintenance are enhancing throughput while minimizing downtime and scrap rates. Collectively, these strategies are reshaping cost structures, enabling rapid product customization, and fostering a more agile response to evolving market demands.

Examining the Ripple Effects of 2025 United States Tariff Measures on the Packaging Film Value Chain and Stakeholder Cost Structures

In 2025, the United States implemented a series of targeted tariff measures on imported packaging films and raw polymer resins, altering cost structures across the value chain. These duties have increased landed costs for Asian and European exporters, prompting many downstream converters to re-evaluate supplier relationships. As input expenses rose, manufacturers with integrated resin production or domestic polymer sourcing gained a competitive edge, while import-dependent operations absorbed margin pressure or passed costs onto customers.

Consequently, several converters have expedited strategic investments in North American production assets, seeking to localize critical film lines and secure raw material supply. At the same time, multinationals are negotiating long-term purchase agreements with resin producers to mitigate price volatility. This tariff-driven realignment has also catalyzed greater collaboration among resin suppliers, equipment OEMs, and brand owners to optimize material blends and processing parameters, thereby preserving film performance while offsetting incremental cost burdens.

Looking ahead, the cumulative impact of these tariffs extends beyond immediate pricing dynamics. It is reshaping global trade flows, prompting a reassessment of near-shoring strategies, and accelerating the adoption of cost-efficient packaging designs. For stakeholders across the packaging ecosystem, proactive engagement with regulatory developments and supply chain diversification remains imperative to thrive amid evolving trade policy landscapes.

Unlocking Critical Market Insights from Material Application Structure Process Technology and Packaging Form Segment Analyses for Strategic Positioning

A granular analysis of segment performance reveals that material diversity remains a cornerstone of the packaging film market. Biodegradable options, led by polylactic acid and starch-based formulations, are carving out share in niche applications where compostability is a must. Meanwhile, polyamide grades deliver premium barrier performance for medical and electronics packaging, and polyester films, particularly polyethylene terephthalate, are prized for their clarity and tensile strength. Polyethylene derivatives-ranging from high-density to linear low-density and low-density variants-continue to dominate commodity packaging, and polypropylenes like biaxially oriented and cast variants address the need for stiffness and seal integrity. Additionally, polyvinyl chloride maintains relevance in certain industrial contexts due to its chemical resistance and cost efficiency.

Application segmentation further underscores diverse end-use requirements. Consumer packaging spans gift packaging and personal care wraps, while food applications leverage specialized films for bakery, dairy, fruits, vegetables, meat and seafood, and snack platforms, with fresh and processed meat demanding tailored barrier solutions. Industrial sectors from agriculture to construction deploy films for mulch, protective sheeting, and engineered electronic enclosures, and the medical arena calls for diagnostic, device, and pharmaceutical packaging with rigorous regulatory compliance.

Structurally, monolayer films find favor in simpler applications, whereas multilayer constructions-whether two-to-three layer assemblies or advanced four-to-six and seven-or-more layer systems-unlock high-performance barrier profiles. Process technology bifurcation highlights the enduring vitality of extrusion film techniques, including blown films with single, double, or triple bubble processes, and cast film lines. Non-extrusion methods such as calendered and laminated films also retain strategic relevance, especially where surface finish and composite structures are paramount. Finally, packaging form segments range from gusseted and spout bags to stand-up, flat-bottom, and zipper pouches, alongside roll stock, sheet, and wrapper formats, illustrating the tailored versatility that end-users demand.

This comprehensive research report categorizes the Packaging Film market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Structure

- Process Technology

- Packaging Form

- Application

Comparative Regional Dynamics Influencing Packaging Film Adoption Trends Across the Americas Europe Middle East & Africa and Asia Pacific Markets

Regional dynamics continue to define divergent growth trajectories and innovation priorities for packaging films. In the Americas, the United States leads in advanced barrier and sustainable film adoption, propelled by robust e-commerce and foodservice sectors. Canada’s regulatory push toward plastics recycling has accelerated demand for films compatible with existing collection streams. Meanwhile, Latin American markets, particularly Brazil and Mexico, exhibit growing interest in value-added films that extend shelf life and reduce waste, aligning with rising consumer focus on food security and cost efficiency.

