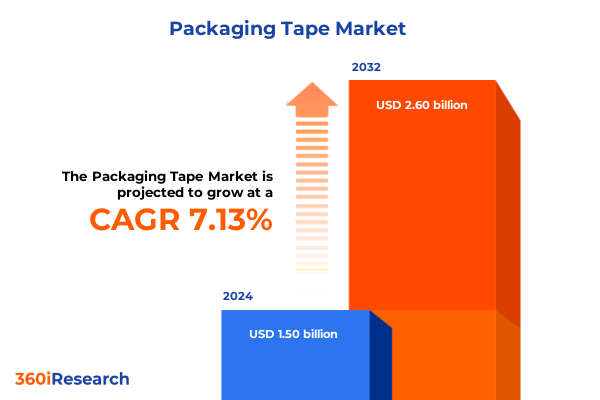

The Packaging Tape Market size was estimated at USD 1.61 billion in 2025 and expected to reach USD 1.70 billion in 2026, at a CAGR of 7.12% to reach USD 2.60 billion by 2032.

Unveiling the Critical Role of Packaging Tape in Modern Supply Chains and Its Evolving Significance for Efficiency, Sustainability, and Innovation

Packaging tape has become an indispensable component within modern supply chain operations, serving as both a functional necessity and a strategic asset. Its role extends beyond simple parcel sealing to encompass branding, product protection, and operational efficiency. As e-commerce volumes continue to surge and consumer expectations for rapid delivery intensify, packaging tape must deliver consistent performance under high-speed application processes while meeting sustainability criteria that are increasingly demanded by end users.

The confluence of global trade complexities, technological advancements, and regulatory pressures has elevated packaging tape from a low-value commodity to a focal point for innovation. Manufacturers are experimenting with novel adhesive chemistries to improve bond strength while facilitating clean removal and recyclability. At the same time, digital integration through smart dispensers and IoT-enabled tracking is driving enhanced process visibility and waste reduction. In this evolving context, understanding the underlying market drivers and emerging trends is vital for stakeholders aiming to optimize operational costs, bolster brand perception, and maintain competitive advantage.

Examining the Transformative Shifts Reshaping the Packaging Tape Landscape from Digital Integration to Sustainable Material Innovations

The packaging tape industry is experiencing a profound transformation driven by digital integration and technological convergence. Industry 4.0 principles are being applied to tape application systems, incorporating automation, data analytics, and real-time monitoring to streamline packaging lines and minimize downtime. These digital advancements not only drive productivity gains but also enable predictive maintenance, reducing unplanned equipment stoppages and ensuring consistent seal integrity.

Concurrently, sustainability considerations are reshaping material formulations. Companies are increasingly investing in bio-based adhesives and recyclable backing materials to comply with stringent environmental regulations and meet the circular economy aspirations of major retailers. This shift is further reinforced by consumer scrutiny around packaging waste, prompting manufacturers to develop solutions that facilitate closed-loop recycling without compromising performance.

In parallel, the explosive growth of e-commerce has underscored the need for high-performance tapes that can withstand variable handling conditions. Custom printing technologies are now being leveraged to incorporate tracking codes and branded messaging directly onto the tape surface, enhancing both operational efficiency and customer engagement. As these transformative shifts converge, the packaging tape landscape is being redefined, creating new opportunities and competitive dynamics.

Assessing the Cumulative Impact of Newly Implemented United States Tariffs in 2025 on Packaging Tape Supply Chains, Pricing and Competitiveness

In early 2025, the United States implemented a revised tariff schedule targeting imports of pressure-sensitive films and adhesive tapes, aiming to bolster domestic production and address trade imbalances. These measures introduced a tiered duty structure that varies by material composition and country of origin. The policy’s rationale centers on safeguarding local manufacturers against heavily subsidized imports and encouraging investment in domestic adhesive and film manufacturing capabilities.

The immediate effect of these tariffs has been an upward pressure on unit costs for import-dependent stakeholders. Many distributors and end users have experienced increased cost of goods sold, leading companies to pass through a portion of these costs to customers or absorb them through margin compression. This cost inflation has prompted a broader reassessment of procurement strategies, as organizations weigh the trade-off between short-term price stability and long-term supplier diversification.

Supply chain resilience has emerged as a critical imperative, with firms accelerating efforts to nearshore or reshore certain supply chain elements. Inventory management practices have been revisited to incorporate safety stocks and dual sourcing models, reducing vulnerability to future policy shifts. Meanwhile, domestic tape producers have capitalized on these regulatory changes by expanding capacity and accelerating capacity utilization, thereby enhancing their competitive positioning in both domestic and export markets.

Taken together, the cumulative impact of the 2025 United States tariffs reveals a market in flux, where strategic agility and supply chain optimization are key determinants of success.

