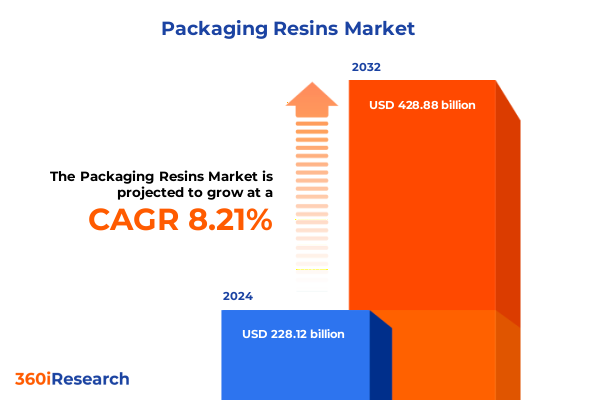

The Packaging Resins Market size was estimated at USD 245.43 billion in 2025 and expected to reach USD 264.05 billion in 2026, at a CAGR of 8.30% to reach USD 428.88 billion by 2032.

Exploring the Strategic Role and Evolving Significance of Packaging Resins Amidst Global Supply Chain Dynamics and Sustainability Challenges

Packaging resins serve as the foundational building blocks in the design and manufacture of modern packaging solutions, delivering a blend of mechanical strength, barrier protection, and lightweight performance that few other materials can match. From consumer goods to industrial applications, these versatile polymers enable extended shelf life, product safety, and cost-efficient logistics. As the packaging sector continues to evolve under the influence of shifting consumer expectations, regulatory standards, and technological advances, understanding the core attributes and supply chain dynamics of resins becomes essential for any strategic planning process.

In today’s interconnected marketplace, the packaging resin value chain is shaped by factors ranging from feedstock availability and global petrochemical flows to sustainability mandates and digital manufacturing trends. Concurrently, the drive for circular economy solutions has elevated the importance of recycled and bio-based polymers, prompting innovation across compounding, compatibilization, and resin return systems. Against this backdrop, businesses that can integrate technical resin knowledge with robust supply chain intelligence will be better positioned to meet escalating demands for functional performance, environmental stewardship, and regulatory compliance.

Uncovering the Transformative Shifts Redefining Packaging Resin Innovation Through Sustainability, Circular Economy and Advanced Manufacturing Technologies

The packaging resin landscape has undergone a profound transformation as sustainability, technological innovation, and regulatory mandates converge to redefine industry norms. A growing number of resin producers and brand owners are investing heavily in advanced recycling technologies, such as chemical depolymerization and compatibilizer-enhanced mechanical processes, which facilitate higher-quality rPET, rPE, and other recycled polymers. These developments are complemented by a surge in bio-based resin offerings that promise to reduce carbon footprints without compromising critical barrier and mechanical properties.

Meanwhile, digital and additive manufacturing tools are enabling more precise resin compounding and real-time process optimization. From digital twins that simulate resin flow characteristics in extrusion and injection molding to advanced barrier coatings developed through nanotechnology, the intersection of materials science and Industry 4.0 innovations is unlocking new application possibilities. As brands pursue lighter, stronger, and more sustainable packaging formats, the competitive landscape increasingly rewards those who can harness these breakthroughs to deliver differentiated products.

Assessing the Cumulative Impacts of Recent United States Packaging Resin Tariffs on Industry Supply Chains, Cost Structures, and Strategic Sourcing Decisions

The United States has implemented a series of tariff measures that have significantly reshaped resin supply chains and cost structures through early 2025. On March 3, 2025, the administration announced an increase in tariffs on Chinese resin and plastic product imports from an additional 10 percent to 20 percent, effectively broadening the scope of Section 301 duties to cover a wider range of polymer feedstocks and downstream applications. This upward adjustment removed prior de minimis exemptions for low-value shipments and increased average tariff rates on polyolefins to approximately 26.5 percent, while certain downstream plastic products now face total duties of up to 45 percent.