In Europe, stringent single-use plastic directives and upcoming extended producer responsibility mandates are driving film suppliers to pioneer fully recyclable and compostable monomaterial constructions. The Middle East is channeling investments into state-of-the-art production hubs, targeting export opportunities in adjacent regions, while Africa’s nascent market is primed for affordable yet performance-driven film solutions that address infrastructural and cold-chain limitations.

Across Asia Pacific, China and India remain the largest consumers of packaging films, fueled by booming urbanization, retail modernization, and local content policies. Manufacturers in Japan, South Korea, and Taiwan are at the forefront of high-barrier and functional films for electronics and pharmaceuticals. Concurrently, Southeast Asian nations are rapidly expanding domestic film extrusion and coating capacities to serve both domestic and export markets, underscoring the region’s pivotal role in the global packaging film ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Packaging Film market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Moves Innovation Portfolios and Collaborative Initiatives of Leading Packaging Film Manufacturers to Drive Market Leadership

Key industry participants are leveraging diverse strategies to fortify their market positions amid intensifying competition. Global packaging conglomerates have prioritized capacity expansions in strategic regions, aligning production footprints with rising demand in emerging markets. At the same time, focused innovators are differentiating via proprietary barrier coatings and specialty films designed for next-generation active and intelligent packaging applications. Several leading players have forged alliances with resin producers to co-develop bio-based and recycled content film grades, thereby accelerating time-to-market for sustainable offerings.

Acquisitions and joint ventures continue to redefine the competitive landscape, as nimble converters join forces with equipment manufacturers to enhance processing capabilities and scale. Investment in digital printing technologies is a common theme among market leaders seeking to offer on-demand, short-run solutions tailored for premium brands. Moreover, ongoing R&D initiatives are addressing critical performance gaps, such as high-barrier films that are fully recyclable and compostable, reflecting the industry’s dual imperatives of functionality and environmental stewardship.

Ultimately, the companies that invest in end-to-end collaboration-spanning resin synthesis, advanced process engineering, and brand partnership-will likely set the benchmark for innovation and profitability. Their ability to anticipate regulatory shifts, secure sustainable supply chains, and deliver customized film solutions will determine the next wave of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Packaging Film market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpha Industries, Inc.

- Alpha Packaging Inc. by Pretium Packaging

- Aluflexpack AG by Montana Tech Components

- Amcor PLC

- Berry Global Inc.

- C-P Flexible Packaging, Inc.

- CCL Industries

- Cellpack Packaging Gmbh by BEWI ASA

- Constantia Flexibles International GmbH

- Dow Chemical Company

- DuPont de Nemours, Inc.

- Graphic Packaging Holding Corporation

- Guangzhou Novel Packaging

- Hangzhou Ming Ri Flexible Packaging

- Henkel AG & Co. KGaA

- Huhtamäki Oyj

- Jindal Poly Films Ltd.

- Kao Corporation

- Logos Packaging Holdings Ltd.

- Mondi PLC

- Novolex Holdings, LLC

- PPC Flexible Packaging LLC

- ProAmpac Holdings Inc.

- Reynolds Group Holdings

- Smurfit Westrock Plc

- Toyobo Co Ltd.

- Transcontinental Inc.

- Uflex Ltd.

- Wipak OY

Actionable Strategic Recommendations to Navigate Industry Disruptions and Capitalize on Emerging Growth Opportunities in Packaging Film

To navigate the complexities of the evolving packaging film sector, industry leaders must adopt a holistic strategy that integrates sustainability, innovation, and supply chain resilience. Prioritizing investment in bio-based and chemically recyclable polymers can satisfy regulatory mandates while differentiating product portfolios. Simultaneously, cultivating partnerships with resin suppliers will mitigate raw material volatility and enable co-development of high-performance film grades.

Embracing digital printing and modular production configurations can unlock the potential of personalized packaging, short-run manufacturing, and rapid prototyping. This agility is especially critical as brands seek to respond swiftly to seasonal promotions, localized marketing campaigns, and emerging consumer trends. Furthermore, aligning R&D efforts with lean manufacturing and Industry 4.0 principles will drive cost efficiency and support continuous quality improvement across film lines.