Revealing Key Segmentation Insights Highlighting How Product Types, Backing Materials, Applications and End Users Drive Packaging Tape Dynamics

A nuanced understanding of segmentation reveals critical insight into market dynamics. Sales across acrylic, hot melt, and natural rubber formulations illustrate distinct performance profiles, with acrylic achieving superior UV and solvent resistance, hot melt delivering rapid tack and high-speed application suitability, and natural rubber maintaining dominance in general-purpose sealing.

Backing materials further differentiate product offerings, as BOPP provides clarity and tensile strength favored for visible packaging, cloth backings deliver robustness in heavy-duty scenarios, paper backings enable easy removal and masking precision for paint protection applications, and PVC backing offers chemical and weather resistance for specialized industrial environments.

Usage scenarios span bundling applications that require consistent tensile performance, labeling functions demanding residue-free removal, masking tasks prioritizing clean edges and paint compatibility, and sealing operations where moisture barrier and bond retention are critical. Each of these end-use categories presents unique technical requirements that inform product development and strategic positioning.

Industries such as e-commerce & logistics drive high-volume requirements, necessitating tapes that balance performance with cost effectiveness. Food & beverage applications impose food-grade adhesive standards and hygiene considerations, healthcare sectors demand sterile handling and compatibility with medical packaging protocols, while manufacturing environments seek tapes that integrate seamlessly with automated packaging systems.

Distribution pathways continue to evolve, as traditional brick-and-mortar channels serve longstanding industrial and commercial accounts, whereas digital marketplaces and direct-to-customer e-commerce models enable faster procurement cycles, custom printing services, and enhanced order flexibility.

This comprehensive research report categorizes the Packaging Tape market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Backing Material

- Application

- End User Industry

- Distribution Channel

Mapping Key Regional Insights into the Americas, Europe Middle East & Africa and Asia-Pacific Markets for Packaging Tape Adoption and Growth

Regional dynamics underscore differentiated growth trajectories. In the Americas, robust e-commerce and logistics networks have accelerated demand for high-performance tapes that support rapid fulfillment and secure transit. Domestic manufacturing has also benefited from supportive tariff structures, driving capacity expansions in North America and reinforcing the region’s role as both a major consumer and exporter of adhesive tape products.

Across Europe, Middle East & Africa, regulatory frameworks such as the EU’s Circular Economy Action Plan have elevated sustainability as a market differentiator. Companies operating in this region are adopting recycled backings and eco-friendly adhesives to comply with evolving mandates. Meanwhile, infrastructure investments in the Middle East and industrialization trends in Africa present new entry points for suppliers offering cost-effective, climate-resilient tape variants.

In Asia-Pacific, the region remains the largest global production hub, with China and India spearheading capacity additions. High growth rates in manufacturing, automotive, and e-commerce sectors have fueled localized demand, while trade relationships with North America and Europe shape cross-border flows. APAC producers are also innovating to meet regional requirements for humidity resistance, temperature stability, and rapid application in high-volume settings.

Collectively, these regional snapshots highlight the interplay between market access, regulatory environments, production capabilities, and end-user expectations, forming a multifaceted landscape for packaging tape stakeholders.

This comprehensive research report examines key regions that drive the evolution of the Packaging Tape market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting Strategic Moves of Leading Packaging Tape Manufacturers Showcasing Innovative Portfolios, Collaborations and Competitive Differentiation

Leading manufacturers are deploying diverse strategies to secure market leadership. One major global player has concentrated on embedding sustainability within its product development roadmap, unveiling a suite of bio-based adhesive formulations and forging alliances with logistics firms to pilot circular packaging programs. Another competitor has intensified collaboration with electronics and automotive OEMs to customize high-performance tapes that support automated assembly lines and adhesive bonding applications under strict tolerances.

A Japanese innovator has leveraged its expertise in polymer science to pioneer ultra-thin films and advanced release liners, targeting niche medical device and semiconductor packaging segments. Concurrently, a North American producer has pursued strategic acquisitions to enhance its backing material portfolio, integrating specialty cloth and reinforced film capabilities to meet growing demand for heavy-duty sealing solutions.

Another industry leader has adopted a digital-first approach, investing in customer portals that offer real-time order tracking, predictive replenishment algorithms, and tailored technical support. This initiative not only improves customer experience but also generates data insights that inform product innovation and channel management.

Across the board, these competitive moves illustrate a focus on innovation, strategic partnerships, and operational scalability, as companies aim to differentiate their offerings and adapt to regional and segment-specific requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Packaging Tape market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3Advance Tapes International

- 3WestRock

- A B Graphic International Ltd.

- Adhesives Research Inc.

- Avery Dennison Corporation

- Bostik SA

- Can-Do National Tape

- Dow Inc.

- Edwards Label, Inc. by Atlas Copco

- FLEXcon Company, Inc.