Diving into Detailed Segmentation Insights for Packaging Resins Across Resin Types, End-Use Industries, Processing Technologies, and Packaging Forms

When the market is examined based on resin type, polyethylene’s subdivisions into high-density, low-density, and linear low-density grades-each prized for attributes ranging from stiffness in caps and containers to flexibility in films-stand alongside polypropylene’s copolymer and homopolymer variants, which deliver tailored combinations of toughness and clarity across closures and packaging components. Polystyrene’s two primary grades, general purpose and high impact, continue to service rigid trays and protective cushioning, while PVC’s flexible and rigid forms underpin applications from shrink films to sturdy containers. Equally, polyethylene terephthalate’s distinction between bottle and film grades highlights the polymer’s dual role in beverage packaging and barrier films.

Across end-use industries, resins find application in automotive care product bottles, electronics enclosures and protective films, and a broad spectrum of food and beverage containers, ranging from beverage bottles to multi-layer sheets and rigid food trays. The healthcare and pharmaceutical sectors rely on specialized medical packaging and pharmaceutical bottles that adhere to strict purity and traceability standards, whereas personal care and cosmetics favor cosmetic jars and skin care containers designed for both aesthetic appeal and functional protection.

Processing technology segmentation underscores the importance of blow molding-in both extrusion and injection-stretch blow variations-for hollow parts; extrusion processes such as film, sheet, and coating & lamination for flexible structures; and injection molding’s standard operations for precision components. Thermoforming, including vacuum forming, rounds out the technological toolkit for shaping both single-use and durable packaging. Finally, the distinction between flexible packaging forms-bags, films, sheets, and pouches-and rigid options-bottles, jars, caps, closures, containers, and trays-captures the diverse formats through which resin innovation reaches the end consumer.

This comprehensive research report categorizes the Packaging Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Processing Technology

- Packaging Form

- End-Use Industry

Illuminating Key Regional Dynamics Shaping Packaging Resin Demand and Supply Chain Resilience Across Americas, EMEA, and Asia-Pacific Markets

In the Americas, North America remains a hub of resin innovation and regulatory leadership, driven by comprehensive recycling infrastructure, robust chemical production capacity, and stringent food contact and environmental standards enforced by agencies such as the U.S. FDA and Canada’s Health Canada. Latin American markets, by contrast, are experiencing accelerated demand driven by rapid urbanization and growing consumer packaged goods sectors, prompting both domestic expansions and increased imports of polyethylene, PET, and polypropylene grades.

This comprehensive research report examines key regions that drive the evolution of the Packaging Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves and Competitive Strategies of Major Packaging Resin Manufacturers Driving Innovation, Expansion, and Sustainability Initiatives Globally

Major resin producers have embarked on strategic initiatives to strengthen market positions and advance sustainability goals. Integrated petrochemical companies are scaling up investments in chemical recycling facilities, while partnerships between resin manufacturers and consumer brands are fostering closed-loop systems for post-consumer resin reclamation. Joint ventures targeting next-generation bio-based polymers have emerged as a priority, reflecting an industry-wide shift toward feedstocks that can reduce lifecycle emissions without sacrificing performance.

Simultaneously, leading players are leveraging digital platforms to enhance supply chain transparency and predictive maintenance, integrating real-time tracking of resin shipments with quality assurance protocols. Collaborations between resin suppliers and equipment manufacturers have yielded optimized compounding processes and advanced barrier solutions, reinforcing the position of incumbent corporations even as new entrants pursue niche, high-value applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Packaging Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALPEK POLYESTER, S.A. de C.V.

- Arkema S.A.

- BASF SE

- Borealis AG

- Braskem S.A.

- BY Sanfame Group

- Chevron Phillips Chemical Company

- China Petrochemical Corporation

- Covestro AG

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Far Eastern New Century Corporation

- Formosa Plastics Corporation

- Indorama Ventures Public Company Limited

- INEOS AG

- Lyondellbasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- Nova Chemicals Corporation

- Reliance Industries Limited

- SABIC

- The Dow Chemical Company

- Toray Industries, Inc.