Finally, a regionally nuanced approach to market entry and expansion-balancing domestic production with strategic exports-will enhance competitiveness. By monitoring trade policy developments, investing in flexible infrastructure, and deploying data-driven insights, organizations can capitalize on shifting demand patterns, manage risk, and secure sustainable growth in the dynamic packaging film landscape.

Detailed Research Methodology Integrating Qualitative Quantitative Data Collection and Analysis Approaches for Comprehensive Packaging Film Market Examination

This market analysis synthesizes primary and secondary research methodologies to ensure robust and reliable findings. Primary insights were garnered through in-depth interviews with senior executives, product managers, and technical experts across the packaging film value chain, complemented by targeted surveys among end-users. Secondary research incorporated comprehensive review of regulatory frameworks, industry white papers, and global trade databases to contextualize market developments and competitive dynamics.

Quantitative data collection involved tracking polymer resin flows, film production capacities, and trade volumes, normalized across key regions. Proprietary databases were cross-referenced with publicly available financial reports, patent filings, and academic publications to triangulate performance indicators. Qualitative workshops and focus groups provided nuanced perspectives on application-specific requirements, especially within food, medical, and electronics packaging segments.

The combination of rigorous data validation, expert triangulation, and scenario analysis underpins the strategic recommendations and insights presented. By integrating both macroeconomic factors and granular segment trends, the research methodology delivers actionable intelligence capable of informing investment decisions, product development roadmaps, and regulatory compliance strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Packaging Film market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Packaging Film Market, by Material

- Packaging Film Market, by Structure

- Packaging Film Market, by Process Technology

- Packaging Film Market, by Packaging Form

- Packaging Film Market, by Application

- Packaging Film Market, by Region

- Packaging Film Market, by Group

- Packaging Film Market, by Country

- United States Packaging Film Market

- China Packaging Film Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Synthesizing Key Findings to Illuminate Future Directions Strategic Imperatives and Value Creation in the Packaging Film Industry Ecosystem

The packaging film industry stands at a strategic inflection point, driven by sustainability imperatives, e-commerce proliferation, and trade policy realignments. Key trends such as the shift toward bio-based and recyclable materials, the rise of digital and smart packaging, and the impact of 2025 tariff measures underscore the sector’s dynamic nature. Segment analyses highlight the critical importance of tailored solutions across material technologies, application requirements, structural designs, process methods, and form factors.

Regionally, varying regulatory landscapes and supply chain configurations create both challenges and opportunities. While developed markets pursue stringent environmental targets and advanced functionality, emerging regions continue to seek cost-effective, high-performance films that address evolving consumer demands. Competitive strategies among leading manufacturers emphasize capacity alignment, collaborative innovation, and end-to-end integration to secure market leadership.

In conclusion, stakeholders equipped with a nuanced understanding of segment and regional dynamics, tariff implications, and competitive best practices will be best positioned to capitalize on growth opportunities. Continuous investment in sustainable innovation, digital capabilities, and supply chain diversification will drive resilience and profitability. These insights form the strategic foundation for organizations aiming to deliver differentiated packaging film solutions and navigate the complexities of a rapidly evolving marketplace.

Connect Directly with Ketan Rohom Associate Director Sales & Marketing to Secure Your Comprehensive Packaging Film Market Research Report Today

We invite industry stakeholders seeking actionable and in-depth insights to connect directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure the definitive market research report on packaging film. Drawing on rigorous primary interviews and comprehensive secondary analysis, this report offers unparalleled granularity across material, application, structural, technological, form, and regional dimensions. By partnering with Ketan Rohom, you gain privileged access to bespoke data interpretations, targeted discussions on tariff implications, and tailored recommendations designed to accelerate strategic decision-making. Reach out today to explore how this authoritative resource can inform your next investment, product development strategy, or competitive intelligence initiative, and position your organization at the forefront of packaging film innovation and market leadership.

- How big is the Packaging Film Market?

- What is the Packaging Film Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?