- H.BFuller Company

- Henkel AG & CoKGaA

- Meridian Adhesives Group

- Nitto Denko Corporation

- Scapa Group PLC

- Siat SPA

- Xerox Corporation

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends and Strengthen Competitive Positions in Packaging Tape

Industry leaders should prioritize investment in sustainable materials by allocating research and development resources toward adhesives derived from renewable feedstocks and fully recyclable backing substrates. This proactive approach not only addresses regulatory compliance but also resonates with environmentally conscious end users, fostering brand loyalty and market differentiation.

At the same time, embracing digital integration through smart tape dispensers and IoT-enabled packaging lines will enhance operational visibility and reduce material waste. By capturing real-time usage metrics, companies can optimize inventory levels and prevent production bottlenecks, translating into tangible cost savings and service improvements.

Supply chain diversification is another imperative. Firms must establish strategic relationships with alternative raw material suppliers in emerging markets to mitigate exposure to tariff fluctuations and geopolitical tensions. Nearshoring certain production activities can further improve lead times and operational resilience.

Optimization of manufacturing processes through automation and advanced data analytics will drive throughput enhancements and minimize downtime. Implementing predictive maintenance protocols and adaptive production scheduling will enable rapid response to shifting demand patterns.

Collaborations with logistics providers and e-commerce platforms can yield co-developed packaging solutions that streamline fulfillment operations and elevate the end-customer experience. Finally, targeting niche segments such as healthcare and electronics packaging allows companies to leverage specialized regulatory expertise and capture premium margins.

Outlining Rigorous Research Methodology Combining Primary Insights, Secondary Analysis and Expert Validation to Ensure Market Intelligence Accuracy

This report’s methodology integrates both primary and secondary data sources to provide a comprehensive market perspective. Primary research involved in-depth interviews with procurement officers, operations managers, and senior executives across the packaging tape value chain, capturing firsthand insights on evolving performance requirements and strategic priorities.

Secondary analysis encompassed a thorough review of trade statistics, technical white papers, patent filings, and regulatory documents to map historical trends and emerging technological developments. This dual approach ensures a robust contextual foundation and validates market observations.

A systematic segmentation framework was applied, categorizing the market by product type, backing material, application, end user industry, and distribution channel. This granularity enables identification of high-growth niches and performance gaps.

Regions including the Americas, Europe Middle East & Africa, and Asia-Pacific were analyzed through localized expert panels and regional association consultations, ensuring that cultural, logistical, and regulatory nuances are accurately represented. Data triangulation was achieved by cross-referencing multiple sources and verifying findings with industry veterans.

An expert review process was conducted to refine preliminary conclusions, inviting feedback from supply chain specialists, material scientists, and market strategists. This iterative validation fosters confidence in the report’s strategic recommendations and analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Packaging Tape market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Packaging Tape Market, by Product Type

- Packaging Tape Market, by Backing Material

- Packaging Tape Market, by Application

- Packaging Tape Market, by End User Industry

- Packaging Tape Market, by Distribution Channel

- Packaging Tape Market, by Region

- Packaging Tape Market, by Group

- Packaging Tape Market, by Country

- United States Packaging Tape Market

- China Packaging Tape Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Providing a Concise Conclusion Synthesizing Key Findings and Strategic Imperatives for Stakeholders in the Packaging Tape Sector

The collective insights from this analysis underscore a packaging tape market at the nexus of technological innovation and environmental accountability. Advancements in adhesive chemistries and smart dispensing systems are redefining performance benchmarks, while sustainability mandates are accelerating the adoption of recyclable and bio-based solutions.

Strategic agility in response to the 2025 United States tariffs has emerged as a critical determinant of competitiveness. Companies that proactively diversified supply chains and optimized domestic production stand to benefit from both cost stability and enhanced market access.

Regional and segment-specific nuances further complicate the landscape, with diverse requirements across the Americas, Europe Middle East & Africa, and Asia-Pacific regions, as well as varied demands among bundling, labeling, masking, and sealing applications. Stakeholders must adopt tailored approaches that align product portfolios with distinct end-user expectations and regulatory frameworks.

Ultimately, success in this evolving environment hinges on a balanced strategy that marries innovation with compliance, harnesses digital capabilities, and anticipates shifting market drivers. By leveraging the granular segmentation and strategic recommendations presented herein, organizations can forge a path toward sustained leadership.

Secure Comprehensive Packaging Tape Market Intelligence Today by Reaching Out Directly to Ketan Rohom to Elevate Your Strategic Decision-Making

For decision-makers seeking to deepen their understanding and gain actionable intelligence, the complete market research report offers comprehensive analysis, detailed segmentation insights, and strategic recommendations tailored to evolving packaging tape dynamics.

To access this authoritative resource and explore bespoke solutions that align with your organization’s strategic objectives, please reach out to Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through tailored options and support your decision-making journey.

- How big is the Packaging Tape Market?

- What is the Packaging Tape Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?