- TotalEnergies SE

Actionable Recommendations for Industry Leaders to Optimize Packaging Resin Strategies in Response to Market Shifts, Regulatory Pressures, and Emerging Sustainability Imperatives

Industry leaders should prioritize the development of closed-loop resin value chains by expanding partnerships with mechanical and chemical recycling providers to secure a reliable stream of high-quality recycled polymers. In parallel, investments in advanced analytics and digital supply chain tools can provide the visibility needed to anticipate feedstock disruptions and optimize inventory buffers. Embracing modular production lines that can switch seamlessly between virgin, recycled, and bio-based feedstocks will allow companies to respond swiftly to changing regulatory requirements and consumer preferences.

Moreover, fostering innovation through targeted R&D collaborations-spanning universities, technology startups, and downstream brand owners-can accelerate breakthroughs in barrier technologies, compostable formulations, and turnkey packaging platforms. By aligning these efforts with clear sustainability metrics and third-party certifications, organizations can enhance their market credibility and secure preferential positioning with environmentally conscious customers.

Outlining the Rigorous Research Methodology Underpinning the Packaging Resin Market Analysis Including Data Collection, Validation, and Analytical Frameworks

The research underpinning this market analysis combined extensive secondary data gathering from public and proprietary sources with primary consultations involving resin producers, compounders, brand owners, and industry associations. Detailed supply chain mapping was conducted to trace feedstock flows and identify critical nodes of supply risk, while expert interviews provided nuanced perspectives on emerging material innovations and regional policy impacts.

Quantitative and qualitative data were triangulated through cross-validation techniques to ensure consistency and reliability. The analytical framework integrated segmentation by resin type, processing method, end-use industry, and packaging form, enabling a granular understanding of market dynamics. Findings were reviewed by a panel of subject-matter experts, and final insights were refined through iterative validation sessions with senior industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Packaging Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Packaging Resins Market, by Resin Type

- Packaging Resins Market, by Processing Technology

- Packaging Resins Market, by Packaging Form

- Packaging Resins Market, by End-Use Industry

- Packaging Resins Market, by Region

- Packaging Resins Market, by Group

- Packaging Resins Market, by Country

- United States Packaging Resins Market

- China Packaging Resins Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Concluding Insights on Packaging Resin Market Evolution Emphasizing Key Takeaways, Strategic Imperatives, and Future Outlook Amid Evolving Global Conditions

The packaging resin sector is navigating a period of unprecedented change, driven by evolving sustainability mandates, shifting geopolitical landscapes, and accelerating technological innovation. As tariff measures reshape supply chains and recycled content targets gain traction, stakeholders across the value chain are confronting new complexities while pursuing opportunities to differentiate through performance and environmental leadership.

Looking ahead, success in this market will hinge on the ability to blend agile sourcing strategies with forward-thinking material development programs. Companies that can harmonize cost control, regulatory compliance, and sustainability commitments will be best positioned to capture value in both established and emerging packaging segments. By leveraging the insights outlined in this report, decision-makers can chart a course that balances resilience with growth and innovation with responsibility.

Engage with Ketan Rohom to Secure Comprehensive Packaging Resin Market Intelligence and Drive Strategic Decisions with Expertly Crafted Research Insights

If you are seeking to navigate the complexities of the packaging resin landscape with confidence and precision, our comprehensive market research report delivers the clarity and strategic foresight you need. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our tailored insights can accelerate your decision-making and strengthen your competitive position. Whether you require in-depth analysis of emerging resin innovations, expert guidance on tariff-related challenges, or actionable recommendations for sustainable growth, Ketan can ensure you receive the right level of detail and support. Reach out today to secure access to this indispensable resource and transform your resin strategy into a powerful engine for value creation.

- How big is the Packaging Resins Market?

- What is the Packaging Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?